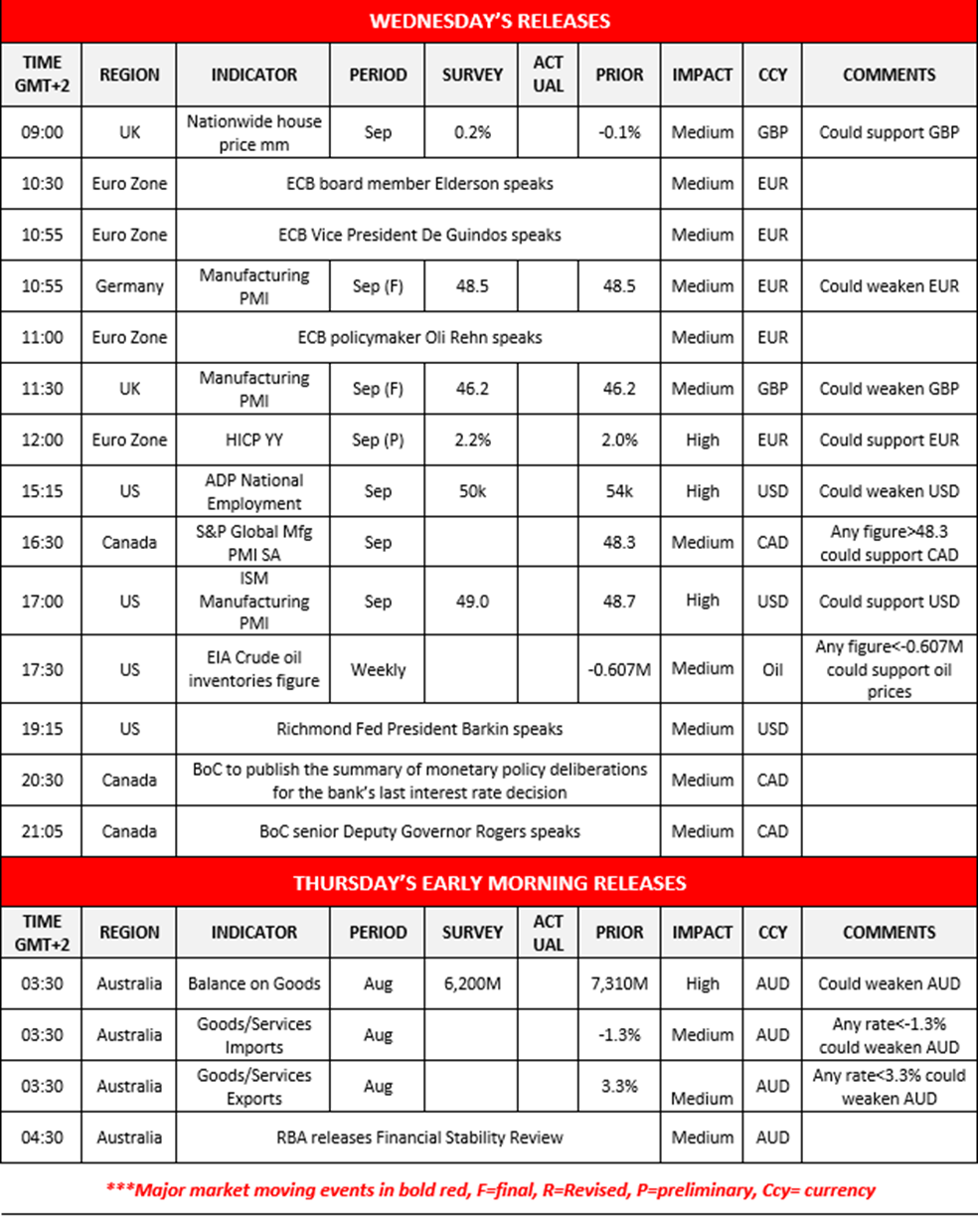

The US Government has now officially shut down following an impasse between Democrats and Republicans over the Government’s funding. The Government shutdown marks the first time a shutdown has occurred in the past six years and ironically, the last time was also during President Trump’s first term as POTUS. As a result, hundreds of thousands of federal workers who are deemed as nonessential may be furloughed or sent home without pay, as has occurred in prior shutdowns. Moreover, of concern is now the delay of the release of the US Employment data on Friday and thus the release of the ADP figure later on today could lead to heightened volatility in the markets. Lastly, the longer the shutdown continues the greater the impact on the USA’s GDP rate for the quarter and thus may have longer-term implications depending on how long the situation continues. In our view, with the government now in shutdown mode, both parties will continue to blame one another until one side caves in. Nonetheless, the shutdown could weigh on the US Equities markets and on the dollar the longer it continues.In Canada, the BoC is expected to release the summary of the bank’s monetary policy deliberations during their last meeting. In turn the Loonie may experience some volatility depending on the narrative which emerges from the bank’s last meeting minutes where should it be implied that the bank may remain on hold it could aid the CAD and vice versa.

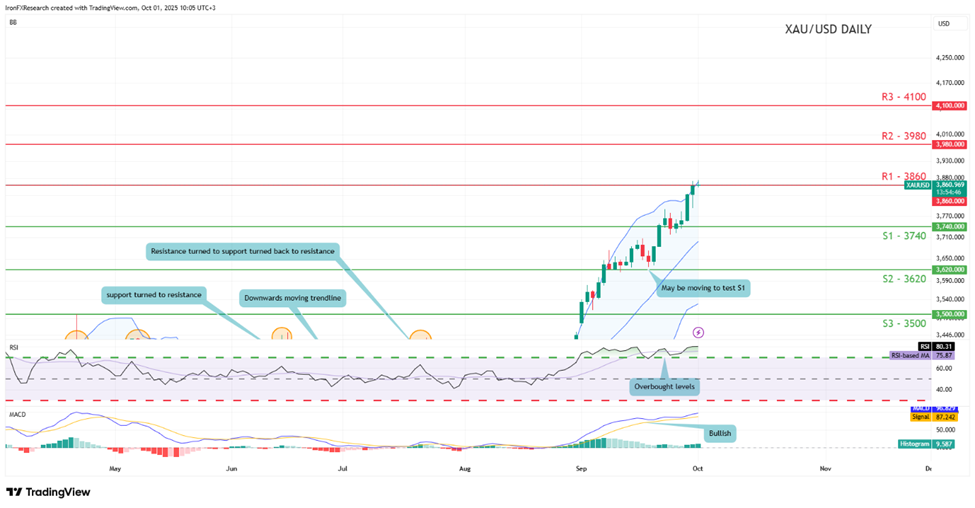

XAU/USD appears to be moving in an upwards fashion. We opt for a bullish outlook for gold’s price and supporting our case is the RSI indicator below our chart which currently registers a figure above 70, implying a strong bullish market sentiment. Yet at the same time a figure above 70 also implies that the asset is in overbought levels and may due a correction to lower ground. For our bullish outlook to continue we would require a break above our 3860 (R1) resistance level, with the next possible target for the bulls being our hypothetical 3980 (R2) resistance line. On the other hand, for a bearish outlook we would require a clear break below our 3740 (S1) support line with the next possible target for the bears being the 3620 (S2) support level. Lastly, for a sideways bias we would require gold’s price to remain confined between our 3740 (S1) support level and 3860 (R2) resistance line.

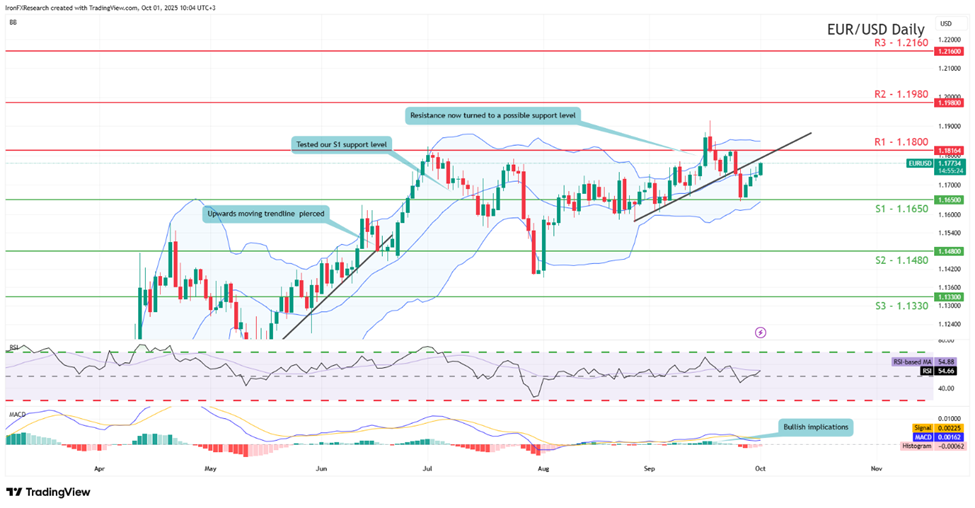

EUR/USD appears to be moving in a sideways fashion. We opt for a sideways bias and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained we would require the pair to remain confined between our 1.1650 (S1) support level and our 1.1800 (R1) resistance line. On the other hand, for a bearish outlook we would require a break below our 1.1650 (S1) support level with the next possible target for the bears being the 1.1480 (S2) support line. Lastly, for a bullish outlook we would require a clear break above our 1.1800 (R1) resistance level with the next possible target for the bulls being the 1.1980 (R2) resistance line.

今日其他亮点:

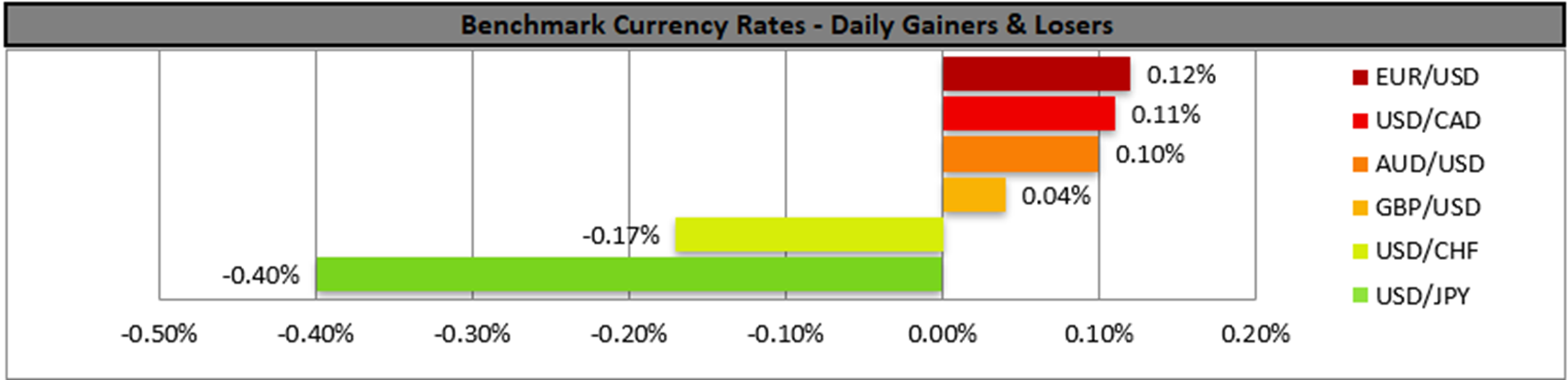

In today’s European session, we note the release of UK’s Nationwide House prices for September, Germany’s and the UK’s final manufacturing PMI figures for September and Euro Zone’s preliminary HICP rates for the same month, while ECB’s Elderson, De Guindos and Rehn are scheduled to speak. In the American session, we get Canada’s S&P Global manufacturing PMI figure for September, the US ISM manufacturing PMI figure and ADP national employment figure for September and the weekly EIA crude oil inventories figure, while Richmond Fed President Barkin and BoC’s Rogers are scheduled to speak and BoC to release the summary of monetary policy deliberations for the bank’s last interest rate decision. In tomorrow’s Asian session we note the release of Australia’s August trade data while RBA is to release its Financial Stability Review.

XAU/USD Daily Chart

- Support: 3740 (S1), 3620 (S2), 3500 (S3)

- Resistance: 3860 (R1), 3980 (R2), 4100 (R3)

EUR/USD Daily Chart

- Support: 1.1650 (S1), 1.1480 (S2), 1.1330 (S3)

- Resistance: 1.1800 (R1), 1.1980 (R2), 1.2160 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.