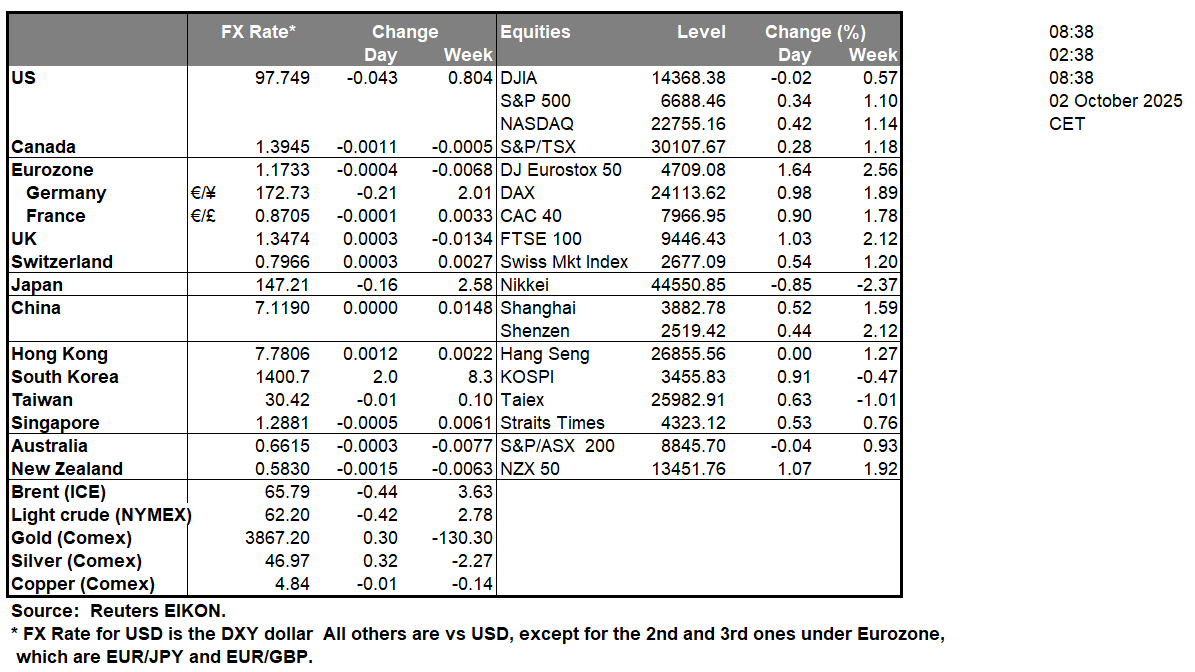

The Supreme Court has blocked President Trump’s attempts to immediately fire Fed Board Governor Lisa Cook. According to the FT, the court has said in an order that it had deferred the President’s application until the justices heard oral arguments in the case in January of 2026, essentially allowing Fed Governor Cook to continue in her position until next year. In our view the decision by the Supreme Court to allow Governor Cook to operate in her existing capacity is a tremendous victory for the Fed’s independence and could alleviate market worries regarding the Fed’s vulnerability to external pressures, which in turn could provide support for the dollar. Furthermore, the decision by the Fed may set a precedent that Fed officials cannot be immediately fired by a sitting US President without due cause and thus could increase overall optimism surrounding the Fed’s long term monetary policy path. The US Government is still currently in a “shut down” mode with Bloomberg reporting that President Trump is preparing to use the shutdown in order to fire federal workers this week. Overall, the President may be attempting to strong-arm Democratic Senators as the longer the shutdown is maintained, the pressure on the Senate from their constituents may increase and thus could force the Democratic party into providing concessions. However, that pressure goes both ways and thus it remains to be seen which side will cave in first. From a market perspective, the continued shutdown could weigh on the US Equities markets and may continue to do so given the negative implications on the US economy due to a prolonged shutdown.

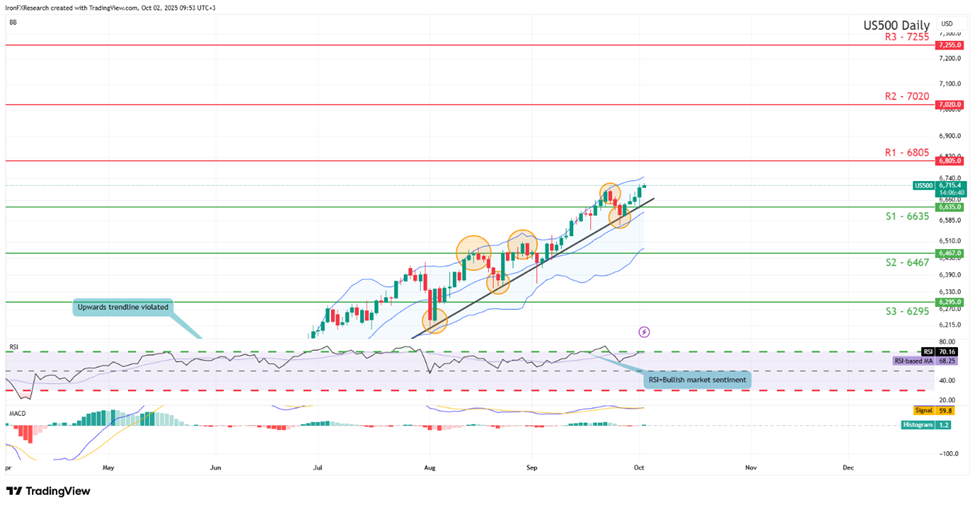

US500 appears to be moving in an upwards fashion. We opt for a bullish outlook for the index and supporting our case is the upwards moving trendline, in addition to the RSI indicator below our chart which currently registers a figure near 70, implying a bullish market sentiment. For our bullish outlook to continue, we would require a break above our 6805 (R1) hypothetical resistance level, with the next possible target for the bulls being the 7020 (R2) hypothetical resistance line. On the other hand, for a bearish outlook, we would require a clear break below our 6635 (S1) support level with the next possible target for the bears being the 6467 (S2) support line. Lastly, for a sideways bias we would require the index to remain between our 6635 (S1) support level and our 6805 (R1) resistance line.

EUR/USD appears to be moving in a sideways fashion. We opt for a sideways bias and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained, we would require the pair to remain confined between our 1.1650 (S1) support level and our 1.1800 (R1) resistance line. On the other hand, for a bearish outlook we would require a break below our 1.1650 (S1) support level with the next possible target for the bears being the 1.1480 (S2) support line. Lastly, for a bullish outlook we would require a clear break above our 1.1800 (R1) resistance level with the next possible target for the bulls being the 1.1980 (R2) resistance line.

今日其他亮点:

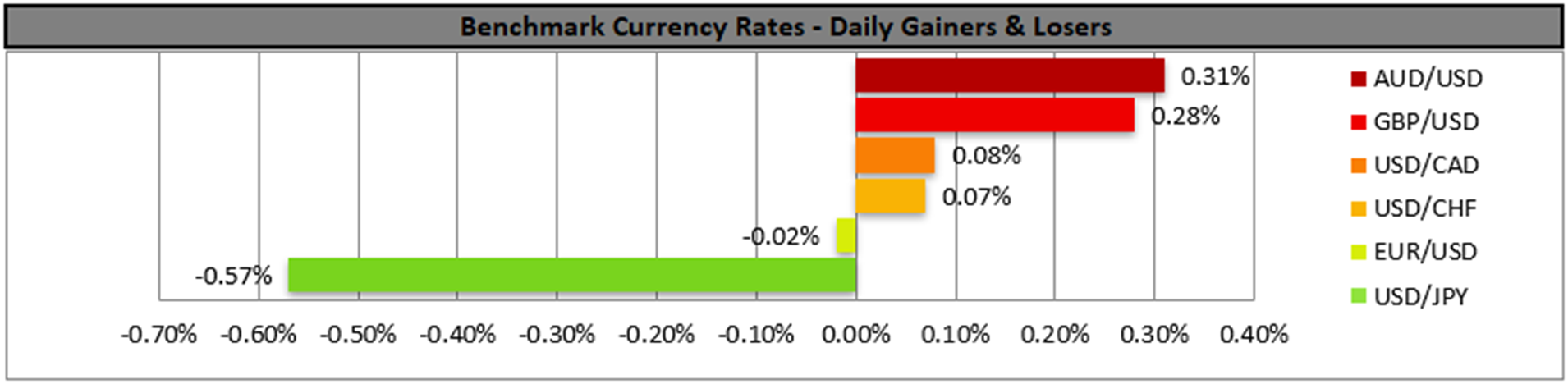

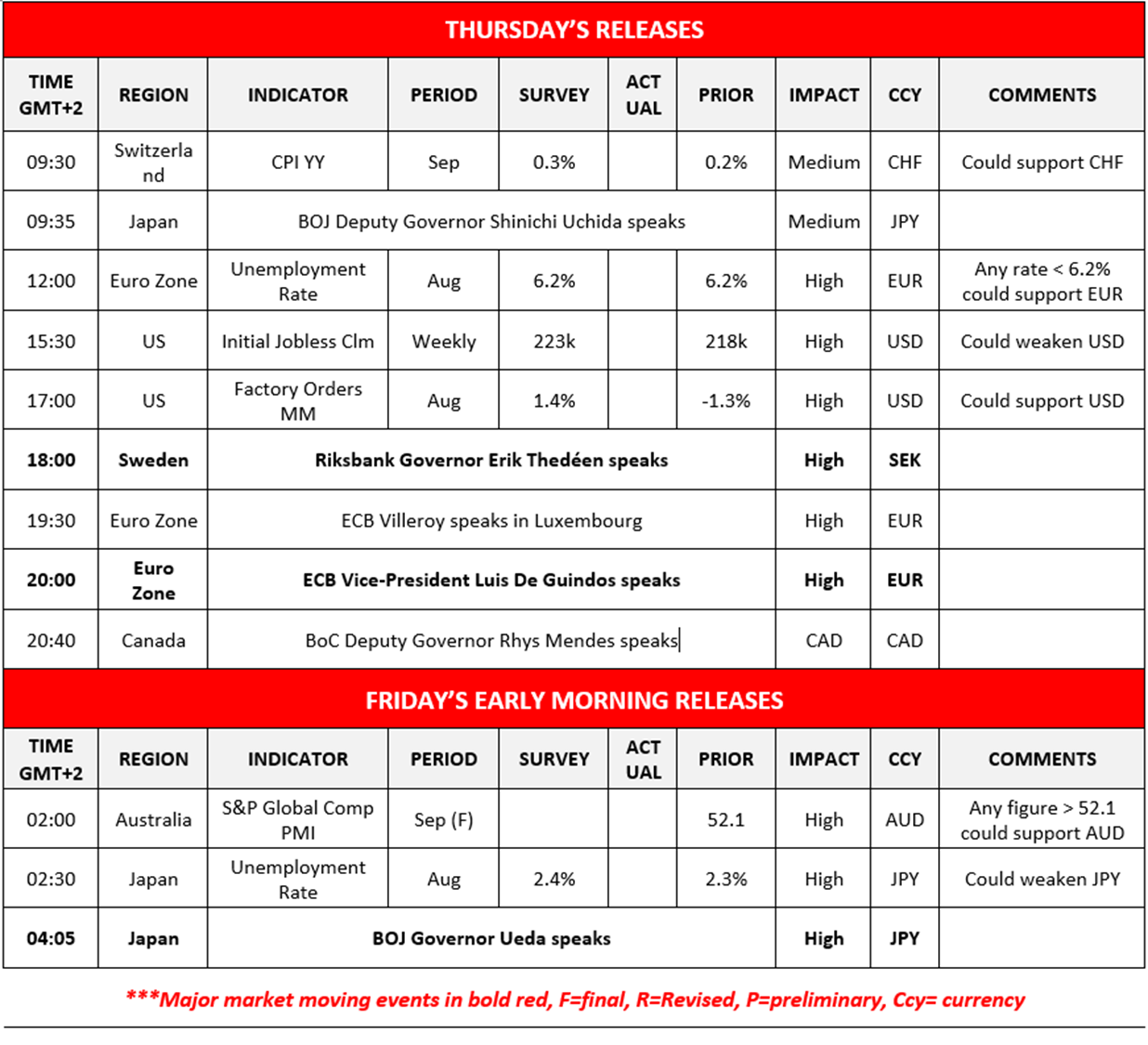

In today’s European session, we note the release of Switzerland’s CPI rate for September and the Eurozone’s unemployment rate for August. In the American session, we note the release of the US weekly initial jobless claims figure, the US factory orders rate for August. In tomorrow’s Asian session we note the release of Australia’s final composite PMI figure for September and Japan’s unemployment rate for August. On a monetary level, we note the speeches by BOJ Deputy Governor Uchida, Riksbank Governor Thedeen, ECB Villeroy, ECB Vice President De Guindos and BoC Deputy Governor Mendes. Tomorrow we note the speech by BOJ Governor Ueda.

US500 Daily Chart

- Support: 6635 (S1), 6467 (S2), 6295 (S3)

- Resistance: 6805 (R1), 7020 (R2), 7255 (R3)

EUR/USD Daily Chart

- Support: 1.1650 (S1), 1.1480 (S2), 1.1330 (S3)

- Resistance: 1.1800 (R1), 1.1980 (R2), 1.2160 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.