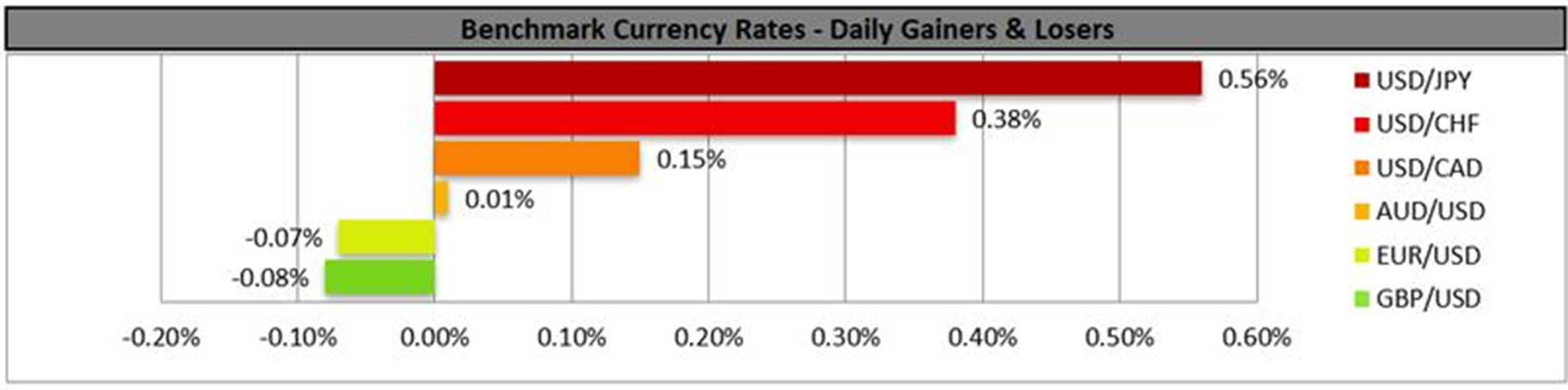

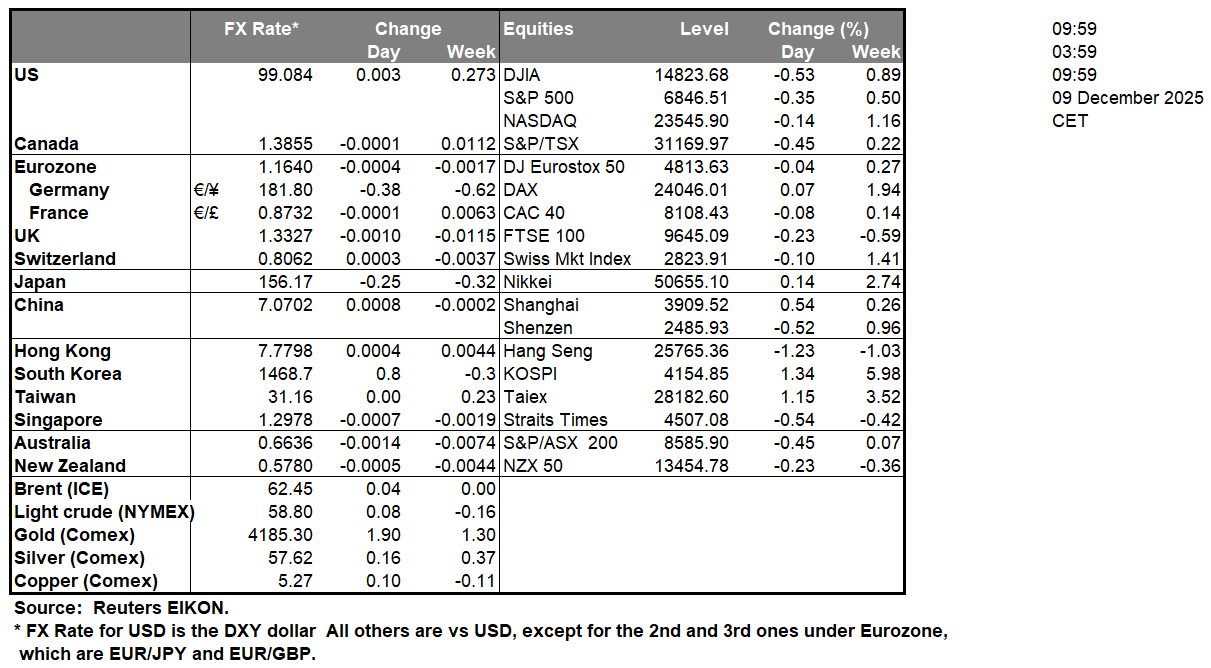

The RBA earlier on today remained on hold, leaving the cash rate unchanged at 3.60% as was widely expected by market participants. Thus attention turned to the bank’s accompanying statement where it was noted that inflation has picked up more recently and that “the data do suggest some signs of a more broadly based pick-up in inflation, part of which may be persistent and will bear close monitoring”. Moreover, RBA Governor Bullock stated that “”If inflation continues to be persistent and looks like it is not coming back down towards the target, then I think that does raise questions about how tight financial conditions are and the board might have to consider whether or not it’s appropriate to keep interest rates where they are or in fact at some point raise them”, clearly showcasing that the rate hike option is on the table. In turn the comments made by the RBA Governor could provide support for the Aussie.In the US, the JOLTS Job openings figure for the month of October are set to be released during today’s American session and could in turn lead to some volatility in the dollar. In particular, the financial release is anticipated by economists to come in at 7.150 million which would be lower than the prior release of 7.227 million and thus could weigh on the dollar. On the other hand, a higher-than-anticipated figure could provide support for the greenback.In the US Equities markets, according to the FT, President Donald Trump will allow Nvidia (#NVDA) to export its H200 chip to China which in turn could provide support for Nvidia’s stock price Sticking to the Equities story, a bidding war has emerged between Netflix (#NFLX) and Paramount as they both attempt to take over Warner Bros. In turn, the victor could face downward pressures on their stock price temporarily, but may gain in the long run

EUR/USD appears to be moving in an upwards fashion. We opt for a bullish outlook for the pair and supporting our case is the upwards moving trendline which was incepted on the 5th of November, in addition to the RSI, MACD and ADX with DI indicators below our chart which tend to point towards a bullish market sentiment. For our bullish outlook to be maintained, we would require a clear break above our 1.1685 (R1) resistance level with the next possible target for the bulls being our 1.1815 (R2) resistance line. On the other hand, for a sideways bias we would require the pair to remain confined between our 1.1560 (S1) support level and our 1.1685 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 1.1560 (S1) support level with the next possible target for the bears being our 1.1460 (S2) support line.

XAU/USD appears to be moving in a sideways fashion, with the precious metal appearing to be aiming for our 4142 (S1) support level. We opt for a sideways bias for gold’s price and supporting our case is the failure to clear our 4240 (R1) resistance line, yet all three indicators below our chart tend to point towards a bearish market sentiment. Nonetheless, for our sideways bias to be maintained, we would require the commodity’s price to remain confined between our 4142 (S1) support level and our 4240 (R1) resistance line. On the other hand, for a bearish outlook, we would require a clear break below our 4142 (S1) support level with the next possible target for the bears being our 4080 (S2) support line. Lastly, for a bullish outlook we would require a clear break above our 4240 (R1) resistance line with the next possible target for the bulls being our 4315 (R2) resistance level.

今日其他亮点:

Today, we get Germany’s trade data for October, the US JOLTS job openings figure for October and the weekly US API weekly crude oil inventories figure. In tomorrow’s Asian session, we get Japan’s corporate goods prices for November and China’s inflation metrics for the same month.

EUR/USD Daily Chart

- Support: 1.1560 (S1), 1.1460 (S2), 1.1345 (S3)

- Resistance: 1.1685 (R1), 1.1815 (R2), 1.1917 (R3)

黄金/美元4小时走势图

- Support: 4142 (S1), 4080 (S2), 4010 (S3)

- Resistance: 4240 (R1), 4315 (R2), 4380 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.