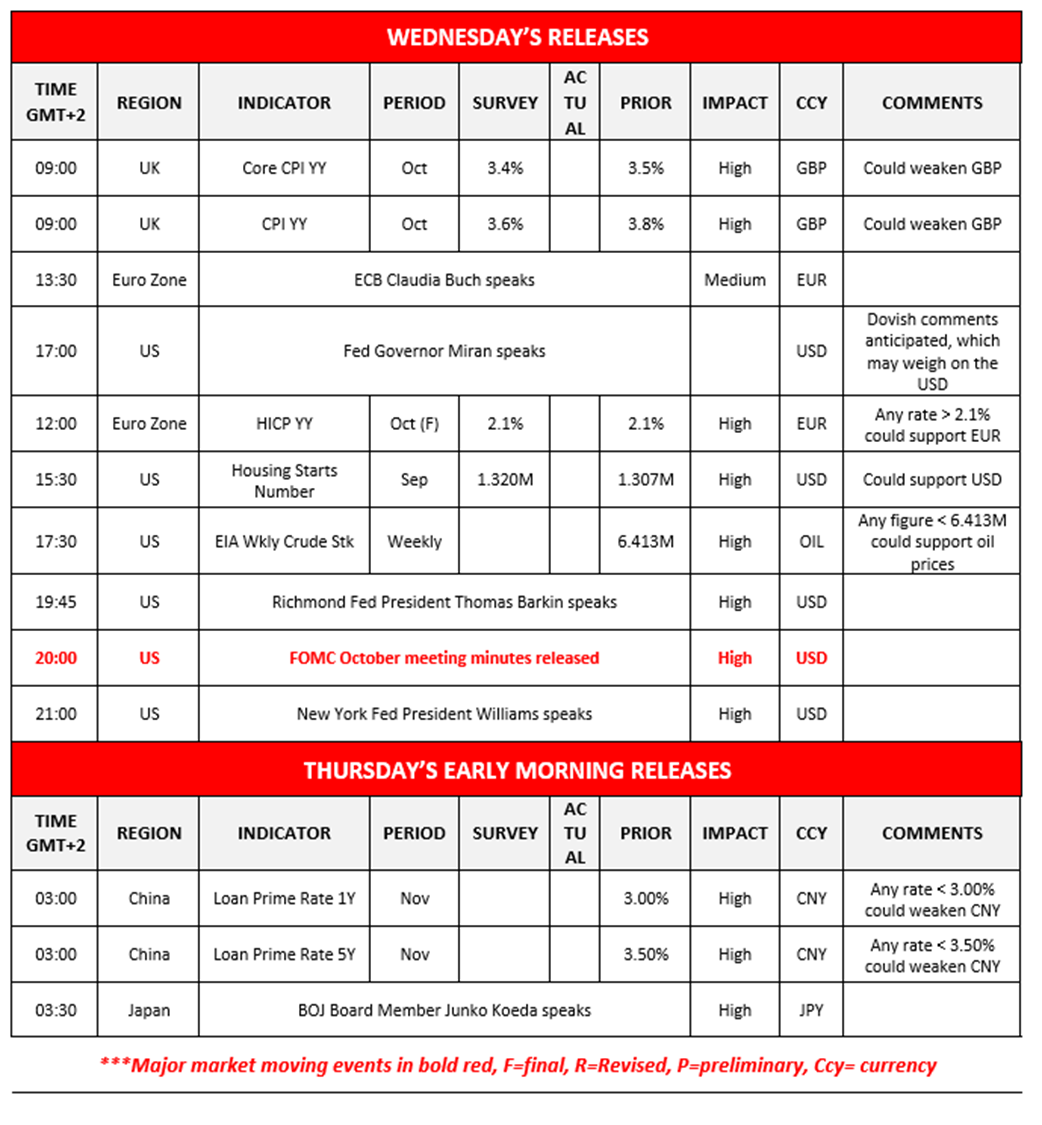

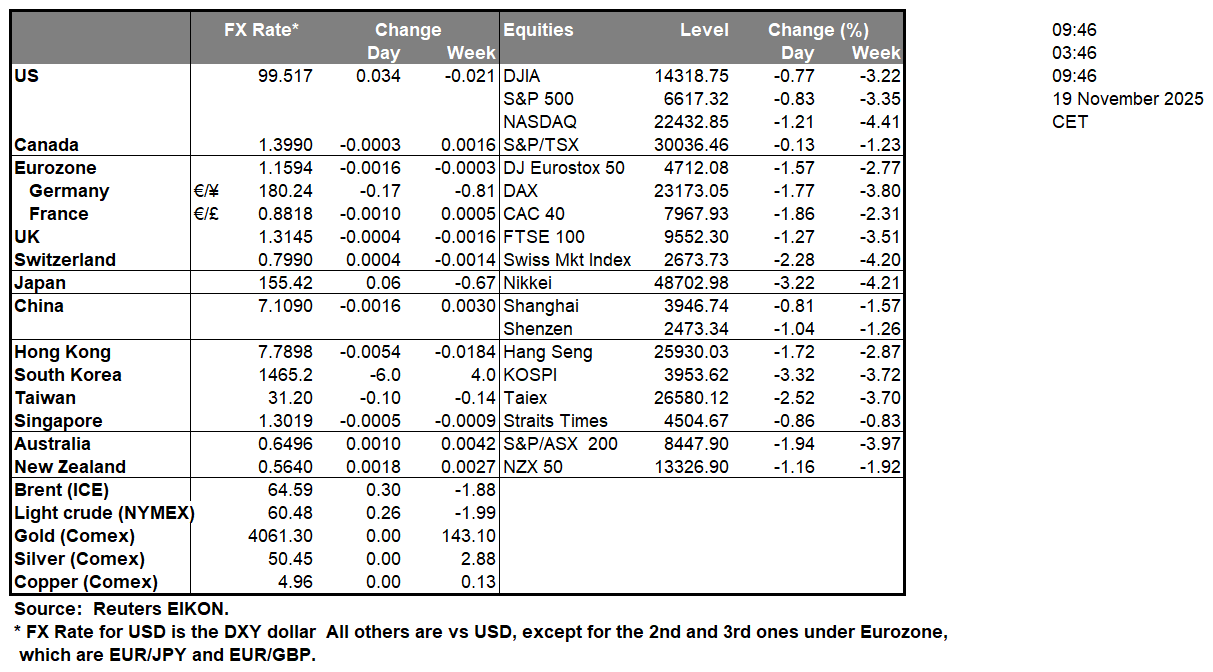

The FOMC’s October meeting minutes are set to be released during today’s American session and could influence the greenback. The minutes may provide insight into the Fed’s inner deliberations and the concerns that may have emerged in the prior meeting, which may also showcase the divisions within the Fed as to how they approached their prior monetary policy decision. Moreover, the minutes could set the tone for the markets as we head towards the last meeting of the year in the first weeks of December. Hence, should a prevailing hawkish sentiment emerge, it may provide support for the dollar and could increase market expectations of a Fed rate hold in their December meeting. On the other side, a dovish sentiment may have the opposite effect. In our view, we wouldn’t be surprised to see policymakers being split on as to how they should have approached the bank’s last decision, with heavy emphasis being placed on the state of the labour market.In the US Equities markets, all eyes will be on Nvidia’s (#NVDA) earnings report later on today. Considering how Nvidia acts as a barometer for the tech industry and can be attributed much of the credit for technological advancements recently, their earnings report could make or break the US Equities markets. Specifically for the company’s stock price and for the Nasdaq and S&P500 to gain, we would require the company’s earnings to not only meet EPS and revenue expectations but to exceed them. Otherwise, a failure to meet expectations by the street could weigh on the company’s stock price as well as the major indexes such as the S&P500, NASDAQ 100 and the Dow Jones 30.In the UK, the nation’s headline CPI rate accelerated which may provide support for the Cable.

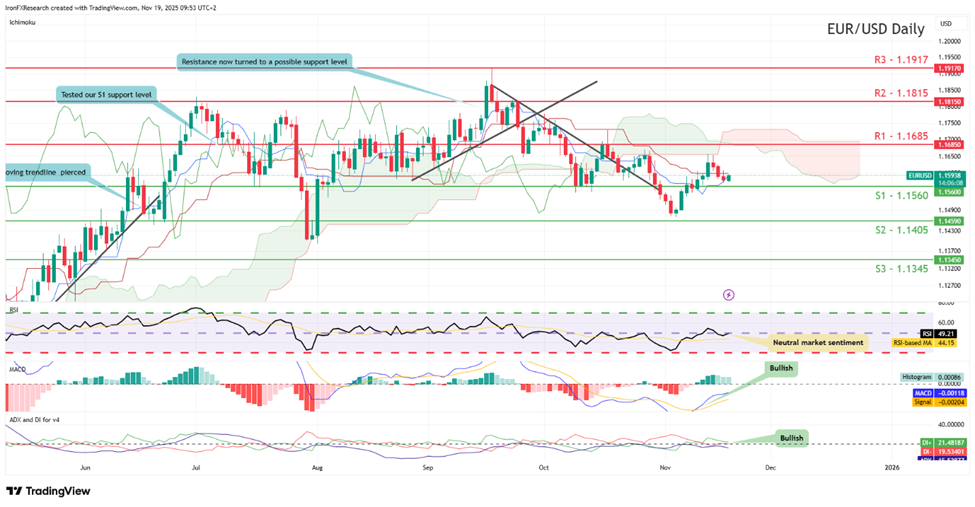

EUR/USD appears to be moving in a sideways fashion after re-emerging above our 1.1560 (S1) support level. We opt for a sideways bias for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained we would require the pair to remain confined between our 1.1560 (S1) support level and our 1.1685 (R1) resistance line. On the other hand, for a bullish outlook we would require a clear break above our 1.1685 (R1) resistance line with the next possible targets for the bulls being our 1.1815 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below our 1.1560 (S1) support line with the next possible target for the bears being our 1.1405 (S2) support level.

XAU/USD appears to have resurfaced above our resistance turned to support at the 4045 (S1) level. We opt for a sideways bias for the precious metal’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50 implying a neutral market sentiment. For our sideways bias to be maintained we would require the commodity’s price to remain confined between our 4045 (S1) support level and our 4145 (R1) resistance line. On the other hand, for a bullish outlook we would require a clear break above our 4145 (R1) resistance line with the next possible target for the bulls being our 4240 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below our 4045 (S1) support line with the next possible target for the bears being our 3980 (S2) support level.

今日其他亮点:

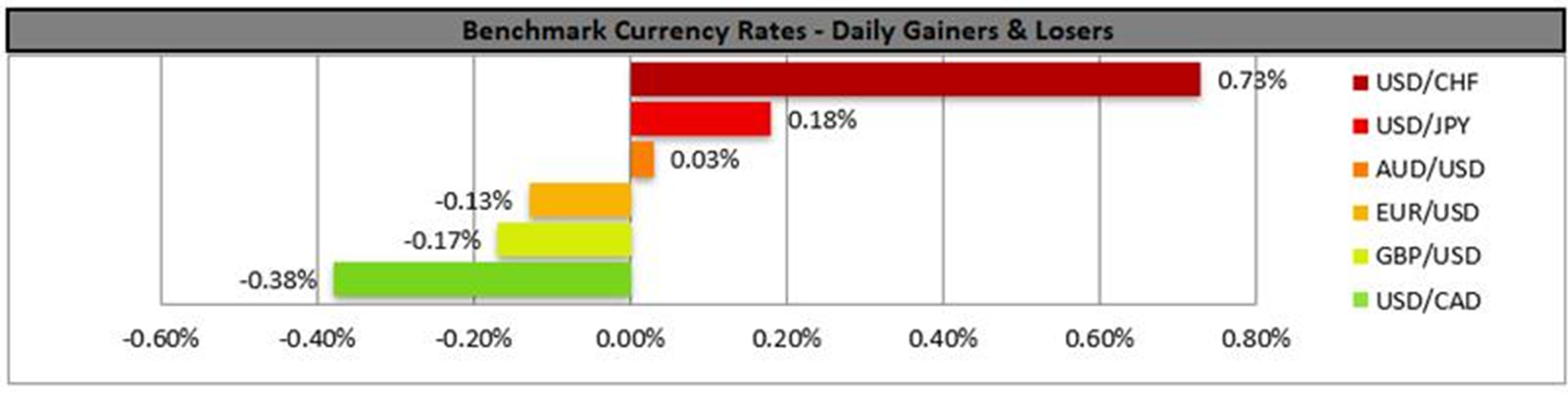

Today we get the UK’s CPI rates for October, the speeches by ECB Buch and Fed Governor Miran, followed by the Zone’s final HICP rate for October, the US Housing starts figure for September, the EIA weekly crude oil inventories figure and ending the day are the speeches by Richmond Fed President Barkin, the release of the FOMC’s October meeting minutes and the speech by New York Fed President Williams. In tomorrow’s Asian session we note China’s Loan prime rates and the speech by BOJ Koeda.

EUR/USD Daily Chart

- Support: 1.1560 (S1), 1.1405 (S2), 1.1345 (S3)

- Resistance: 1.1685 (R1), 1.1815 (R2), 1.1917 (R3)

黄金/美元 4小时图

- Support: 4045 (S1), 3980 (S2), 3902 (S3)

- Resistance: 4145 (R1), 4240 (R2), 4340 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.