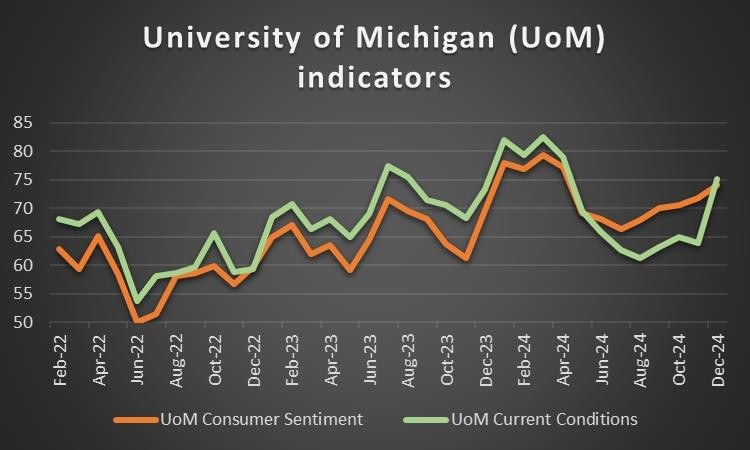

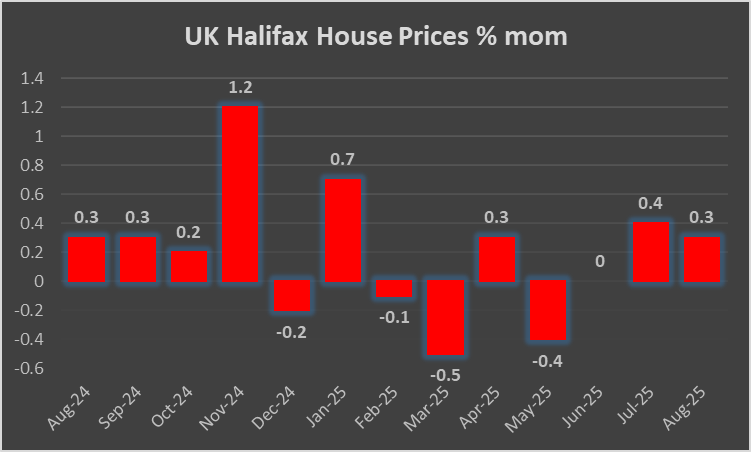

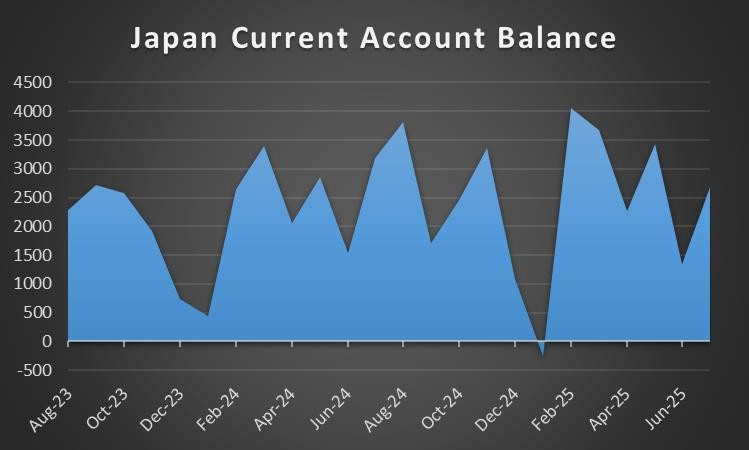

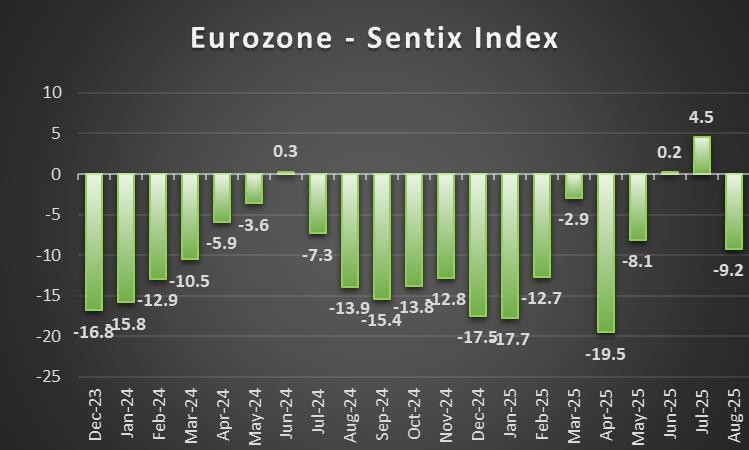

The week is nearing its end as we open a window at what next week has in store for the markets. On Monday, we get the Czech Republic’s preliminary CPI rates for September and Euro Zone’s Sentix index for October. On Tuesday we get August’s industrial orders of Germany, the UK’s Halifax House Prices for September and Canada’s trade data for August. On Wednesday, we get Japan’s current account balance for August, from New Zealand RBNZ’s interest rate decision, Germany’s industrial output for August, Sweden’s September preliminary CPI rates and the Fed is to release the minutes of its September meeting. On Thursday we get the weekly US initial jobless claims figure and on Friday we note the release of Sweden’s GDP rate for August, Norway’s CPI rates for September, Canada’s employment data for the same month and the preliminary US University of Michigan consumer sentiment for October.

USD – Fed’s meeting minutes to move the USD

We would start the USD paragraph with a note that the US employment report for September are still to be released as these lines are written and could alter the USD’s direction, yet the US Government shutdown may delay the release. The US Government shutdown may have been the main issue for the USD in the week. US President Trump and US Congress Democrats were unable to reach a deal that would allow the Congress to approve further funding for the US Government. The situation is ongoing and currently there seems to be no solution in sight. The US Government shutdown is another indication for the instability in the US and tends to intensify market uncertainty. US President Trump is reported to be preparing to use the shutdown in order to fire federal workers this week. Overall, the President may be attempting to strong-arm Democratic Senators as the longer the shutdown is maintained, the pressure on the Senate from their constituents may increase and thus could force the Democratic party into providing concessions. However, that pressure goes both ways and thus it remains to be seen which side will cave in first. On a macro level and given the drop of the ADP Employment change figure for September which dropped into the negatives, market worries for a possibly loose US employment market may be enhanced. Such worries tend to enhance the market’s dovish expectations for the Fed’s intentions. On monetary level, we highlight the release of the Fed’s September meeting minutes next Wednesday, and should the document show a stronger than expected dovish inclination on behalf of the bank we may see the release weighing on the USD and vice versa. Also the release next Thursday, of Fed Chairman Powell’s prerecorded welcoming remarks before the Community Bank Conference could be of interest. Should the Fed Chairman intensify his doubts for the necessity of an extensive easing of the bank’s monetary policy we may see the USD getting some support and vice versa.

Analyst’s opinion (USD)

“Overall, fundamentals are expected to lead the SUD next week. The US Government shutdown should it be prolonged could weigh on the USD, while the dovish market’s expectations for the Fed could also weigh on the USD . ”

GBP – Worries for UK Government’s fiscal plans

On a political level for the pound we note the UK Government’s controversial plans for a compulsory digital ID card. Yet our interest lies mostly on UK Government’s fiscal intentions as the situation is tense, with November’s budget as a compass. UK Chancellor of the Ex Chequers Rachel Reeves, was reported stating that the government is facing difficult choices yet also pledged to maintain “taxes, inflation and interest rates as low as possible”, with the key words in our opinion being “as possible”. Hence we may see the UK Government maintaining a contractionary fiscal policy and further signals towards that direction could weigh on the GBP. It’s characteristic of the market’s worries for the UK outlook that UK 10-year gilt auction draws weakest demand since May, as per Reuters. Please note that on Friday, Fitch is to review UK’s credit rating and a possible downgrading or in any case an adverse opinion could weigh on the pound. On a monetary level, we note the comments of BoE MPC member Catherine Mann that inflation in the UK and become persistently high. Yet at the same time she did not exclude the possibility of more rate cuts. Mann is considered in general as leaning on the hawkish side, yet nevertheless the comments may have enhanced market expectations for the bank to remain on hold which could be considered as supportive for the pound. We note the speech of BoE Governor Andrew Bailey on Monday as well as BoE Chief economist Huw Pill on Wednesday and any further hawkish comments could support the pound. On a macro level, we note the acceleration of the GDP rates for Q2, in a positive sign for the expansion of the UK economy. In the coming week, the pound traders’ calendar is rather empty yet the Halifax house prices for September on Tuesday and the Construction PMI figure for the same month could generate some interest, yet other than that we may see fundamentals leading the pound.

Analyst’s opinion (GBP)

“On the one hand we see the market’s expectations for the BoE to remain on hold until the end of the year tends to be supportive for the pound. On the other hand though the fiscal tightness of the UK Government tends to weigh on the sterling.”

JPY – BoJ’s intentions could support the Yen

JPY seems about to end the week stronger against the USD, but also the GBP and EUR in a signal of a wider strength of the Japanese currency. There are a number of factors supporting the JPY and BoJ’s monetary policy intentions seem to be one of them. The market expects the bank to hike rates until the end of the year which tends to narrow the outlook of interest rate differentials with the fed and other central banks thus providing support for the JPY. Bloomberg reported that BoJ Deputy Governor Shinichi Uchida reaffirmed the Bank of Japan’s standing policy to raise benchmark interest rates if the economy performs in line with forecasts. It should be noted that the comment was made after the release of the Tankan Indexes for Q3, which undershoot the market’s expectations. Next Wednesday, we expect BoJ Governor Ueda’s speech to be closely watched by JPY traders and a possibly hawkish tone could provide support for the Yen. JPY traders are turning their attention to the leadership election of the new leader of the LDP, which is to largely also decide Japan’s new PM. The new Government is expected to influence Japan’s fiscal policy but also the Japanese government’s approach to BoJ’s monetary policy. Frontrunners for the election seem to oppose BoJ’s intentions to tighten its monetary policy. Overall, we view risks stemming from the LDP elections over the weekend as tilted to the bearish side for JPY. On a fundamental level, the uncertainty caused by geopolitical issues as well as the US Government shutdown may have provided some safe haven inflows for the JPY. Macroeconomics were not so favourable for JPY in the past few days given that the industrial output growth rate for August remained well in the negatives and retail sales for the same month also showed a contraction. In the coming week, we note the release of the current account balance for August as well as the Corporate Goods Prices for the same month.

Analyst’s opinion (JPY)

“JPY seems to be the winner for the week in the FX market, supported by BoJ’s hawkish intentions as well as safe haven inflows for the Japanese currency. Should fundamentals continue to favour the Yen in the coming week, we may see it gaining further ground ”

EUR – Conflicting fundamentals for the common currency

The common currency seems to have been caught between conflicting fundamentals. On the one hand the worries for Russian aggressiveness tend to weigh on the common currency. A most recent example mentioned by the German press, is that the EU seems to be unprepared for a possible Russian air raid, and seems particularly vulnerable against Russian drones. If combined with the cold relationships with the US, or at best the viewing of US President Trump as untrustworthy, and the strong belief among Europeans that they cannot rely on the US for military assistance anymore, is expected to shift the EU’s fiscal policies towards military spending. Also the pressure from US President Trump for the EU to stop buying Russian fuel does not pose well for the EUR. For the time being we view the issue as weighing on the common currency. On the other hand, though we note that the market’s expectations for the ECB’s monetary policy intentions as supportive for the single currency. Currently EUR OIS imply that the market awaits the bank to remain on hold, well beyond the end of the year. It’s characteristic that Bloomberg reported that ECB President Lagarde stated that inflation risks are ‘quite contained’ in each direction, a statement implying that the bank may be in a good place with no mood to nor to ease nor to tighten its monetary policy. Such tendencies are expected to mildly support the EUR and in the coming week we note the planned speeches of ECB President Lagarde and other ECB policymakers for more clues about the bank’s intentions. On a macroeconomic level, the slight acceleration of the HICP rate for the prior month on a preliminary level, tends to add a hawkish note to the market’s expectations for the ECB’s intentions. In the coming week, Euro Zone’s forward looking Sentix index for October may be closely watched as well as Germany’s industrial orders and output for August, yet other than that, fundamentals including ECB’s monetary policy may be the key drivers for the single currency.

Analyst’s opinion (EUR)

“In the coming week we may see fundamentals including ECB’s monetary policy as the key drivers for EUR’s direction. On the one hand the ECB’s current intentions to keep its monetary policy steady tends to provide support for the EUR, while the uncertainty and the tensions in the EU-Russian relationships tend to weigh on the EUR.”

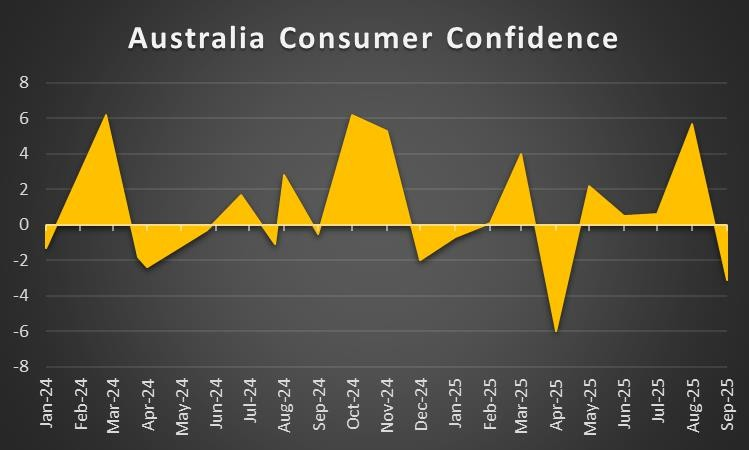

AUD – RBA remained on hold with a hawkish tilt

The Aussie on a monetary level got some support as RBA remained on hold as was widely expected, keeping rates unchanged at 3.6%. In its accompanying statement the bank seemed to be leaning more towards the hawkish side by noting that financial conditions have eased and that the full effect of earlier rate cuts will take some time to be shown. Overall should this hawkish turn in RBA’s direction be intensified we may see the Aussie getting additional support. Yet we also note that the bank in its financial stability review seemed worried about global financial stability while also finds that Australian households, businesses and banks are well placed to weather most shocks. On a macroeconomic level, news are not so good as the building approvals displayed a wide contraction for August while the trading surplus for the same month narrowed, implying that Australia has gained less from its international trading activities. In the coming week, we note the release of Australia’s consumer sentiment for October. On a fundamental level we expect the Aussie to be affected by the market sentiment in the sense that as a commodity currency it’s considered a riskier asset in the FX market, hence an improvement of the market sentiment could provide some support for AUD and vice versa. Also the US- Sino relationships could play a role for AUD’s direction given the close Sino-Australian economic ties. An improvement of the US-Sino relationships given the ongoing negotiations between the two super economies, could provide support for AUD and the contrary a deterioration of their relationships could weigh on the Aussie.

Analyst’s opinion (AUD)

“It is our view that the RBA’s monetary policy stance is at a ‘good’’ place currently and thus we wouldn’t be surprised to see some pushback from policymakers if asked about a possible rate cut in the near future. Moreover, the monthly acceleration of inflation in the economy may dampen hopes that the RBA could cut in their next meeting.”

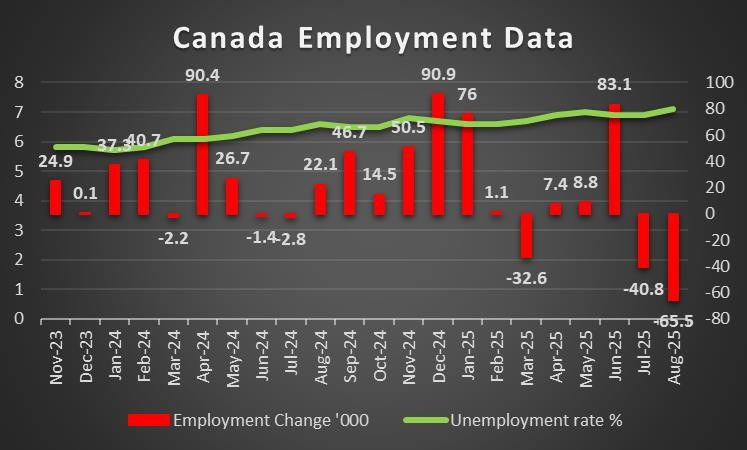

CAD – September’s employment data to move the Loonie

In the coming week we highlight the release of Canada’s September employment data next Friday. The release of Canada’s August employment data was a disappointment for Loonie traders as the unemployment rate rose to 7.1% if compared to July’s 6.9% while the employment change figure dropped deep into the negatives reaching as low as – 65.5k. The data highlighted the weakness of the Canadian employment market enhancing also the market’s dovish expectations for BoC’s intentions. Should the actual data imply a tightening Canadian employment market we may see the Loonie getting some support and vice versa. On a monetary level, the market’s expectations for the bank to cut rates once more before the year ends tends to weigh on the Loonie. It should be note that the Bank’s decisiveness to ease its monetary policy was underscored by the release of its deliberations for the last interest rate decision. Hence we see BoC’s intentions as a factor primarily weighing on the Loonie. On a fundamental level the market sentiment could also play a role in the path of the CAD with a possible improvement supporting it given the CAD’s status as a commodity currency. On the flip side the sinking of oil prices over the past week tends to weigh on the CAD as well as Canada is a major oil producer.

Analyst’s opinion (CAD)

“We view the release of Canada’s employment data for September as the key event for CAD traders in the coming week, and a possible further deterioration of the conditions in the Canadian employment market could weigh on the Loonie. Furthermore the weakening of oil prices and the market’s dovish expectations for BoC’s intentions tend to weigh on the CAD.”

General Comment

In the coming week we expect that USD’s dominance may ease given the lower number of high impact financial releases stemming from the US on the flip side the markets’ interest for the USD could be maintained as US fundamentals including the US Government shutdown and the Fed’s intentions are expected to continue to captivate market interest. In the US equities markets we tend to maintain currently a bullish outlook as the market’s dovish expectations for the Fed’s intentions as well as high expectations for the potentials of AI keep spirits high. On the other hand given the high concentration observed in US stock markets and the frequent consecutive new all time high peaks, we are worried that prices are overstretched to the upside and a correction lower may be in order for US equities. Similar observations can be made about gold’s price which also has reached new record high levels.

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.