For the past week US stock markets tended to be on the rise, and its characteristic that Nasdaq and S&P 500 reached new record high levels. We are to review a number of fundamental issues which tend to affect US equities and are to conclude the report with a technical analysis of S&P 500’s daily chart.

US July CPI rates allow for US equities to rise

US equities were on the rise yesterday as the release of the US CPI rates for July sent mixed signals. On the one hand, the headline rate failed to accelerate even marginally as was expected, yet on the other, the headline rate accelerated beyond market expectations, implying a resilience of inflationary pressures. The main issue for the release though, was that it allowed for the markets’ dovish expectations for the Fed’s intentions to be maintained, if not be enhanced after the weak July employment data released on August 1st. Currently, Fed Fund Futures (FFF) tend to imply a probability of 98% for the bank to proceed with a 25-basis points rate cut in its next meeting, September 17th. It should be noted that FFF imply that the market expects the bank to continue cutting rates at each meeting until the end of the year. The market’s expectations for the bank to cut rates allowed for some support for US equities as an easing of the US financial environment could allow for an expansion of economic activity to emerge as well as higher profitability. Should we see the market’s expectations for the Fed to cut rates intensify further, we may see US stockmarkets getting some support.

Trump’s tariffs wars ease supporting US Equities

Overall in the past week we noted an easing of the market’s worries for Trump’s trade wars. The highlight may have been the announcement on Monday, of the extension of the US-Sino trade truce in an effort for a deal to be reached. Furthermore, we note that NVIDIA and AMD agreed to pay 15% of sales of chips in China to the US government, which on the one hand could be against the interests of the two companies yet the hit maybe bearable and certainly an alternative of cutting the exports of US chips to China would be worse. We also note the latest development on the issue as reported by Reuters is that the US Government is to embed trackers in AI chip shipments to catch diversions in chip exports to China. Should we see market worries for US President Trump’s trade wars ease further we may see US stockmarkets gain further ground as the uncertainty related to the issue is to be reduced.

Trump-Putin meeting being the next issue

In the past week US President Trump had threatened China and India with additional tariffs should they continue buying Russian oil. The issue highlighted how political issues overspill to trading relationships which in turn could affect the global economy. In the past few days media had highlighted the possibility for a ceasefire or even a peace deal in return for Moscow being able to keep Crimea and parts of east Ukraine. In a latest development White House officials tried to downplay the possibilities of a deal characterising the meeting as a listening exercise for US President Trump. We currently see Russia having little incentive to reach a deal at the current stage and should the two sides fail improve their relationships we may see it having a slight bearish effect on US equities, while an improvement or even an announcement of a possible deal could ease market worries and thus allow for the risk oriented market sentiment to intensify and thus for US stock markets to get some support.

Upcoming earnings reports and financial releases

The earnings season continues yet most high profile companies have released their earnings reports, yet we note some interesting releases which are to come. On Thursday we note Ali Baba’s earnings report release, on Monday BHP’s report is due out and on Tuesday we get the release of Home Depot and Xiaomi. As for financial releases, we get tomorrow Thursday the PPI rates for July and a possible acceleration could weigh on US equities, while on Friday we get the retail sales growth rate for July and a possible acceleration could support US stock markets.

技术分析

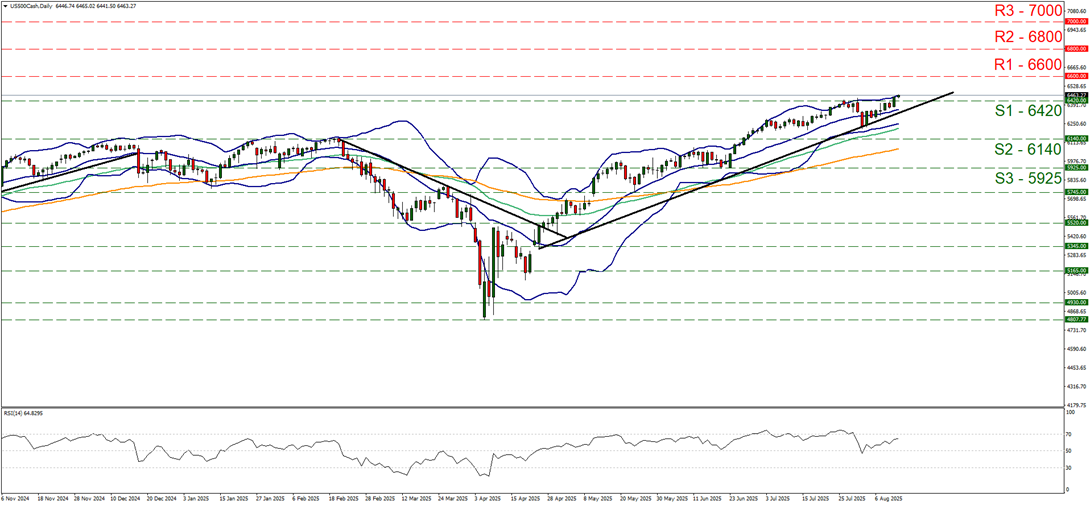

US500 Daily Chart

- Support: 6420 (S1), 6140 (S2), 5925 (S3)

- Resistance: 6600 (R1), 6800 (R2), 7000 (R3)

US stock markets were on the rise yesterday and its characteristic on a technical level that S&P 500, breached the 6420 (S1) resistance line, now turned to support reaching new record high levels. The upward movement of the index over the past week, allowed us to shift the upward trendline guiding the index’s price action since the 24th of April, to the right allowing for a renewal of the validity of the upward trendline. Given that the index’s price action was able to breach the prior record high level and that the RSI indicator is nearing the reading of 70, implying an intensifying bullish market sentiment for the index, we switch our bias for a sideways motion and adopt a bullish outlook for the index. Yet at the same time we note that the price action has reached the upper Bollinger band which in turn may slow down the bulls. We set as the next possible target for the bulls the 6600 (R1) resistance line. Should the bears take over, we may see the pair breaking the 6420 (S1) support line and aim if not reach the 6140 (S2) support level.

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.