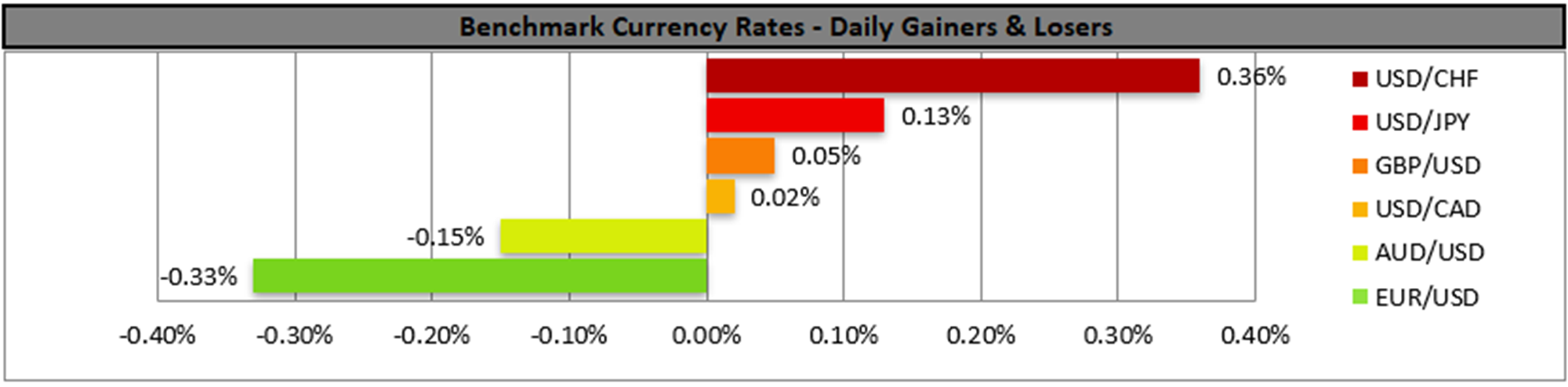

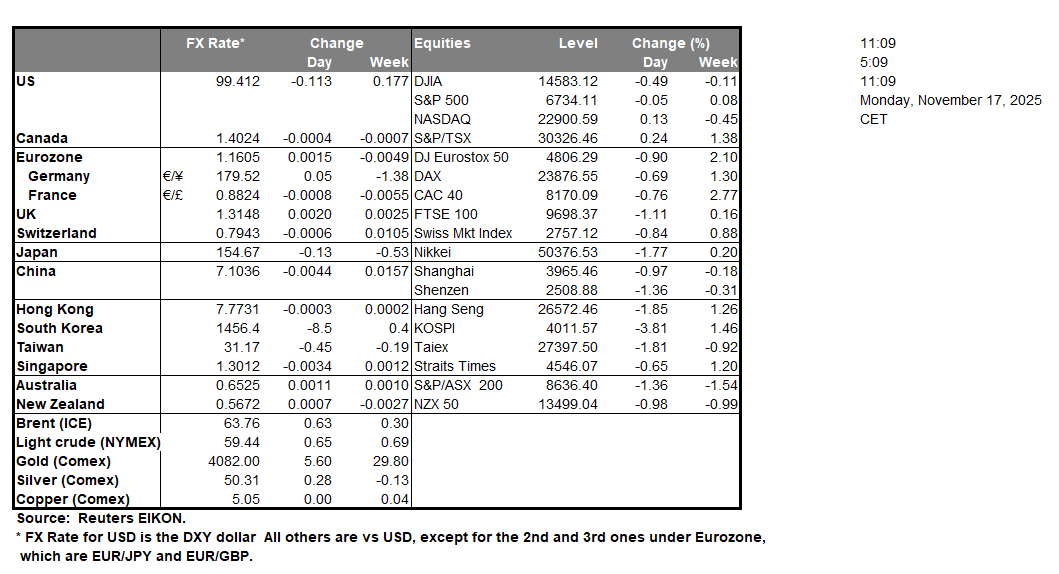

US fundamentals continue to lead the markets, with the USD index remaining relative stable, while in the Far-east the contraction of Japan’s GDP rate for Q3, tends to intensify worries for the Japanese macroeconomic outlook. Also, in the equities markets analysts are advising caution ahead of Nvidia earnings release on Wednesday. In the FX market we highlight the release of Canada’s CPI rates for October. The rates are expected to slow down and if the rates slow down beyond market expectations, we may see the Loonie losing some ground. Slowing beyond market expectations CPI rates for the past month tend to imply easing inflationary pressures in the Canadian economy, which in turn may start adding pressure on BoC to restart the easing of its monetary policy. On the flip side a possible acceleration of the rates could take the markets by surprise and provide asymmetric support for the CAD as if combined with October’s improved employment data could harden BoC’s stance.

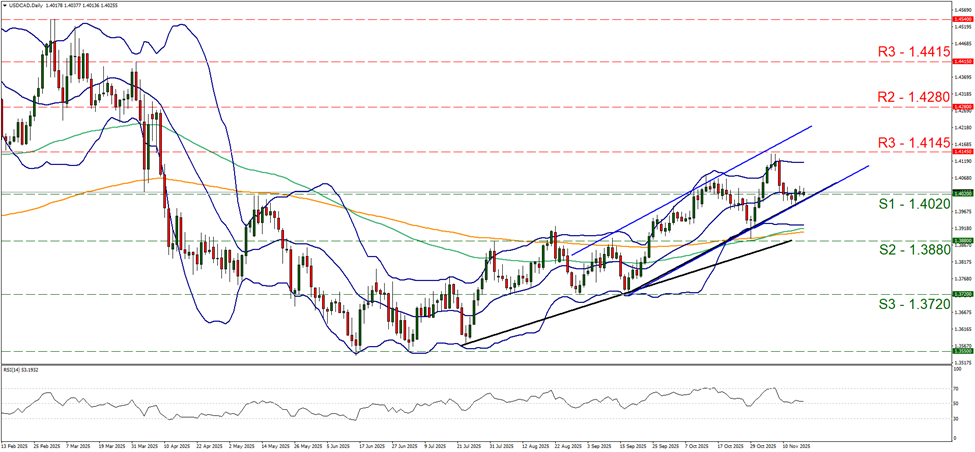

USD/CAD remained relatively steady, just above the 1.4020 (S1) support line. Overall we maintain a bias for a sideways motion of the pair, given also that the RSI indicator remains near the reading of 50, yet bullish tendencies may erupt as the pair’s price action is within tan upward channel since the end of August. For a bullish outlook to emerge we would require the pair to break the 1.4145 (R1) resistance line, which marks the latest peak and start aiming for the 1.4280 (R2) resistance level. For a bearish outlook to be adopted we would require USD/CAD to break the 1.4020 (S1) support line and continue to break also the 1.3880 (S2) support level which withheld the downward pressure on the 29th of October.

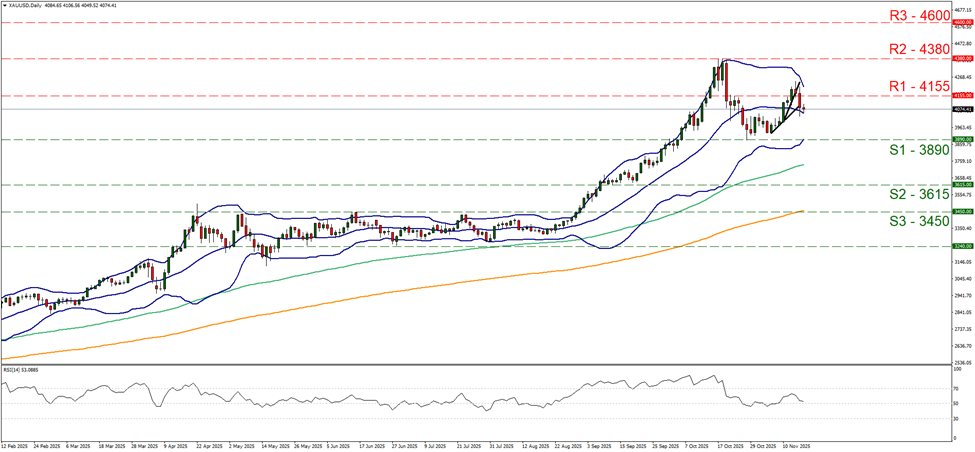

Also on a technical level, we note that gold’s price tumbled on Friday breaking the 4155 (R1) support line, now turned to resistance. Given the drop we switch our bullish outlook in favour of a sideways motion bias for the time being. Please note that the RSI indicator has approached the reading of 50, implying a rather indecisive market which could allow the sideways motion to be maintained, while similar signals are being send by the converging Bollinger bands implying less volatility for gold’s price. Should the bulls regain control over gold’s price, we may see it breaking the 4155 (R1) resistance line and start aiming for the 4380 (R2) resistance level. Should the bears take over we may see gold’s price breaking the 3890 (S1) support line and continue lower to aim the 3615 (S2) support level.

今日其他亮点:

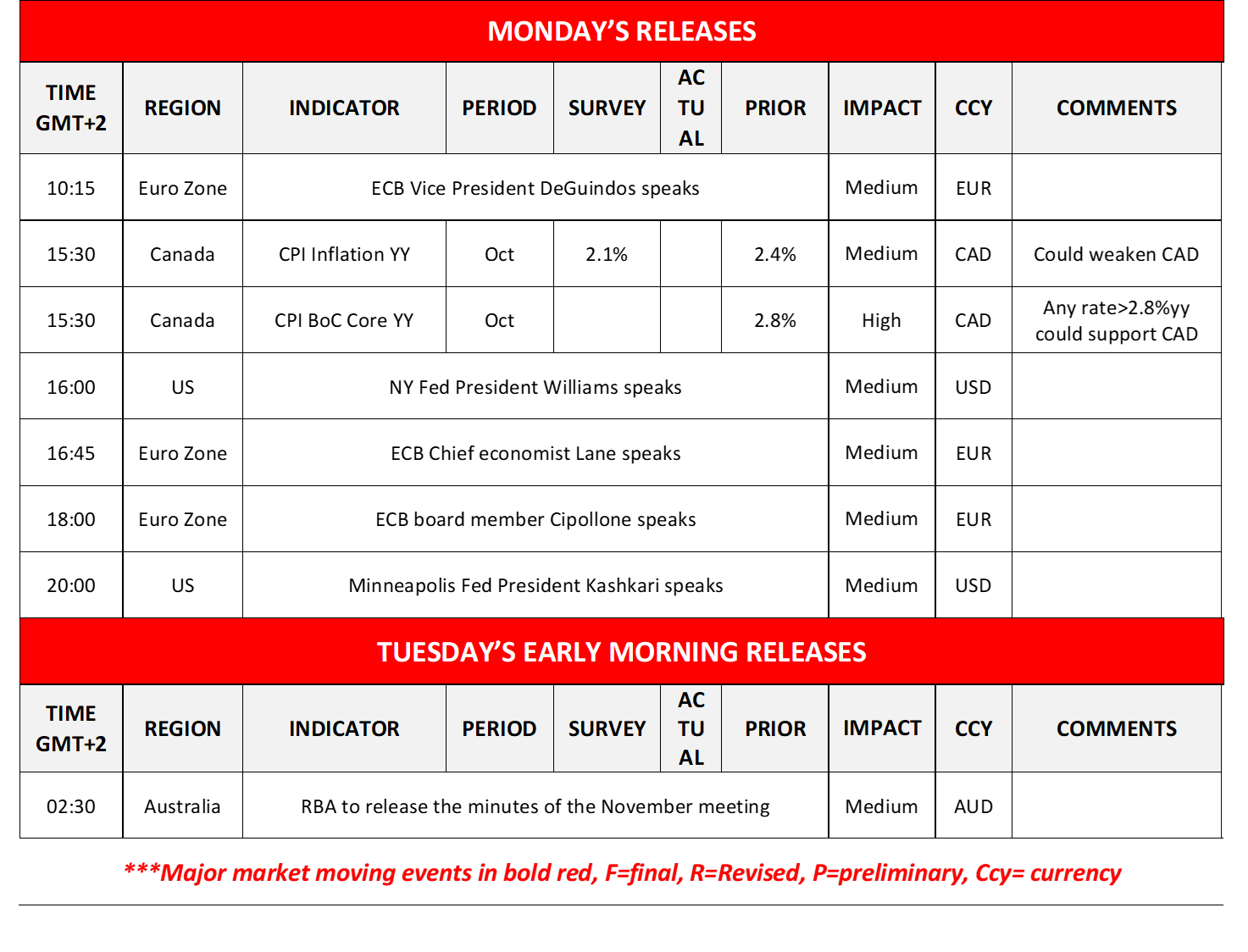

Today ECB Vice President De Guindos, NY Fed President Williams, ECB’s Lane, ECB board member Cipollone, and Minneapolis Fed President Kashkari speak, while in tomorrow’s Asian session RBA is to release the minutes of the November meeting.

本周

On Tuesday we note the release of Canada’s housing starts figure for October. On Wednesday note Japan’s machinery orders rate for September, Japan’s trade balance figure, the UK’s CPI rate, the Zone’s HICP rate all for October and ending the day are the FOMC’s October meeting minutes. On Thursday we note Chian’s loan prime rates , the US weekly initial jobless claims figure, the US Philly Fed Business index figure for November, the Eurozone’s preliminary consumer confidence figure for November and New Zealand’s trade balance figure for October. On Friday we note Australia’s preliminary manufacturing PMI figure for Nover, Japan’s CPI rates for October, Japan’s preliminary manufacturing PMI figure for November, the UK’s retail sales rate for October, France’s preliminary services PMI figure, Germany’s preliminary manufacturing PMI figure, the Zone’s preliminary composite PMI figure and the UK’s preliminary services PMI figure all for the month of November, followed by Canada’s retail sales for September, the US preliminary manufacturing PMI figure for November and the US UoM final consumer sentiment figure for November.

USD/CAD Daily Chart

- Support: 1.4020 (S1), 1.3880 (S2), 1.3720 (S3)

- Resistance: 1.4145 (R1), 1.4280 (R2), 1.4415 (R3)

黄金/美元 日线图

- Support: 3890 (S1), 3615 (S2), 3450 (S3)

- Resistance: 4155 (R1), 4380 (R2), 4600 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.