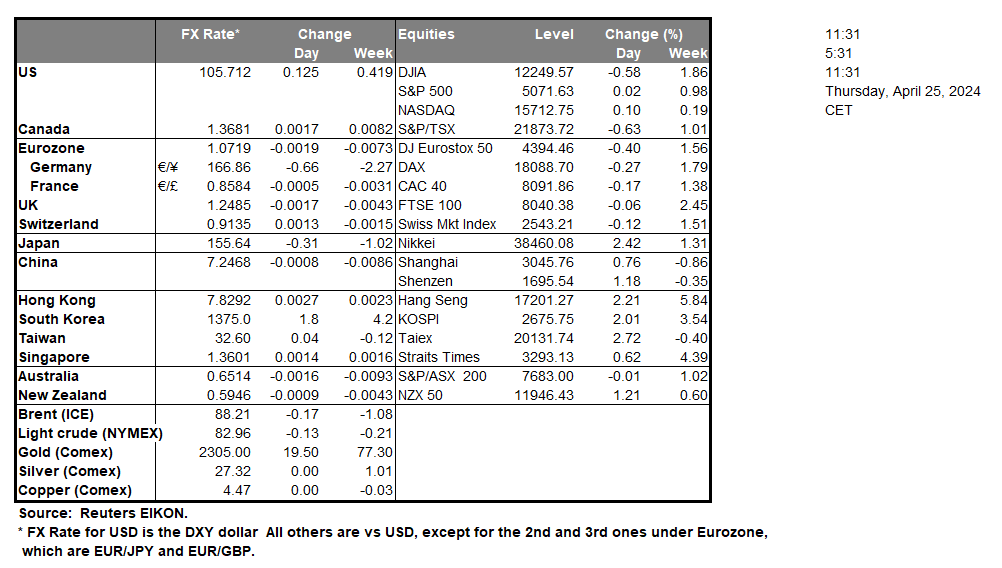

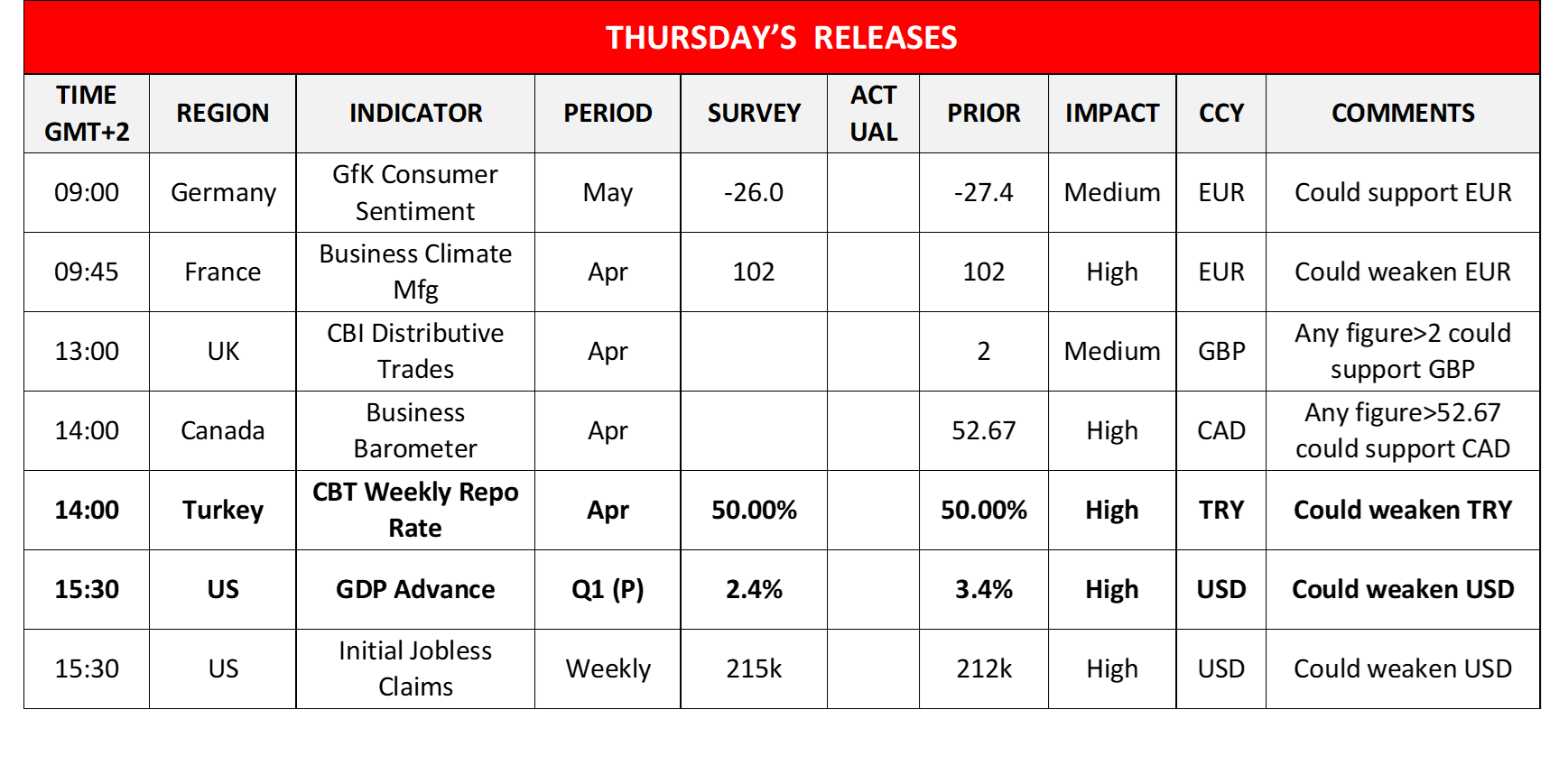

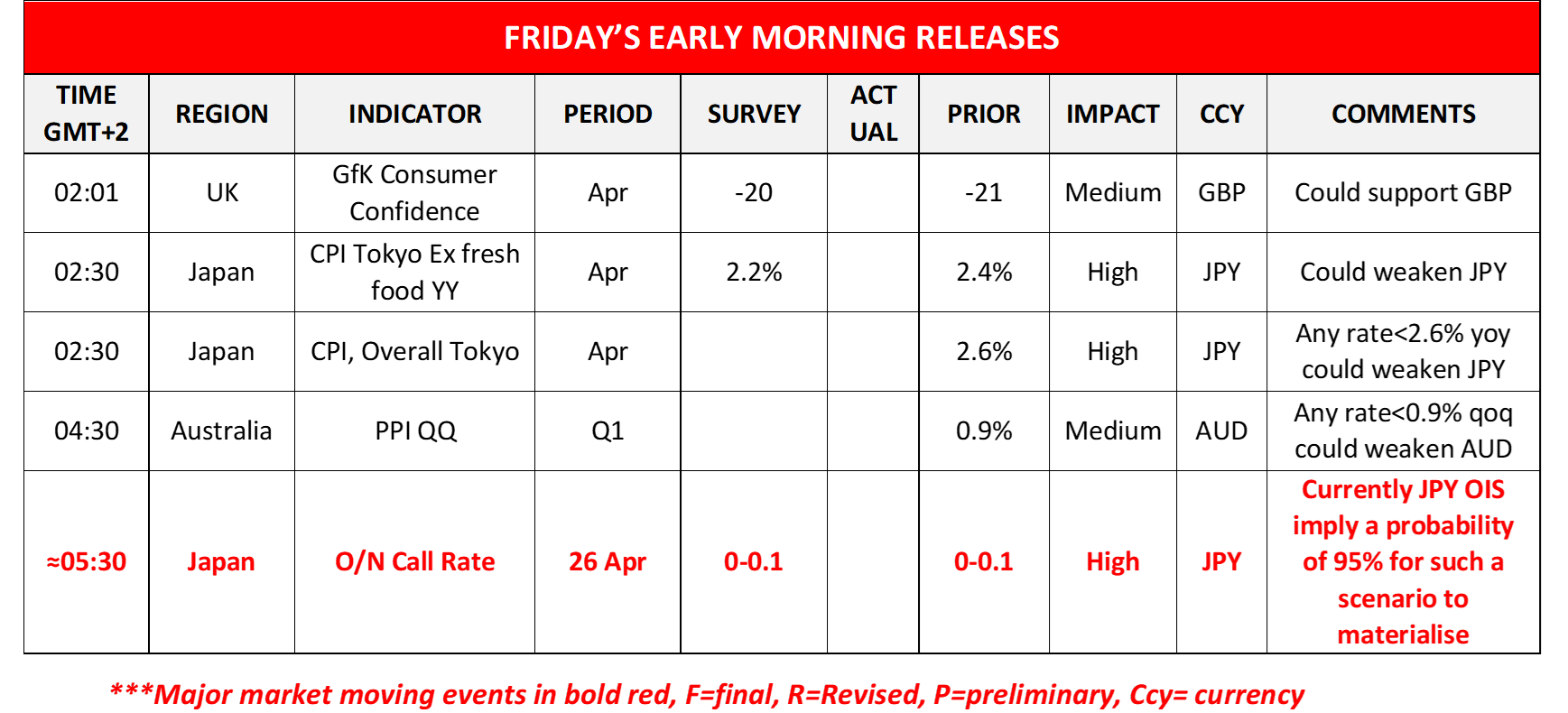

The US Preliminary GDP rate for Q1 is due to be released later on today. According to economists, the US Preliminary GDP rate for Q1 is expected to come in at 2.5%, which would be lower than last quarter’s 3.4% growth rate. In such a scenario, in which it may be implied that the US economy is growing at a decreasing rate, it could add pressure on the Fed to ease on their recent hawkish rhetoric, as the US economy in the long run may be less prepared to combat the tight financial conditions, imposed by the current interest rate levels. On the other hand, should it come in higher than expected, it could provide support for the dollar, as it may imply that the US economy may be able to withstand interest rates remaining higher for longer and thus could allow the Fed to maintain its hawkish tone.In tomorrow’s Asian session, we are highlighting the BOJ’s interest rate decision, with JPY OIS currently implying a 95.41% probability for the bank to remain on hold. As such our attention turns to the bank’s accompanying statement, in which should BOJ policymakers imply that the bank may hike at a greater pace that what is currently expected, it could support the JPY, whereas should the bank’s accompanying statement be predominantly dovish in tone i.e maintaining the current interest rate level for a greater period of time that what is currently expected, it could weigh on the JPY.The BOC’s April meeting minutes indicated that BOC policymakers appear to be divided over whether or not to start easing monetary policy or to maintain tight financial conditions, which could increase volatility in the Loonie, as market participants appear to be split over whether or not the bank will remain on hold or hike interest rates at their next meeting.

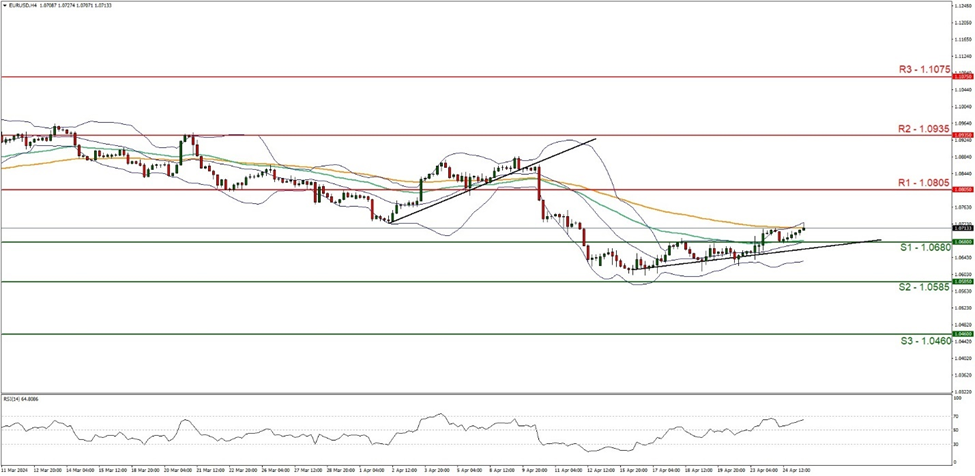

EUR/USD appears to be moving in an upwards fashion. We maintain a bullish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 60, implying a bullish market sentiment, in addition to the upwards moving trendline which was incepted on the 16 of April. For our bullish outlook to continue, we require a break above the 1.0805 (R1) resistance line, with the next possible target for the bulls being the 1.0935 (R2) resistance ceiling. On the flip side, for a sideways bias we would like to see the pair remaining between the 1.0680 (S1) support level and the 1.0805 (R1) resistance level. Lastly, for a bearish outlook we would require a clear break below the 1.0680 (S1) support level, with the next possible target for the bears being the 1.0585 (S2) support line.

XAU/USD appears to be moving in a downwards fashion, after appearing to have met resistance at the 2330 (R1) level. We maintain a bearish outlook for the commodity and supporting our case is the RSI indicator below our chart which currently registers a figure near 40, implying a bearish market sentiment, in addition to the Bollinger bands seemingly pointed to the downside implying some bearish market tendencies. For our bearish outlook to continue, we would require a clear break below the 2271 (S1) support level, with the next possible target for the bears being the 2222 (S2) support line. On the flip side, for a bullish outlook we would require a clear break above the 2330 (R1) resistance line, with the next possible target for the bulls being the 2378 (R2) resistance line. Lastly, for a sideways bias, we would like to see the commodity remain confined between the sideways channel defined by the 2271 (S1) support level and the 2330 (R1) resistance line.

今日其他亮点:

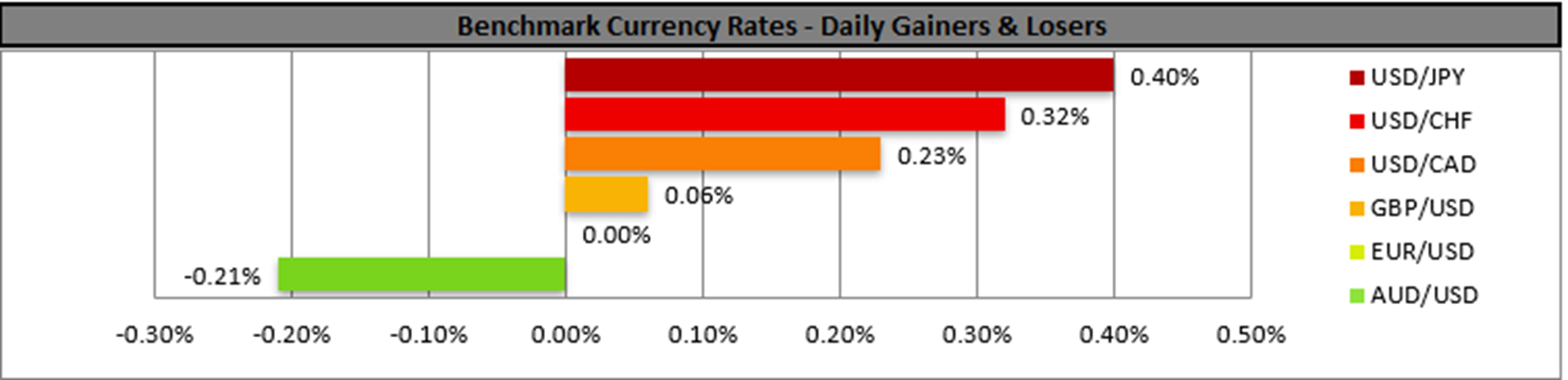

Today in the European session, we get Germany’s GfK Consumer Sentiment for May, France’s Business Climate for Manufacturing for April, UK’s distributive trades indicator for April. Later on, we get Canada’s Business Barometer for April, from Turkey we get CBT’s interest rate decision, the weekly US initial jobless claims figure and we highlight the release of the US GDP advance rate for Q1. During tomorrow’s Asian session we get UK’s GfK consumer confidence for April, from Japan Tokyo’s CPI rates for April, Australia’s PPI rates for Q1 and we highlight from Japan BoJ’s interest rate decision.

欧元/美元4小时走势图

Support: 1.0680 (S1), 1.0585 (S2), 1.0460 (S3)

Resistance: 1.0805 (R1), 1.0935 (R2), 1.1075 (R3)

黄金/美元4小时走势图

Support: 2271 (S1), 2222 (S2), 2173 (S3)

Resistance: 2330 (R1), 2378 (R2), 2430 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.