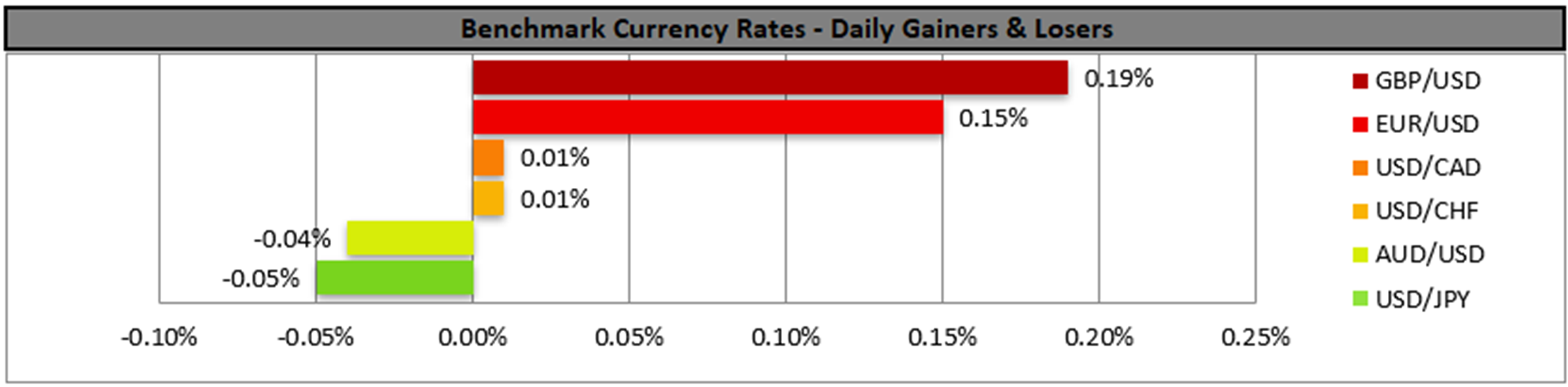

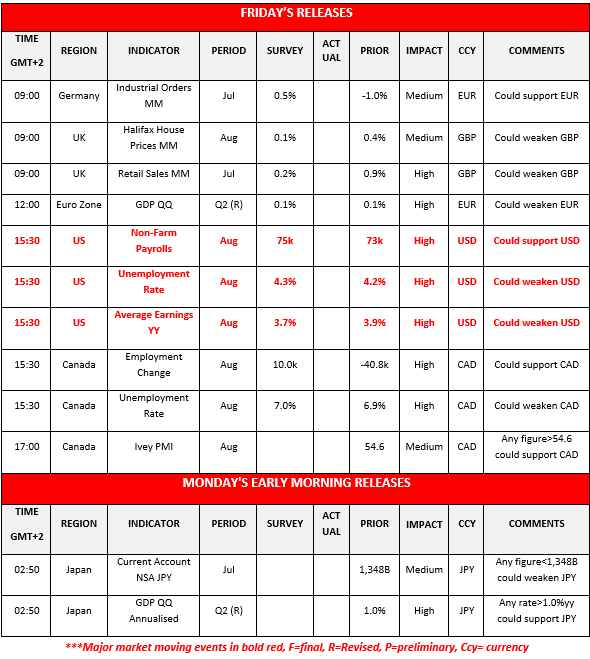

Market attention today is on the release of the US employment report for August. The NFP figure is expected to rise slightly, reaching 75k if compared to July’s 73k, the unemployment rate to tick up to 4.3% and the average earnings growth rate to slow down to 3.7%yy if compared to July’s 3.9%yy. Should the actual rates and figures meet their respective forecasts, despite the NFP figure rising slightly, the overall picture the employment data present is one of a cooling US employment market, which in turn may add more pressure on the Fed to ease its monetary policy. For the time being, the market expects the Fed to cut rates by 25 basis points in the September and October meetings and to remain on hold in December. It’s understandable that should the market’s dovish expectations for the Fed’s intentions be enhanced, we may see them weighing on the USD. Yet the actual data only seldom meet the forecasts. Hence, should we see the actual data showing wider easing than expected of the US employment market, for example, should the NFP drop instead of rising, we may see the USD losing ground substantially, while should the data show a tighter than expected US employment market, we may see the USD gaining some ground. Please bear in mind that the release may have ripple effects beyond the FX market and a wider easing of the US employment market could have bullish effects on US stock markets and gold.

Yet besides the US employment data for August at the same time, we also get Canada’s employment data for the same month. For the time being, the unemployment rate is expected to tick up to 7.0% and the employment change figure to rise and reach 10k if compared to July’s -40.8k. The forecasts tend to provide mixed signals for the Canadian employment market and should the actual data show the picture of a tighter-than-expected Canadian employment market, we may see the Loonie getting some support and vice versa.

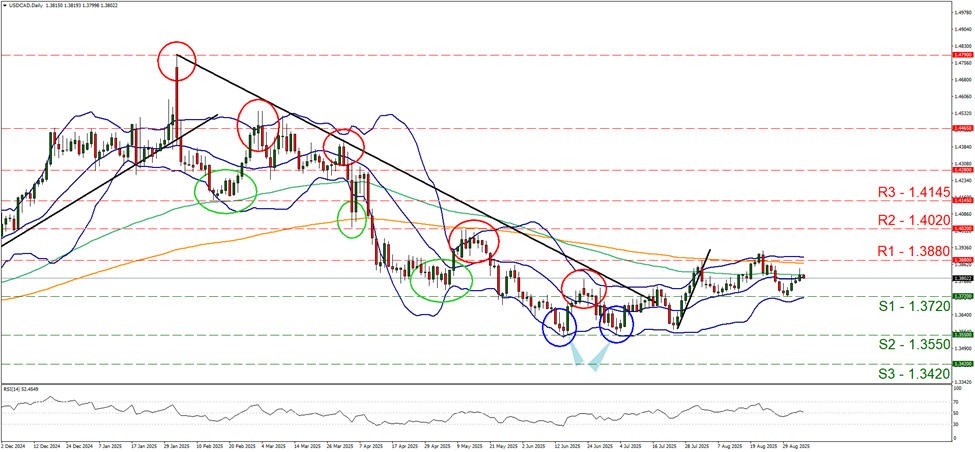

On a technical level we note that USD/CAD edged higher yet in today’s Asian session seems to be correcting lower, with the pair’s price action remaining well within the boundaries set by the 1.3880 (R1) resistance line and the 1.3720 (S1) support level. Given that the pair has remained with the prementioned boundaries for the past forty days we tend to maintain our bias for the sideways motion to continue. Furthermore we note that the RSI indicator continues to run along the reading of 50, implying a relative indecisiveness on behalf of market participants for the pair’s direction, which could allow the sideways motion to continue. Yet the release of the US and Canadian employment data for August could alter the pair’s direction. Should the bulls take over, we may see the pair’s price action breaking the 1.3880 (R1) resistance line and continue higher aiming for the 1.4020 (R2) resistance level. Should the bears get in the driver’s seat, we may see the pair breaking the 1.3720 (S1) support line and start aiming for the 1.3550 (S2) support level.

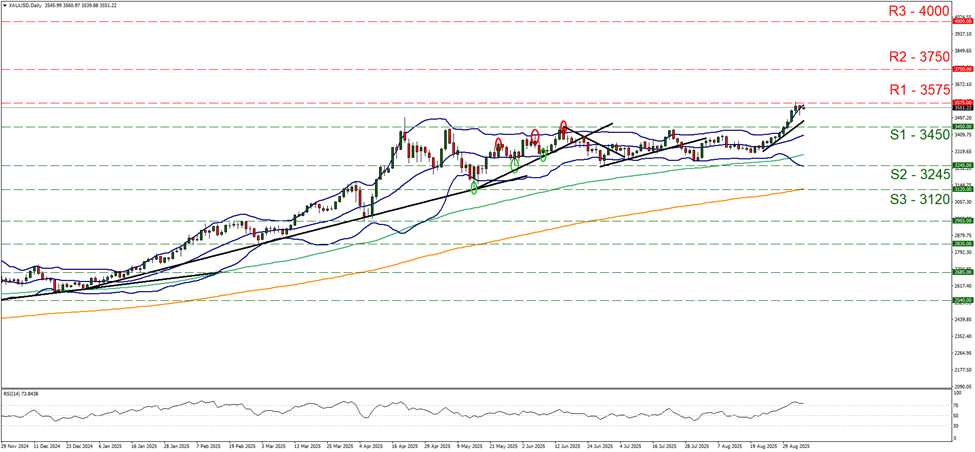

Gold’s price stabilised just below the 3575 (R1) resistance level. We also note that the RSI indicator remains above the reading of 70 implying that the precious metal may still be in overbought territory and lower. We maintain our bullish outlook for the precious metal’s price and should the bulls maintain control over bullion we may see its price reaching new All Time Highs by breaching the 3575 (R1) resistance line. For a bearish outlook to be adopted we would require gold’s price to break the 3450 (S1) support line and start actively aiming for the 3245 (S2) support level.

今日其他亮点:

Today, besides the US and Canadian employment data for August, we also note the release of Germany’s industrial orders for July, UK’s Halifax house prices for August and July’s retail sales, Euro Zone’s revised GDP rate for Q2 and Canada’s Ivey PMI figure for August. In tomorrow’s Asian session, we get Japan’s current account balance for July and revised GDP rate for Q2.

USD/CAD Daily Chart

- Support: 1.3720 (S1), 1.3550 (S2), 1.3420 (S3)

- Resistance: 1.3880 (R1), 1.4020 (R2), 1.4145 (R3)

黄金/美元 日线图

- Support: 3450 (S1), 3245 (S2), 3120 (S3)

- Resistance: 3575 (R1), 3750 (R2), 4000 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.