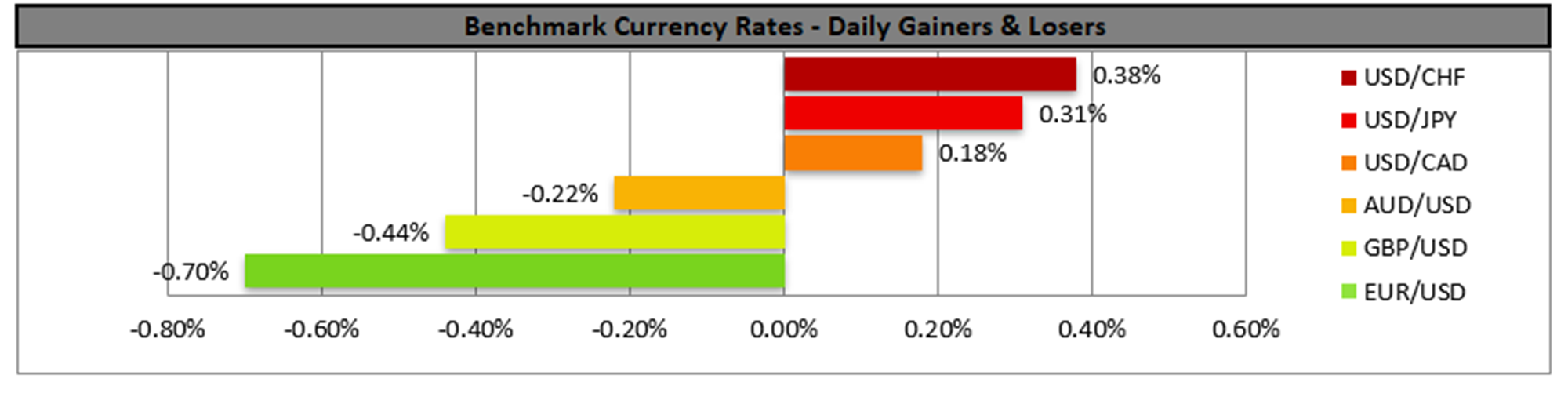

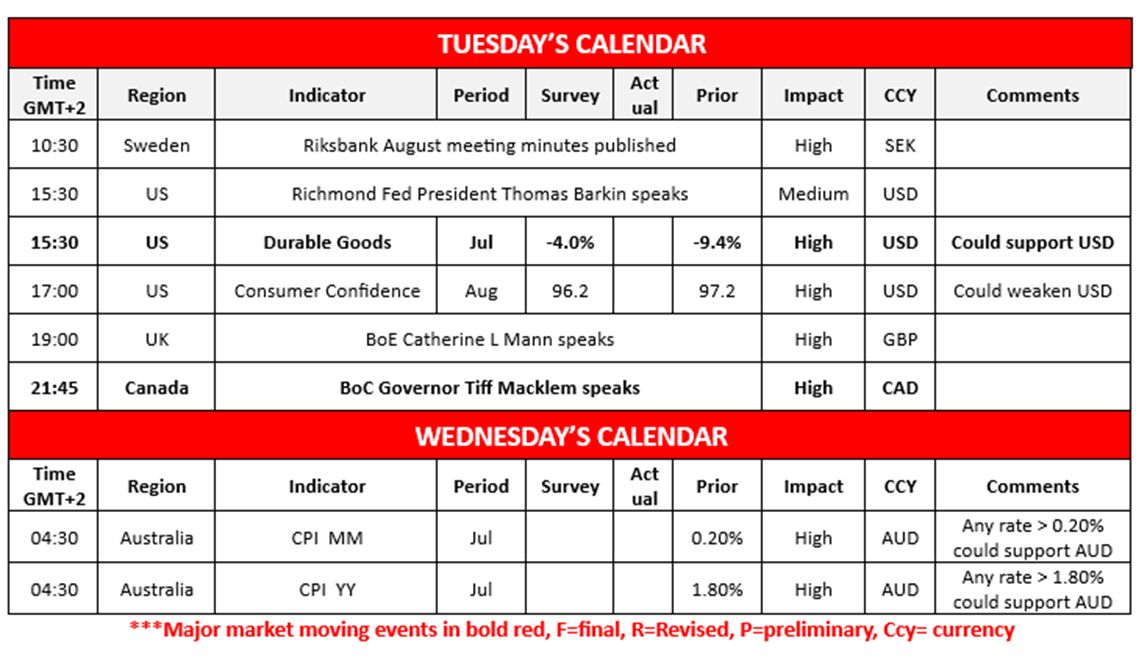

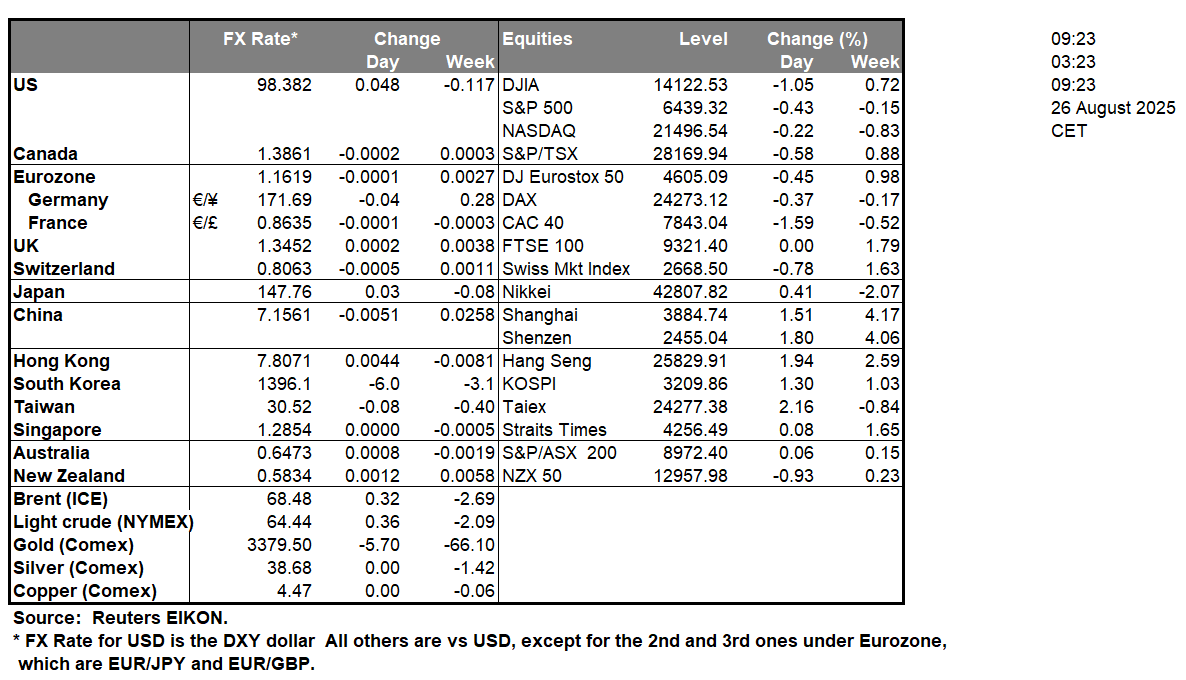

Australia’s CPI rates for July are set to be released during tomorrow’s Asian session. Should the inflation data showcase an acceleration of inflationary pressures in the Australian economy it could provide support for the Aussie and vice versa. However, when looking at the nation’s prior CPI rates which on a year-on-year level are close to the bank’s 2% inflation target, a slightly hotter than expected inflation print may not heavily influence the RBA’s monetary policy path moving forward.In France according to Bloomberg, Prime Minister Francois Bayrou has called a vote of confidence which is set to take place on the 8th of September. The no-confidence vote could potentially send France into political turmoil once again and given France’s economic heavyweight status, the announcement could potentially weigh on the European Equities markets and on the common currency. Overall, the tumultuous political situation could negatively impact the EUR and the European Equities markets as it continues to unfold. In the US the Fed is gearing up to fight for its independence after US President Trump stated per Reuters that he was remove Fed Governor Lisa Cook from her position over alleged improprieties in obtaining mortgage loans. The firing of a central bank Governor markets the first instance of such an event occurring in the bank’s 111-year history. In response Governor Cook stated that “President Trump purported to fire me ‘for cause’ when no cause exists under the law, and he has no authority to do so”. In turn, the “firing” of Governor Cook could weigh on the US Equities markets as well as the dollar, whilst potentially aiding gold given its safe haven asset status.In Canada, Loonie traders may find BoC Governor Macklem’s speech today interesting, as it may influence the CAD’s direction

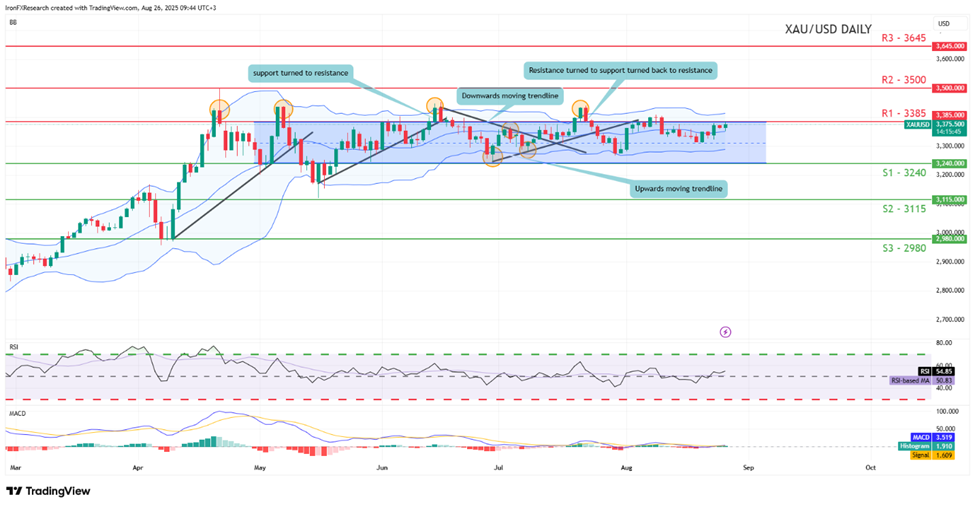

XAU/USD appears to be moving in a sideways fashion, with the commodity having remained within our sideways moving channel which was incepted on the 30th of April, despite some breakouts. Nonetheless, we opt for a sideways bias for gold’s price. Yet our RSI indicator below our chart has been creeping upwards towards the figure of 60, which may imply some bullish tendencies. For our sideways bias to be maintained we would require gold’s price to remain confined between the 3240 (S1) support level and our 3385 (R1) resistance line. On the other hand for a bearish outlook we would require a clear break below the 3240 (S1) support level with the next possible target for the bears being the 3115 (S2) support line. Lastly, for a bullish outlook we would require a clear break above our 3385 (R1) resistance line with the next possible target for the bulls being the 3500 (R2) resistance level.

AUD/USD appears to be moving in a sideways fashion. We opt for a sideways bias for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained we would require the pair to remain confined between the 0.6360 (S1) support level and the 0.6525 (R1) resistance line. On the other hand, for a bullish outlook we would require a clear break above our 0.6525 (R1) resistance line, with the next possible target for the bulls being the 0.6675 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below our 0.6360 (S1) support line with the next possible target for the bears being the 0.6225 (S2) support level.

今日其他亮点:

Today we get the US Durable Goods orders rate for July, the US’s consumer confidence figure for August. In tomorrow’s Asian session we note the release of Australia’s CPI rates for July. On a monetary level we note the release of the Riksbank’s August meeting minutes, the speech by Richmond Fed President Barkin, the speech by BoE Mann and the speech by BoC Governor Tiff Macklem.

XAU/USD Daily Chart

- Support: 3240 (S1), 3115 (S2), 2980 (S3)

- Resistance: 3385 (R1), 3500 (R2), 3645 (R3)

AUD/USD Daily Chart

- Support: 0.6360 (S1), 0.6225 (S2), 0.6090 (S3)

- Resistance: 0.6525 (R1), 0.6675 (R2), 0.6825 (R3)

如果您对本文有任何常规疑问或意见,请直接发送电子邮件至我们的研究团队,地址为 research_team@ironfx.com

免责声明:

本信息不被视为投资建议或投资推荐, 而是一种营销传播. IronFX 对本信息中引用或超链接的第三方提供的任何数据或信息概不负责.