As the week is coming to an end we have a look at what next week’s calendar has in store for the markets. On Monday we note the release of New Zealand’s Q3 CPI rates and from China we get PBoC’s interest rate decision and GDP rates for Q3. On Tuesday we get New Zealand’s trade data and Canada’s CPI rates, and on Wednesday we get Japan’s trade data and UK’s CPI rates, all being for September. On Thursday, we get from Turkey CBT’s interest rate decision and Canada’s retail sales for August while the release of the US weekly initial jobless claims figure is uncertain given the shutdown of the US Government which could also affect the release of the US CPI rates for September on Friday. Also on Friday we get Japan’s CPI rates for September, Australia’s retail sales for Q3, UK’s retail sales for September, the preliminary PMI figures of France, Germany and the Euro Zone as a whole for October and from the US we get the preliminary S&P PMI figures for October and the final University of Michigan consumer sentiment also for October.

USD – Fundamental uncertainty shakes the USD

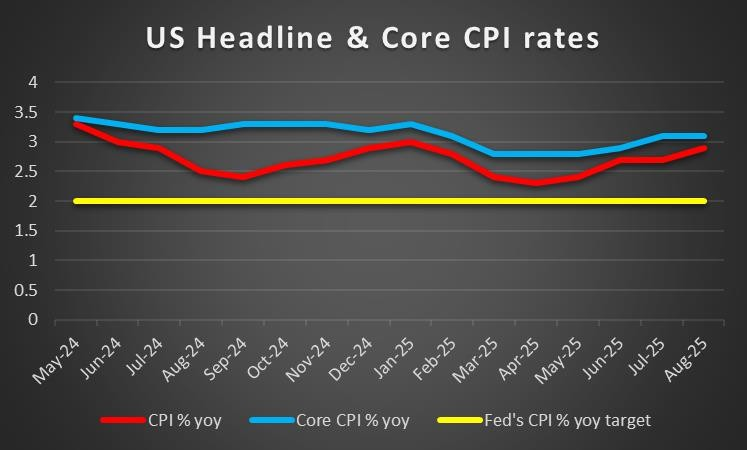

The greenback seems to be shaken by the fundamentals surrounding it at the current stage. On the one hand the US Government shutdown has entered its third week and the US Senate failed to advance the GOP funding bill for a 9th time on Wednesday. Democrats seem to remain firm in their demands for an extension of health care tax credits in exchange for their votes. The issue continued to maintain uncertainty in the markets, on a fundamental level which is further enhanced as the release of key financial data is being delayed keeping the markets partially in the dark on a macro level. Should the shutdown of the US Government be prolonged without a solution of the impasse on the horizon, we may see it weighing on the USD. At the same time uncertainty in the markets was further enhanced last Friday with the threats of US President Trump to impose 100% tariffs over and above tariffs in place for Chinese products entering the US. The issue shook the markets with the frictions in the US-Sino trade relationships escalating as the two sides are applying additional port fees to ships. Also the issue of Chinese rare earth exports to the US is a big thorn as China may impose restrictions to such exports to the US. The White House has warned China not to impose them, however that remains to be seen. Should we see the tensions in the US-Sino trade relationships escalating further we may see the USD suffering. On a monetary level, we note the market’s dovish expectations for the Fed’s intentions. Yet we have to note the split among Fed policymakers with some favouring a faster pace of easing the bank’s monetary policy while others seem to have doubts for the necessity of extensive easing. In the coming week, there are some speeches of Fed policymakers planned, yet we are to enter, from midweek onwards, the bank’s moratorium of statements ahead of the bank’s next meeting on the 29th of October. A possible intensification of the market’s expectations for the bank to ease its monetary policy, could weigh on the USD and vice versa.

Analyst’s opinion (USD)

“Overall, we see the case for the USD to wobble in the coming week with focus being placed on fundamentals. A possible prolongment of the US shutdown, further escalation of the US-Sino trade war and an intensification of the market’s dovish expectations for the Fed’s intentions are all factors that could weigh on the greenback.”

GBP – September’s CPI rates in focus

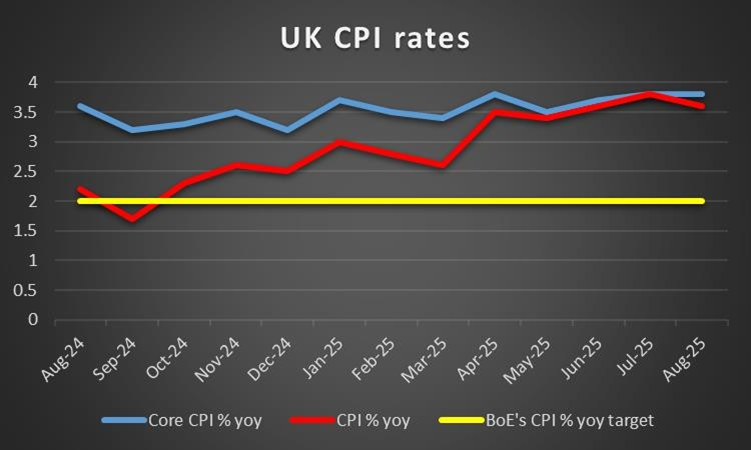

On a fundamental level, pound traders remain worried for the outlook of the UK economy. On a more positive note, the International Monetary Fund seems to be expecting the UK economy to be the second- fastest-growing of the world’s most advanced economies this year, according to new projections. However there are still a number of challenges ahead for the UK economy, including the effect of the US tariffs, the stubborn inflation and BoE’s intentions about its monetary policy. The market focus is on UK Chancellor of the Exchequer Reeves, yet that is still a long way, on the 26th of November. Should market worries for the UK economic outlook intensify we may see them weighing on the pound. For the time being we note on a macro level, that the release of the UK employment data for August were disappointing as the UK employment market loosened further, while the GDP growth rate for August was anemic. In the coming week we note the release of the CPI indicators, yet the main point of interest is expected to be on UK’s CPI rates for September. Should we see the CPI rates accelerate in the past month showing a relative resilience of inflationary pressures in the UK economy, an issue that IMF also warned about, we may see the GBP getting some support as the pressure on BoE not ease its monetary policy but possibly to consider tightening may intensify. Currently market expectations are for BoE to maintain rates unchanged until the end of the year and start cutting rates from Feb26 onwards. For the time being BoE Governor Bailey seems worried for the UK employment market which tends to imply that the Governor is leaning more on the dovish side. Furthermore policymaker Alan Taylor stated that he fears a bumpy landing for the UK economy, enhancing market worries even further. Should we see market expectations for a possible easing of BoE’s monetary policy intensifying in the coming week, we may see the pound slipping lower.

Analyst’s opinion (GBP)

“In the coming week we note the market’s worries for the UK economic outlook weighing on the pound should they intensify. On a macro level the release of UK CPI rates for September could get substantial attention by pound traders and a possible acceleration could support the sterling.”

JPY – Will Takaichi be elected as Japan’s new PM?

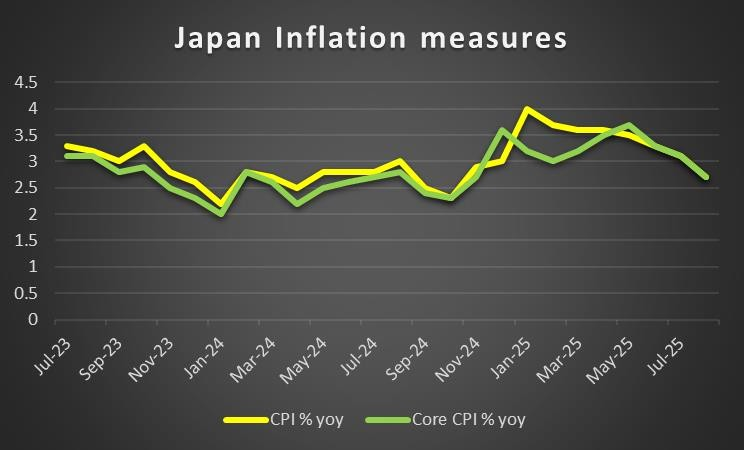

The main event for JPY in the coming week is the political process for the election of the new PM. The election is to take place in the Diet on the 21st of October, after an initial vote on the 15th was postponed given the split of the ruling coalition. LDP’s candidate Ms. Takaichi seems to be facing a narrow path to the premiership. On the one hand, we see the opposition trying to find a unity bid, the LDP is intensifying negotiations for the formation of a ruling coalition, given that despite the LDP being the largest party it fails to reach a majority. A possible win for Ms. Takaichi could weigh on the JPY given her opposition to BoJ’s plans to hike rates further. Also on a fundamental level, we note the statements of Japan’s Finance Minister Katsunobu Katō that the Japanese Government remains vigilant for excessive FX volatility, a statement that could be interpreted as a threat for a possible market intervention should JPY weaken to much. On a monetary level we note that BoJ board member Naoki Tamura called for more rate hikes on a hawkish note. We have some statements planned next week by BoJ policymakers and should we see a hawkish tone prevailing we may see the Yen getting some support. On a macroeconomic level in the coming week we note the release of Japan’s September trade data on Wednesday and the Chain Store Sales for the same month on Thursday, yet the highlight of the coming week is expected to be on Friday the release of the September CPI rates and a possible slowdown could weaken BoJ’s narrative for the necessity of more rate hikes and consequently could also weaken the JPY.

Analyst’s opinion (JPY)

“In the coming week, we highlight the election process for the new PM next Tuesday and a possible election of Ms. Takaichi could weigh on the JPY. On a monetary level, a possible hawkish tone by BoJ policymakers could provide support for the JPY as could a possible acceleration of Japan’s September CPI rates. ”

EUR – September’s Preliminary PMI figures could move the EUR

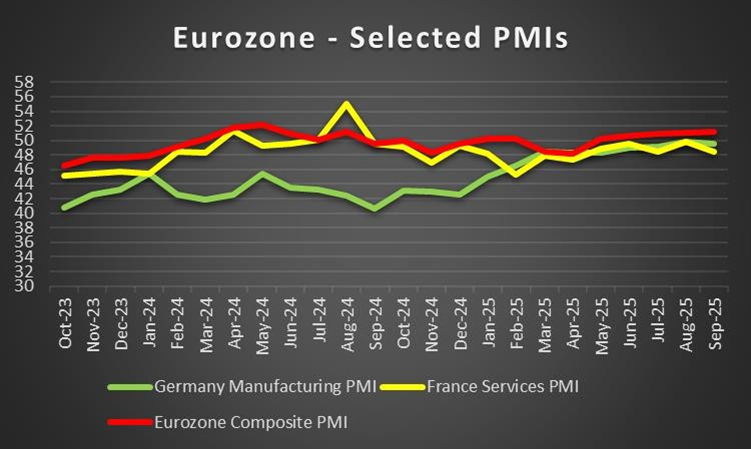

We start the EUR paragraph with the easy part, ECB’s monetary policy. On a monetary level we note the market’s expectations for the bank to keep rates unchanged until the midst of the next year. Yet in slight dash of dovishness ECB President Lagarde stated that she can’t declare an end to interest-rate cuts, despite the economy being “in a good place”. Similarly ECB Governing Council member Villeroy de Galhau stated that the banks next move is more likely to be in cutting rates rather than raising them. Hence any comments by ECB officials, enhancing the possibility of a rate cut could weigh on the EUR. On a fundamental level, we note the uncertainty caused by France’s political scene. Yet France’s PM Lecornu survived two no confidence votes in a sign of political stability and attention now turns on France’s budget which is the main point of conflict given the Macron’s pensions reform. Hence instability is still being maintained and a should we see further signals that the French Government may not survive we may see the EUR losing ground. Yet the main point of interest for EUR traders in the coming week, may be the release of the preliminary PMI figures for October next Friday. Also on a fundamental level, we note that the war in Ukraine is ongoing, yet news surfaced yesterday that, next Thursday Trump is to speak with Putin. Any indication of a ceasefire could provide some support for the EUR. With the inflation under control and the employment market being relative stable, macroeconomic attention is on economic activity and growth. We intend to focus on Germany’s manufacturing sector, which is considered Euro Zone’s locomotive and is considered under pressure, but also France’s services PMI figure as well as Euro Zone’s Composite PMI indicator for a rounder view. Should the indicators show an improvement in economic activity for the current month, we may see the common currency getting some support and vice versa.

Analyst’s opinion (EUR)

“In the coming week we may see the release of the preliminary October PMI figures shaking the single currency with a possible improvement of economic activity providing some support. Also should we see more stability in the French political scene we may see the EUR being supported as could hopes for a possible ceasefire in Ukraine support the common currency.”

AUD – US-Sino trade war weighs on the Aussie

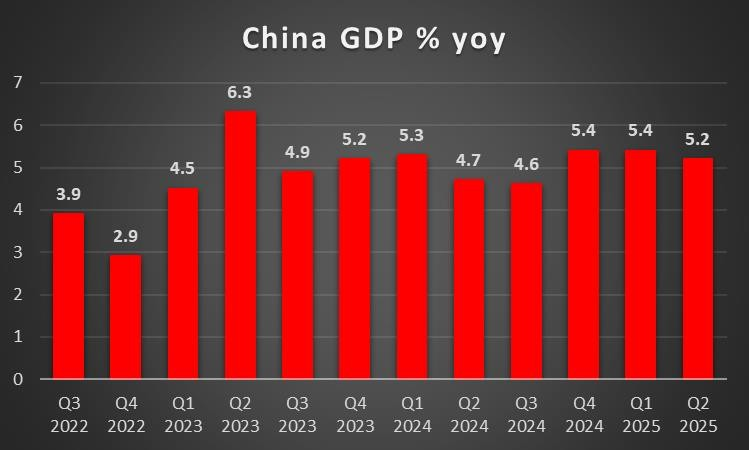

The escalation of the tensions in the US-Sino trade relationships cannot escape the attention of Aussie traders, given the close Chinese Australian economic ties. It’s characteristic that the Aussie is about to end the week in the reds against an allready weak USD. At this point we would like to note that China may have the high ground of the negotiations, given the improvement of its exports for September yet on the flip side, the deflationary pressures in the Chinese economy are pressing the Chinese Government. On Monday’s Asian session, we highlight the release of Chinese data including the GDP rate for Q3 and PBoC’s interest rate decision. Should the GDP growth rate slow down beyond market expectations, we may see AUD weakening. Should we see further escalation of the tensions in the US-Sino trade relationships could weigh on the Aussie, given also that the market sentiment may deteriorate, adversely affecting the Aussie as besides the Australia- China ties, AUD is considered as riskier asset given its commodity nature. On a macroeconomic level, we note the loosening of the Australian employment market for September as employment change figure failed to meet the market’s expectations while the unemployment rate rose from 4.2% to 4.5% which was worrying. The release tends to add more pressure on RBA to ease its monetary policy. RBA Governor Bullock commented that the bank’s rate policy is currently “marginally tight” which we interpret as an innuendo that they could be reduced a bit further. In any case the market expects the bank to deliver another rate cut in the November meeting and should the market’s dovish expectations for the bank’s intentions be enhanced in the coming week, we may see the Aussie slipping.

Analyst’s opinion (AUD)

“The key issue for Aussie traders in the coming week are to be the tensions in the US-Sino relationships. Should the tensions escalate further we may see them weighing on the Aussie and vice versa.”

CAD – Canada’s September CPI rates to be closely watched

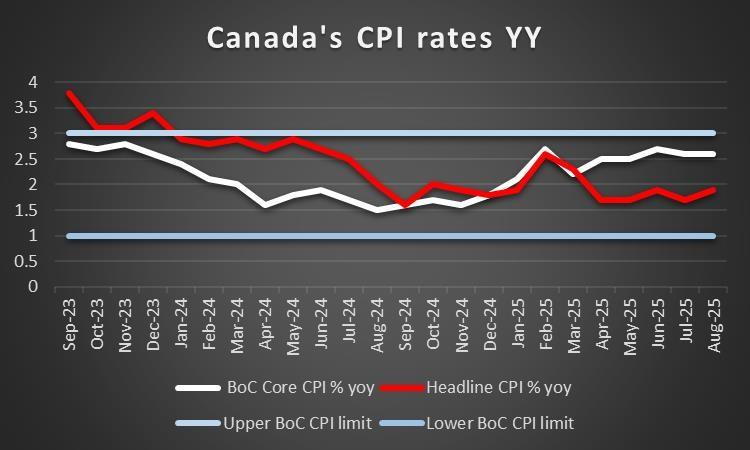

The Loonie is about to end the week in the reds against the USD. On a fundamental level, we note that the Loonie may have been adversely affected by the risk of sentiment of the market, given that the CAD is considered having a riskier background as a commodity currency. Furthermore we also note the fall of oil prices, as market worries for a possible oversupply of the oil market tend to intensify, weighing on oil prices. Should we see in the coming week, oil prices continuing to fall, we may see it weighing on the CAD as well given Canada’s status as a major oil producing economy. On a monetary basis, we note the markets’ expectations for BoC to cut rates in its next meeting which tends to imply that the market may be leaning on the dovish side, thus the expectations of the market for BoC’s intentions may be weighing on the Loonie at the current stage. On a more positive note, BoC Governor Macklem seems to expect a soft landing for the Canadian economy. On a macroeconomic level in the coming week, we highlight the release of the September’s CPI rates, next Tuesday. Should we see the rates slowing down we may see the Loonie losing ground as a possible easing of inflationary pressures in the Canadian economy could add more pressure on BoC to easy its monetary policy further and possibly at a faster pace.

Analyst’s opinion (CAD)

“In the coming week we expect the release of September’s CPI rates to be in the epicenter of Loonie traders’ attention as a possible slowdown could intensify market expectations for the BoC to lower its rates, thus possibly weighing on the CAD.”

General Comment

As a general comment for the FX market we expect US fundamentals to dominate the market and should we see enhanced market uncertainty we may also see a more risk off market sentiment which could weigh on riskier assets while at the same time could provide additional support for safe haven trading instruments. Talking about safe haven instruments one cannot miss out on commenting on the rally of gold’s price which has reached record high levels, in a very steep upward movement over the past few days. We haven’t seen such a rise in US$ for years albeit percentage wise it’s a different story. We maintain a bullish outlook for gold’s price yet highlight the risk of a correction lower of the precious metal’s price as it is at overbought levels. As for US equities we note that after last Friday’s shock correction lower, US stock markets seem to be slowly regaining their footing and optimism. The new earnings season has begun with good news from the banking sector in the US. We note in the coming week the release of the earnings reports of BHP Group’s data on Monday, on Tuesday we get the releases of Coca Cola, Netflix, Philip Morris, 3M, General Motors, next Wednesday we get the earnings reports of Tesla, IBM and AT&T, Intel and Unilever on Thursday. Should we see further optimism characterising equity market participants we may see US stock market indexes being on the rise.

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.