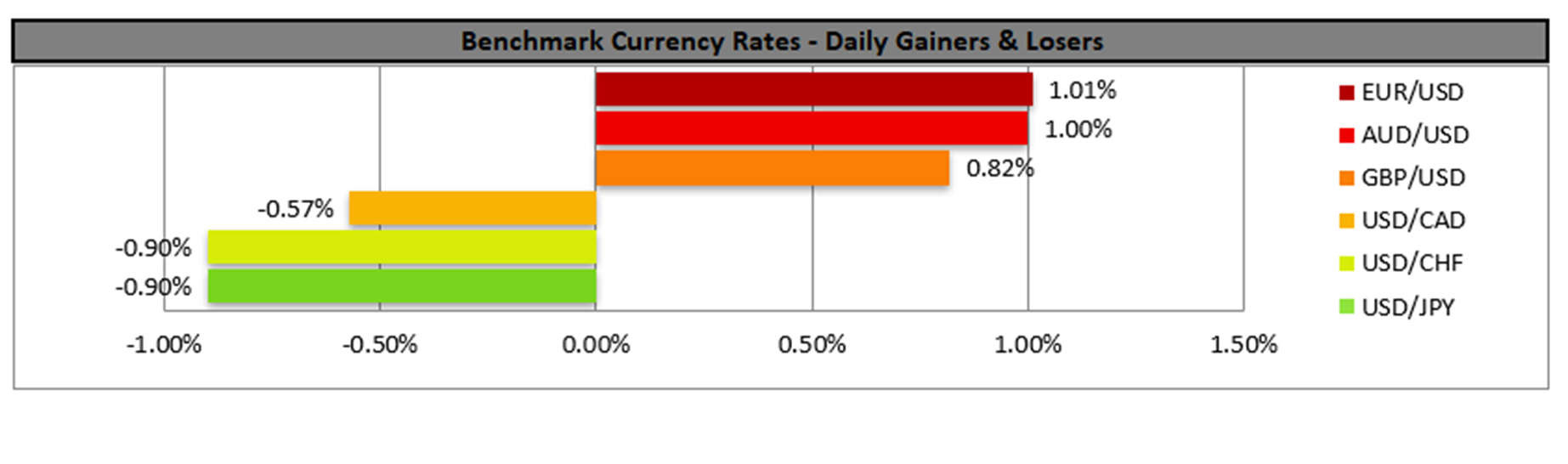

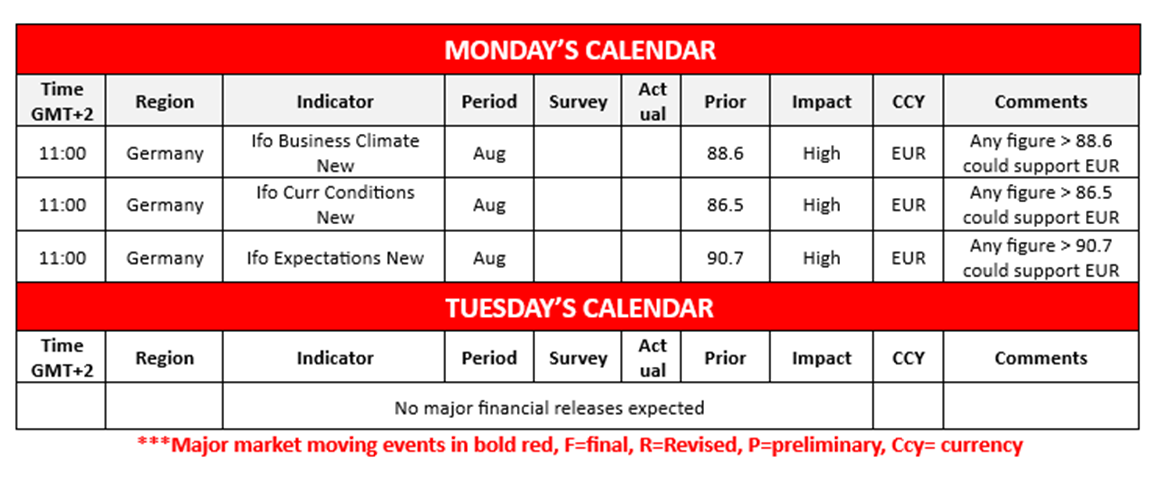

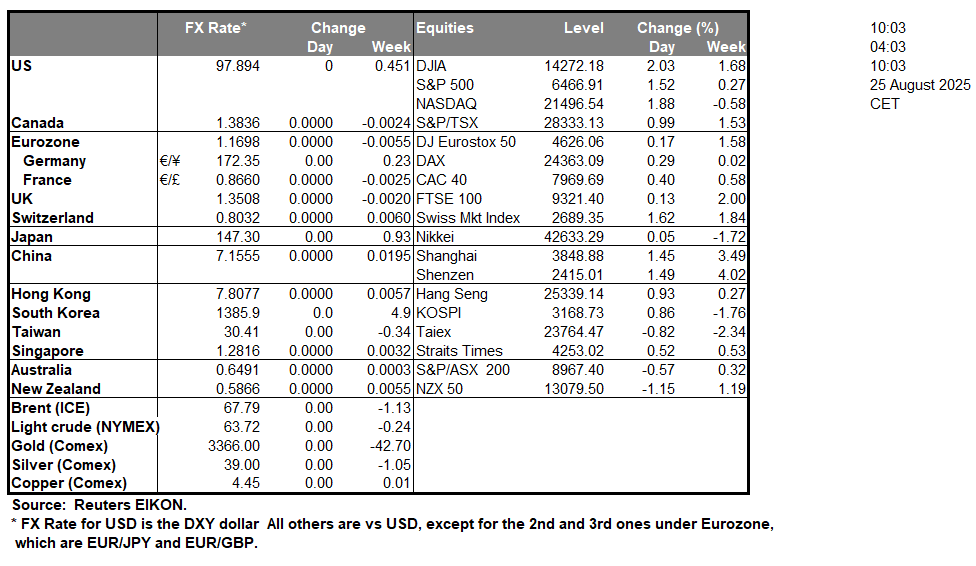

The Jackson Hole Symposium has concluded and as we had expected Fed Chair Powell’s speech this past Friday garnered significant attention from market participants. Specifically of interest appears to have been Fed Chair Powell’s comments that “Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” which in turn may imply that the Fed Chair may be considering to cut rates in the near future and possibly in the banks next monetary policy meeting. Hence, such implications may have weighed on the dollar and could continue to do so until other key financial releases from the US take control of the narrative such as the PCE rates this Friday.The US Government has officially announced that they would be taking a 10% stake in Intel (#INTC) by converting government grants into an equity share. Per Reuters “under the agreement, the US will purchase a 9.9% stake in Intel for $8.9 billion..”, which in turn may have aided the company’s stock price. Therefore, with the current announcement that the US Government will purchase roughly 10% of Intel, it may continue aiding the company’s stock price. Over in Asia New Zealand’s retail sales are for Q2 came in better than expected which in turn could provide support for the Kiwi as consumer spending appears to be picking up and thus may act as a positive signal for the economy.In Europe Germany’s Ifo figures are set to be released today and could thus provide some insight into the current economic situation within Germany, including the economic outlook from a business and consumer perspective. In turn this could influence the common currency depending on the figures which emerge.In the US Equities market significant attention may result as a result of Nvidia’s (#NVDA) earnings for the quarter which are due this Wednesday following the closing of the markets. Moreover, given Nvidia’s heavyweight status and leadership within the technological sector, a failure to meet analysts’ expectations in terms of revenue and earnings per share, could lead to heightened volatility in the equities markets overall and vice versa.

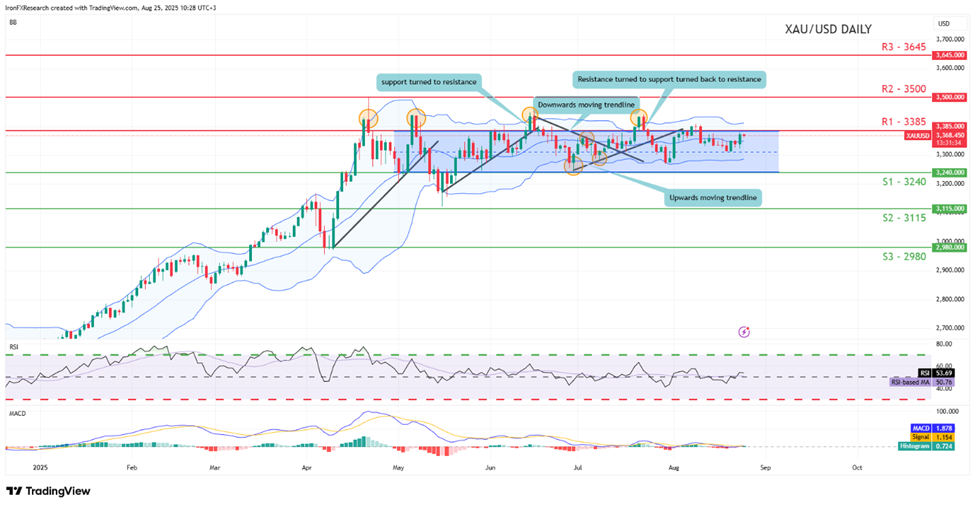

XAU/USD appears to be moving in a sideways fashion, with the commodity having remained within our sideways moving channel which was incepted on the 30th of April, despite some breakouts. Nonetheless, we opt for a sideways bias for gold’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained we would require gold’s price to remain confined between the 3240 (S1) support level and our 3385 (R1) resistance line. On the other hand for a bearish outlook we would require a clear break below the 3240 (S1) support level with the next possible target for the bears being the 3115 (S2) support line. Lastly, for a bullish outlook we would require a clear break above our 3385 (R1) resistance line with the next possible target for the bulls being the 3500 (R2) resistance level.

USD/JPY appears to be moving in a sideways fashion. We opt for a neutral outlook for the pair and supporting our case is the pair’s failure to clear our 148.50 (R1) resistance line. For our sideways bias to continue we would require a clear the pair to remain confined between our 146.25 (S1) support level and our 148.50 (R1) resistance line. On the other hand, for a bearish outlook we would require a clear break below our 146.25 (S1) support level with the next possible target for the bears being the 144.35 (S2) support line. Lastly, for a bullish outlook we would require a clear break above our 148.50 (R1) resistance line with the next possible target for the bulls being the 150.75 (R2) resistance level.

Other highlights for the day:

Today we get the Germany’s Ifo figures all for the month of August

XAU/USD Daily Chart

- Support: 3240 (S1), 3115 (S2), 2980 (S3)

- Resistance: 3385 (R1), 3500 (R2), 3645 (R3)

USD/JPY Daily Chart

- Support: 146.25 (S1), 144.35 (S2), 142.15 (S3)

- Resistance: 148.50 (R1), 150.75 (R2), 153.35 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.