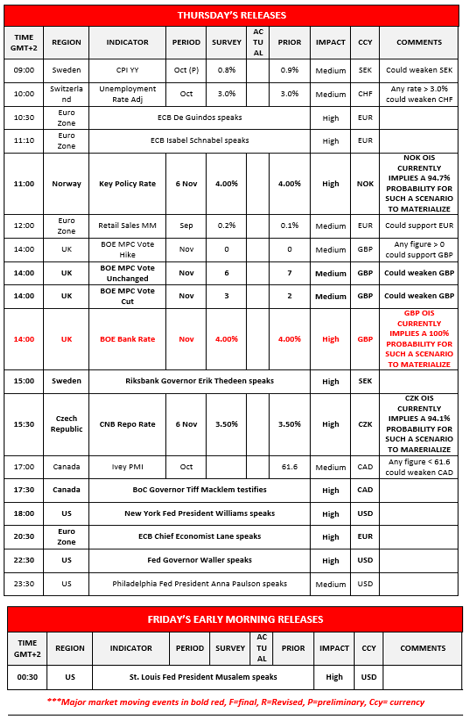

The BoE’s interest rate decision is set to occur during the European trading session. The majority of market participants currently anticipating the bank to remain on hold, with GBP OIS currently implying a 100% probability for such a scenario to materialize. Hence we would turn our attention to the possible voting split which may occur within the bank and in particular, the anticipated increase of another member voting for a rate cut. The significance of one more individual voting for a rate cut may be reflected in the sterling, as it could signal a possible shift within the bank towards a more dovish stance. However, should that fail to materialize the sterling could instead find some support. In our opinion, considering the rising concerns over the UK government’s November budget, where we expected the Labour government to break their manifesto pledges, we would not be surprised to see an overall dovish rhetoric emerging from the bank’s accompanying statement which could weigh on the sterling.On an economic level, we would like to point out that the US Supreme court heard arguments in regards to the legality of the imposition of tariffs brought forth by the Trump Administration. A comment which the FT noted and we found interesting as well was the following “I could see it with some countries, but explain to me why as many countries needed to be subject to the reciprocal tariff policy as are,” she asked Sauer”, showcasing some doubt from the Supreme Court member. In turn any uncertainty which may rise again could influence gold’s price.

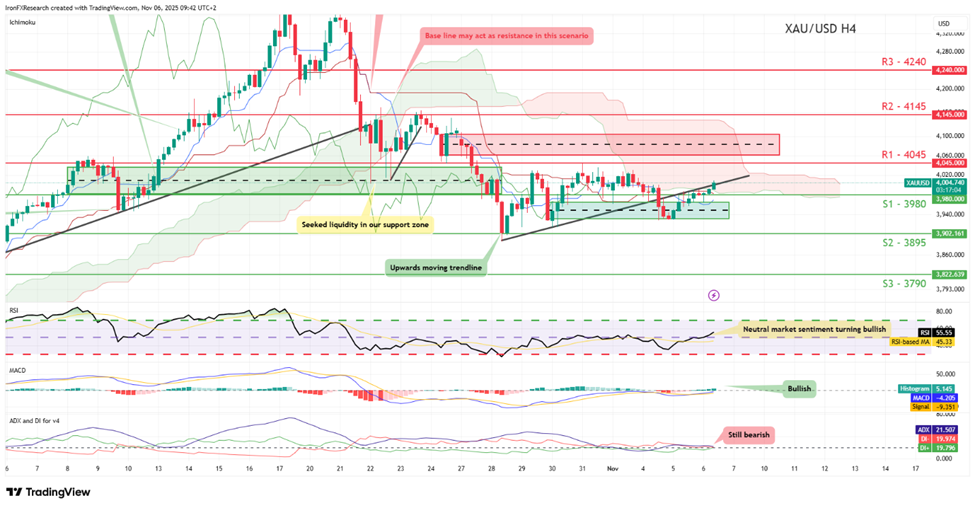

XAU/USD appears to be moving in an upwards fashion after re-emerging above our 3980 (S1) support level. We opt for a bullish outlook for gold’s price and supporting our case is the MACD indicator below our chart. For our bullish outlook to continue we would require a clear break above our 4045 (R1) resistance line with the next possible target for the bulls being our 4145 (R2) resistance level. On the other hand for a sideways bias we would require gold’s price to remain confined between our 3980 (S1) support level and our 4045 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 3980 (S1) support level with the next possible target for the bears being our 3895 (S2) support line.

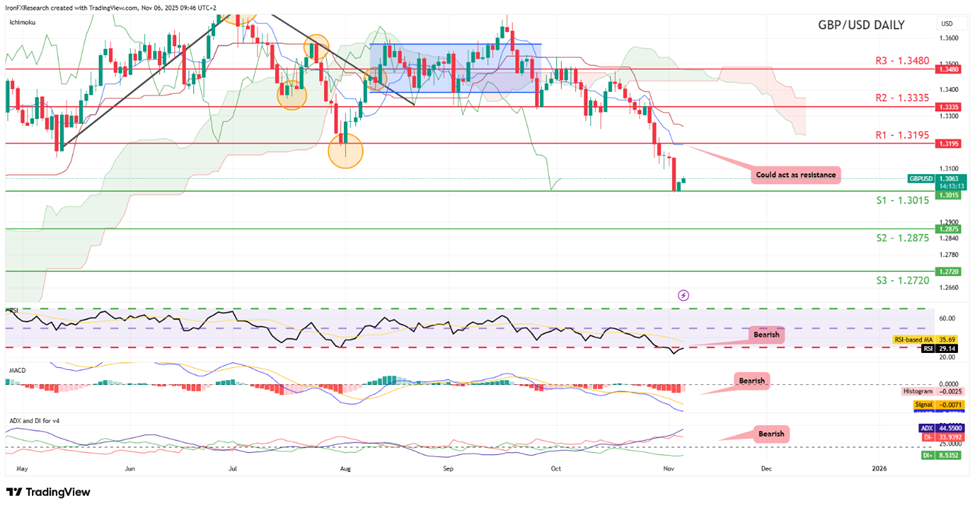

On a technical level, GBP/USD appears to be moving in a downwards fashion after clearing our 1.3195 (R1) support now turned to resistance level. We opt for a bearish outlook for the pair and supporting our case are all three indicators below our chart which tend to point towards a bearish market sentiment. For our bearish outlook to continue we would require a clear break below our 1.3015 (S1) support level with the next possible target for the bears being our 1.2875 (S2) support line. On the other hand, for a bullish outlook we would require a clear break above our 1.3195 (R1) resistance line with the next possible target for the bulls being our 1.3335 (R2) resistance level. Lastly, for a sideways bias we would require the pair to remain confined between our 1.3015 (S1) support level and our 1.3195 (R1) resistance line.

Other highlights for the day:

Today we get Sweden’s preliminary CPI rate for October, Switzerland’s unemployment rate for October, followed by speeches from ECB De Guindos and ECB Schnabel, Norway’s interest rate decision, the Eurozone’s retail sales rate for September, the BoE’s interest rate decision, the speech by Riksbank Governor Thedeen, the CNB’s interest rate decision, Canada’s Ivey PMI figure for October, the speeches by BoC Governor Macklem, New York Fed President Williams, ECB Chief Economist Lane, Fed Governor Waller and Philadelphia Fed President Paulson. In tomorrow’s Asian session we note the speech by St Louis Fed President Musalem.

XAU/USD H4 Chart

- Support: 3980 (S1), 3895 (S2), 3790 (S3)

- Resistance: 4045 (R1), 4145 (R2), 4240 (R3)

GBP/USD Daily Chart

- Support: 1.3015 (S1), 1.2875 (S2), 1.2720 (S3)

- Resistance: 1.3195 (R1), 1.3335 (R2), 1.3480 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.