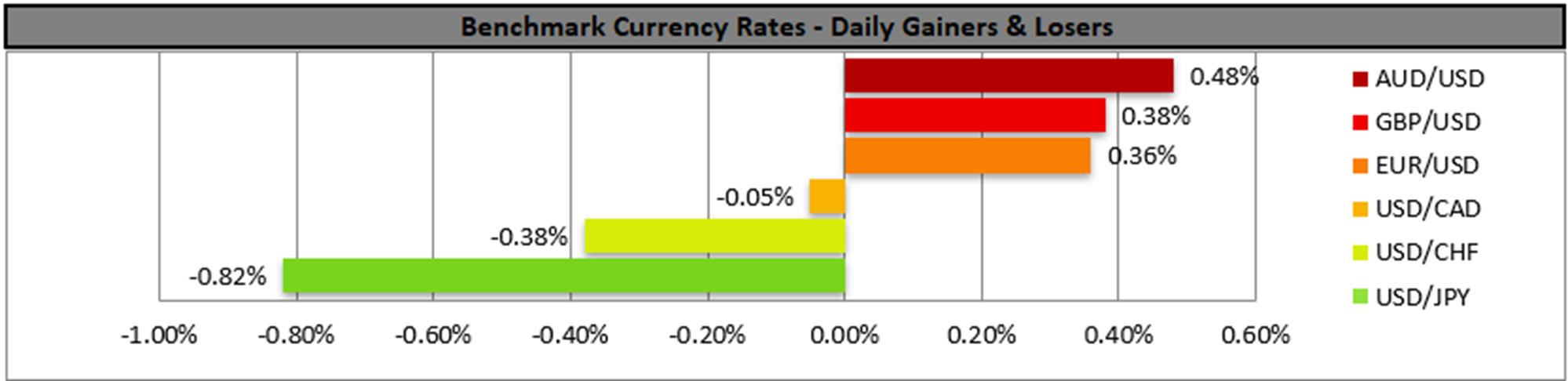

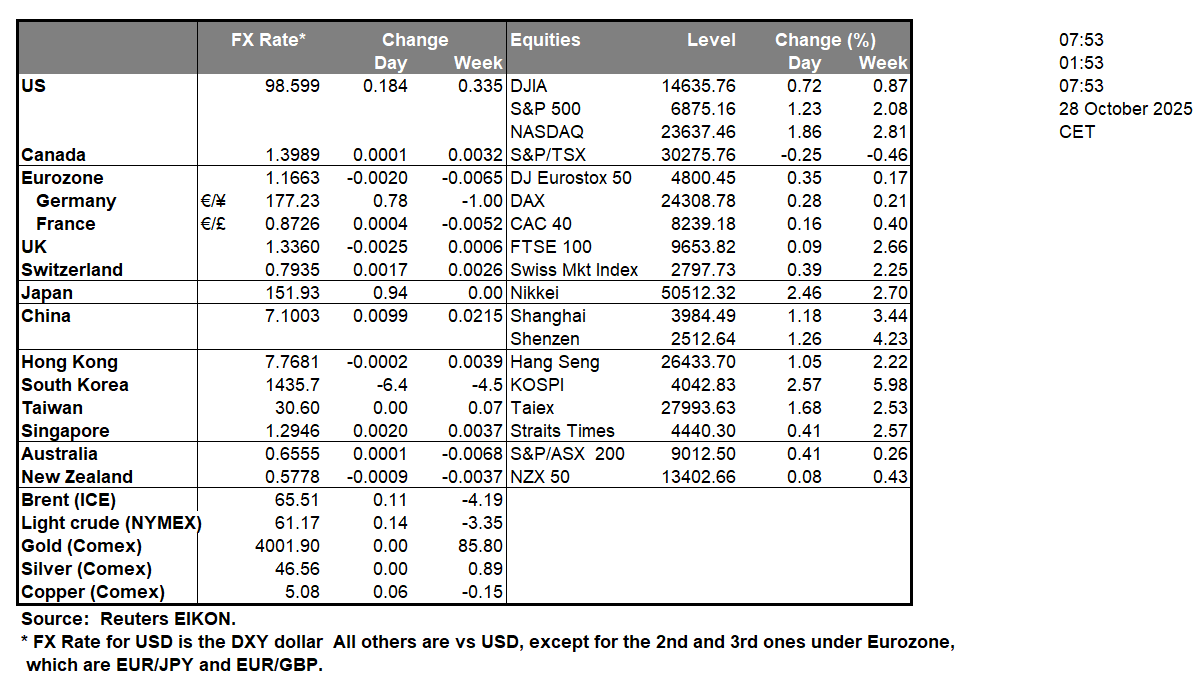

Market worries continued to ease yesterday and during today’s Asian session, as progress in the US-Chinese trade negotiations was reported and US President Trump will be meeting with Chinese President Xi on Thursday in South Korea. The USD edged lower and we expect further progress in the negotiations to possibly continue to weigh on the greenback, while on the flip side, US equities were on the rise signalling increased optimism, while gold’s price continued to drop. On a monetary level, we note that the market has started to position itself ahead of the release of the Fed’s interest rate decision and the bank is widely expected to cut rates by 25 basis points. In the FX market, Aussie traders are expected to keep a close eye on the release of Australia’s CPI rates for September and Q3 in tomorrow’s Asian session. A possible, beyond market expectations, acceleration of the rates could imply persistent inflationary pressures in the Australian economy and add more pressure on RBA to maintain rates unchanged and force the market to re-adjust its expectations for further easing of the bank’s monetary policy. It should be noted that RBA Governor Michelle Bullock yesterday highlighted the importance of lowering inflation and seemed in no rush for the bank to cut rates.Also in the FX market, JPY got some support as the US Trade Secretary Bessent yesterday called for a “sound monetary policy” in Japan, a statement which was interpreted as a signal of support for BoJ’s rate hiking plans. The statement was an example of the influence the US Trump administration has on international macroeconomics and the FX market. On the flip side, Japan’s new economy minister Kiuchi, underscored the possible benefits of a weak Yen. The comments were a painful reminder of the direction the new Japanese Government seems to be adopting in regards to monetary policy and further similar comments could be interpreted as verbal market intervention, which in turn may weigh on the JPY.

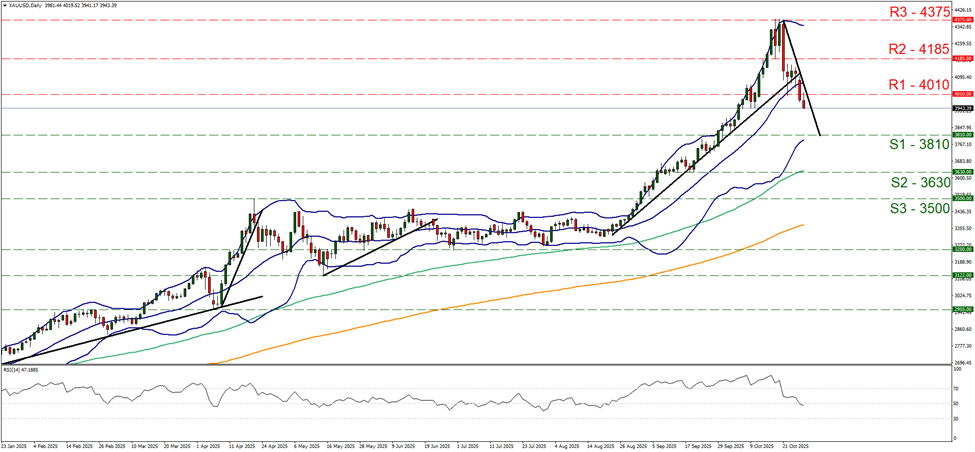

XAU/USD appears to be moving in a downwards fashion. We opt for a bearish outlook for the pair and supporting our case is the RSI indicator which has sharply moved lower and currently registers a figure below 50, implying a bearish market sentiment. For our bearish outlook to continue we would require a break below our 3810 (S1) support level with the next possible target for the bears being our 3630 (S2) support base. On the flip side for a sideways bias we would require gold’s price to remain between our 3810 (S1) support line and our 4010 (R1) resistance level. Lastly, for a bullish outlook we would require a clear break above 4010 (R1) resistance level with the next possible target for the bulls being our 4185 (R2) resistance line.

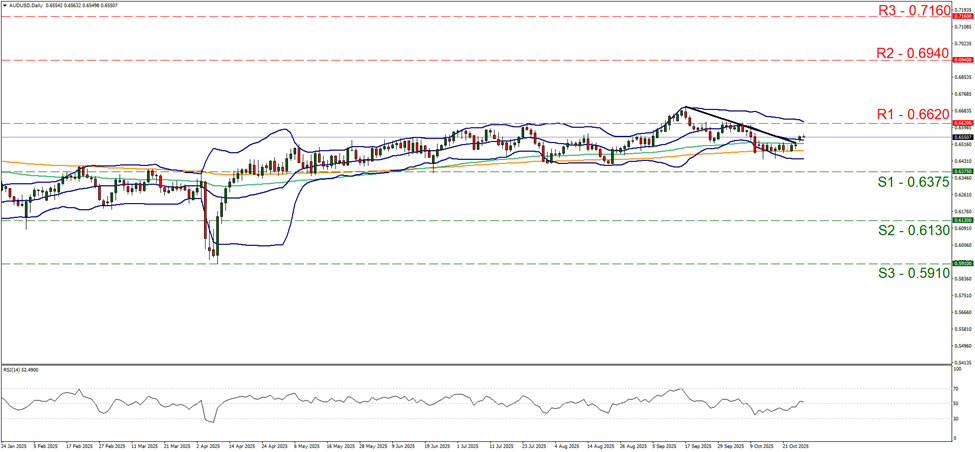

AUD/USD appears to be moving in a sideways fashion. We opt for a sideways bias for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50. For our sideways bias to be maintained we would require the pair to remain confined between our 0.6375 (S1) support level and our 0.6620 (R1) resistance line. On the other hand for a bullish outlook we would require a clear break above our 0.6620 (R1) resistance line with the next possible target for the bulls being our 0.6940 (R2) resistance level. Lastly, for a bearish outlook we would require a break below our 0.6375 (S1) support level with the next possible target for the bears being our 0.6130 (S2) support line.

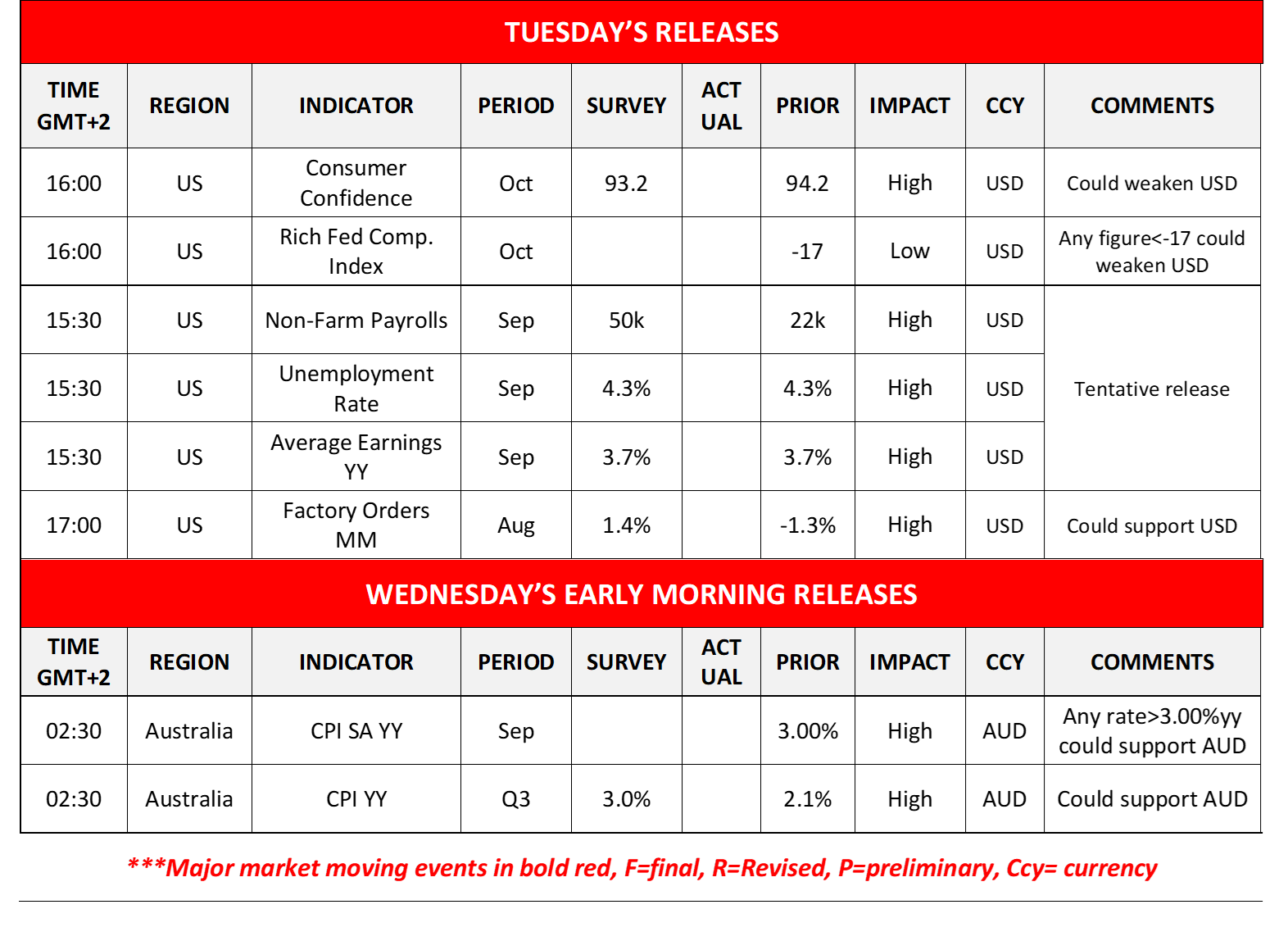

Other highlights for the day:

Today we get the US Consumer Confidence and the Richmond Fed President index, both for October and we are still waiting for the release of the US employment report for September while we also get the US factory orders for August. In tomorrow’s Asian session, we get Australia’s CPI rates for September and Q3.

XAU/USD Daily Chart

- Support: 3810 (S1), 3630 (S2), 3500 (S3)

- Resistance: 4010 (R1), 4185 (R2), 4375 (R3)

AUD/USD Daily Chart

- Support: 0.6375 (S1), 0.6130 (S2), 0.5910 (S3)

- Resistance: 0.6620 (R1), 0.6940 (R2), 0.7160 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.