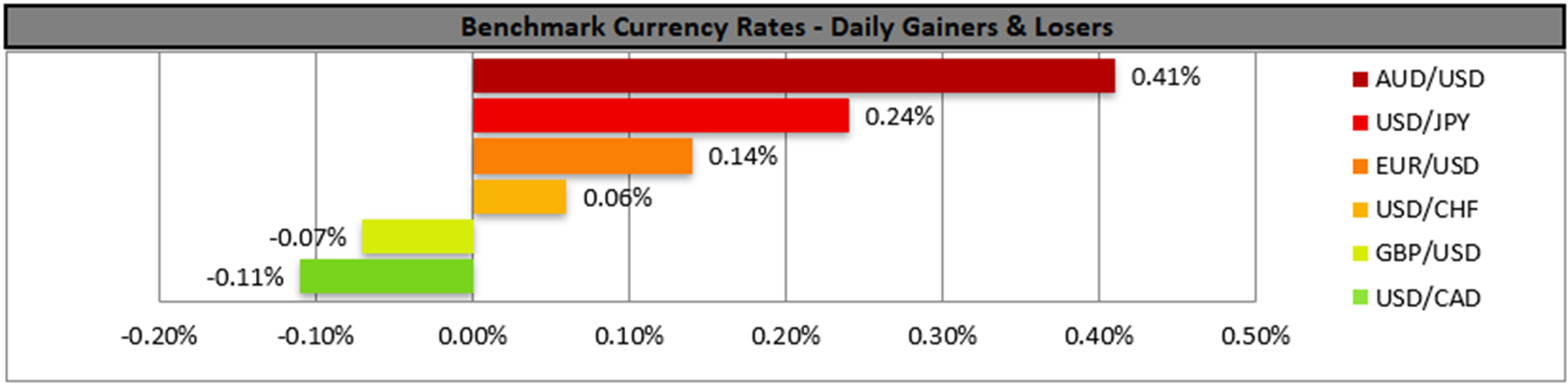

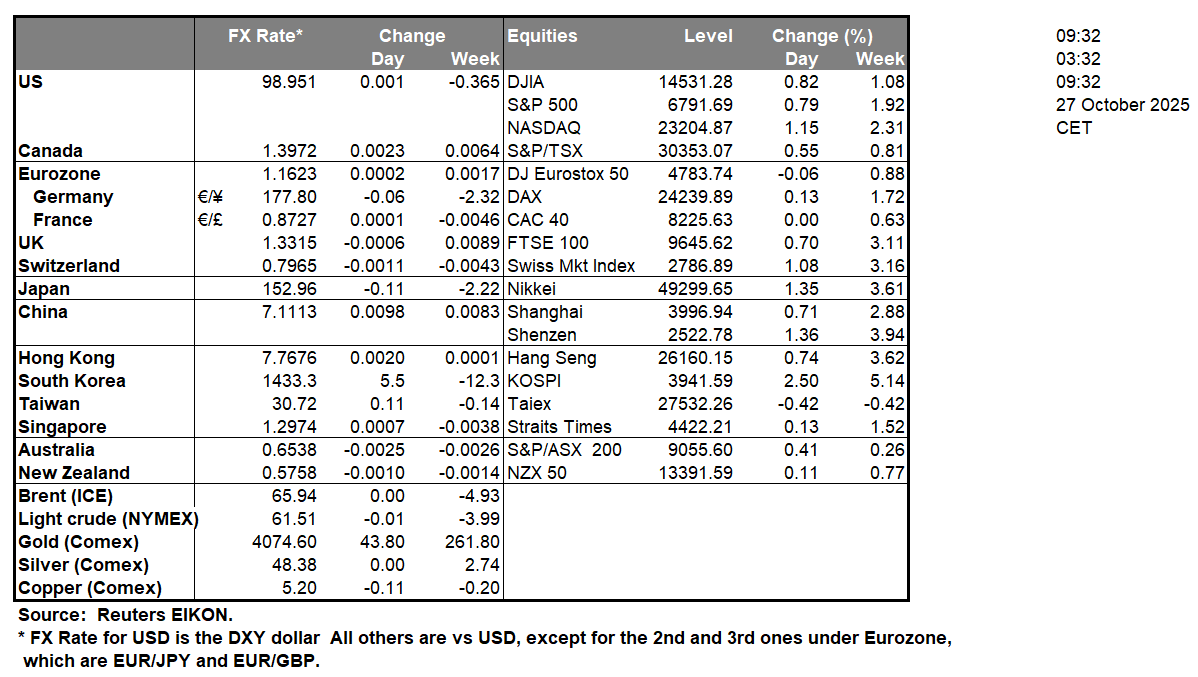

The U.S. dollar rose remained relatively stable against its counterparts since Wednesday and today a busy week is about to begin, filled with high-impact financial releases, central bank interest rate decisions and on a deeper fundamental trade negotiations are ongoing. The Fed’s interest rate decision next Wednesday is in the market’s focus and the market is widely expecting the bank to cut rates, yet the resilience of inflationary pressures as reported on Friday tend to set some doubts for the bank’s forward guidance. The JPY is losing ground against the USD, GBP and EUR over the past week, signaling a wider weakness of the Yen in the FX market, primarily due to market worries for possible political pressures being exercised on BoJ to ease its hawkish intentions. On the flip side, the Aussie gained ground against the USD on market hopes for a possible thawing of the tensions in the US-Sino trade relationships, improving market sentiment. U.S. Treasury Secretary Scott Bessent said that the possibility of the U.S. imposing 100% tariffs on Chinese imports starting November 1 has been eliminated.

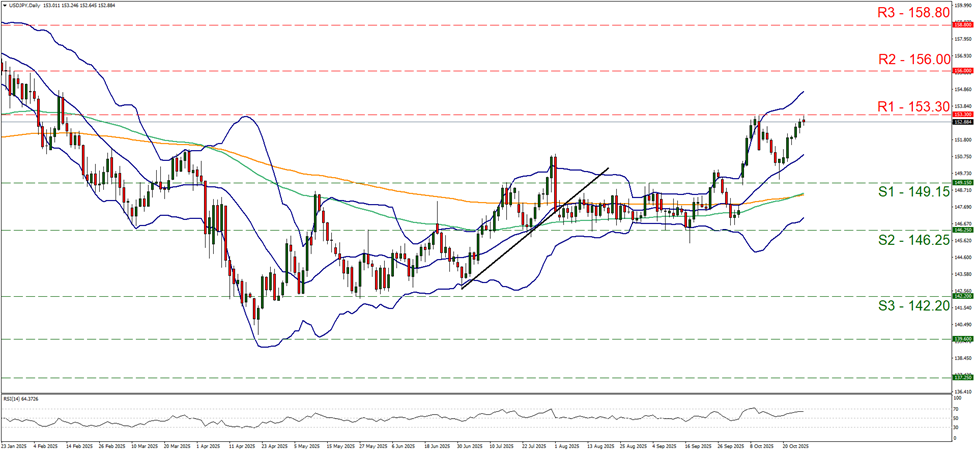

USD/JPY continued to rise on Friday for a sixth day in a row, testing in today’s Asian session the 153.30 (R1) resistance line. Despite the pair’s rise, we tend to remain prudent still maintaining a bias for a sideways motion. Also the RSI indicator is on the rise nearing the reading of 70, implying a bullish market sentiment for the pair. Also the price action has still a way to go before reaching the upper Bollinger band, implying that there is still room for the bulls to play. Should the bulls take over we may see USD/JPY breaking the 153.30 (R1) line clearly and start aiming for the 156.00 (R2) resistance level. Should the bears be in charge, we may see the pair breaking the 149.15 (S1) support line, opening the gates for the 146.25 (S2) level.

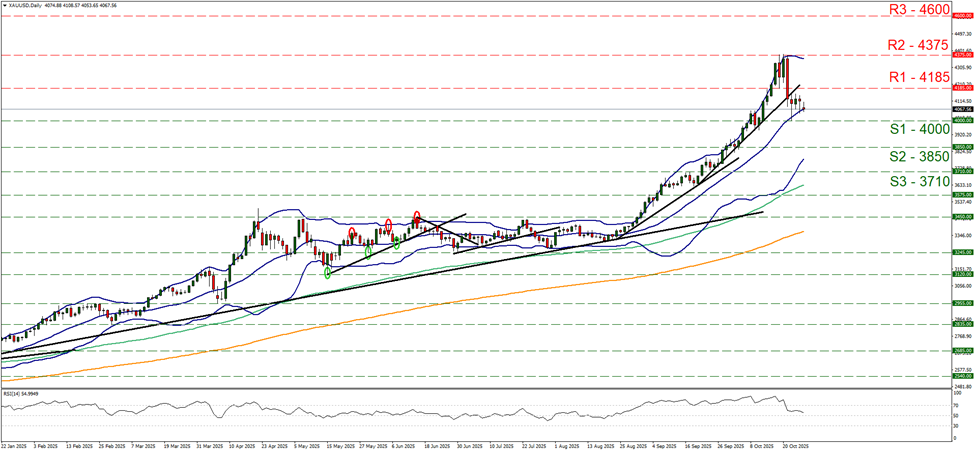

On a technical level we also note that gold’s price edged lower in today’s Asian session, yet remained well within the boundaries set by the 4185 (R1) resistance level and the 4000 (S1) support line. We maintain a bias for a sideways motion of the precious metal’s. We also note that the RSI indicator neared the reading of 50, implying further easing of the bullish market sentiment. For a bullish outlook to emerge we would require gold’s price to break the 4185 (R1) resistance line and continue to break also the 4375 (R2) resistance level, reaching new record high levels. A bearish outlook could be adopted should the precious metal’s price break the 4000 (S1) support line and continue lower aiming for the 3850 (S2) support level.

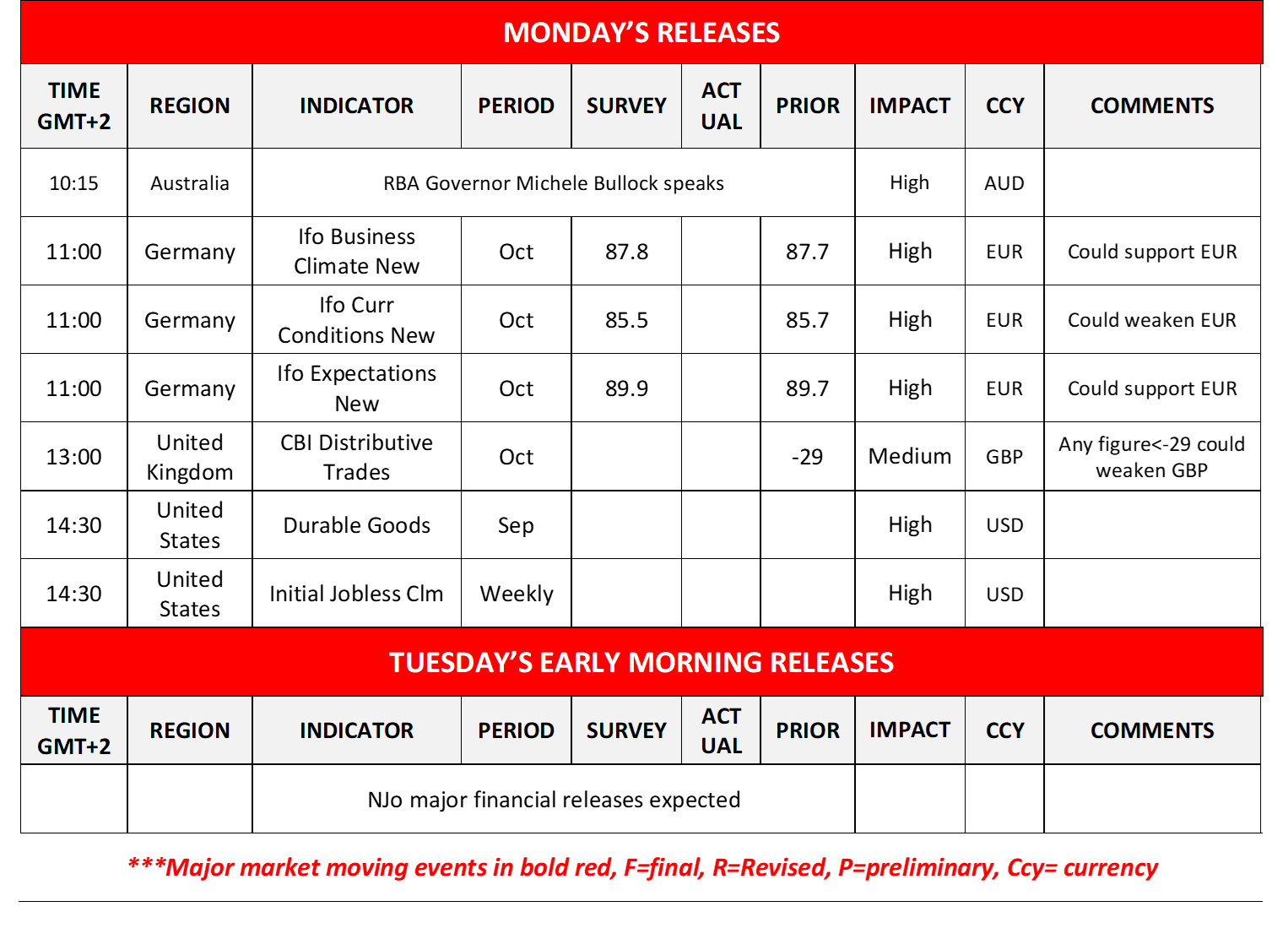

Other highlights for the day:

Today we note the speech of RBA’s Governor Michelle Bullock and as for financial releases, Germany’s Ifo indicators for October, UK’s CBI Distributive trades indicator for the same month and from the US the US Durable Goods orders for September and the weekly initial jobless claims.

As for the rest of the week:

On Tuesday we get Germany’s GfK Consumer Sentiment for November and the US consumer confidence for October. On Wednesday we get Australia’s CPI rates for September, Sweden’s preliminary GDP rate for Q3, and on a monetary level, we note the release from Canada, BoC’s interest rate decision, while from the US we highlight the release of the Fed’s interest rate decision. On Thursday, on a monetary level, we note the release from Japan of BoJ’s interest rate decision while from the Euro Zone ECB’s interest rate decision, while we also note the release of the preliminary GDP rates for Q3 of France, the Czech Republic, Germany, the Euro Zone as a whole and the US, while we also get Switzerland’s KOF indicator for October and the Germany’s preliminary HICP rate for October. On Friday we get Japan’s Tokyo CPI rates for October and preliminary industrial output for September while from China we get October’s NBS manufacturing PMI figure, from France and the Euro Zone we get October’s preliminary HICP rates, while we get the US PCE rates for September and Canada’s GDP rates for August.

USD/JPY Daily Chart

- Support: 149.15 (S1), 146.25 (S2), 142.20 (S3)

- Resistance: 153.30 (R1), 156.00 (R2), 158.80 (R3)

XAU/USD Daily Chart

- Support: 4000 (S1), 3850 (S2), 3710 (S3)

- Resistance: 4185 (R1), 4375 (R2), 4600 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.