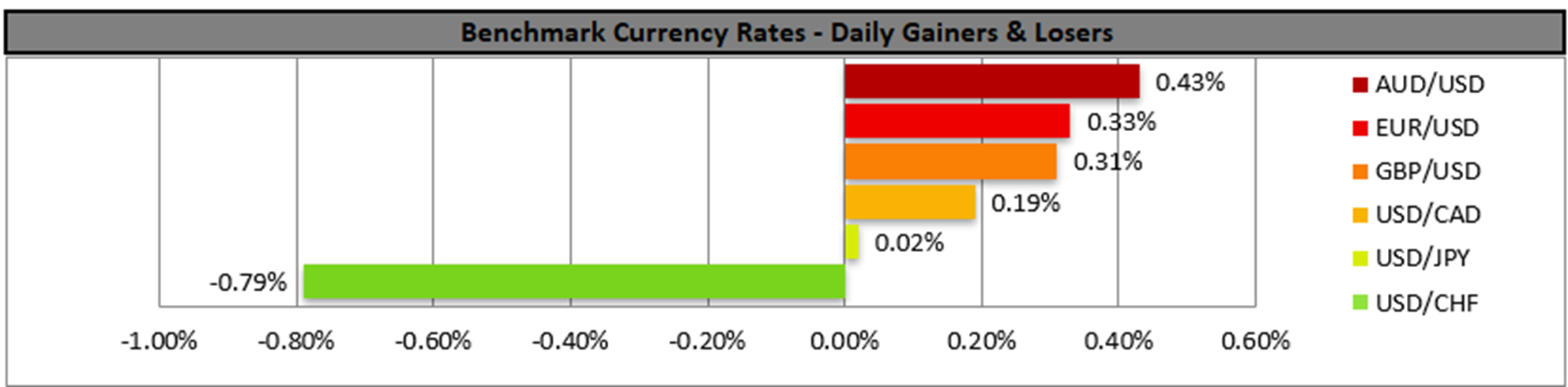

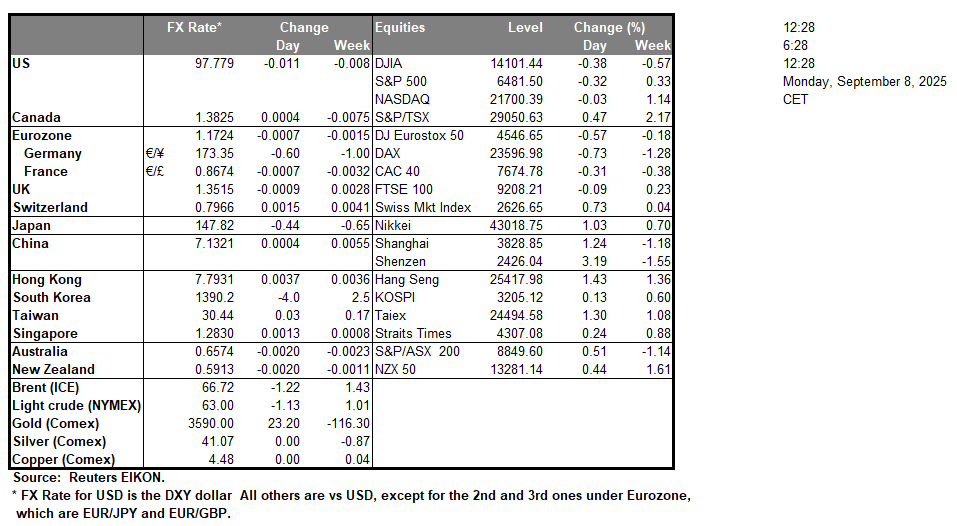

The USD entered shaky ground after the release of the US August employment data as the US employment market proved to be weaker than what was expected, as the NFP characteristically dropped to 22k. After the release, the market has started pricing in a possible 50-basis-point rate cut, with a 25-basis-point rate cut still being the base scenario for the meeting on September 17th, as its being widely priced in. Also, the market now expects the bank to deliver another rate cut in October and one in December. Across the Atlantic, we highlight that French PM Bayrou is to face a vote of confidence which he is expected to lose and thus France seems to be entering a political dead end. Given also that the ECB is expected to release its interest rate decision, we may see market focus also being placed on the EUR area. In Japan, PM Ishiba also stated that he intends to step down after a period of considerable political pressure. His successor may opt to add more pressure on the BoJ to ease its monetary policy and thus could weigh on the JPY.

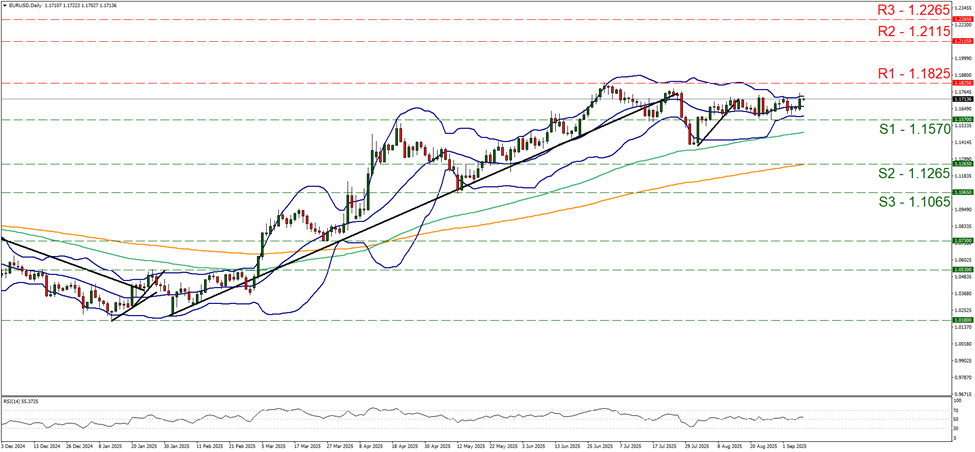

On a technical level, EUR/USD continued to edge higher on Friday, yet in general is still, well between the 1.1825 (R1) resistance line and the 1.1570 (S1) support level. The pair remained within the prementioned boundaries for the past two months and the narrowing of the Bollinger bands over the past week, tends to imply lower volatility for the pair, which in turn may allow the sideways motion to be maintained. Also the RSI indicator, despite edging a bit higher, continues to run along the reading of 50, implying a rather indecisive market for the pair. Hence we maintain our bias for the sideways motion to continue as long as the pair’s price action remains between the R1 and the S1. For a bullish outlook to emerge we would require the pair to break the 1.1825 (R1) line and start aiming for the 1.2115 (R2) resistance base. For a bearish outlook to emerge, we would require the pair to break the 1.1570 (S1) line and start nearing the 1.1265 (S2) barrier.

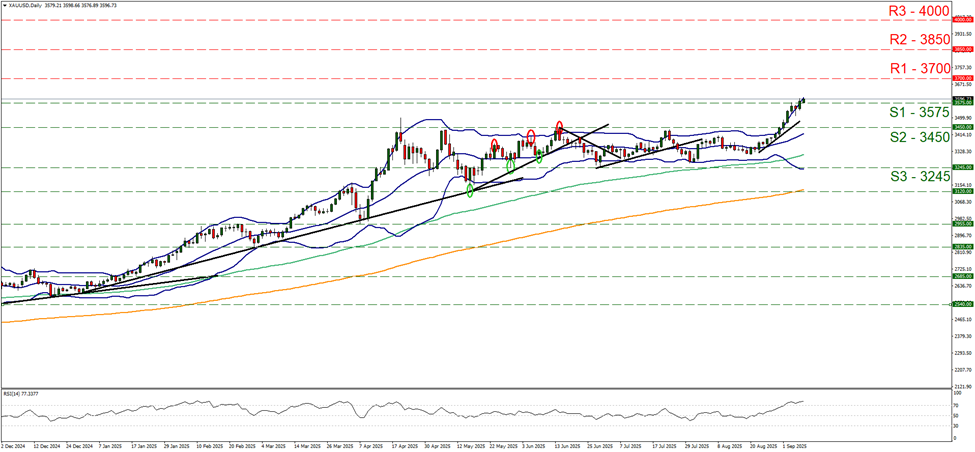

Gold’s price on the other hand rose, reaching new record high levels, breaking the 3575 (S1) resistance line, now turned to support. The RSI indicator continues to be above the reading of 70, and rising while the price action is flirting with the upper Bollinger band, both indicators implying a one the one hand a strong bullish market sentiment for the precious metal’s price yet on the other, imply that the gold’s price is at overbought levels and ripe for a correction lower. For the time being we maintain our bullish outlook yet also issue warning for a possible correction lower of its price, and we set as the next possible target for the bulls the 3700 (R1) resistance level. For a bearish outlook to emerge we would require gold’s price to reverse direction, break the 3575 (S1) support line and continue lower to also break the 3450 (S1) support barrier.

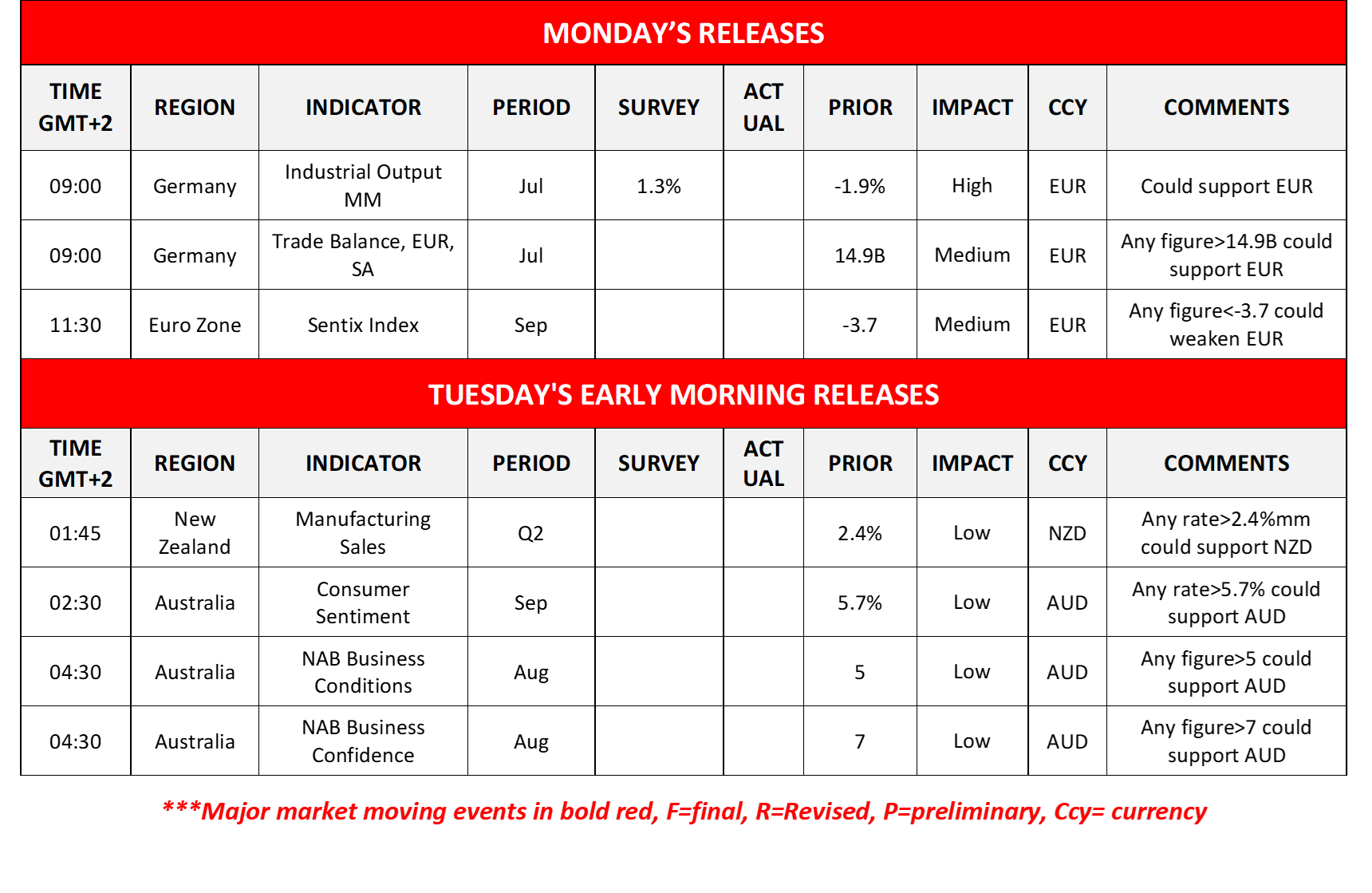

Other highlights for the day:

Today we get Germany’s industrial output rate and trade balance for July, as well as the Euro Zone’s Sentix index for September. In tomorrow’s Asian session, we get New Zealand’s manufacturing sales for Q2, Australia’s consumer confidence for September as well as Business conditions and confidence for August.

As for the rest of the week

On Wednesday we get China’s CPI and PPI rates for August, Sweden’s GDP rates for July, Norway’s CPI rates, and the Czech Republic’s for August, as well as the US PPI rates for the same month. On Thursday we get Japan’s corporate goods prices for August, Sweden’s CPI rates for August, we highlight the release of the US CPI rates for the same month, and the US weekly initial jobless claims figure and on the monetary front, we highlight the release of the ECB’s interest rate decision, while from Turkey we get CBT’s interest rate decision. Finally, on Friday, we note the release of New Zealand’s electronic card sales for August, the UK’s GDP and manufacturing output rates for July, Canada’s building permits rate also for July, and from the US, the preliminary University of Michigan consumer sentiment for September.

EUR/USD Daily Chart

- Support: 1.1570 (S1), 1.1265 (S2), 1.1065 (S3)

- Resistance: 1.1825 (R1), 1.2115 (R2), 1.2265 (R3)

XAU/USD Daily Chart

- Support: 3575 (S1), 3450 (S2), 3245 (S3)

- Resistance: 3700 (R1), 3850 (R2), 4000 (R3)

Se tiver alguma dúvida ou comentários sobre este artigo, solicitamos que envie um email diretamente para a nossa equipa de Research através do research_team@ironfx.com research_team@ironfx.com

Isenção de responsabilidade:

Esta informação não é considerada como aconselhamento ou recomendação ao investimento, mas apenas como comunicação de marketing. O IronFX não é responsável por quaisquer dados ou pela informação fornecida por terceiros aqui mencionados, ou com links diretos, nesta comunicação.