Fed’s meeting minutes could rock the markets

The highlight today is expected to be the release of the Fed’s January meeting minutes.

It should be noted that the market’s expectations for the Fed’s intentions turned more dovish last Friday, as the US CPI rates for the past month showed an easing of inflationary pressures in the US economy.

Yet the release of Fed’s January meeting minutes could alter the market’s expectations.

Should the document show a more hawkish predisposition of Fed policymakers, could catch the markets by surprise and force them to readjust their positions and expectations, thus providing some support for the USD.

Yet the release may have ripple effects beyond the FX market with a hawkish document possibly weighing on US stock markets. On the flip side a more than expected dovish text could weigh on the USD and lift US equities.

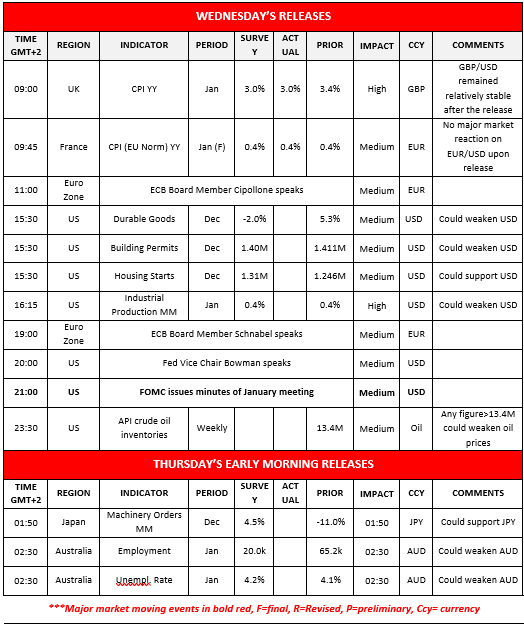

Australia’s employment data

In tomorrow’s Asian session, we highlight the release of Australia’s employment data for January, as it could shake the Aussie.

Analysts expect the employment change figure to drop to 20k and the unemployment rate to tick up to 4.2%, both indicators implying an easing of the Australian employment market.

Should the data show an unexpected tightening of the Australian employment market, we may see the Aussie getting asymmetric support, while a wider than expected slack in the Australian employment market could weigh on AUD.

US stock markets remain stable

US stock markets tend to remain relatively stable, and market participants tend to keep an eye out for the developments in negotiations for the take over of Warner Bros.

Netflix seems to be wobbling, yet could get some support should market expectations for Paramount to fail to take over Warner Bros, be on the rise.

Other highlights for today

Today we got UK’s CPI rates for January, France’s final HICP rates, the US Durable goods, Building Permits and Housing starts for December and industrial output for January, while later on we get the weekly API crude oil inventories figure.

In tomorrow’s Asian session, we get Japan’s machinery orders for December.

Charts to keep an eye out

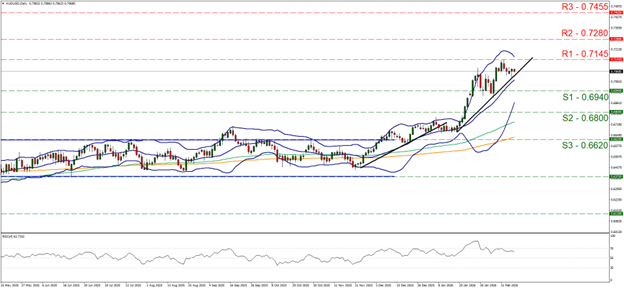

AUD/USD remained relatively stable yesterday, between the 0.7145 (R1) resistance line and the 0.6940 (S1) support level. We maintain a bullish outlook for the pair as long as the upward trendline guiding the pair remains intact.

The RSI indicator remains below, but near the reading of 70 implying a bullish predisposition of the market for the pair. For our bullish outlook to be maintained we would require the pair to from a higher peak and for that to happen AUD/USD has to break the 0.7145 (R1) resistance line and start aiming for the 0.7280 (R2) resistance base.

For a bearish outlook to emerge, we would require the pair to drop break the prementioned upward trendline and continue to break also the 0.6940 (S1) support line, with the next possible target for the bears being the 0.6800 (S2) support barrier.

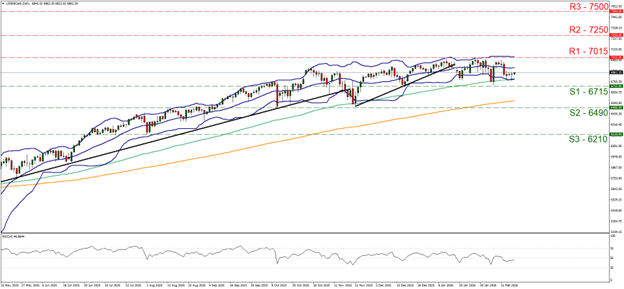

S&P 500 remained in a tight sideways motion between the 7015 (R1) resistance line and the 6715 (S1) support level. wobble just above the 66750 (S1) support line yesterday and during today’s Asian session edged a bit lower.

We maintain currently a bias for the index’s sideways motion to continue, given also that the RSI indicator remains just below but near the reading of 50, implying a rather indecisive market.

Should the bulls be in control of the index’s direction we may see S&P 500 breaking the record high level of 7015 (R1) resistance line and set as the next possible target for the bulls the 7250 (R2) resistance hurdle.

Should the bears take over we may see S&P 500, breaking the 6715 (S1) support line and start aiming for the 6490 (S2) support barrier.

AUD/USD Daily Chart

- Support: 0.6940 (S1), 0.6840 (S2), 0.6620 (S3)

- Resistance: 0.7145 (R1), 0.7280 (R2), 0.7455 (R3)

US 500 Daily Chart

- Support: 6715 (S1), 6490 (S2), 6210 (S3)

- Resistance: 7015 (R1), 7250 (R2), 7500 (R3)

Isenção de responsabilidade:

Esta informação não é considerada como aconselhamento ou recomendação ao investimento, mas apenas como comunicação de marketing. O IronFX não é responsável por quaisquer dados ou pela informação fornecida por terceiros aqui mencionados, ou com links diretos, nesta comunicação.