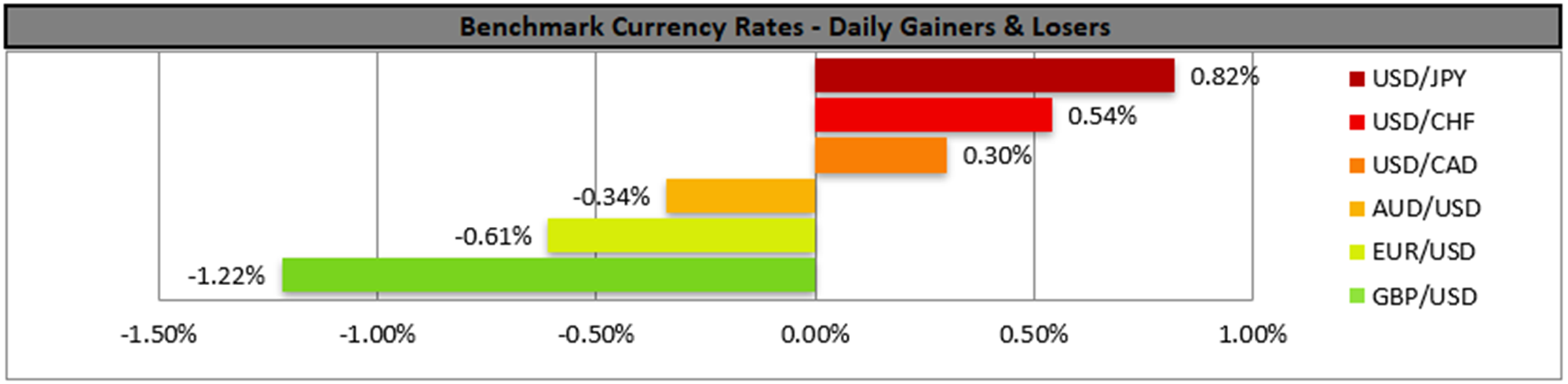

After our concerns for France mentioned in yesterday’s report, we note that across the Channel the GBP suffered a hit yesterday against the USD, JPY and EUR, implying a wider degree of weakness on behalf of the pound. The sterling’s drop seems to have been instigated by substantial concerns for the UK fiscal outlook. The market worries once again were expressed in the gilt market, where the UK’s 30 year 30-year borrowing costs reached levels not seen since 1998. UK equities were on the retreat with FTSE 100 ending its sixth day in the reds. It should be noted on a fundamental level, that the UK’s Chancellor of the Ex-Chequers Reeves, is to deliver an autumn statement, possibly early November at which wealth taxation is expected to be announced. Currently, reports state that the UK has a £40 billion gap to cover, intensifying market worries for the UK fiscal outlook. We see the case for the UK government to follow an approach favouring growth, yet at the same time it may have to follow also an even more contractionary fiscal policy to tame the national debt levels and accommodate servicing costs. Should market worries about the UK outlook intensify, we may see the GBP retreating further.

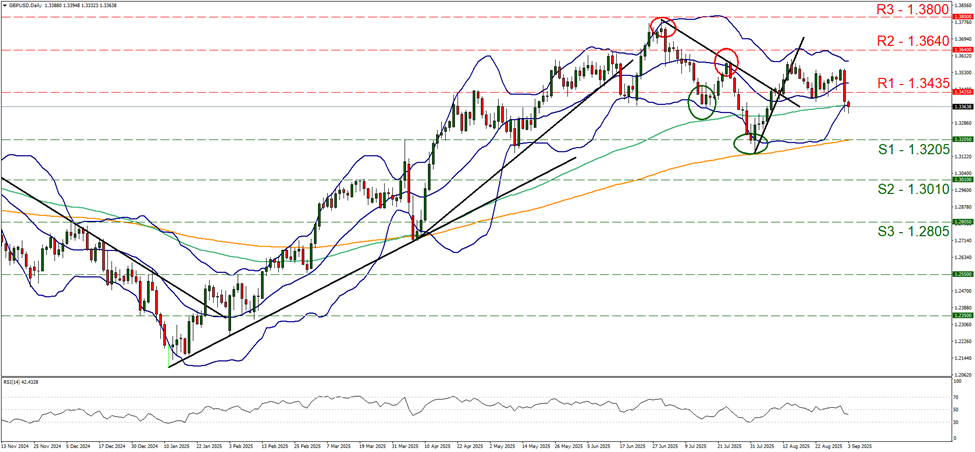

In the FX market, Cable tumbled yesterday breaking the 1.3435 (R1) support line now turned to resistance. The RSI indicator dropped below the reading of 50 implying that the market sentiment is turning bearish for the pair and as GBP/USD seems to have abandoned its sideways motion we switch our opinion to a bearish outlook. Should the bears maintain control over the pair we may see GBP/USD aiming if not breaching the 1.3205 (S1) support line. On the flip side chances for a bullish outlook seem to have been erased at the current stage and for its adoption we would require the pair to break the 1.34.35 (R1) resistance line and continue higher to also break the 1.3640 (R2) resistance level.

In Asia, JPY weakened against the USD yesterday, as the General Secretary of the LDP, ruling party in Japan, and a close aide to Prime Minister Shigeru Ishiba, stated that he intended to resign from his post. Such a development could possibly add even more pressure on Japan’s PM to resign, who up until now was able to fight off calls to step down after the party’s loss at the recent Senate election. A possible successor of Ishiba could add more pressure on BoJ for lower interest rates. On a fiscal level, the market’s worries for the ballooning Japanese debt were expressed yesterday with a sell-off of Japanese Government Bonds and the rising debt costs could weigh on the budget. Japanese equities were also on the retreat as Nikkei 225 ended its day in the reds. Should we see political uncertainty in Japan being enhanced and market worries for the fiscal outlook of Japan rising, JPY may suffer further losses.

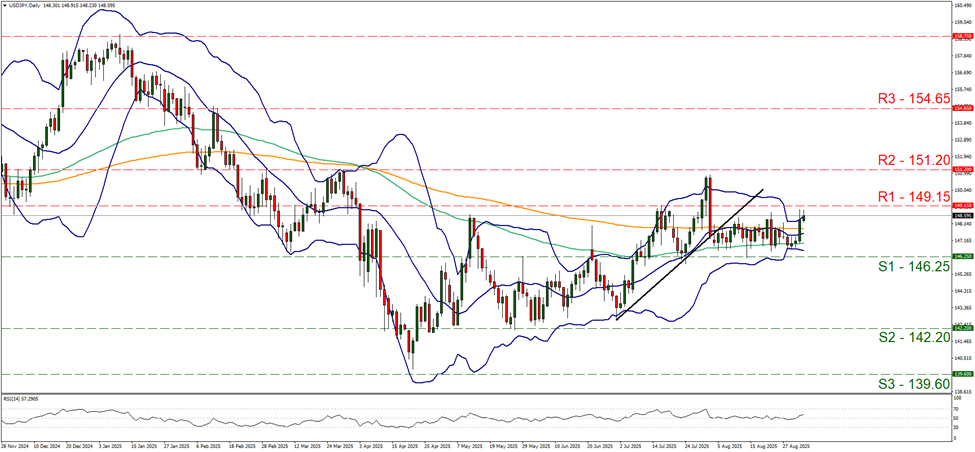

USD/JPY rose yesterday and during today’s Asian session aiming for the 149.15 (R1) resistance line. The RSI indicator rose implying some bullish tendencies for the pair, yet for the time being, as the pair remains within the corridor formed by the R1 and the S1, we maintain our bias for a sideways motion. Should the bulls take over, we may see the pair breaking the 149.15 (R1) resistance line and start aiming for the 151.20 (R2) resistance level. For a bearish outlook to emerge we would require USD/JPY to break the 146.25 (S1) support line and start aiming for the 142.20 (S2) support base.

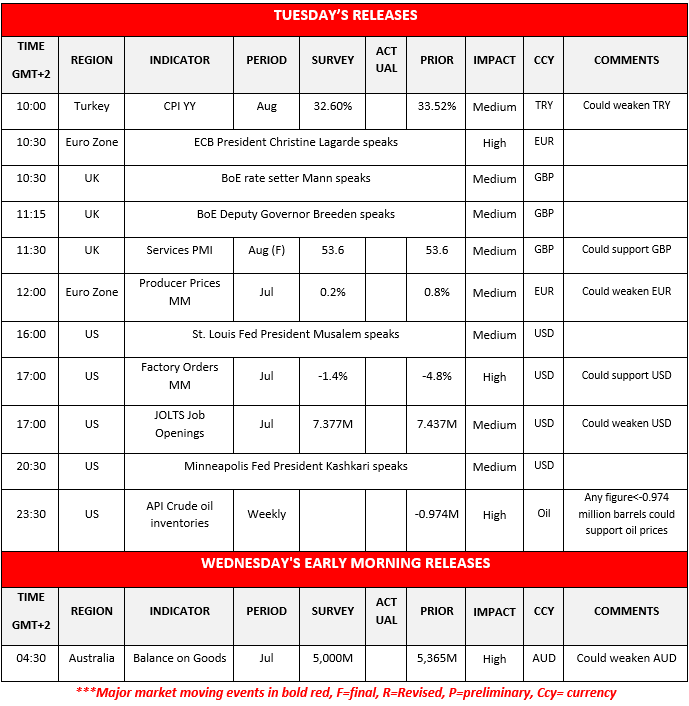

Other highlights for the day:

Today we get Turkey’s August CPI rates, UK’s final services PMI figure for August, Euro Zone’s PPI rates for July, July’s US factory orders and JOLTS job openings figure as well as the weekly API crude oil inventories figure. On a monetary level, we note that ECB President Christine Lagarde, BoE rate setter Mann, BoE Deputy Governor Breeden, St. Louis Fed President Musalem and Minneapolis Fed President Kashkari are scheduled to speak. In tomorrow’s Asian session, we get Australia’s trade data for July.

GBP/USD Daily Chart

- Support: 1.3205 (S1), 1.3010 (S2), 1.2805 (S3)

- Resistance: 1.3435 (R1), 1.3640 (R2), 1.3800 (R3)

USD/JPY Daily Chart

- Support: 146.25 (S1), 142.20 (S2), 139.60 (S3)

- Resistance: 149.15 (R1), 151.20 (R2), 154.65 (R3)

Se tiver alguma dúvida ou comentários sobre este artigo, solicitamos que envie um email diretamente para a nossa equipa de Research através do research_team@ironfx.com research_team@ironfx.com

Isenção de responsabilidade:

Esta informação não é considerada como aconselhamento ou recomendação ao investimento, mas apenas como comunicação de marketing. O IronFX não é responsável por quaisquer dados ou pela informação fornecida por terceiros aqui mencionados, ou com links diretos, nesta comunicação.