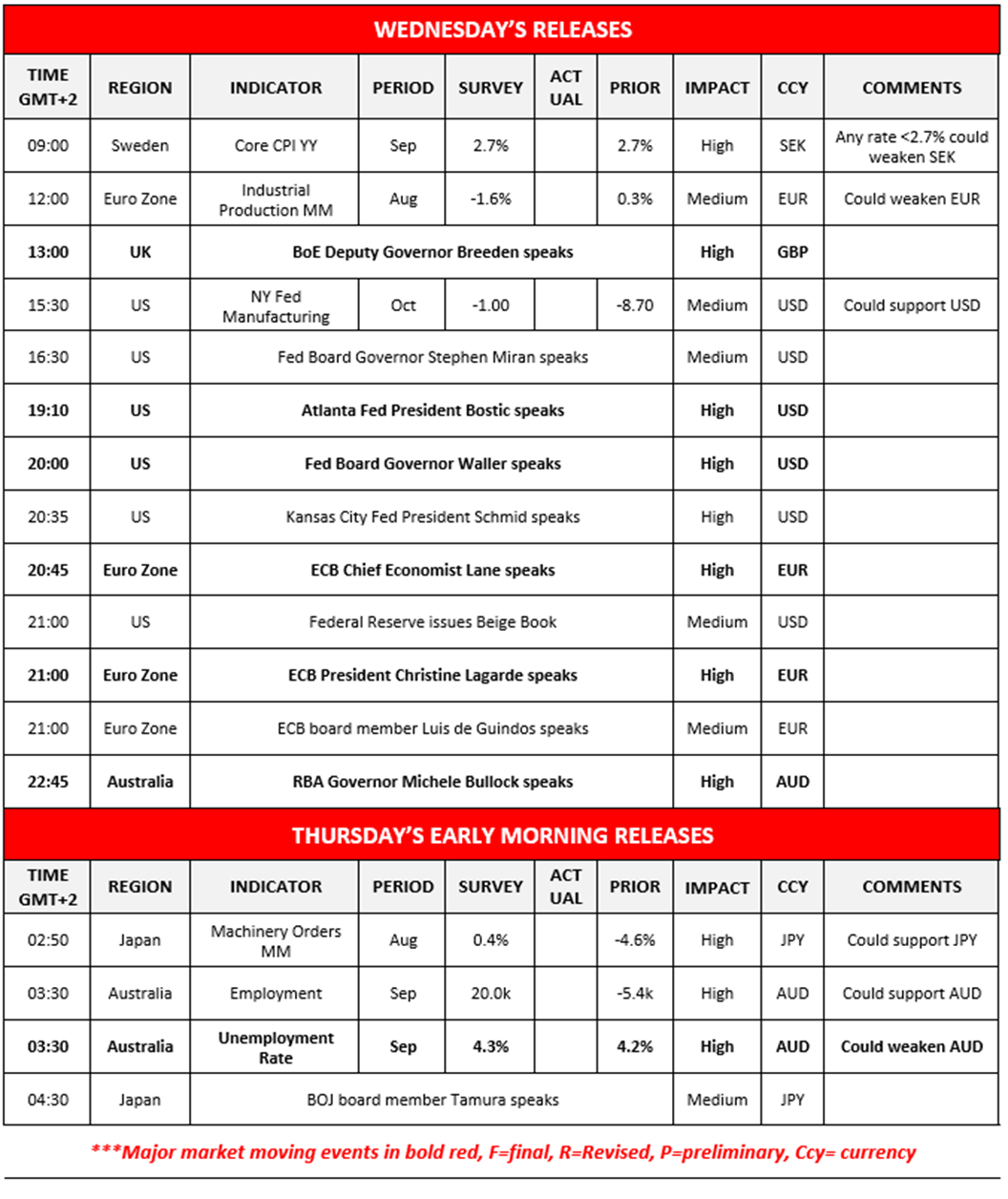

Fed Chair Powell’s comments yesterday appear to have raised concern over the state of the US Labour market. In particular, the FT has quoted the Fed Chair as having stated yesterday that “the downside risks to employment have risen”, implying a cooling of the labour market. In turn given the Fed’s dual mandate, the cooling labour market may be a rising concern for Fed policymakers and thus could imply that the Fed may cut rates again this year. Hence, a possible rate cut in the Fed’s next meeting may weigh on the greenback. In tomorrow’s Asian session, we would like to note the release of Australia’s employment data for September which is expected by economists to showcase a mixed labour market, with the employment change figure expected to improve to 20k whilst the unemployment rate is expected to also increase to 4.3%. In our view, the main financial release of the two may be the unemployment rate and thus, should the rate come in as expected or higher, it may weigh on the Aussie and vice versa. In France the political maneuvering in order to pass the Government’s budget continues and thus may warrant close attention as another failure to pass a budget could weigh on the French Equities markets. On a trade level, the rift between China and the US still remains with President Trump stating that “We are considering terminating business with China having to do with Cooking Oil, and other elements of Trade, as retribution”, which in terms of a big picture shows that there may have been a lack of progress in regards to trade talks between the two nations.

On a technical level, looking at XAU/USD the precious metal’s price appears to be moving in an upwards fashion. We would opt for our predominantly bullish outlook and supporting our case is our upwards moving trendline as indicated on the chart, in addition to our ADX, RSI and MACD indicators located at the bottom of the chart. For our bullish outlook to be maintained, we would require gold’s price to remain above our upwards moving trendline if not also clearing and remaining above our 4220 (R1) hypothetical resistance level with the next possible target for the bulls being the hypothetical 4340 (R2) resistance line.On the other hand for a bearish outlook we would require a clear break below our 4100 (S1) support line with the next possible target for the bears being our 3980 (S2) support level. Lastly, for a sideways bias we would require gold’s price to remain confined between our 4100 (S1) support level and our 4220 (R1) resistance line.

EUR/USD appears to be moving in a predominantly downwards fashion. We opt for a bearish outlook for the pair and supporting our case is the downwards moving trendline which was incepted on the 17th of September, in addition to our MACD,RSI and ADX indicators below our chart. For our bearish outlook to continue we would require a clear break below our 1.1480 (S1) support level with the next possible target for the bears being our 1.1330 (S2) support line. On the other hand, for a sideways bias we would require the pair to remain confined between our 1.1480 (S1) support level and our 1.1650 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above our 1.1650 (R1) resistance line with the next possible target for the bulls being our 1.1800 (R2) resistance level.

Other highlights for the day:

Today we note the release of Sweden’s CPI rate for September, the Eurozone’s industrial production rate for August, the speech by BoE Governor Breeden, following by the US NY Fed manufacturing figure for October and then the flurry of speeches from Fed Governor Miran, Atlanta Fed President Bostic, Fed Governor Waller, Kansas City Fed President Schmid, ECB Chief Economist Lane, the release of the Fed’s Beige Book and to end of the day we get speeches by ECB President Lagarde, ECB de Guindos and RBA Governor Bullock. In tomorrow’s Asian session, we note Japan’s machinery orders rate for August, Australia’s employment data for September and the speech by BOJ member Tamura.

XAU/USD Daily Chart

- Support: 4100 (S1), 3980 (S2), 3860 (S3)

- Resistance: 4220 (R1), 4340 (R2), 4450 (R3)

EUR/USD Daily Chart

- Support: 1.1480 (S1), 1.1330 (S2), 1.1085 (S3)

- Resistance: 1.1650 (R1), 1.1800 (R2), 1.1980 (R3)

Se tiver alguma dúvida ou comentários sobre este artigo, solicitamos que envie um email diretamente para a nossa equipa de Research através do research_team@ironfx.com research_team@ironfx.com

Isenção de responsabilidade:

Esta informação não é considerada como aconselhamento ou recomendação ao investimento, mas apenas como comunicação de marketing. O IronFX não é responsável por quaisquer dados ou pela informação fornecida por terceiros aqui mencionados, ou com links diretos, nesta comunicação.