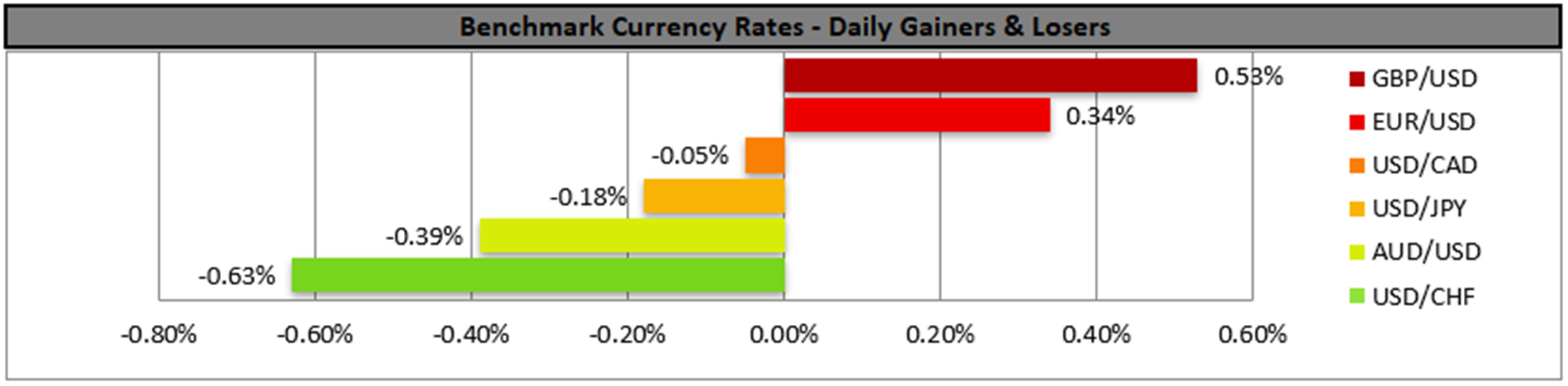

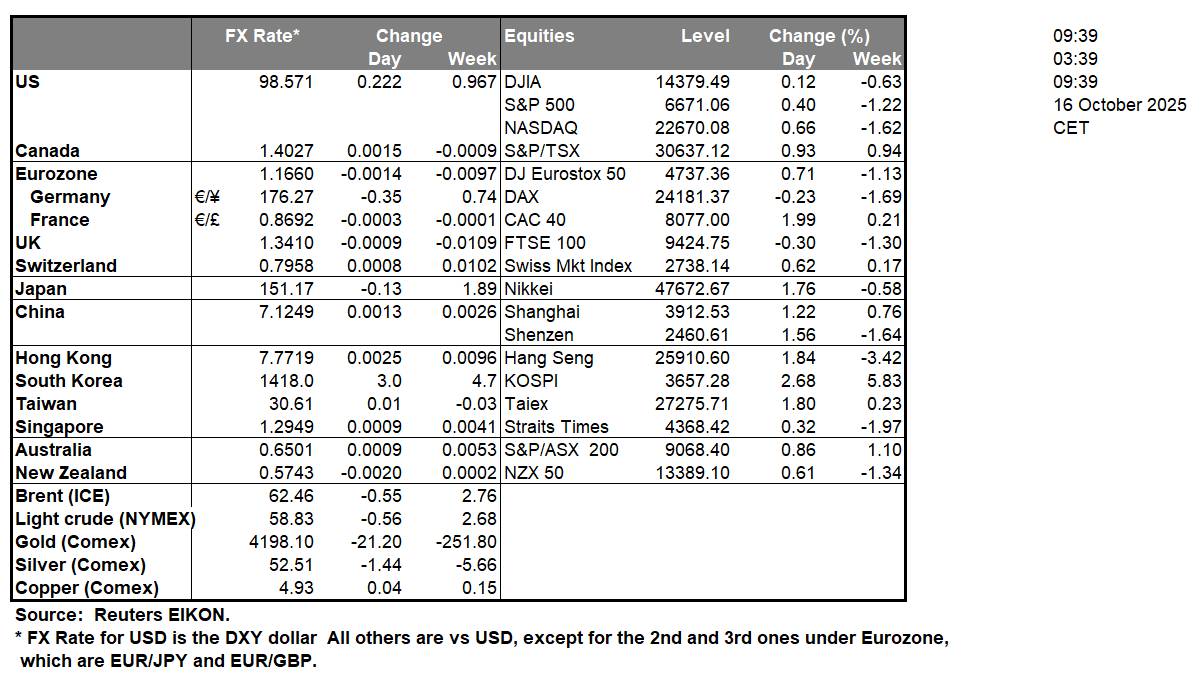

It is no secret that the US and China have resumed their hostile trade rhetoric over the past week following China’s decision to restrict rare earth metal’s. As a reminder, the US then threatened an 100% tariff which may go into place on the 1st of November. However, since that “threat” the US’s tone on China has softened, with the latest comments from Treasury Secretary Bessent implying that the US may seek an extension of a pause of import duties on Chinese goods for longer than three months and that such a possibility exists. On a geopolitical level, we would like to note the recent report that President Trump has authorized CIA action in Venezuela, which in our view is not that surprising that the CIA is operating in Venezuela but rather the actual admission by the US President. Continuing, our opinion is that the US may be attempting to exert further pressure on the nation. In conclusion any escalation of tensions or even a military conflict between the two nations could possibly aid gold’s price. From a monetary policy perspective for the US the EU and Canada, the flurry of policymakers who are set to speak today could influence their respective pairs. In our view, we wouldn’t be surprised to see Fed policymakers adopting a more dovish tone i.e implying further rate cuts, whilst from the EU a more restrictive approach and a possible touting that they have reached a “good place” in terms of monetary policy.

On a technical level, looking at XAU/USD the precious metal’s price appears to be moving in an upwards fashion. We would opt for our predominantly bullish outlook and supporting our case is our upwards moving trendline as indicated on the chart, in addition to our ADX, RSI and MACD indicators located at the bottom of the chart. For our bullish outlook to be maintained, we would require gold’s price to remain above our upwards moving trendline if not also clearing and remaining above our 4220 (R1) resistance level with the next possible target for the bulls being the hypothetical 4340 (R2) resistance line. On the other hand for a bearish outlook we would require a clear break below our 4100 (S1) support line with the next possible target for the bears being our 3980 (S2) support level. Lastly, for a sideways bias we would require gold’s price to remain confined between our 4100 (S1) support level and our 4220 (R1) resistance line.

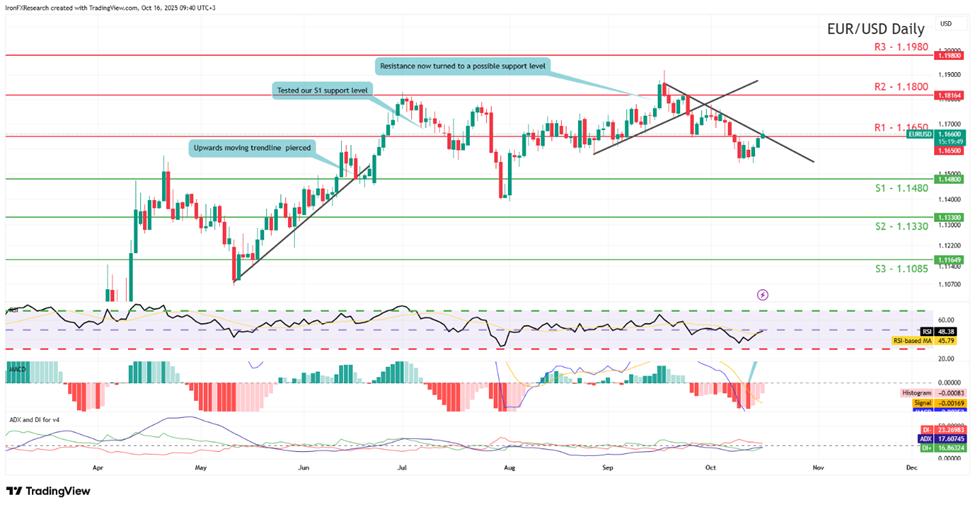

EUR/USD appears to be moving in a predominantly downwards fashion. We opt for a bearish outlook for the pair and supporting our case is the downwards moving trendline which was incepted on the 17th of September, in addition to our MACD and ADX indicators below our chart. However, we should note the pair is currently testing our R1 level and the aforementioned downwards moving trendline. Nonetheless, for our bearish outlook to continue we would require a clear break below our 1.1480 (S1) support level with the next possible target for the bears being our 1.1330 (S2) support line. On the other hand, for a sideways bias we would require the pair to remain confined between our 1.1480 (S1) support level and our 1.1650 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above our 1.1650 (R1) resistance line with the next possible target for the bulls being our 1.1800 (R2) resistance level.

Other highlights for the day:

Today we note the release of the UK’s preliminary GDP rates for August, the UK’s industrial and manufacturing outputs both for August as well, followed by the Czech Republic’s PPI rate for September. In the American trading session, we note the US Philly Fed Business index figure for October, the US PPI machine manufacturing figure and the US retail sales rate both for September whilst ending the day is the weekly EIA crude oil inventories figure. On a monetary level, we note the speeches by Richmond Fed President Barkin, Fed Governor Waller, Fed Barr, Fed Vice Chair Bowman, ECB Chief Economist Lane, ECB President Lagarde and BoC Governor Macklem. In tomorrow’s Asian session, we note the speech by Minneapolis Fed President Kashkari.

XAU/USD Daily Chart

- Support: 4100 (S1), 3980 (S2), 3860 (S3)

- Resistance: 4220 (R1), 4340 (R2), 4450 (R3)

EUR/USD Daily Chart

- Support: 1.1480 (S1), 1.1330 (S2), 1.1085 (S3)

- Resistance: 1.1650 (R1), 1.1800 (R2), 1.1980 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.