We are nearing the end of the week and we have a look at next week’s calendar. On Monday we get Australia’s manufacturing PMI figure, Switzerland’s CPI rate, Germany’s the UK’s, Canada’s and the US’s manufacturing PMI figures, including the US ISM Manufacturing PMI figure all for the month of October. On Tuesday we get Japan’s manufacturing PMI figure for October, the RBA’s interest rate decision, Canada’s trade balance figure, the US Factory orders rate and JOLTs Job openings figure all for September. On Wednesday we get Australia’s manufacturing figure, the BOJ’s September meeting minutes, Germany’s industrial orders rate for September, the Czech Republic’s preliminary CPI rate for October, the Riksbank’s interest rate decision, France’s services PMI figure, the Zone’s composite final PMI figure, the US ADP employment figure and ISM Non-Manufacturing PMI figure all for October. On Thursday we get Australia’s trade balance figure, Sweden’s CPI rate for October, Switzerland’s CPI rate for October and Unemployment rate for October, the Riskbank’s the BoE’s and the CNB’s interest rate decisions and lastly Canada’s Ivey PMI figure for October. On Friday we note the UK Halifax house prices rate for October, the US Employment data for October as well and lastly the University of Michigan consumer sentiment figure for November.

USD – Are we getting the US Employment data for October?

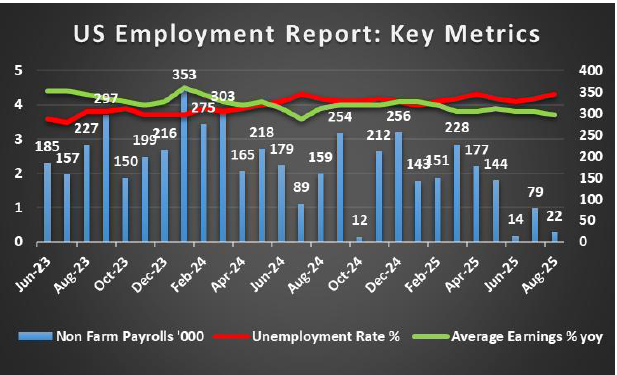

As we start the paragraph for the USD, we note on a fundamental level that the trade tensions between China and the US have eased following the face to face meeting between Trump and Xi this Thursday. In particular both sides have stated that they will work together on trade and with the US stating they will suspend the 50% rule for export controls and Beijing stating they will likewise suspend for one year the implementation of its rate earth export controls, amongst other measures. On a monetary level we note that the Fed’s interest decision occurred on Wednesday, with the bank cutting rates by 25 basis points as was widely expected by market participants and the bank noting in it’s accompanying statement that “uncertainty about the economic outlook remains elevated”. However, of interest was Fed Chair Powell’s presser in which he stated that another rate cut in December “is not a foregone conclusion” implying that the bank, counter to the views of the market could remain on hold until the end of the year. This scenario was not surprising, and thus a more restrictive stance from the Fed in terms of the rhetoric which may emerge over the coming weeks could provide support for the dollar. On a macroeconomic level, we’d like to focus into what next week has in store for dollar traders and in particular the US Employment data for October. Given the ongoing Government shutdown the Bureau of Labour statistics is still delaying the release of the data and thus it is uncertain as to whether we will receive the US Employment data. Overall, the dollar could face heightened volatility as a result.

Analyst’s opinion (USD)

“We applaud the decision to ease the trade tensions with China, which could bring some ‘normality’ back to the markets. In terms of the Fed, it made sense that they may withhold from cutting rates by the end of the year considering that the Government shutdown has severely hindered the Fed’s access to data and by pre-committing or implying another rate cut, it may be seen as a hasty move and uncalculated by the Fed which is not part of their ‘MO’, hence we tend to support the view that the Fed may remain on hold until the end of the year”.

GBP – BoE decision next week

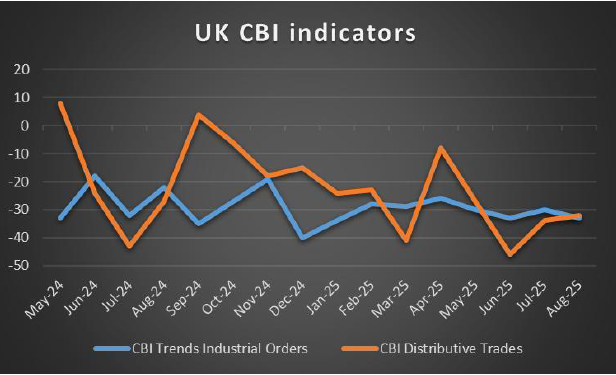

Cable seems to be ceding ground across the board. In particular, the cable for the week has been in the reds against the EUR,USD,CAD,AUD and the JPY, showcasing a wider weakness on behalf of the sterling. On a fundamental level, this coming month is the release of the UK’s November budget which we anticipate will garner significant attention. In this author’s view, the UK November budget will come with some very harsh realities over the state of the Government’s finances and how the gaping budget hole will need to be addressed with unpopular measures. On a monetary level, we note that the BoE’s interest rate decision is set to occur next week, with the majority of market participants currently anticipating the bank to remain on hold at 4.00% with GBP OIS currently implying a 72.6% probability for such a scenario to materialize. Hence, our attention will turn to the bank’s accompanying statement and as to how each member voted, in order to gauge where the overall sentiment in the BoE currently stands. Overall, should it appear that the bank may be preparing to cut rates in the near future it could weigh on the sterling and vice versa. On a macroeconomic level, we would like to note that the UK’s manufacturing PMI figure for October is due out on Monday. Should the figure showcase an improvement or even enter expansionary territory it may provide support for the sterling and vice versa.

Analyst’s opinion (GBP)

“We’ve noted our concerns about the upcoming November budget and with the finish line now less than a month away, we may see market participants positioning themselves in anticipation of the aforementioned release. Furthermore, for the BoE it is this author’s view that a more dovish tone may emerge from policymakers if they are also concerned about the measures the Government may take to cover the budget hole that has been created. Hence, the BoE’s meeting next week may have a dual purpose for participants.”

JPY – BoJ sticks to their guns at 0.50%

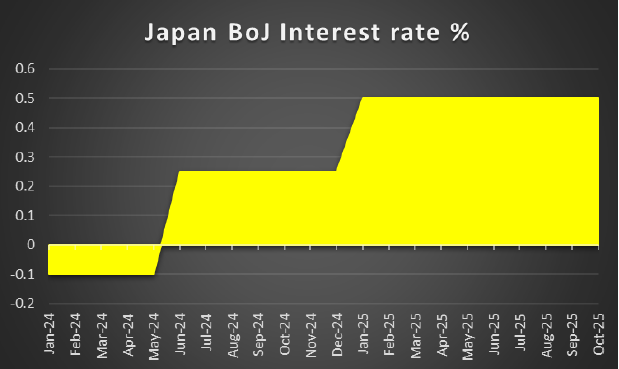

On a monetary level, the BOJ remained on hold at 0.50% as was widely expected by market participants. Moreover for the second meeting in a row, the bank’s members where split with 7 favouring to remain on hold and two members opting for a rate hike. Yet, the main event was BOJ Governor Ueda’s press conference following the bank’s monetary policy in which he stated per the FT “At present, we do not recognise any elevated concern that we are falling behind the curve” which tends to point towards a prolonged “holding pattern” for the bank. In turn, the possibility of the bank remaining on hold for a prolonged period of time could possibly weigh on the JPY. On a macroeconomic level, we would like to note Japan’s Tokyo CPI rates for October which were released earlier on today and showcased an acceleration of inflationary pressures in the Japanese economy which in turn could provide some support for the JPY.

Analyst’s opinion (JPY)

“The main issue for us is the BOJ’s continued holding pattern, as by now we wouldn’t have been surprised if they had decided to hike rates. Moreover, with the new Government external pressure may be building on the BOJ to resume their rate hiking path. Yet, a failure to clearly showcase a willingness to hike rates could weigh on the JPY”

EUR – ECB keeps rates unchanged

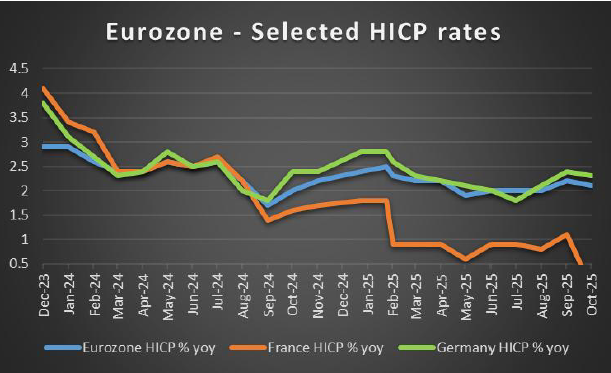

For the EUR on a monetary policy level we must of course note the ECB’s interest rate decision yesterday. The bank remained on hold as was widely expected and thus attention turned towards ECB President Lagarde’s post decision press conference and the bank’s accompanying statement where it was noted that “The EU-US trade deal reached over the summer, the recently announced ceasefire in the Middle East and today’s announcement of progress in the US-China trade negotiations have mitigated some of the downside risks to economic growth” and with president Lagarde stating that “The Governing Council is not pre-commiting to a particular rate path” showcases that the bank may remain on a prolonged holding period. In turn this could be perceived as slightly hawkish in nature and may have provided the EUR with the opportunity to claw back some of its losses against the dollar. On a macroeconomic level we would like to note the Zone’s preliminary Core CPI rate for October came in hotter than expected at 2.4% yet the headline rate came in at 2.1% thus validated the anticipated easing of inflationary pressures in the Eurozone. Moreover, the Zone’s preliminary GDP rate for Q3 came in better than expected which may aidf the EUR in the long run. For next week we would like to note the composite PMI figure for the Zone, France’s services PMI figure and Germany’s manufacturing PMI figures all for October.

Analyst’s opinion (EUR)

“The EUR is an interesting one but as we had anticipated, the ECB appears to be done with cutting interest rates in the near future. Moreover, for next week the EUR may cede control of its direction to other stronger currencies”

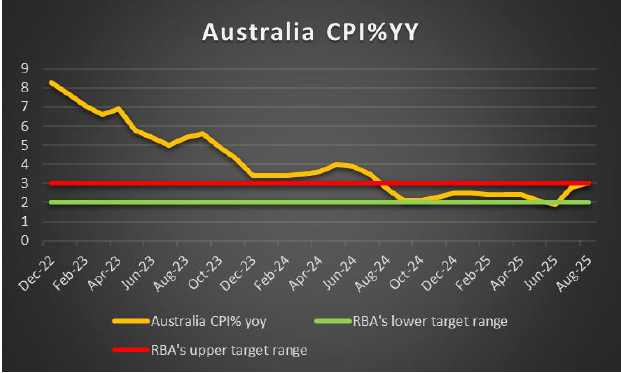

AUD – RBA Decision next week

The RBA’s interest rate decision is set to occur in the coming week and could thus garner significant attention from Aussie traders. Specifically the majority of market participants are currently anticipating the bank to remain on hold, with AUD OIS currently implying a 93% probability for such a scenario to materialize. Hence our attention will turn to the bank’s accompanying statement which we would not be surprised to mention the positive economic implications as a result of the recent agreements made between China and the US to prevent a full-blown trade war. Moreover, considering that Australia’s CPI rates for Q3 exceeded expectations by economists and showcase a significant acceleration of inflationary pressures the Aussie may have gained support during the week. Furthermore as a result of the hotter than expected inflation print we would not be surprised to see the RBA adopting a more hawkish tone in their accompanying statement which could aid the Aussie.

Analyst’s opinion (AUD)

“The recent trade developments between the US and China may have been well received in Australia considering that China is their trading partner. Moreover, the hotter than expected inflation print may have further boosted the Aussie and considering the RBA’s meeting next week, we wouldn’t be surprised to see a hawkish tone emerging which could further aid the AUD”

CAD – BoC cuts rates as expected

The Bank of Canada cut rates by 25 basis points as was widely expected by market participants. In their accompanying statement it was stated that “If inflation and economic activity evolve broadly in line with the October projection, Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment” showcasing that the bank appears to be ready to remain on hold for a prolonged period of time. Yet has kept the door open should they need to revisit their policy. Nonetheless, the comments may have been perceived as relatively hawkish in nature which could provide some support for the CAD. On a macroeconomic level the nation’s GDP rate on a month on month basis for August came in lower than expected, showcasing a contraction in economic growth for the Canadian economy, which may have weighed slightly on the CAD as the weeks comes to a close. For next week traders may be interest in the release of Canada’s manufacturing data.

Analyst’s opinion (CAD)

“The BOC in our view may be heavily influenced from developments to the Canadian economy and in particular their economic relationship with the US as the situation and relationship between the two nations continues to be volatile.”

General Comment

As an epilogue, in the FX market we expect the USD to maintain the initiative over its counterparts and we must continue to raise our concern over the ongoing US Government shutdown. Moreover, it remains to be seen as to whether we will received the US Employment data next week. In other news the US Equities markets appear to have benefited from the recent trade talks between China and the US which seem to have borne fruit and thus allowed the two nations to avoid a full blown trade war. In turn, the return of some normality may have weighed on gold’s price as it may have seen some safe haven outflows. Politically we must note that the situation in Venezuela remains volatile and we wouldn’t be surprised to see the US conducting more strikes on alleged cartel members which could further intensify the tensions in the region.

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.