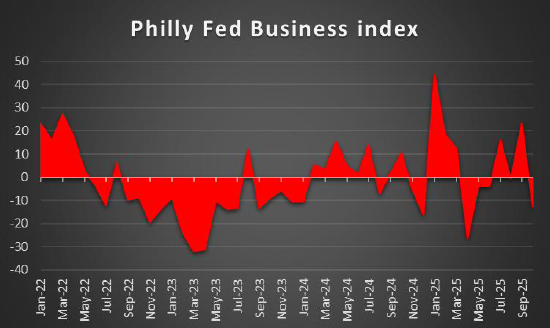

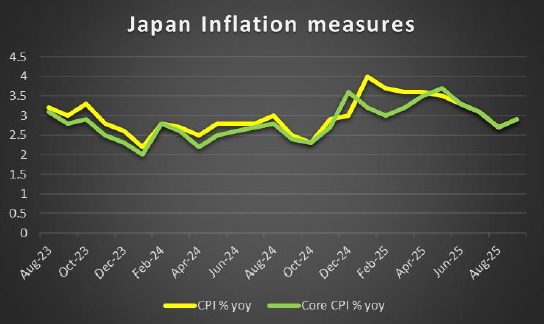

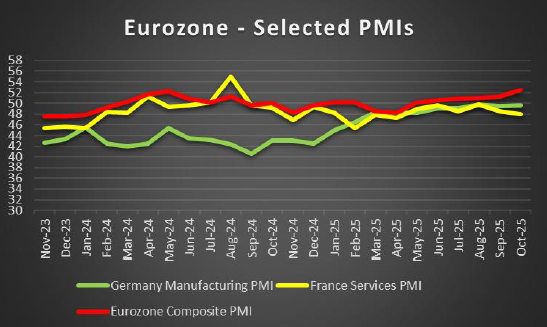

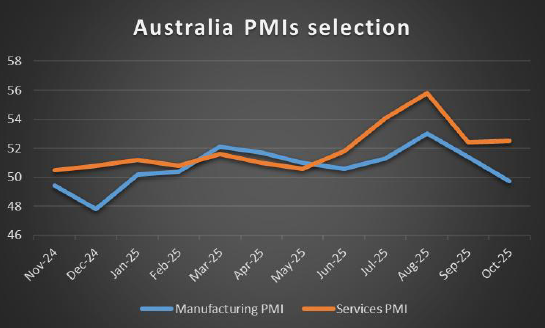

As the week comes to a close, we will open the door and look at what next week has in store the for the markets. Starting on Monday, we note Japan’s GDP rate for Q3 and Canada’s inflation data for October. On Tuesday we note the RBA’s November meeting minutes and Canada’s housing starts figure for October. On Wednesday note Japan’s machinery orders rate for September, Japan’s trade balance figure, the UK’s CPI rate, the Zone’s HICP rate all for October and ending the day are the FOMC’s October meeting minutes. On Thursday we note Chian’s loan prime rates , the US weekly initial jobless claims figure, the US Philly Fed Business index figure for November, the Eurozone’s preliminary consumer confidence figure for November and New Zealand’s trade balance figure for October. On Friday we note Australia’s preliminary manufacturing PMI figure for Nover, Japan’s CPI rates for October, Japan’s preliminary manufacturing PMI figure for November, the UK’s retail sales rate for October, France’s preliminary services PMI figure, Germany’s preliminary manufacturing PMI figure, the Zone’s preliminary composite PMI figure and the UK’s preliminary services PMI figure all for the month of November, followed by Canada’s retail sales for September, the US preliminary manufacturing PMI figure for November and the US UoM final consumer sentiment figure for November.

USD – US Government turns the lights back on

On a fundamental level for the greenback, we note that the government shutdown has officially ended on Wednesday the 12th of November, after both the Senate and the House passed a bill to provide funding for the government until the end of January 2026. As a result, the reopening of the government may provide some support for the greenback, although considering we will be in a similar situation in two months time, the effects may be relatively muted. Moreover, we should note that the BLS will resume activities and thus participants will be able to gauge the current economic situation in the US. On a monetary level, we note that the Fed continues to be split over which path they should take with Fed Collin’s stating that she would hesitate to support another rate cut in the near future, hence implying that she may vote for the bank to remain on hold for their final meeting of the year next month. In particular, Boston Fed President Collins stated that “Absent evidence of a notable labor market deterioration, I would be hesitant to ease policy further”. In turn the comments made could have provided some support for the dollar. On a macroeconomic perspective, we noted that the BLS has resumed operations and thus attention turns to the agency on whether we will received any delayed financial releases which may provide clues into the state of the US economy from all aspects. For next weekm we would like to note the US Philly Fed Business index and the US S&P preliminary manufacturing PMI figure both for the month of November, which may provide some clues as to how the US economy is faring. Should the releases point towards a resilient US economy, it may aid the dollar and vice versa.

Analyst’s opinion (USD)

“The BLS has its work cut out considering it just resumed operations. In our view, we see the case being made for the Fed to remain on hold in their next meeting should the upcoming employment data be incomplete. Moreover, we must remember that the reopening of the US government, as things stand is only temporary, given that funding is only up until the end of January 2026. Hence, any positive implications of a reopening may be short lived. On a monetary policy, we agree that the Fed is currently divided but with a new Fed Chair next year, attention may turn to comments made by incoming members.”

GBP – Labour government still conducting damage control over upcoming budget.

The main events for pound traders continues to be the upcoming UK November budget which is due out in two weeks time. Despite the announcement expected to occur in two hours, the issue is still ongoing and receives regular news coverage, considering the possible implications on the UK economy. Moreover, the apparent attempt to justify what measures may be taken to address the gaping budget hole, appears to have further exacerbated the situation. Furthermore, rumours have emerged that a leadership bid may be made in order to attempt to oust Keir Starmer as Prime Minister. On a macroeconomic level, its been a pretty gloomy week for pound traders starting with the release of the UK’s employment data for September which was released on Tuesday. The data showcased a loosening labour market, with the unemployment rate increasing from 4.8% to 5.0% which tended to exceed the expectations by economists. Furthermore, the nation’s preliminary GDP rates for Q3 came in lower than expected implying a slowdown of economic growth in the economy. Overall, the financial releases from the UK this week may have weighed on the pound as it tends to paint a concerning picture for the UK economy. For next week, traders may pay close attention to the release of the UK’s CPI rates for October which are due out Wednesday and could influence the tone taken by BoE policymakers. Should the CPI rates showcase easing inflationary pressures in the economy, calls for a rate cut by the bank may intensify. However, with the unemployment rate rising, should the CPI rates showcase an acceleration of inflationary pressures it may raise significant concern for the economy and could in turn weigh on the FTSE100.

Analyst’s opinion (GBP)

“We are very cautious for the sterling and for the FTSE100 as we see the attempts being made by Labour to justify their upcoming budget. In our view the need to explain their possible actions showcases that they may be taking a difficult decision which may entail a break of their manifesto pledges. Overall, we wouldn’t be surprised to see a weakening of the sterling in the coming week.”

JPY – BOJ to hike?

One of the main key points for Yen traders this week was the release of the BOJ’s summary of opinions on Monday. In the summary of opinions, it was stated that “If its outlook for economic activity and prices will be realized, the Bank, in accordance with improvement in economic activity and prices, will continue to raise the policy interest rate” and that “It is likely that conditions for taking a further step toward the normalization of the policy interest rate have almost been met”. The two statements showcase a willingness by the bank to hike rates in the near future, with heavier emphasis being placed on the second quote we provided and in particular that the conditions “have almost been met” hence, we would not be surprised to see a rate hike by the bank within the next two monetary policy meetings. In turn should further policymakers echo the possibility of a rate hike in the near future, it may provide support for the JPY. From a macroeconomic view, we would like to note Japan’s GDP rate for Q3 which is due out on Monday and is expected to showcase a contraction of the economy and may thus weigh on the JPY. Moreover, we would like to also point out the release of Japan’s CPI rates for October which are due out Friday where should inflation accelerate, it may aid the JPY and vice versa.

Analyst’s opinion (JPY)

“The BOJ’s summary of opinions was interesting considering its contents. In our view, we wouldn’t be surprised to see a rate hike by the bank in the near future which could aid the JPY.”

EUR – PMI’s next week

In the coming week we note that there are financial releases of interest for EUR traders and in particular the PMI figures for Germany, France and the Eurozone. However, lets recap this week’s financial releases and in particular the preliminary GDP rates for Q3 for the Zone which were released earlier on today. Specifically, we would like to note that on a year-on-year level came in better than expected at 1.4% versus 1.3% which could provide some support for the EUR. Yet when looking at the prior rate of 1.5%, the economic picture did not improve. Regardless, in combination with the ZEW Economic sentiment for November which also came in better than expected at 25.0%, which may have provided support for the EUR since the start of the week. Although we should note that France’s HICP rate for October came in lower than expected, implying easing inflationary pressures in the French economy, which may have weighed on the common currency. On a monetary policy level we note that succession talks may be beginning, as four of the six jobs on the ECB’s executive board will be vacant by the end of 2027, starting with ECB Vice President de Guindo’s whose term ends in May. In turn as talks begin as to who may replace the Vice President of the ECB, the EUR may experience some volatility depending on the nature of the announcements.

Analyst’s opinion (EUR)

“The PMI figures next week are certain to garner attention from EUR traders. Moreover, with talks possibly occurring to replace ECB Vice President De Guindos the EUR may continue to garner attention up until the end of the year.”

AUD – RBA meeting minutes next Tuesday

The Aussie seems about to end the week in the reds against the USD once again. On a macroeconomic level , we would like to note Australia’s employment data for October which came in better than expected implying a resilient labour market in Australia. In particular, we would like to note the employment change figure which came in at 42.2k versus the expected 20k, in addition the unemployment rate coming in at 4.3% versus the expected 4.4% The better than expected employment data may in turn have provided support for the Aussie during the week. Moreover, interest in the Aussie may remain in the upcoming week as well considering we are expected the release of the nation’s preliminary manufacturing PMI figure for November. In a roundabout way, some signs have emerged from China which may imply that economic activity could be picking up from the retail sector and thus, should that materialize into an increase of economic activity and thus an increase in manufacturing, demand for raw materials from Australia could also increase which may benefit the Aussie over a longer time period. On a monetary policy level, we note that the RBA’s November meeting minutes are set to be released during Tuesday’s Asian session and could thus possibly dictate the AUD’s direction for the rest of the week depending on the narrative which emerges.

Analyst’s opinion (AUD)

“The Australian economy appears to be all right for the time being and thus we wouldn’t be surprised to see the nation’s preliminary manufacturing PMI figure entering expansionary territory in the coming week, which may provide support for the Australian dollar. Moreover, we get the RBA’s meeting minutes on Tuesday which are interesting in their own right. Hence, trader interest in the AUD may remain in the upcoming week”

CAD – BoC minutes showed policymakers mulled over rate cut

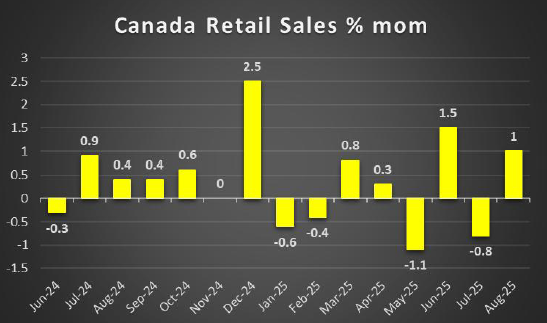

The Loonie is about to end the week in the greens against the dollar, albeit slightly weakened over the past two days. We would like to note the release of the Bank of Canada’s last meeting minutes on Wednesday which tended to point towards a more hawkish stance that what may have been anticipated from policymakers. In particular, it appears policymakers mulled over their decision to cut rates in their last meeting, with some noting the “choppy” waters in regard to annual inflation and considering underlying indicators. In turn the relatively hawkish sentiment may have provided support for the Loonie. Although, we should note that from macroeconomic standpoint, we are set to receive the release of Canada’s CPI rates for the month of October on Monday which could alter or re-inforce the current prevailing narrative from the bank of Canada. Yet, at 2.4% even a slight uptick may not warrant a complete 180 degree turn in the bank’s monetary policy path but could instead increase calls for the bank to remain on hold, which in turn could aid the CAD. On the flip side, should inflation continue to ease it may have the opposite effect and may in turn weigh on the Loonie.

Analyst’s opinion (CAD)

“The litmus test for the CAD up until the end of the year may be the release of the inflation data on Monday as it could dictate the narrative emerging from BoC policymakers up until December and possibly for the first two weeks of the month as well. Hence, CAD traders may experience market volatility in the coming week.”

General Comment

As an epilogue, we expect the USD to ease its grip on the FX market, yet US fundamentals could shake the markets at any given moment, given their gravity and intensity. In US equities markets the market worries over the AI bubble are still prevalent and thus should they intensify it may weigh on the US Equities markets. Moreover, with the government finally having reopened in the US, we may begin to get financial releases from the US whilst also preparing to see the impact on the US economy as a result of the US government shutdown. As for gold’s price it is maintaining a sideways motion and gold traders seem to keep a wait and see position, yet incoming fundamentals could affect gold’s price either way.

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.