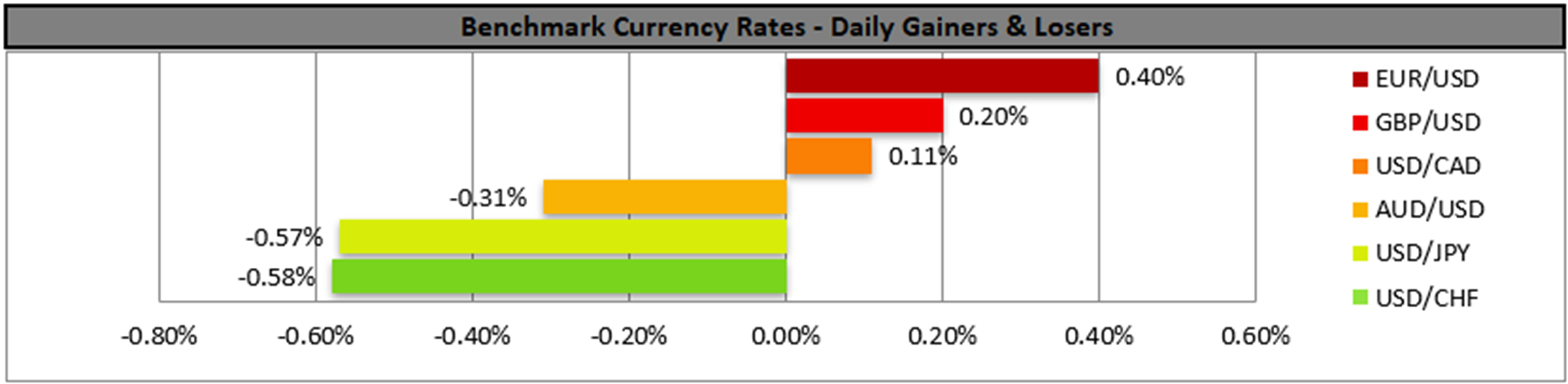

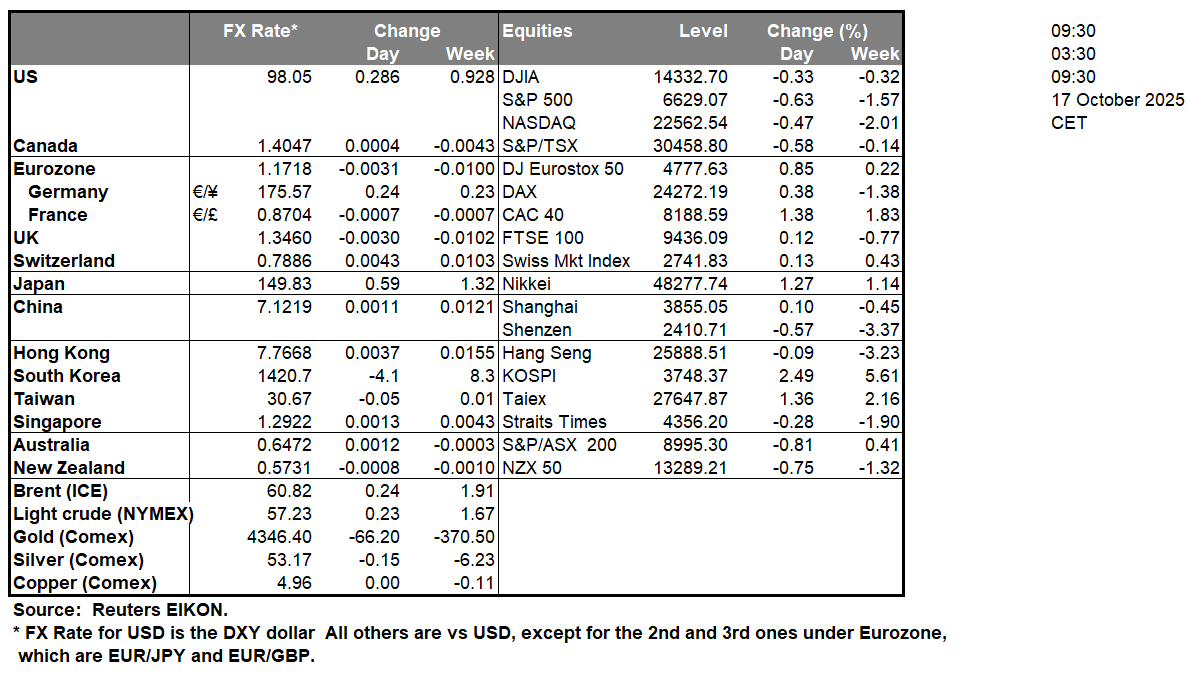

The USD continued to weaken against its counterparts yesterday and is preparing to end the week in the reds. On a macroeconomic level, amidst a blackout of financial data releases given the US Government shutdown, we highlight the unexpected and wide drop of the Philly Fed business index, signalling a contraction of economic activity, intensifying the market worries for the US economic outlook. Yet we still view fundamentals as the key driver for the USD. On the one hand, the prolonged US Government shutdown seems to have no end as the US Senate failed to advance the GOP funding bill for a 9th time on Wednesday. Democrats seem to remain firm in their demands for an extension of health care tax credits in exchange for their votes. Should the shutdown of the US Government be prolonged without a solution of the impasse on the horizon, we may see it weighing on the USD. On the other we view as the main issue affecting the markets on a fundamental level, the tensions of the US-Sino relationship. For the time being, tensions seem to remain in a stage of further possible escalation, and should that be the case we may see the USD weakening further. Overall, the uncertainty seems to be weighing on the USD, while at the same time continues to feed gold bulls with safe-haven inflows. At this point we would like to note that China may have the high ground of the negotiations, given the improvement of its exports for September yet on the flip side, the deflationary pressures in the Chinese economy are pressing the Chinese Government. On Monday’s Asian session, we highlight the release of Chinese data including the GDP rate for Q3 and PBoC’s interest rate decision. Should the GDP growth rate slow down beyond market expectations, we may see CNH and AUD weakening.

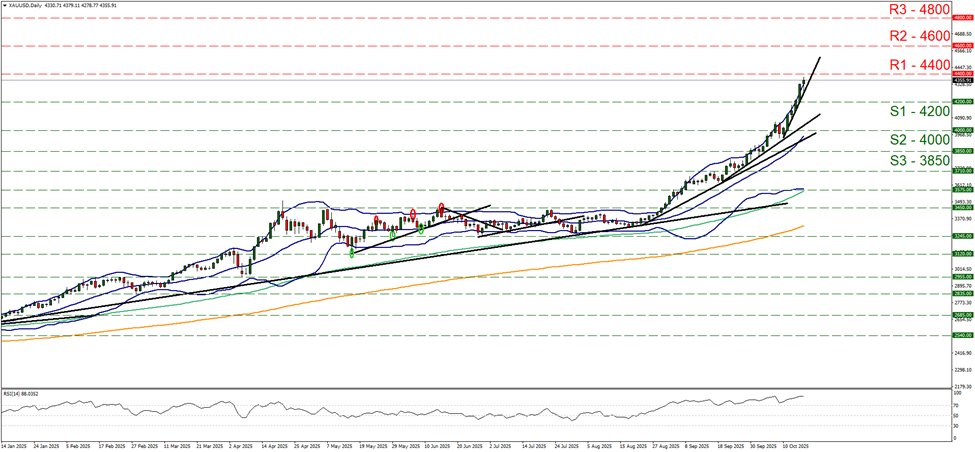

Gold’s price continued its rally, nearing the 4400 (R1) resistance line. We maintain a bullish outlook for the precious metal’s price as long as the upward trendline initiated since the 22nd of August remains intact. Also the RSI indicator remains above the reading of 70, signaling a strengthening of the bullish sentiment for gold’s price among market participants. Yet along with our bullish outlook we issue a warning for a correction lower of gold’s price as gold is at overbought levels and the price action has broken above the upper Bollinger Band. Should the bulls maintain control we may see gold’s price breaking the 4400 (R1) resistance line with the next possible target for the bulls being the 4600 (R2) resistance level. For a bearish outlook we would require a clear break of the prementioned upward trendline, and gold’s price action to break the 4200 (S1) support line and start actively aiming for the 4000 (S2) support level.

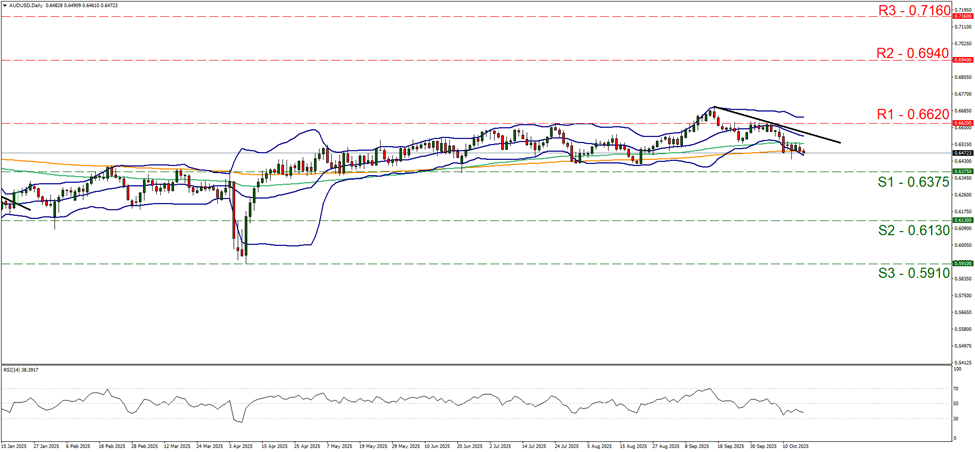

AUD/USD is now aiming for the 0.6375 (S1) support line, guided by a downward trendline incepted since the 17th of September. We intend to maintain a bearish outlook for the pair as long as the downward trendline remains intact. We also note that the RSI indicator is below the reading of 50 and nearing the reading of 30, implying a strengthening bearish market sentiment for the pair. Also the price action is currently flirting with the lower Bollinger band which may slow down the bears a bit or even cause a correction higher for the pair. Should the bears maintain control as expected, we may see the pair breaking the 0.6375 (S1) support line with the next possible target for the bears being set at the 0.6130 (S2) level. Should the bulls take over, a scenario that we currently see as remote, we may see AUD/USD breaking the prementioned downward trendline and continue to break the 0.6620 (R1) line paving the way for the 0.6940 (R2) resistance barrier.

금일 주요 경제뉴스

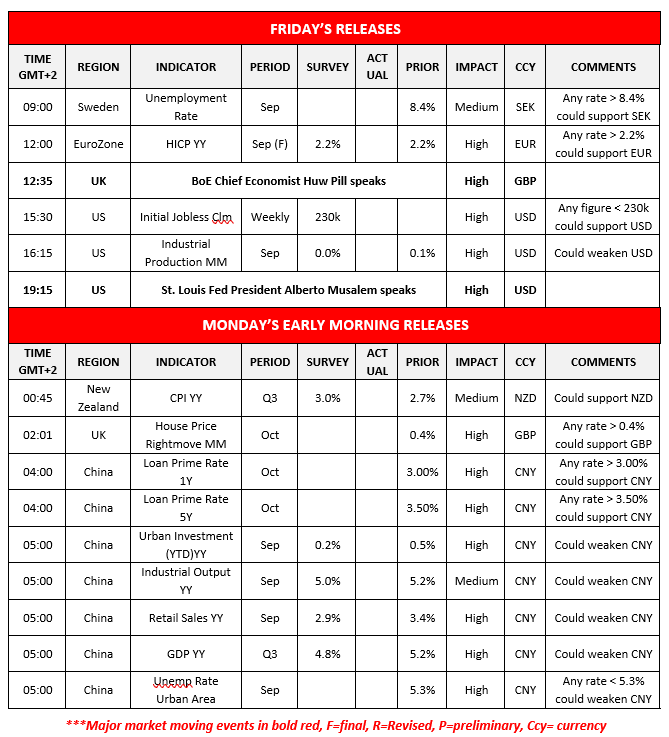

Today we note the release of the Sweden’s unemployment rate, the Zone’s final HICP rate for September, the US weekly initial jobless claims figure, the US industrial production rate for September. In Monday’s Asian session we note New Zealand’s CPI rate for Q3, the UK’s House Price Rightmove rate for October, China’s 1YR and 5YR loan prime rate’s, China’s urban investment, industrial output and retail sales rates all for September, followed by China’s GDP rate for Q3 and China’s unemployment rate for September.

XAU/USD Daily Chart

- Support: 4200 (S1), 4000 (S2), 3850 (S3)

- Resistance: 4400 (R1), 4600 (R2), 4800 (R3)

AUD/USD Daily Chart

- Support: 0.6375 (S1), 0.6130 (S2), 0.5910 (S3)

- Resistance: 0.6620 (R1), 0.6940 (R2), 0.7160 (R3)

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.