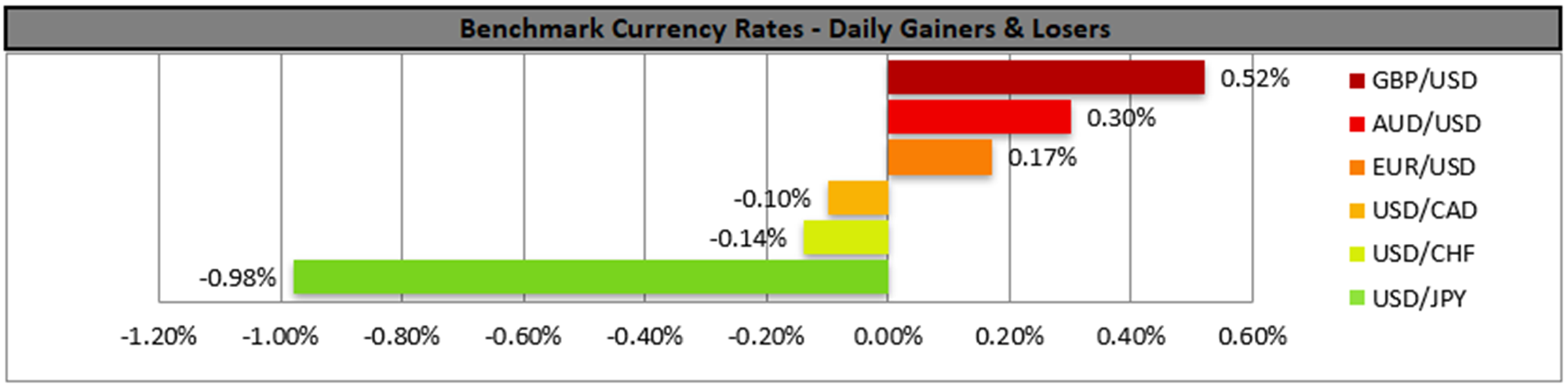

The USD continued to tumble against its counterparts yesterday as the market’s expectations for the Fed to ease its monetary policy were considerably amplified. It’s characteristic that Fed Fund Futures (FFF) now imply a 92.7% probability for the bank to cut rates by 25 basis points in its next meeting, and the rest implies that a 50 basis points rate cut is also possible. Hence, the message conveyed by FFF is that the market no longer considers whether the bank will cut rates or not, but by how much. Also, the rhetoric of Fed policymakers has turned more dovish since the release of weak employment data for July, but also the substantial downward revisions of the NFP figure for June and May implied fast, deteriorating conditions in the US labour market. At the same time, inflationary pressures tend to remain resilient, but Trump’s tariffs do not seem to have elevated consumer prices in a meaningful way yet. Lastly, there is always political pressure from the US Government and US President Trump personally, for the bank to ease its monetary policy. In a latest development, US Treasury Secretary Bessent yesterday called for a “series of rate cuts,” and also stated that the US Central Bank could begin its rate-cutting path with a double rate cut in the September meeting. He highlighted how BoJ had gotten “behind the curve” by postponing any rate hikes, a sense that we share. It’s characteristic how the JPY was the main gainer from USD’s weakening yesterday. Yet at the same time, we also note that stronger Australian employment data propelled the Aussie higher earlier today. July’s Australian employment data were in line with market expectations and eased the pressure on RBA to continue cutting rates at the current stage. Today, we highlight the release of the US PPI rates for July, which are to provide an idea about inflationary pressures at a producer’s level. Should the rates accelerate beyond market expectations, we may see USD bears easing their grip on the USD.

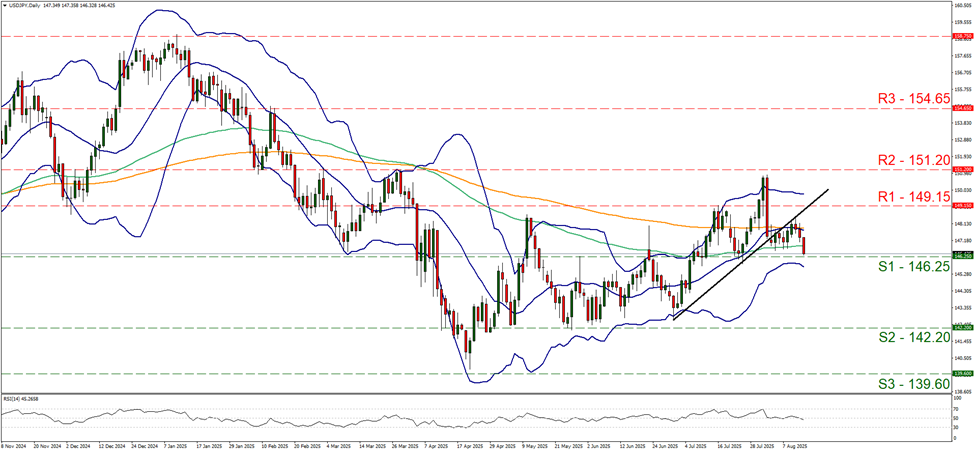

In the FX market, USD/JPY dropped yesterday and during today’s Asian session, testing the 146.25 (S1) support line. Despite the price action’s bearish tendencies, we note that the RSI indicator has reached the reading of 50, which implies a relative indecisiveness on behalf of market participants for the pair’s direction. Should the bears maintain control over the pair’s direction, we may see it clearly breaking the 146.25 (S1) support line clearly and start aiming if not reaching the 142.20 (S2) support level. Should the bulls take over, which we currently see as a remote scenario, we may see the pair reversing direction, breaking the 149.15 (R1) resistance line and start aiming for the 151.20 (R2) resistance level.

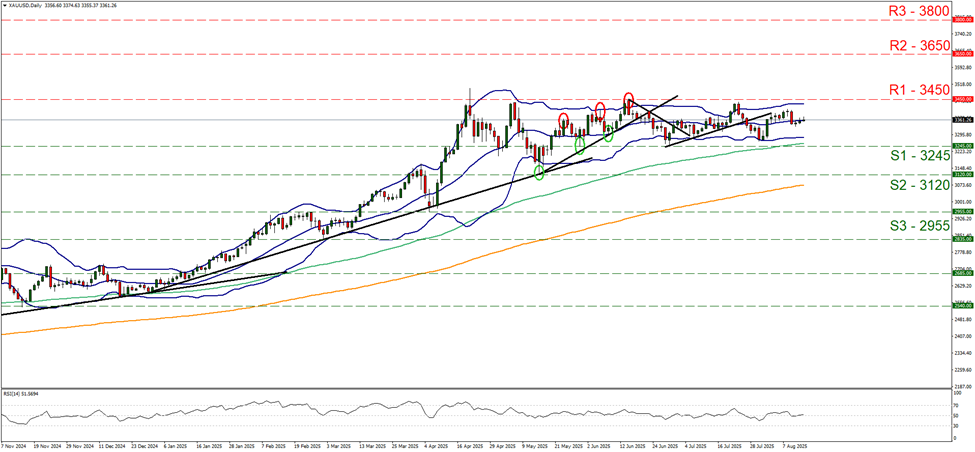

Gold’s price edged higher yet remained well between the 3450 (R1) resistance line and the 3245 (S1) support level. We maintain our bias for the sideways motion of the pair to be continued within the boundaries of the prementioned levels. Our opinion seems to be supported also by the RSI indicator which runs along the reading of 50 and the relative narrowness of the Bollinger Bands. For a bearish outlook to emerge we would require the bullion’s price action to break the 3245 (S1) support line and start aiming for the 3120 (S2) support level. For a bullish outlook to be adopted we would require the precious metal’ price to break the 3450 (R1) resistance level, close to the all-time high of $3500 and set as the next possible target for the bulls being set at the 3650 (R2) resistance level.

금일 주요 경제뉴스

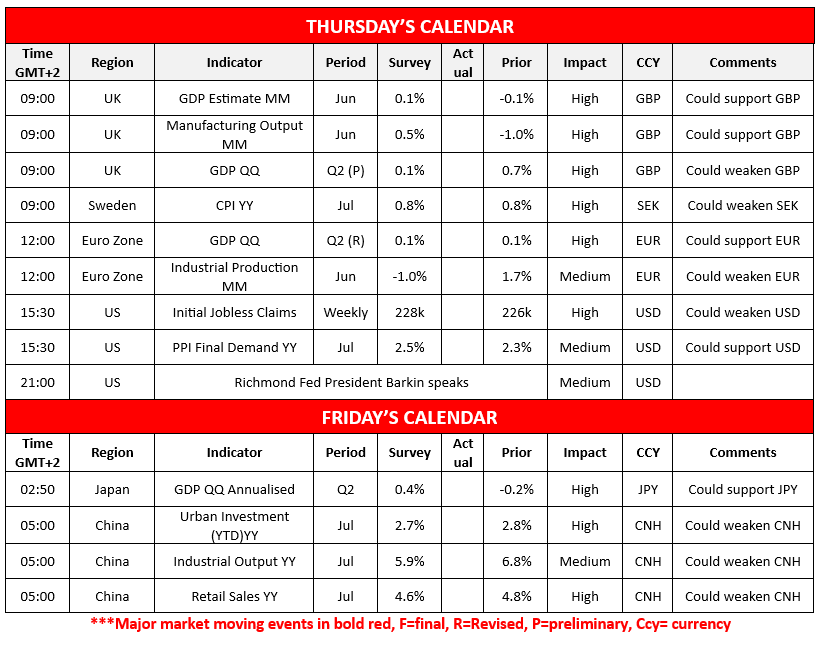

Today we get UK’s GDP rates and manufacturing output rate for June and the preliminary GDP rate for Q2, Sweden’s CPI rates for July, Euro Zone’s revised GDP rate for Q2, Euro Zone’s industrial output for June and from the US the weekly initial jobless claims figure, while the Fed’s Barkin is scheduled to speak. In tomorrow’s Asian session, we note the release of Japan’s GDP rate for Q2 and from China the urban investment, industrial output and retail sales growth rates, all being for July.

USD/JPY Daily Chart

- Support: 146.25 (S1), 142.20 (S2), 139.60 (S3)

- Resistance: 149.15 (R1), 151.20 (R2), 154.65 (R3)

XAU/USD Daily Chart

- Support: 3245 (S1), 3120 (S2), 2955 (S3)

- Resistance: 3450 (R1), 3650 (R2), 3800 (R3)

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.