In the absence of high impact financial releases from the US, fundamentals continue to lead the markets. Nevertheless financial releases from other economies are still maintaining some interest among FX traders. In the coming week, starting on Sunday with the release of China’s inflation metrics for the past month, on Monday we get BoJ’s summary of opinions for the October meeting, Norway’s CPI rates for October and Euro Zone’s Sentix index for November. On Tuesday we get Japan’s current account balance for September, Australia’s Business conditions and optimism for October, UK’s employment data for September, Norway’s GDP rate for Q3, the Czech Republic’s CPI rates for October and Germany’s ZEW indicators for November. On Wednesday we note the release of New Zealand’s electronic card sales for October and on Thursday we get Japan’s corporate goods prices for October, Australia’s employment data for the same month, UK’s preliminary GDP rate for Q3, Euro Zone’s industrial output for September and normally we should get the US CPI rates for October, yet the release will probably be delayed given the ongoing US Government shutdown. Finally on Friday we note the release of China’s industrial output and urban investment rates for October, Euro Zone’s GDP estimate rate for Q3, Canada’s manufacturing sales and from the US the calendar notes the release of the PPI rates and the retail sales growth rates for October, again both could be delayed.

USD – Prolonged US Government shutdown leaves markets in the dark

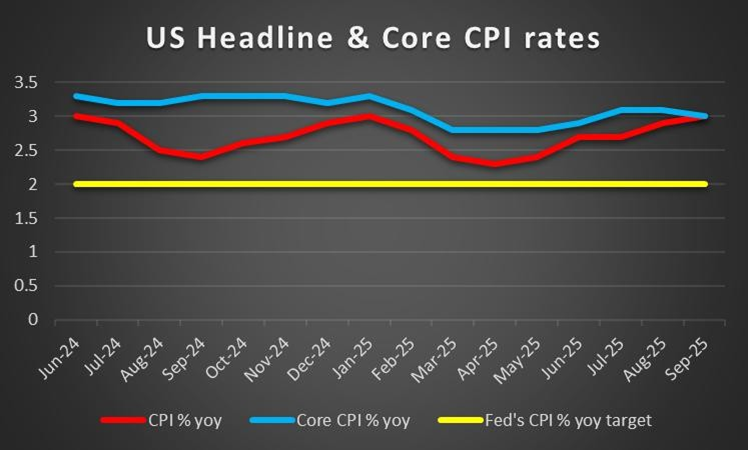

On a fundamental level for the greenback, we note that the US Supreme Court seems skeptical for Trump’s tariffs, as some members view them as a form of tax, something that should be examined by Congress. Yet we note that the Supreme Court has a 6-3 conservative majority, thus may deem the tariffs as legal under the framework of IEEPA, a legislation allowing the president to regulate trade (thus apply tariffs) as a response to an emergency. Also on a fundamental level for the greenback, we note the prolonged Government shutdown, which is the longest in US history until now. The shutdown practically has left the markets in the dark as with few exceptions, as the release of high impact financial data is being delayed. Yet the prolonging of the shutdown has started to have a wider effect on the US. It’s characteristic that the major US airports were ordered to cut flights by 10%. The issue is a real test for the Fed’s data driven approach to interest rate decisions. A slack in the US employment market is suspected, yet without concrete data the Feds’ hands are practically tied. Nevertheless we note reports stating that the Fed injected $29.4 billion into the markets through repo agreements, albeit the actual amount is being disputed with some arguing that it was $50 billions. Yet on the flip side, other reports state that the US Central bank had at the same time issued reverse repo agreements cancelling out the net effect for the markets. In any case the Fed may find itself in a peculiar position at which it needs to keep a tight monetary policy to harness inflationary pressures in the US economy, while on the flip side may be recognising the lack of liquidity in the markets. For the time being we tend to rely mostly on the bank’s forward guidance for its monetary policy intentions, but also statements made by Fed policymakers. Signals tend to be mixed, yet the majority seems to be leaning on the dovish side, hence we tend to expect the bank to continue cutting rates in the December meeting.

Analyst’s opinion (USD)

“For the time being we note that any easing of the market expectations for the Fed to continue cutting rates, could provide support for the USD. Furthermore the prolonged US Government shutdown and the uncertainty regarding Trump’s tariffs seems to be weighing on the USD as uncertainty rises”

GBP – Reeves’ taxation intentions tend to weigh on the pound

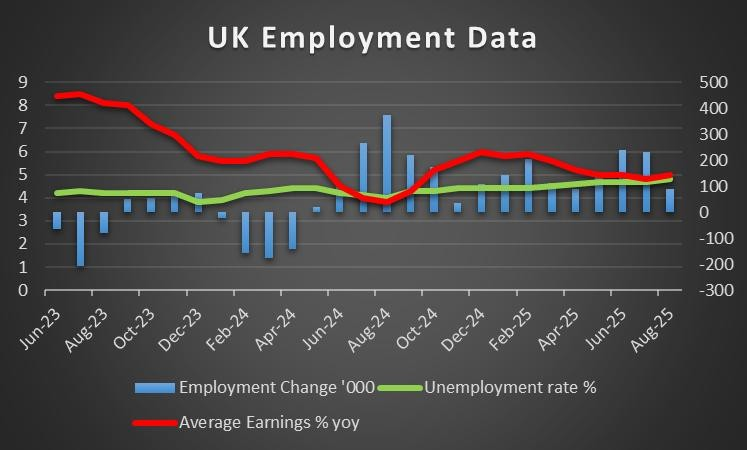

The main events for pound traders over the past few days were the release of BoE’s interest rate decision and UK Chancellor of the Exchequer Reeves’ statements. Starting with the latter, the market is eagerly awaiting UK’s mini budget which is to be released on the 26th of November. Yet UK’s Chancellor of the Exchequer Reeves started to pave the way. In statements made past Tuesday she refused to rule out tax rises as she stated that the “necessary choices” will be met in her upcoming budget. On the other hand, Reeves insisted that the budget is to one of growth for the UK. Nevertheless, the markets seem to maintain their doubts for the efficiency of the Labour Government’s intentions and issue tends to weigh on the pound. On a monetary level we note that BoE remained on hold as was widely expected keeping interest rates unchanged at 4.00%. Yet the bank in its minutes seems to have laid the groundwork for a rate cut in the December meeting which tended to provide a dovish inclination to its decision. Another element displaying dovishness was the vote count. The MPC members decided to remain on hold after a 5-4 vote, meaning should only one member flip towards the side favouring a rate cut, the end result would be different. Also the dynamics have shifted in favour of the doves as the BoE policymakers favouring a rate cut increased from 2 in the bank’s prior decision to 4, while the members favouring the bank to remain on hold were reduced to 5 from prior 7. Should we see BoE policymakers in the coming week, highlighting the possibility of further easing of the bank’s monetary policy we may see the pound slipping. On a macro level we note the release of UK’s September employment data next week. Should the data show a widening slack in the UK employment market we may see the pound losing ground and vice versa.

Analyst’s opinion (GBP)

“We continue to view UK Chancellor of the Exchequer Reeves’ tax intentions as weighing on the pound for the time being, as could market expectations for the BoE to cut rates in its December meeting. On a macro level, we note the release of UK’s employment data for September and a possible easing of the UK employment market could also weigh on the pound”

JPY – BoJ and the Japanese Government’s feud affecting JPY’s direction

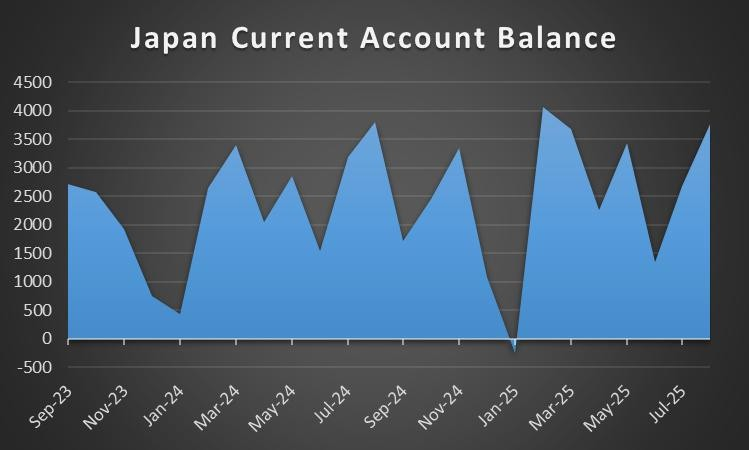

One of the main drivers for JPY’s direction is the feud between BoJ’s hawkish intentions and the Japanese Government’s pressure on BoJ to ease its hawkishness if not even its monetary policy. The Minutes of the September meeting were telling as BoJ policymakers discussed the growing case for a rate hike. We are highlighting the release of the Bank’s summary of opinions of the October meeting on Monday’s Asian session and should the document include further signals for an upcoming rate hike in the December meeting we may see the Yen getting some support. For the time being the market seems to expect the bank to remain on hold in December and currently JPY OIS imply a probability of 74% for such a scenario to materialise. On the other hand the Japanese Government seems to be opposing the bank’s plans to raise rates which tends to weigh on the JPY. On a fiscal level we note the Japanese Government’s plans for an expansionary fiscal policy which in turn could provide some support for the Yen, yet that remains to be seen, given the high national debt of Japan. For the time being, the weakness of the JPY against the USD seems to have been halted, which in turn distances the scenario of the Japanese Government proceeding with a market intervention operation to the JPY’s rescue. Last but not least we would like note the Yen’s dual nature as a national currency and at the same time a safe haven for the international markets. Hence should we see further easing of market worries and a more risk on profile emerging we may see JPY losing some ground and vice versa.

Analyst’s opinion (JPY)

“We note BoJ’s intentions as the main issue for JPY’s direction at the current stage. Should the bank stress the possibility of a rate hike we may see JPY getting some support and vice versa. On the other hand should we see the Japanese government increasing the pressure on BoJ to abandon its monetary policy tightening intentions we may see JPY losing ground”

EUR – Fundamentals to lead the common currency

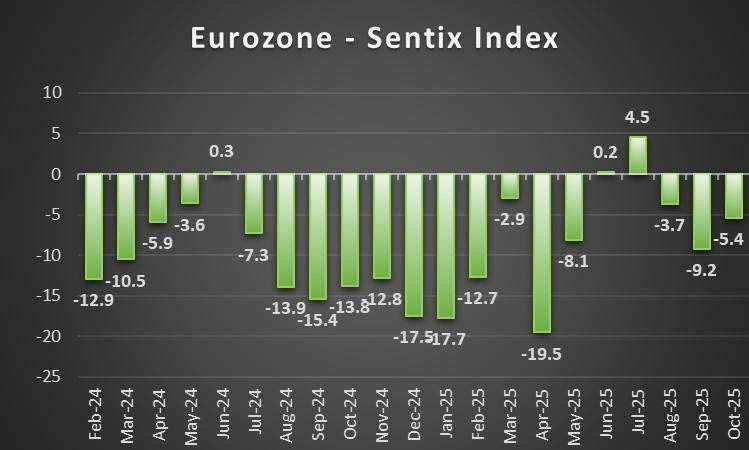

In the coming week we note that there only a few high impact financial releases for the Euro area on the calendar, hence we turn our attention towards fundamentals. On a monetary level, we note that the market expects the ECB to remain on hold until Q4 26, expectations that tend to provide an advantage in the FX market for the time being, given that central banks like the BoE and the Fed are expected to continue easing. ECB policymakers seem content with the level of the rates as inflation may be undershooting the bank’s 2% target, yet that is deemed as temporary. For the time being we tend to view the bank’s intentions as being supportive for the EUR. On a more fundamental level, we note that Bulgaria is to enter the Euro Zone on 1st of January next year and ECB President Lagarde was visiting the country to ease any worries among the local population. Also on a political level, we note that in Germany, Chancellor Merz seems to be involved in a scandal at which he is accused to have staged drone sightings in sensitive areas and accused the Russians, in order to boost the sense of emergency for the re-armament of the country among the local population. The main beneficiary is to be the drone manufacturer UUS. The issue came to light by the political magazine Stern, which sourced an employee of the company who wishes to remain anonymous. Should a scenario of political instability emerge in Germany we may see it weighing on the EUR. Also on a fundamental level, our worries for the escalation of the war in Ukraine tend to be elevated, an issue that tends to weigh on the EUR given the instability in the Euro Zone’s eastern flank. Ukrainian drone attacks have intensified, while in eastern Ukraine the Russians seem to be holding their ground if not expand their control over Ukrainian territory. On a fiscal level, we may see the EU Commission’s plans for an expansionary fiscal policy supporting the common currency.

Analyst’s opinion (EUR)

“Given the low number of high impact financial releases stemming from the Euro Zone in next weeks’ calendar, we expect fundamentals to lead the common currency. For the time being the ECB’s content with the current level of rates tends to be supportive for the EUR as the interest rate differentials outlook is the common currency’s favor given the market’s rate cutting expectations for BoE and the Fed”

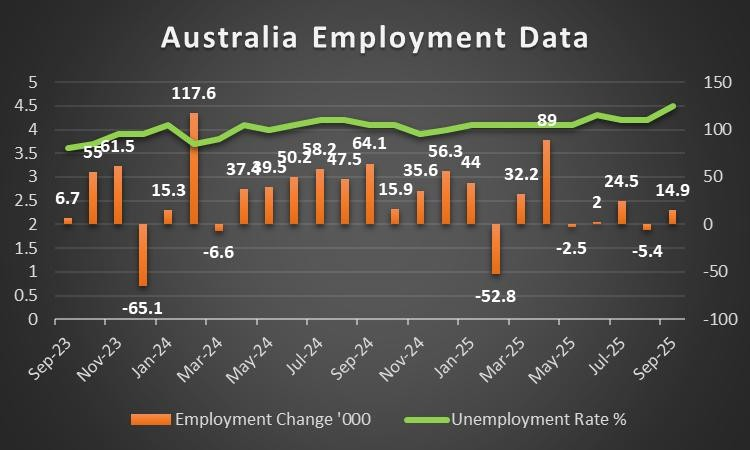

AUD – October’s employment data in focus

The Aussie seems about to end the week in the reds against the USD relenting any gains made in the past two weeks. In the coming week, we expect AUD traders’ attention to turn towards the release of October’s employment data next Thursday. Should the data show further easing of the Australian employment market, we may see the release weighing on the Aussie, given that September’s unemployment rate climbed to levels not seen since Nov 21. On the flip side, a possible tightening of the Australian employment market could ease the pressure on RBA to cut rates further. On the other hand inflationary pressures in the Australian economy, tend to add pressure on RBA to keep rates steady and the rise of inflation seems to be currently the main concern for the Australian central bank. For the time being the market expects the bank to remain on hold until May next year, which could be interpreted as supportive for the Aussie. Aussie traders are also to keep a close eye on developments in China and we highlight the release of China’s industrial output, urban investment and retail sales growth rates all for October next Friday. A possible acceleration of the rates could imply also support for the Aussie given the close Chinese-Australian economic ties. Also given that the Aussie is considered a riskier asset in the FX market, the market sentiment is to play a key role for AUD’s direction, with a possible improvement, risk oriented market sentiment providing support for the Aussie and vice versa.

Analyst’s opinion (AUD)

“We expect in the coming week, Aussie traders to focus on the release of Australia’s employment data for October and a possible tightening of the Australian employment market could support the Aussie and vice versa. Also the market’s expectations for the RBA to remain on hold for the coming months tends to be supportive for the Aussie, while a possible improvement of the market sentiment could also provide support for AUD”

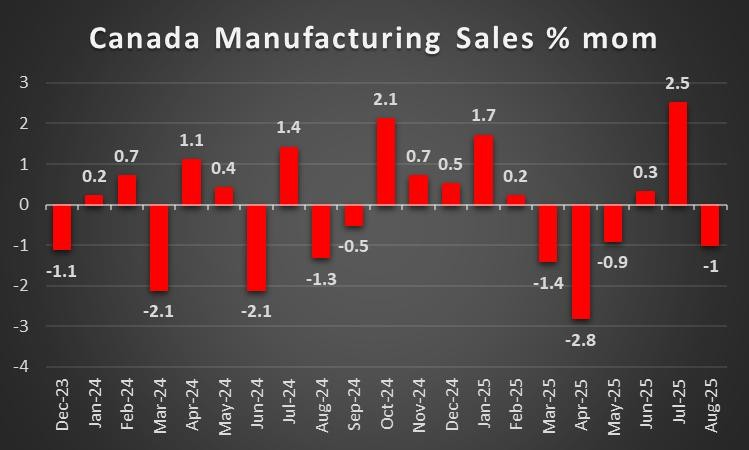

CAD – Can the CAD’s ongoing weakening be halted?

The Loonie is about to end the week in the reds against the USD after a six day losing streak, yet Canada’s employment data for October are to be released in today’s American session which could shake the Loonie. It should be noted that the CAD is losing ground despite BoC maintaining a stance leaning on the hawkish side. Its characteristic that the market expects currently the bank to remain on hold until the end of next year, while BoC Governor Macklem stated that he is not even considering of cutting rates. The bank’s firm stance is being fed also by inflationary pressures in the Canadian economy given that the CPI rates currently remain in the upper half of the bank’s inflation target range of 1-3% yy. On a fundamental level, the frictions in the US-Canadian trade relationships and the US tariffs on Canadian products is maybe the main issue for Loonie traders, weighing on the CAD. Any further escalation could possibly weigh on the CAD. Also any bearish tendencies of oil prices could also weigh on the CAD given Canada’s status as a major oil producing economy. Last but not least, market sentiment could also affect the CAD given the Canadian Dollar’s riskier nature. Hence a possible improvement of the market sentiment could provide support for the CAD as a more risk oriented profile of the market may emerge, while a more cautious approach by market participants could weigh on the CAD. On a macroeconomic level, given the rather empty calendar relating to high impact financial releases from Canada, hence we expect fundamentals to lead the CAD in the coming week. On the flip side a rebound of the CAD against the USD could be nearing, should trade relationships normalise and the Fed continue cutting rates as the central bank interest rate differentials outlook between the Fed and BoC, may start favoring the CAD.

Analyst’s opinion (CAD)

“The Loonie is expected to be affected primarily from fundamentals in the coming week. On a monetary level BoC’s stance tends to favour the CAD while trade frictions of Canada with the US tends to weigh on the Loonie.”

General Comment

As an epilogue, we expect the USD to ease its grip on the FX market, yet US fundamentals could shake the markets at any given moment, given their gravity and intensity. In US equities markets the earnings season is still ongoing, yet the main issue over the past week may have been the market’s worries for overstretched valuations and AI’s true prospects. The prementioned worries are causing slight bearish tendencies, which could be continued if not intensified should the market worries be enhanced in the coming week, yet we did not witness a market mini crash that some analysts had predicted, at least not yet. As for gold’s price it is maintaining a sideways motion and gold traders seem to keep a wait and see position, yet incoming fundamentals could affect gold’s price either way.

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.