US stock markets are trying to recover after their wide drop last Friday. In today’s report we are to discuss the frictions in the US-Sino trading relationship, the latest earnings reports and what is on the calendar but also the what the Fed’s intentions are about its monetary policy. On a technical level we are to provide a technical analysis of S&P 500’s daily chart for a rounder view.

The frictions in the US-Sino trade relationships

Maybe the key issue on a fundamental level for US equities over the past week were the threats of US President Trump to impose 100% tariffs on Chinese products entering the US. The tariffs were to be “over and above any Tariff that they are currently paying,” starting on Nov. 1. The US President but also White House officials, tried to ease the markets for the possible ramifications of such a scenario by stating “Don’t worry about China, everything will be fine!” while also praising Chinese President Xi Jinping. Despite that the two sides, China and the US, are set to begin charging additional port fees on ocean shipping firms from each other’s respective nation, that ship anything from toys to crude oil. However, China will not be charging those additional fees on Chinese-built ships even if they are operated by a U.S company. The tit-for-tat fees and threats of tariffs could possibly upend the global trade economy and may result in heightened volatility in the markets, as the two world’s economic superpowers appear to be on track for a trade war starting on the 1st of November. Should the issue prove to be nothing more than a negotiating tactic on behalf of Trump thus easing the market’s worries, we may see it improving the market sentiment, thus could provide some support for US equities. On the flip side further escalation in the tensions of the US-Sino trade relationships, we may see a bearish effect on US stock markets.

How dovish is actually the Fed?

A second issue that could affect the direction of US stock markets could be the Fed’s intentions for its monetary policy. For the time being Fed Fund Futures (FFF) imply that the market expects the bank to deliver a rate cut in the October meeting and another one in the December meeting. The market also expects the bank to continue easing its monetary policy in 2026 with more rate cuts. In a latest development Fed Chairman Powell, stated that the economy is on a firmer footing, which tended to sound a bit more hawkish, yet at the same time also kept the door open for more rate cuts to come. We may see conflicting signals coming out today as some Fed policymakers which are scheduled to speak, may express doubts for a faster monetary policy easing while others may support the necessity of more rate cuts. Please note that Fed policymakers are to be entering a moratorium period for the next two weeks, given the meeting on the 29th of October. In any case should we see the market’s expectations for the Fed to ease its monetary level intensify further, we may see US equities getting some support while should the market be forced to ease its dovish expectations for the bank’s intentions we may see US equities retreating.

Earnings report released and coming up

The earnings season has kicked off and we had yesterday the release of earnings reports of a number of major US banks, namely JP Morgan, Wells Fargo, Goldman Sachs, Citygroup, Bank of America and Morgan Stanley, all of them exceeding analysts’ forecasts both on an EPS and revenue level. The better than expected results may improve the market sentiment as the banking sector semes to remain healthy resisting the pressure from the outside financial and industrial environment, foreshadowing also a relative health for the US economy. Tomorrow we note the release of the earnings report of Nestle, On Friday we get American Express’s report, on Monday we note the release of BHP Group’s data, on Tuesday we note the releases of Coca Cola, Netflix, Philip Morris, 3M, General Motors and finally next Wednesday we get the earnings reports of Tesla, IBM and AT&T.

기술적 분석

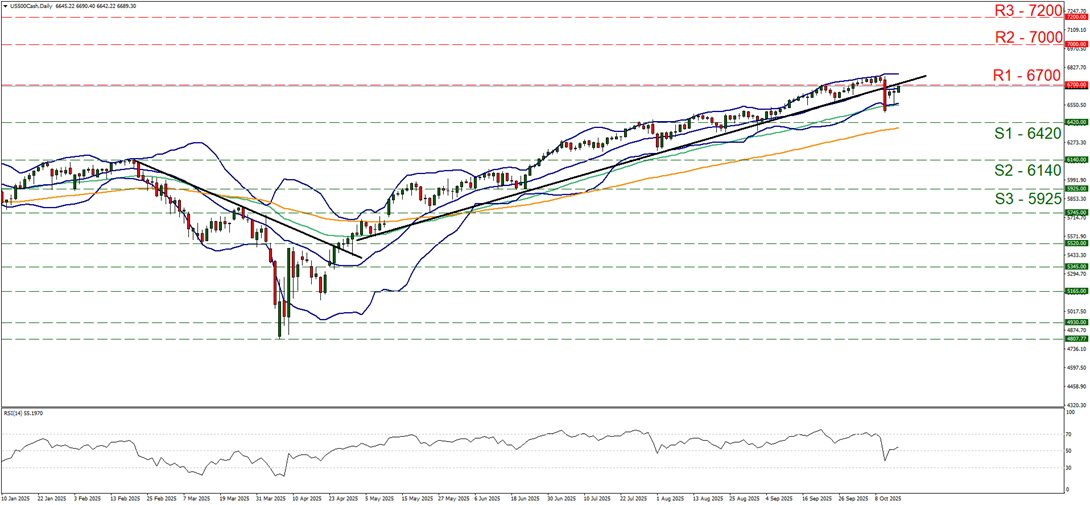

US500 Daily Chart

- Support: 6420 (S1), 6140 (S2), 5925 (S3)

- Resistance: 6700 (R1), 7000 (R2), 7200 (R3)

Since last week’s report, S&P 500 abandoned the All Time High levels it was, corrected substantially lower last Friday and broke the 6700 (R1) support line, now turned to resistance. Given that the index in its correction lower, broke the upward trendline guiding it since the 1st of May, we switch our bullish outlook in favour of a sideways motion bias for the time being. Yet the index’s bulls seem to be regaining slowly their confidence while the RSI indicator has started to rise breaking just above the reading of 50, singaling an erasing of the market’s bearish mood yet it does not signal a bullish sentiment among market participants, at least not yet. Should the bulls regain control over the index’s price action, we may see S&P500 breaking the 6700 (R1) resistance line and start actively aiming for the 7000 (R2) resistance level. On the other hand for a bearish outlook to emerge we would require the index’s price action to break the 6420 (S1) support line, paving the way for the 6140 (S2) support barrier.

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.