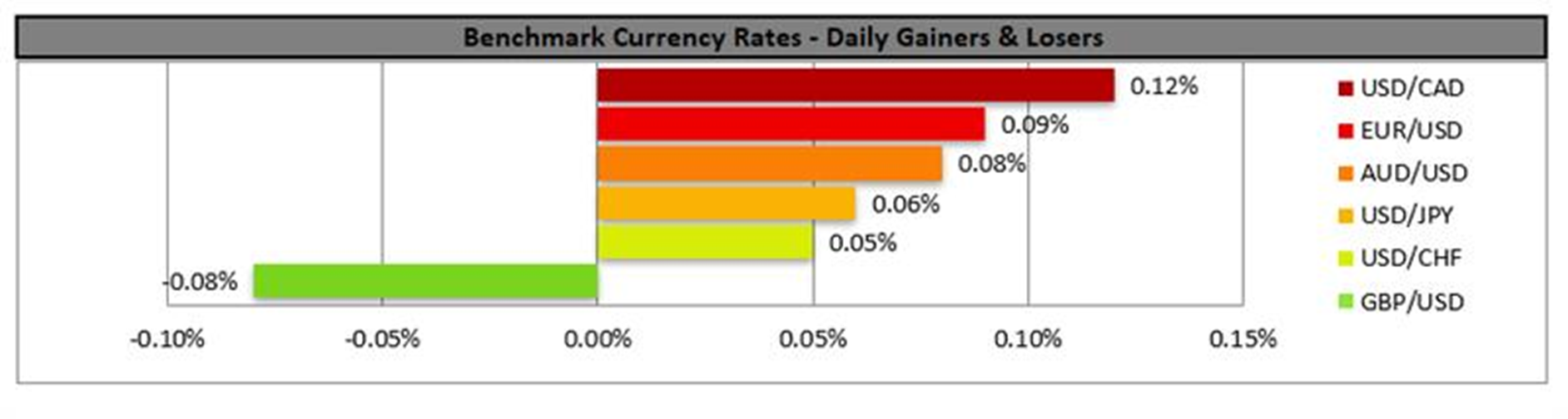

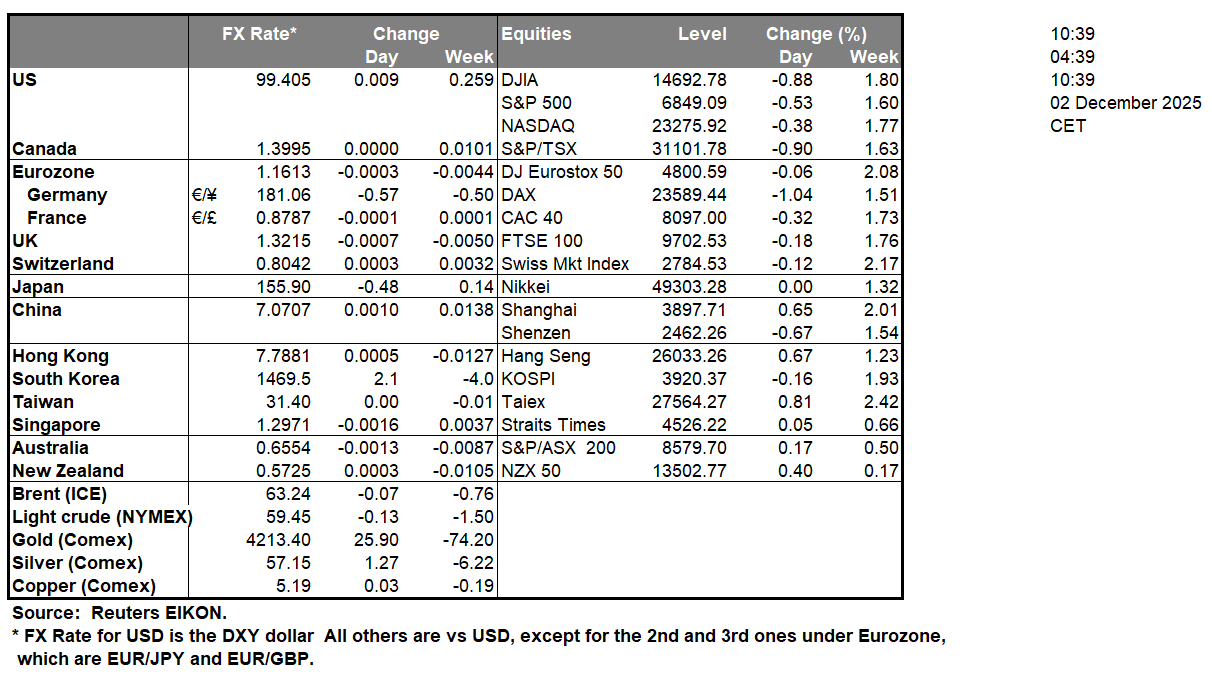

Airbus has “warned that quality issues are affecting a limited number of fuselage panels on its best-selling A320 aircraft” , with the company noting yesterday that it was inspecting all aircraft potentially affected by the issue. The company noted that the issue stemmed from a supplier quality issue “affecting a limited number of A320 metal panels”. The announcement by the company comes as a software update was required on about 6,000 A320 jets over the weekend. In turn the series of issues faced by the company could continue weighing on the company’s stock.The US S&P and ISM manufacturing PMI figures for November where released during yesterday’s American session and tended to showcase mixed signals for the state of the US manufacturing sector. In particular, the S&P manufacturing PMI figure came in better than expected at 52.2 versus 51.9, implying a greater expansion of the US manufacturing sector than what was expected. In theory this may have aided the dollar, yet the ISM manufacturing PMI figure for the same month came in at 48.2 which was lower than expected and tended to provide the opposite picture i.e a contraction, which may have weighed on the dollar. Nonetheless, dollar traders may be focused on the US JOLTs job openings figure for September which is due out today and could possibly influence the greenback depending on what picture the financial release showcases.The Eurozone’s preliminary HICP rate for November is due out today and is expected to remain steady at 2.1%. Hence any rate higher or lower could potentially influence the common currency’s direction for today.On a geopolitical level, tensions between the US and Venezuela continue to rise with reports having emerged that President Trump offered Maduro “safe passage” should he relinquish power. In turn any military conflict may influence oil prices.

On a technical level, EUR/USD appears to be moving in an upwards fashion after re-emerging above our 1.1560 (S1) support level. We now opt for a bullish outlook for the pair and supporting our case are all three indicators below our chart which tend to imply a bullish market sentiment. For our bullish outlook to be maintained, we would now require a clear break above our 1.1685 (R1) resistance level, with the next possible target for the bulls being our 1.1815 (R2) resistance line. On the other hand, for a sideways bias we would require the pair to remain confined between our 1.1560 (S1) support level and our 1.1685 (R1) resistance line. Lastly, or a bearish outlook we would require a clear break below our 1.1560 (S1) support line with the next possible target for the bears being our 1.1405 (S2) support level.

XAU/USD appears to be moving in an upwards fashion after clearing our resistance now turned to support at the 4142 (S1) level. We opt for a bullish outlook for the precious metal’s price and supporting our case is the upwards moving trendline located on our chart. For our bullish outlook to be maintained we would require a clear break above our 4240 (R1) resistance line with the next possible target for the bulls being our 4315 (R2) resistance level. On the other hand, for a sideways bias we would require gold’s price to remain confined between our 4142 (S1) support level and our 4240 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 4142 (S1) support level with the next possible target for the bears being our 4080 (S2) support line.

금일 주요 경제뉴스

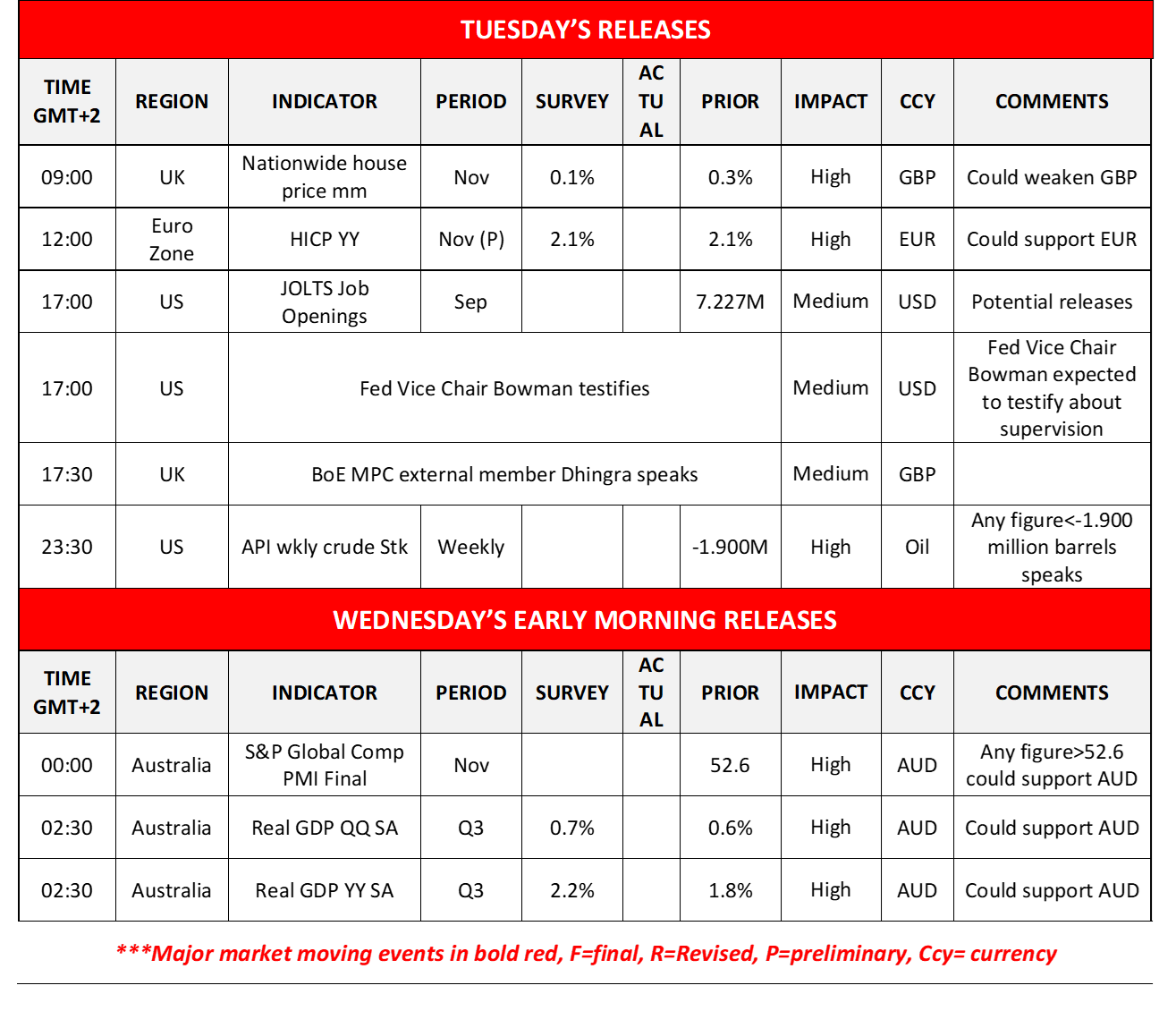

Today we get UK’s Nationwide house prices for November, Euro Zone’s preliminary HICP rate also for November, the US JOLTS job openings figure for September, and later on the US API weekly crude oil inventories figure. On a monetary level, we note the speech of Fed Vice President Bowman and BoE MPC external member Dhingra speak. In tomorrow’s Asian session, we get Australia’s final PMI figures for November and GDP rates for Q3.

EUR/USD Daily Chart

- Support: 1.1560 (S1), 1.1405 (S2), 1.1345 (S3)

- Resistance: 1.1685 (R1), 1.1815 (R2), 1.1917 (R3)

XAU/USD H4 Chart

- Support: 4142 (S1), 4080 (S2), 4010 (S3)

- Resistance: 4240 (R1), 4315 (R2), 4380 (R3)

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.