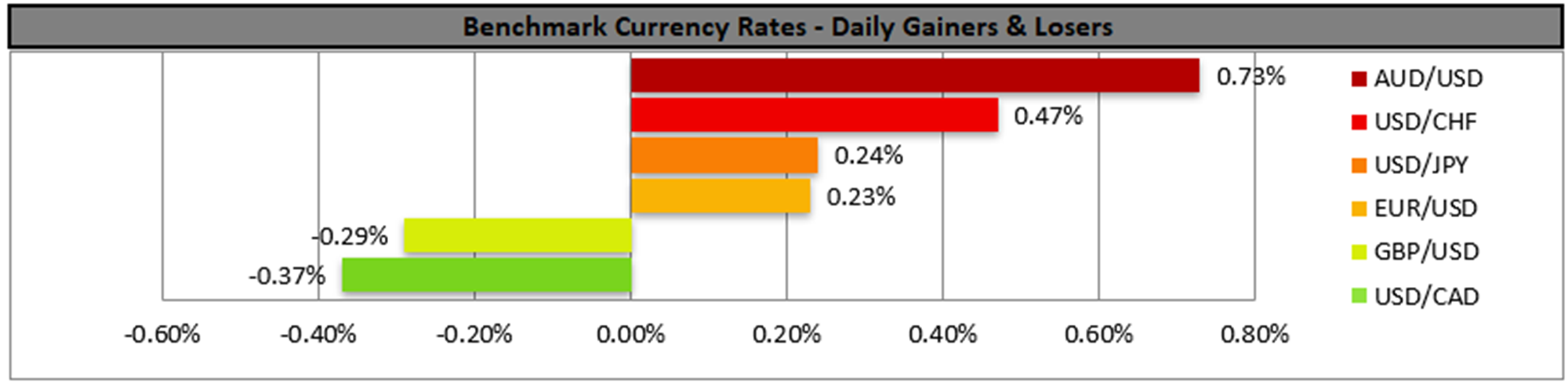

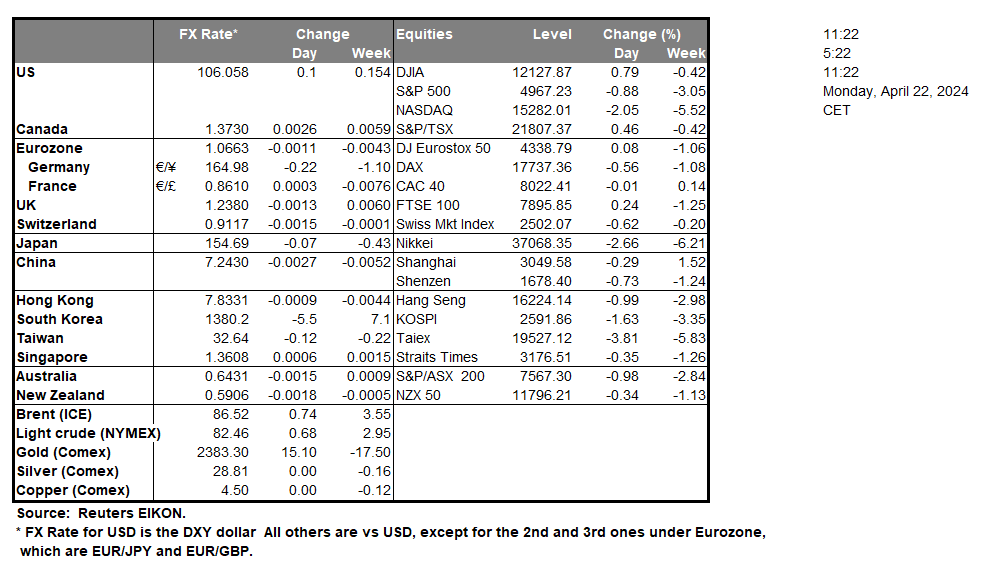

The USD presented little mobility against its counterparts yesterday, with fundamentals remaining the same more or less. Uncertainty about the Middle East remains present yet may have eased a bit as the possibility of a major counterstrike seems to be distancing. On the other hand, the elephant in the room for US markets remains the sticky inflation and the Fed’s intentions about it. The Fed’s favourite inflation measure namely the core PCE price index is due near the end of the week and may shake the markets. As for US stockmarkets this week, besides the fundamentals surrounding it we also note that the earnings season is in full swing and this week we are to focus on the tech sector given that Intel (#INTC), Microsoft (#MSFT), Google (#GOOG), Meta (#META), IBM (#IBM) and Amazon (#AMZN) are to release their earnings reports. Across the Atlantic the ECB seems set to proceed with a rate cut in June as ECB’s De Galhau stated that not even the uncertainty of oil prices could alter such a scenario, thus we may see the EUR weakening as the interest rate differentials may start weighing.

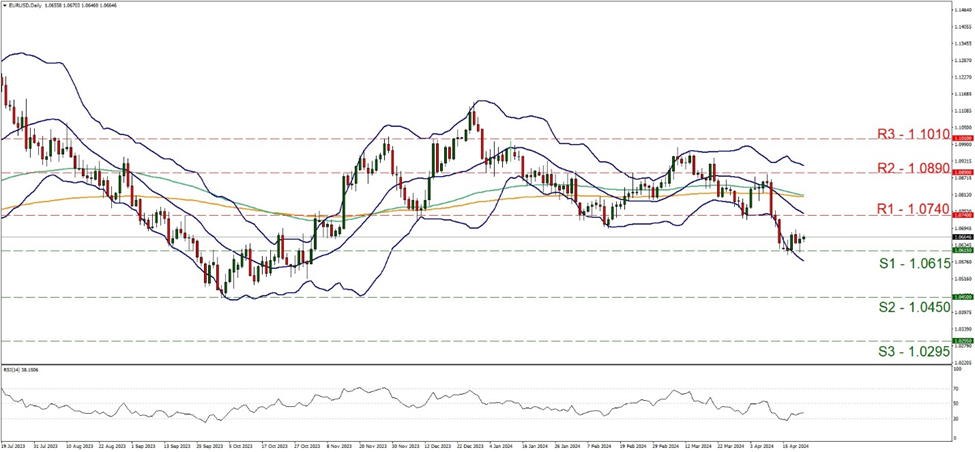

EUR/USD remained relatively unchanged yesterday, above the 1.0615 (S1) support line. The pair seems to have stabilised over the past few days, yet there also seems to be a bearish predisposition of the market for the pair. Characteristically we note that the RSI indicator remains below the reading of 50, despite bouncing on the reading of 30. Also the 20 moving average (MA), which is also the median of the Bollinger bands and the 100 MA (green line) are pointing downwards witnessing the downward trajectory of the pair’s price action., Yet for a clearcut bearish outlook, we would require the pair to break the 1.0615 (S1) support line which held its ground against the downward pressure in the past week, thus paving the way for the 1.0450 (S2) support level. Should the bulls take over, we may see the pair breaking the 1.0740 (R1) line and start aiming for the 1.0890 (R2) resistance level.

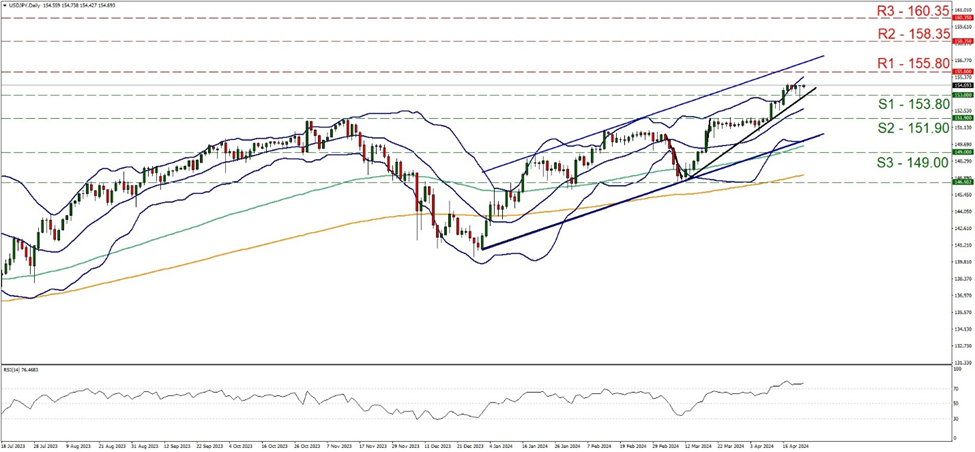

USD/JPY remained rather stable over the past few days between the 153.80 (S1) support line and the 155.80 (R1) resistance level. We tend to maintain our bullish outlook for the pair given that the upward trendline incepted since the 12 of March remains intact. We also note that the 20 MA, 100 MA and 200 MA are all pointing upwards, highlighting the upward direction of the pair. Furthermore the RSI indicator remains above the reading of 70 implying a strong bullish sentiment of the market for the pair, yet may also imply that the pair is at overbought levels and ripe for a correction lower. Nevertheless, the price action has some distance from the upper Bollinger band implying that there is some room for the bulls to play should the market wish so. Should the buying interest be renewed, we may see the pair breaking the 155.80 (R1) resistance line aiming for the 158.35 (R2) resistance hurdle. Should the bears take over, we may see the pair breaking the prementioned upward trendline ina first signal that the upward motion has been interrupted and continue lower to break also the 153.80 (S1) support line aiming for the 151.90 (S2) support base.

금일 주요 경제뉴스

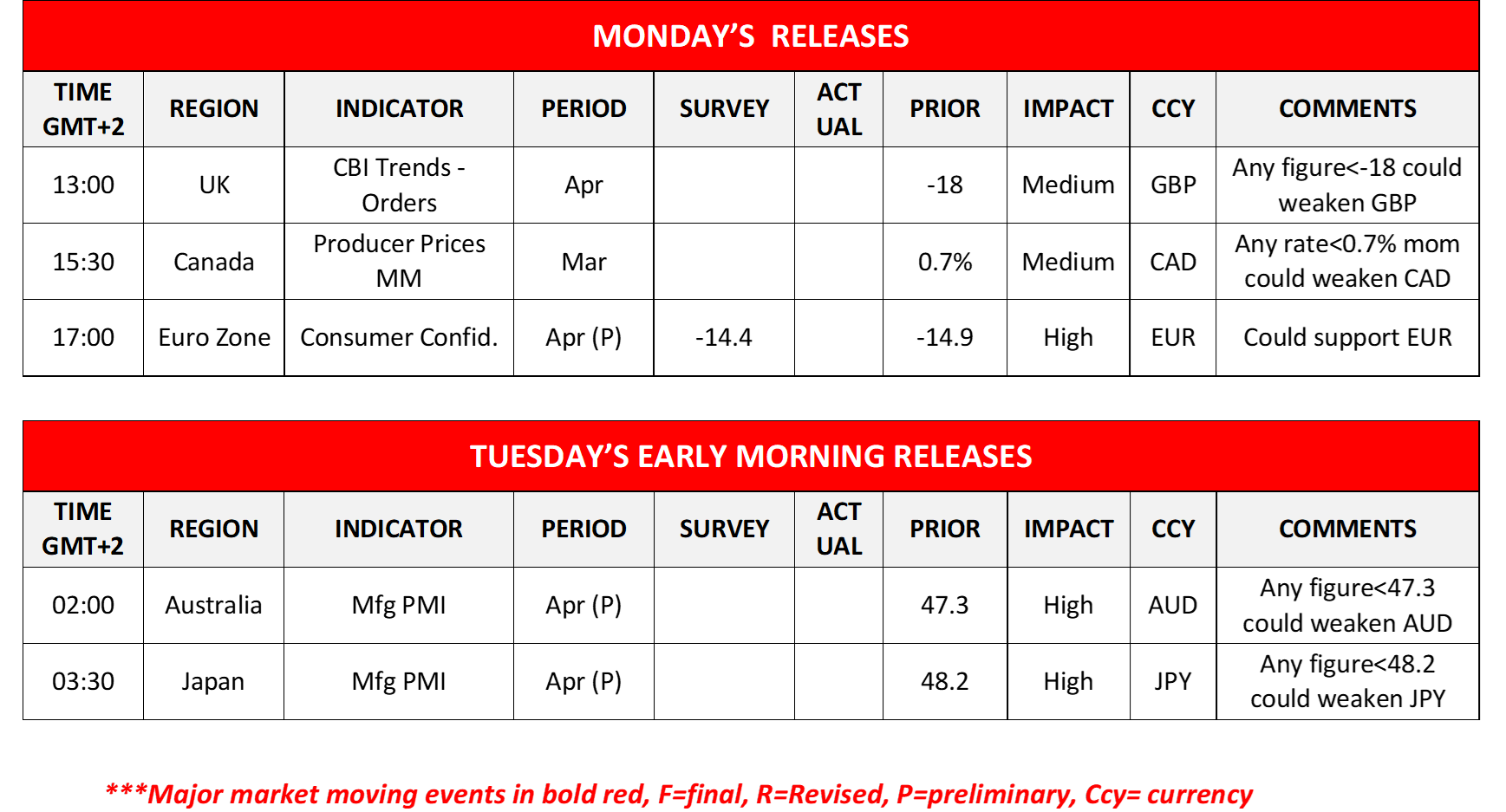

Today we get from the UK the CBI indicator for trends in industrial orders for April. In the American session, we get Canada’s producer prices for March and Eurozone’s preliminary consumer confidence for April.

금주 주요 경제뉴스

On Tuesday we get March’s preliminary PMI figures for France, Germany, the Eurozone as a whole, the UK and the US. On Wednesday we get New Zealand’s Trade data for March, Australia’s CPI rates for Q1, Germany’s Ifo indicators for April, the US durable goods orders for March and Canada’s retail sales for February and BoC’s March meeting minutes. On Thursday we note the release of Germany’s Gfk consumer sentiment for May, UK’s CBI indicator for distributive trades for April, Canada’s Business Barometer for April and from the US the weekly initial jobless claims, as well as the highlight for the week the US GDP advance rate for Q1, while from Turkey we get CBRT’s interest rate decision. On Friday, we get BoJ’s interest rate decision and Tokyo’s CPI rates for April, Australia’s PPI rates for Q1 and from the US the consumption rate for March, the Core PCE price index for March and the final US UoM consumer sentiment for April.

EUR/USD Daily Chart

Support: 1.0615 (S1), 1.0450 (S2), 1.0295 (S3)

Resistance: 1.0740 (R1), 1.0890 (R2), 1.1010 (R3)

USD/JPY Daily Chart

Support: 153.80 (S1), 151.90 (S2), 149.00 (S3)

Resistance: 155.80 (R1), 158.35 (R2), 160.35 (R3)

이 기사와 관련된 일반적인 질문이나 의견이 있으시면 저희 연구팀으로 직접 이메일을 보내주십시오 research_team@ironfx.com

면책 조항:

본 자료는 투자 권유가 아니며 정보 전달의 목적이므로 참조만 하시기 바랍니다. IronFX는 본 자료 내에서 제 3자가 이용하거나 링크를 연결한 데이터 또는 정보에 대해 책임이 없습니다.