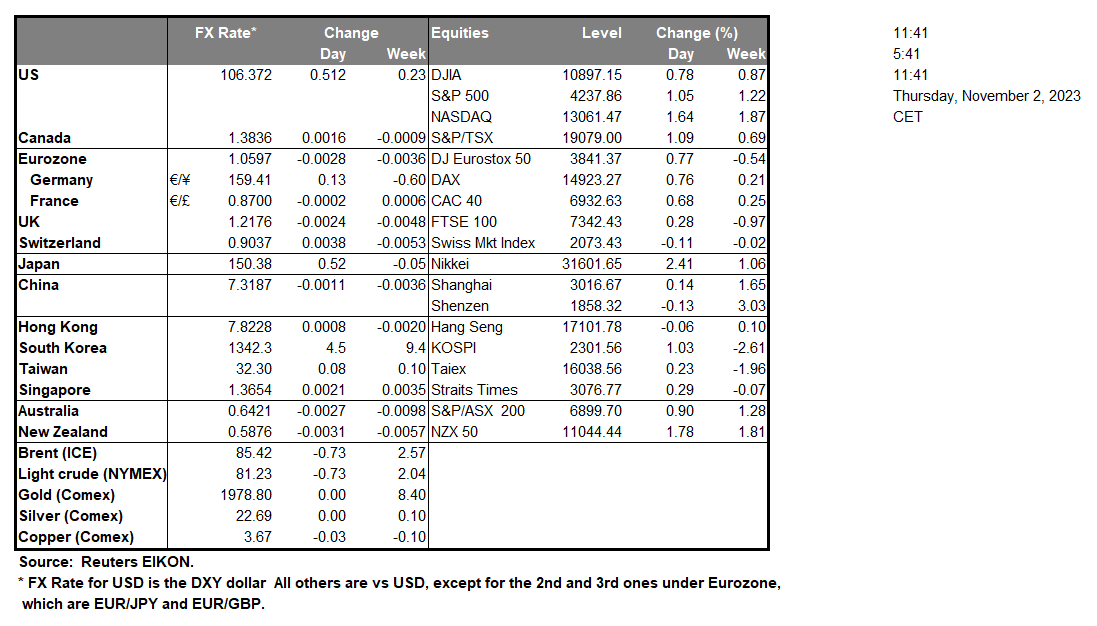

The Fed remained on pause during their monetary policy meeting yesterday, as was widely expected by market analysts. Furthermore, Fed Chair Powell acknowledged that the US economy remained strong and that the “recent indicators suggest that economic activity has been expanding at a strong pace and well above earlier expectations”. Implying that should inflationary pressures persist in the US economy; the bank may hike rates in the future. Furthermore, the Fed Chair is cited by Reuters as stating that “”We’re not confident that we haven’t, we’re not confident that we have “, when speaking about sufficiently restrictive rates. In Canada BoC Governor Macklem, according to media outlets, stated that part of the reason that the BoC held interest rates steady, was due to the upcoming wave of mortgage renewals which are anticipated to impact the Canadian economy. Furthermore, the Governor stated that “Federal and provincial government spending is starting to get in the way of getting inflation back to target”, implying that as a result, the bank may have to resume on its restrictive monetary path. Over in Asia, Australia’s trade balance came in much lower than expected, at 6.786B, which could be indicative of a reduction in demand for Australia goods. Furthermore, it appears the current economic deterioration in China, may be impacting Australia’s economy given their heavy reliance on China to import their goods. Over, in Europe, the BOE’s interest rate decision is due out later on today, with the bank widely expected to remain on hold. In the event that the BOE Members appear to be predominantly dovish, we may see a weakening of the pound against in counterparts.

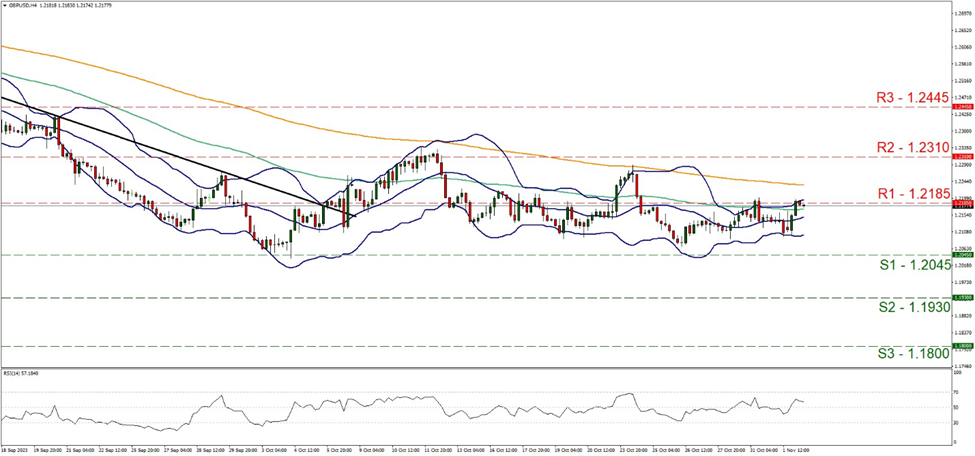

GBP/USD appears to be moving in a sideways fashion and supporting our case is the RSI indicator below our 4-Hour chart which currently registers a figure near 50, implying a neutral market sentiment. In addition, the narrowing of the Bollinger bands imply low market volatility. For our neutral outlook to continue, we would like to see the pair remaining confined between the 1.2045 (S1) and the 1.2185 (R1) support and resistance levels respectively. On the other hand, for a bullish outlook we would like to see a clear break above the 1.2185 (R1) resistance level with the next possible target for the bulls being the 1.2310 (R2) resistance ceiling. Lastly, for a bearish outlook, we would like to see a clear break below the 1.2045 (S1) support level with the next possible target for the bears being the 1.1930 (S2) support base.

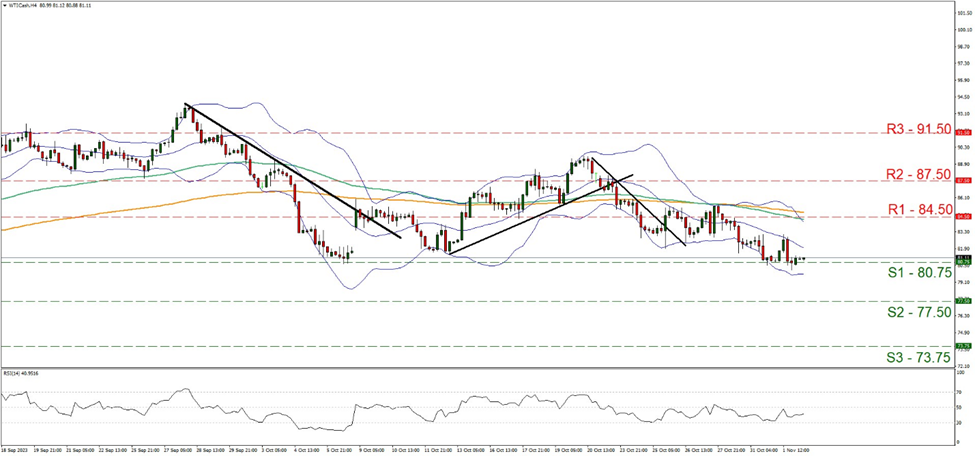

WTICash appears to be moving in a downwards fashion, with the commodity currently testing the 80.75 (S1) support level. We maintain a bearish outlook, and support our case is the RSI indicator below our 4-Hour chart which currently registers a figure below 50, implying a bearish market sentiment. In addition, the move and rejection of the mid-range of the Bollinger bands appear to further support our bearish belief. For our bearish outlook to continue, we would like to see a clear break below the 80.75 (S1) support level and a move towards the 77.50 (S2) support level, with the next possible target for the bears being the 73.75 (S3) support base. On the other hand, for a bullish outlook, we would like to see a clear break above the 84.50 (R1) resistance level, with the next possible target for the bulls being the 87.50 (R2) resistance ceiling.

その他の注目材料

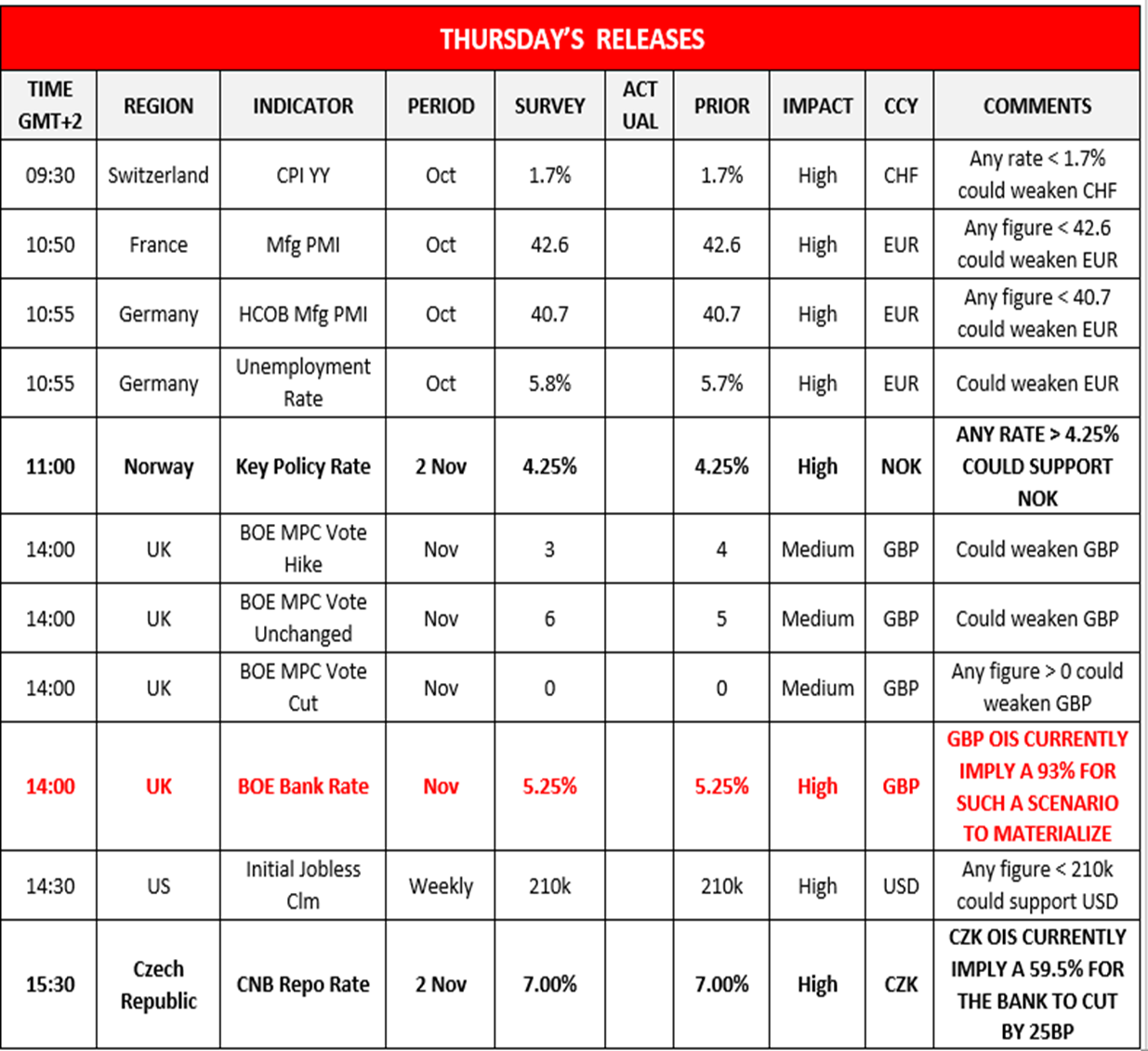

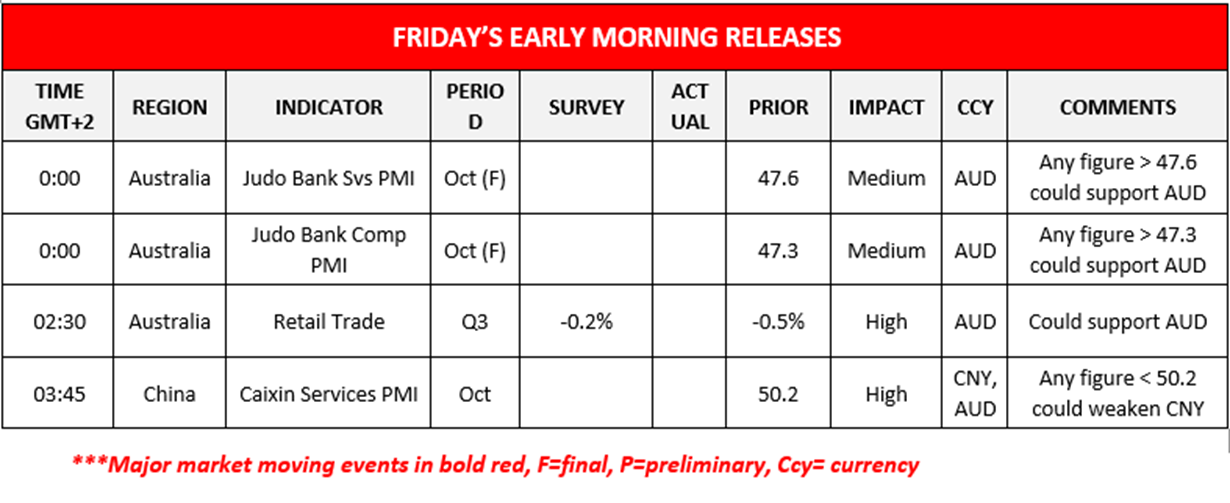

Today in the European session, we highlight the release of Switzerland’s CPI rates, France’s Manufacturing PMI figure, Germany’s HCOB Manufacturing PMI figure and Unemployment rate, all for the month of October. During the American session, we note the release of the US weekly initial jobless claims figure. In tomorrow’s Asian session, we note Australia’s Judo bank services final PMI figure and the Composite PMI final figure both for October, followed by Australia’s retail trade rate for Q3 and China’s Caixin services PMI figure for October. On a monetary level, we note Norway’s interest rate decision, the BOE’s interest rate decision and finishing of the day is the CNB’s interest rate decision.

#GBP/USD 4 Hour Chart

Support: 1.2045 (S1), 1.1920 (S2), 1.1800 (S3)

Resistance: 1.2185 (R1), 1.2310 (R2), 1.2445 (R3)

#WTICash 4 Hour Chart

Support: 80.75 (S1), 77.50 (S2), 73.75 (S3)

Resistance: 84.50 (R1), 87.50 (R2), 91.50 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。