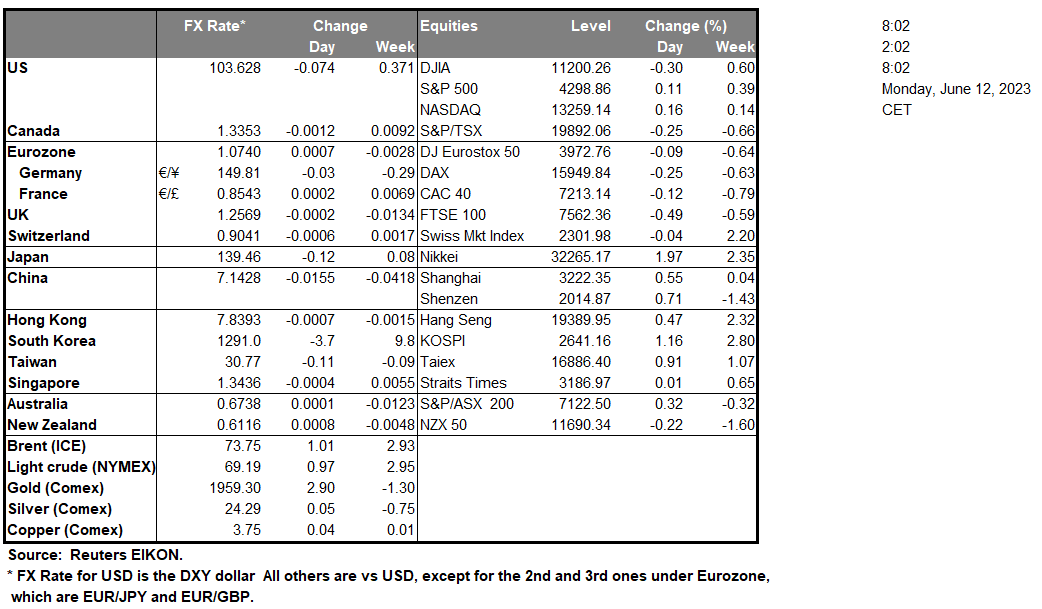

The USD remained in a relatively tight rangebound movement against its peers on Friday, yet the coming week is expected to generate substantial interest with the Fed’s interest rate decision on Wednesday and the market increasingly expecting the bank to remain on hold at the 5.00%-5.25% range. Yet before that the release of the US CPI rates on Tuesday may alter the market’s expectations and a number of high-impact financial releases scattered throughout the week are to keep traders’ interest alive.

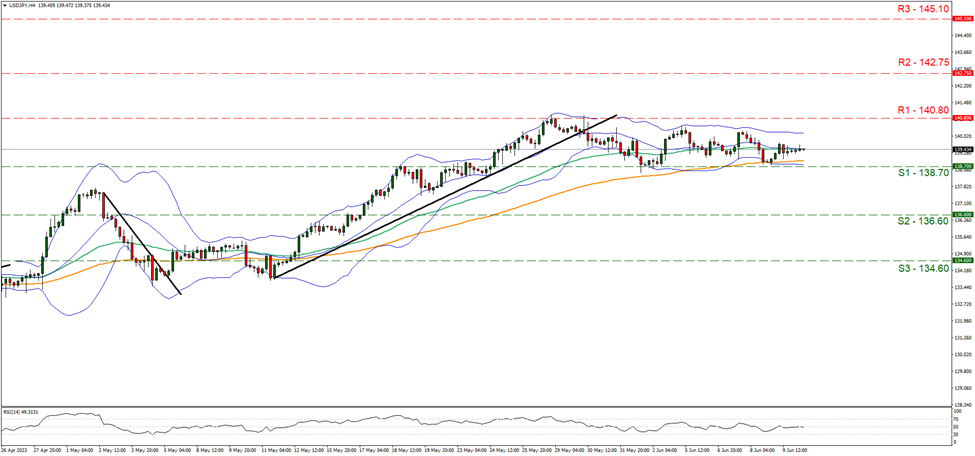

USD/JPY maintained its sideways motion as expected in Friday’s report between the 138.70 (S1) support line and the 140.80 (R1) resistance line. We tend to maintain our bias for the sideways motion of the pair to continue, given also that the RSI indicator is running along the reading of 50, implying a rather indecisive market. Should the bulls take over the reins, regarding the pair’s direction, we may see USD/JPY breaking the 140.80 (R1) resistance line and aim for the 142.75 (R2) resistance level. Should the bears take over, we may see USD/JPY breaking the 138.70 (S1) support line and aim for the 136.50 (S2) support level.

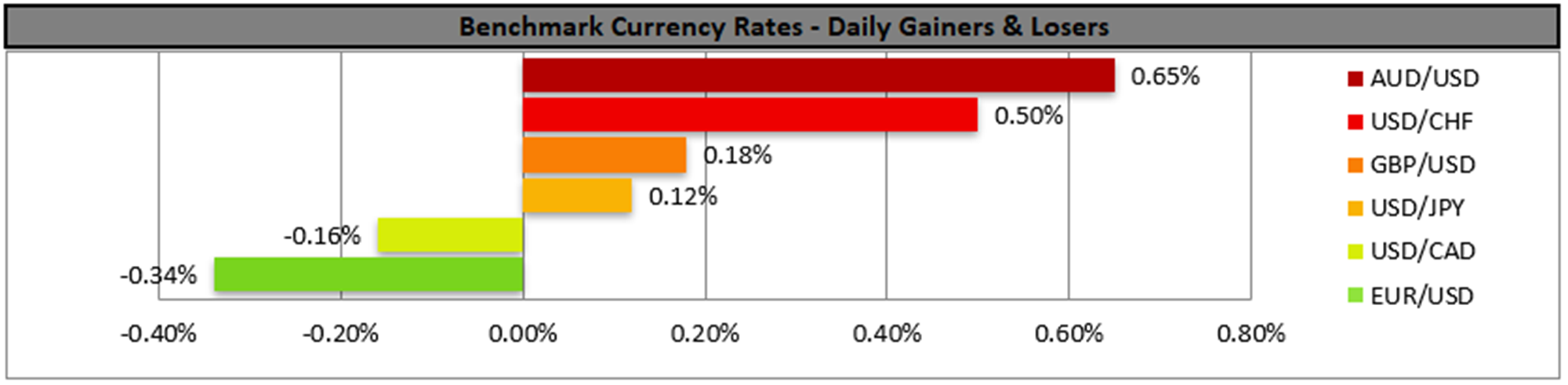

We note also that in the FX market, the Loonie managed to remain relatively stable and end the week with some gains against the USD, despite May’s Canadian employment data being worse than expected. Overall the market sentiment seems to be slightly improving as riskier assets such as US stock markets but also commodity currencies such as the Aussie were on the rise for the week.

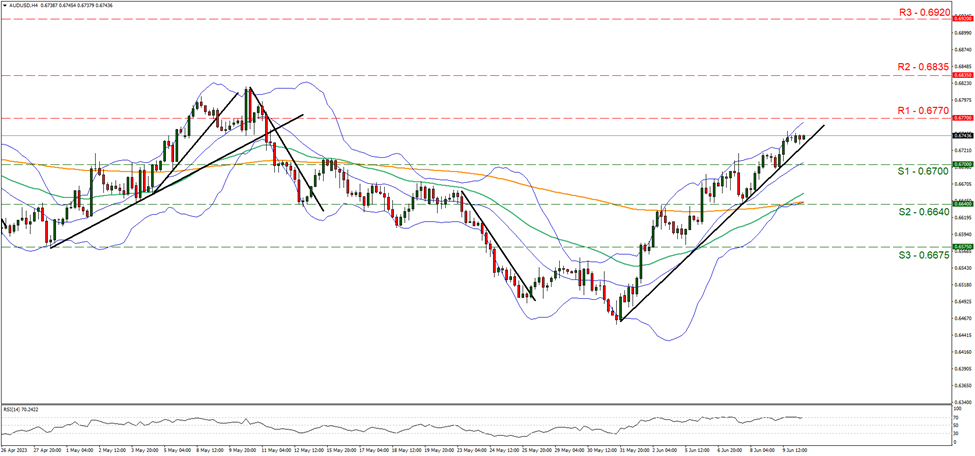

AUD/USD edged higher on Friday aiming for the 0.6770 (R1) resistance line, yet there were some signs of a stabilisation during today’s Asian session. For the time being, we tend to maintain our bullish outlook as the upward trendline guiding the pair since the 31 of May, seems to remain intact. Furthermore, the RSI indicator seems to be running along the reading of 70, underscoring the bullish sentiment of the market for the pair, yet may also imply that the pair may be nearing overbought levels and may be ripe for a correction lower. Should the pair find fresh buying orders along its path, we may see it breaking the 0.6770 (R1) resistance line and aim for the 0.6835 (R2) resistance level. Should a selling interest be expressed by the market we may see the pair reversing course, breaking initially the prementioned upward trendline, in a first signal that the upward trendline has been interrupted and proceed with breaking the clearly the 0.6700 (S1) support line and aiming for the 0.6640 (S2) support barrier.

その他の注目材料

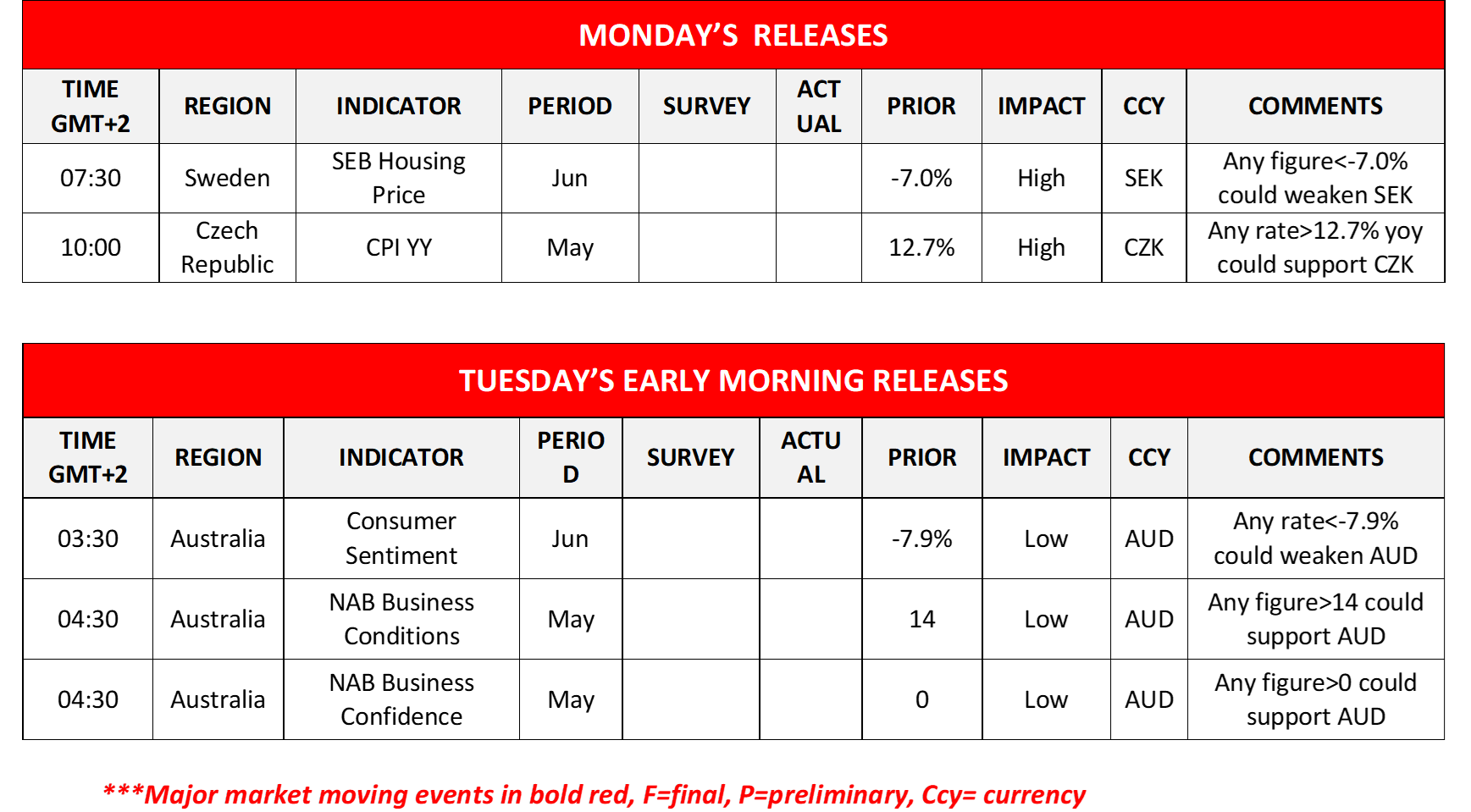

In today’s European session, we note the release of Sweden’s SEB Housing Prices for June and from the Czech Republic the CPI rates for May. During tomorrow’s Asian session, we note the release from Australia of the Consumer confidence indicator for June and the NAB Business Confidence and Business Conditions indicators for May.

今週の指数発表:

On Tuesday we note the release of the UK’s employment data for April, Germany’s ZEW indicators for June and we highlight the US CPI rates for May. On Wednesday we get UK’s GDP and manufacturing output rates for April and the US PPI rates for May, while the highlight of the week is expected to be the Fed’s interest rate decision. In a packed Thursday we note the release of New Zealand’s GDP rates for Q1, Japan’s machinery orders for April and trade data for May, Australia’s employment data for May, China’s urban investment, industrial output and retail sales for the same month, while from Canada we get May’s number of House starts and April’s manufacturing sales and end the day with the USD retail sales for May and on the monetary front, we note ECBs’ interest rate decision. Finally, on Friday we make a start with BoJ’s interest rate decision and also get the Preliminary US University of Michigan consumer sentiment for June.

AUD/USD 4時間チャート

Support: 0.6700 (S1), 0.6640 (S2), 0.6675 (S3)

Resistance: 0.6770 (R1), 0.6835 (R2), 0.6920 (R3)

USD/JPY 4時間チャート

Support: 138.70 (S1), 136.60 (S2), 134.60 (S3)

Resistance: 140.80 (R1), 142.75 (R2), 145.10 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。