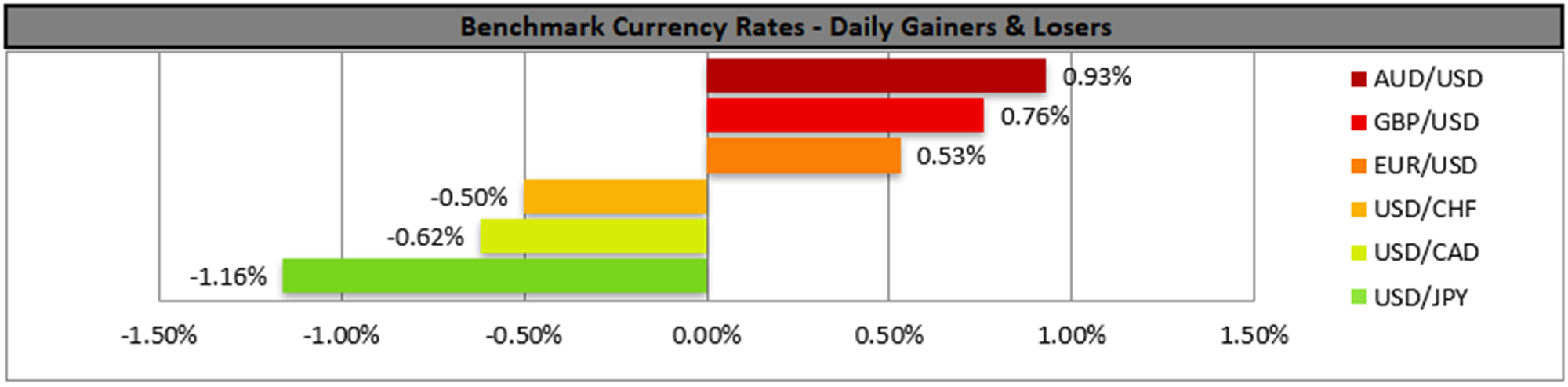

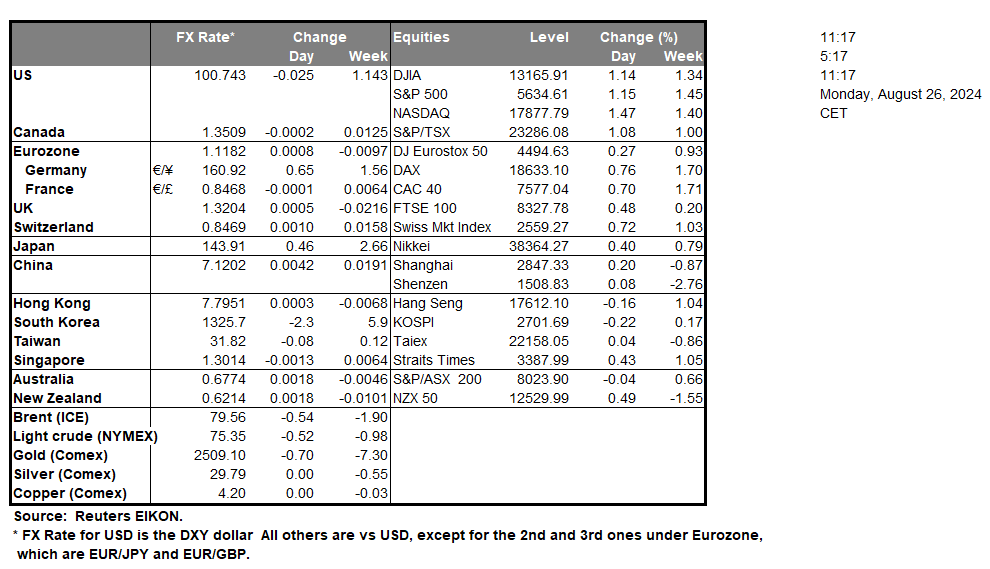

The USD restarted its weakening against its counterparts on Friday as Fed Chairman Powell’s speech indicated that interest rate cuts lay ahead for the Fed, in his speech regarding the US economic outlook and the Fed’s monetary policy at the Jackson Hole Economic Symposium. It’s characteristic that the Fed Chairman was reported stating that ‘The time has come for policy to adjust’. Yet we have to also note that the market’s dovish expectations are extensive and have intensified, as they are now including a 25-basis points rate cut in September a 50-basis points rate cut in November and another single 25-basis points rate cut in December. Overall, we see the case for the USD to continue to weaken on a monetary policy level. The event practically improved the market sentiment keeping US stockmarkets supported, while gold’s price also was able to benefit from USD’s weakening, highlighting the negative correlation of the two trading instruments.

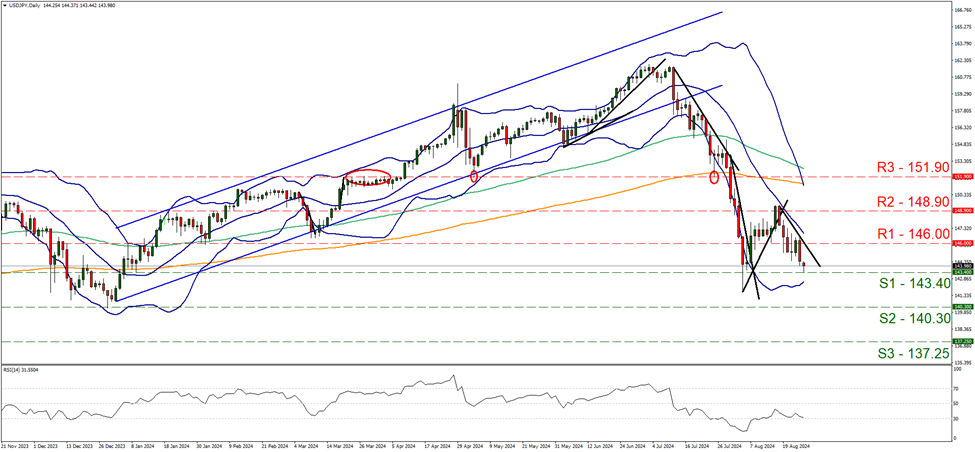

USD/JPY dropped on Friday and during today’s Asian session tested the 143.40 (S1) support line. We tend to maintain our bearish outlook as the price action shifted the downward trendline guiding the pair since the 16 of August, to the right allowing for its validity to be maintained. We also note that the RSI indicator remained just above the reading of 30, implying a strong bearish market sentiment for the pair. Should the bears maintain control over the pair, we may see USD/JPY breaking the 143.40 (S1) support line and taking aim at the 140.30 (S2) support base. Should the bulls find a chance and take over, we may see USD/JPY breaking the prementioned downward trendline in a first signal of a trend reversal and continue to break the 146.00 (R1) resistance line, aiming for higher grounds.

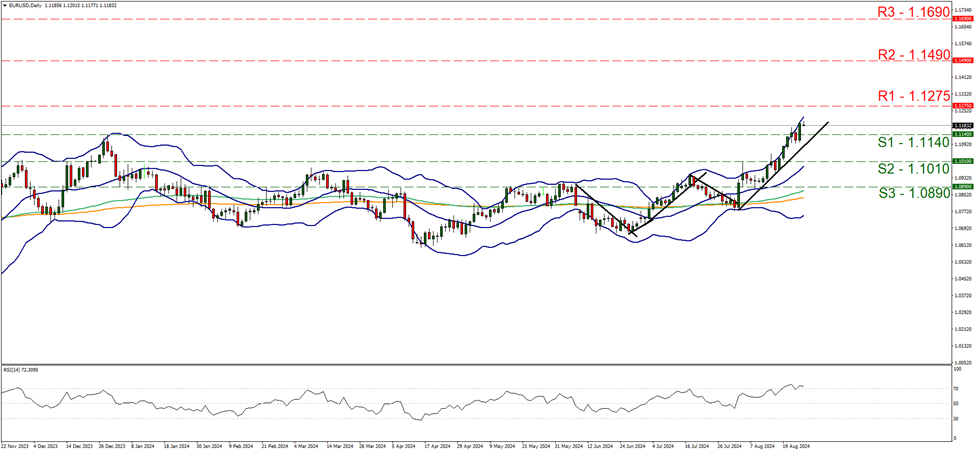

EUR/USD rose on Friday breaking the 1.1140 (S1) resistance line, now turned to support. We maintain our bullish outlook for the pair as the upward trendline guiding it since the 2 of June remains intact. Please note that the RSI indicator remains above the reading of 30 which on the hand highlights the strong bullish sentiment among market participants for the pair yet on the flip side may imply that the pair has reached overbought levels and may be ripe for a correction lower. Should the buying interest be maintained we may see EUR/USD aiming if not breaching the 1.1275 (R1) resistance line. For a bearish outlook we would require the pair to reverse direction, break the 1.1140 (S1) support base clearly, break the prementioned upward trendline and start testing if not breaching the 1.1010 (S2) support level.

その他の注目材料

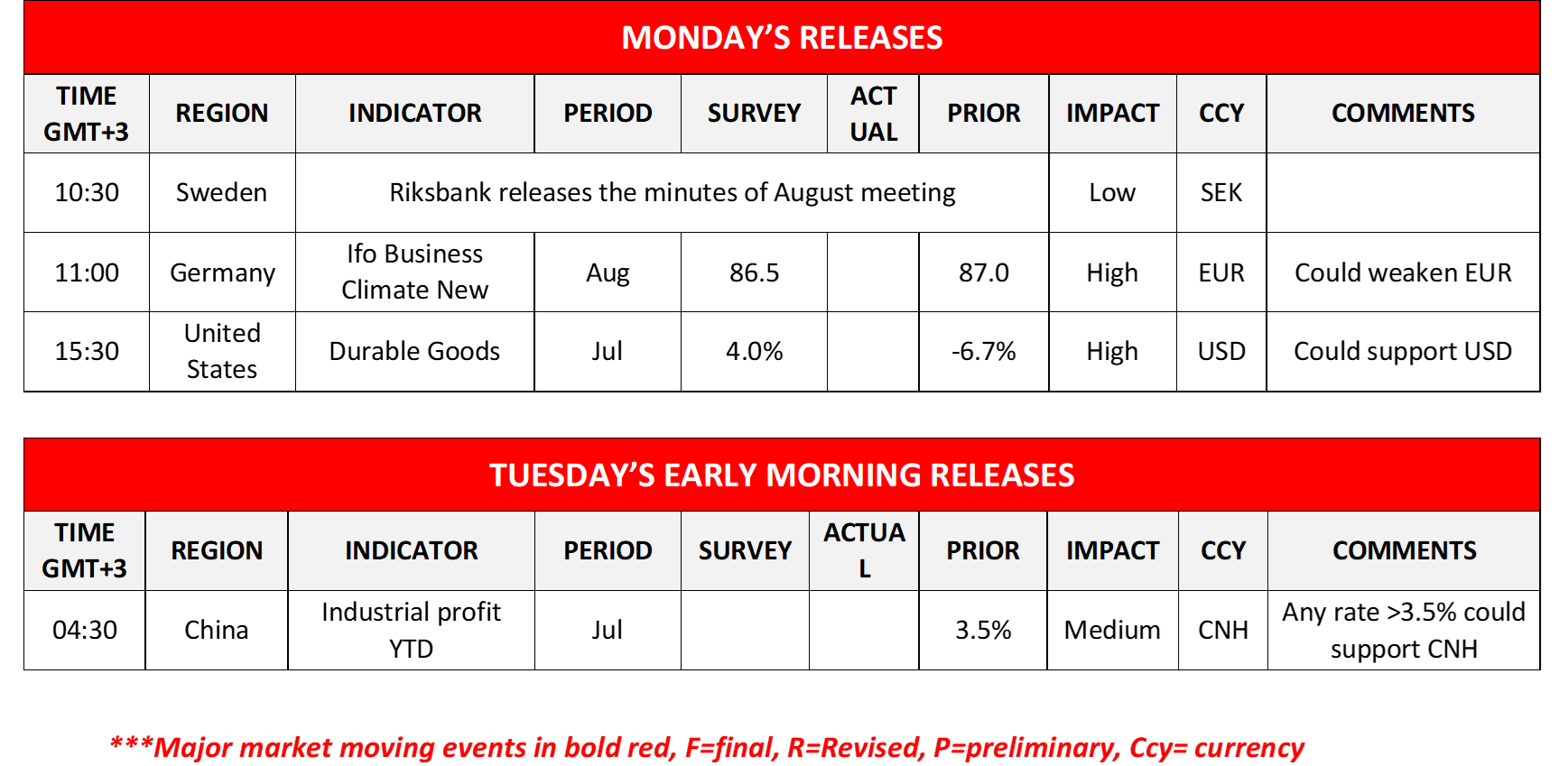

Today we get Germany’s Ifo indicators for August and the US durable goods orders growth rate for July. In tomorrow’s Asian session, we get China’s Industrial Profit for July.

今週の指数発表:

On Tuesday we get UK’s CBI distributive trades and the US consumer confidence, both for August. On Wednesday we get from Australia July’s CPI rates for July. On Thursday we get Australia’s Capital Expenditure for Q2, Sweden’s final GDP rate for Q2, Eurozone’s Business Climate for August, Canada’s Business Barometer for the same month, Germany’s preliminary HICP rate for August and from the US we highlight the release of the second estimate for the GDP rate for Q2 and also note weekly initial jobless claims while from Canada we get the current account balance for Q2. On Friday we get from Japan Tokyo’s CPI rates for August, Australia’s retail sales for July, France’s final GDP rate for Q2 and preliminary CPI rates for August, Switzerland’s KOF indicator for the same month, UK’s nationwide house prices for August, the Czech Republic’s final GDP for Q2, Eurozone’s preliminary HICP rate for August, the US consumption rate for July, the US Core PCE price Index for July, Canada’s GDP rates for Q2 and the final US UoM consumer sentiment for August and on Saturday China’s NBS PMI figures for August.

USD/JPY Daily Chart

- Support: 143.40 (S1), 140.30 (S2), 137.25 (S3)

- Resistance: 146.00 (R1), 148.90 (R2), 151.90 (R3)

EUR/USD デイリーチャート

- Support: 1.1140 (S1), 1.1010 (S2), 1.0890 (S3)

- Resistance: 1.1275 (R1), 1.1490 (R2), 1.1690 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。