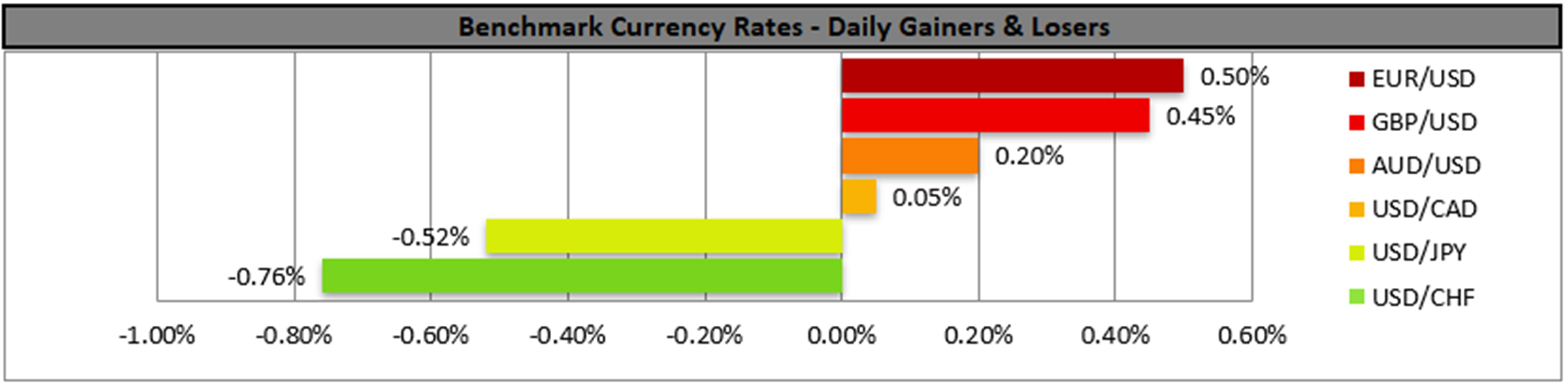

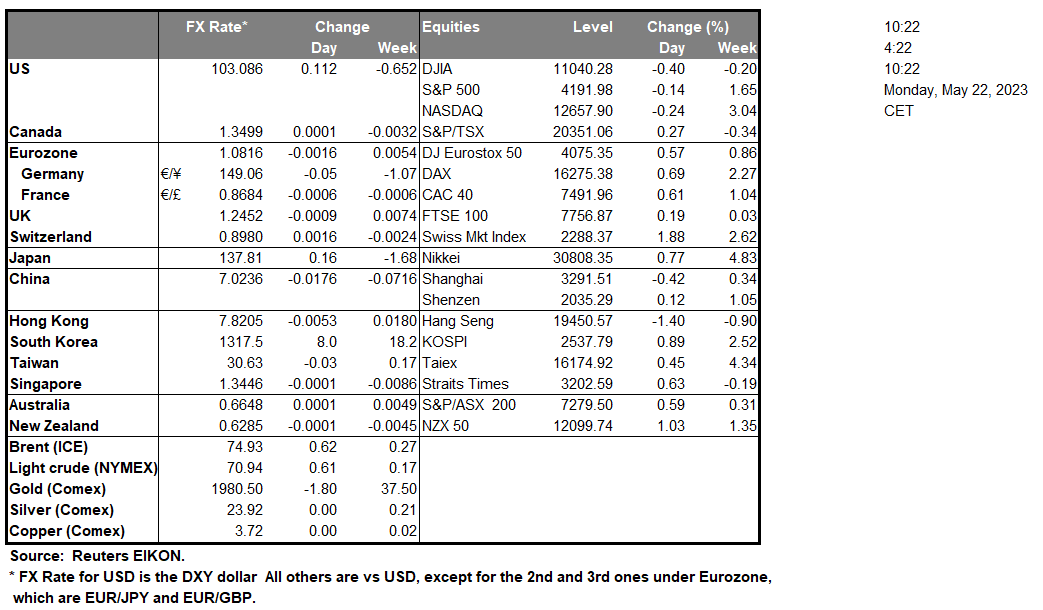

The USD tended to drop against its counterparts on Friday, while showed some signs of stabilisation during today’s Asian session. Market attention is expected to fall later today, on the restart of the negotiations between Republicans and the White House about the rise of the US debt ceiling and an avoidance of the US defaulting on its debt, while US Treasury Secretary Yellen seems to warn that the US may fall short of funds by June 15, raising market worries further. On the monetary front, we note that we got some conflicting messages, yet Fed Chairman Powell’s comment that rates may not have to be raised as high as expected, may have prevailed easing market worries in the “pause”-”no pause” pendulum.

Across the Atlantic, we note that ECB President Lagarde doubled down on the bank’s hawkish intentions, as she was reported stating that the bank will do what is necessary to achieve price stability with no trade-offs. Overall should the bank’s hawkishness be maintained in ECB policymakers’ statements later today, we may see the EUR getting some support. EUR/USD edged higher on Friday yet remained well below the 1.0855 (R1) resistance line. Nevertheless, we tend to maintain our bearish outlook as the price action, despite edging higher failed to even threaten the downward trendline guiding the pair since the 4 of May, hence we tend to maintain our bearish outlook intact. Should the bears actually maintain control over the pair we may see it dropping and breaking and the next target for the bears may be the 1.0695 (S1) support line. Should the bulls take over, we may see the pair rising breaking the prementioned downward trendline, in a first sign that the downward motion has been interrupted, break also the 1.0855 (R1) resistance line and aim for the 1.1000 (R2) resistance level.

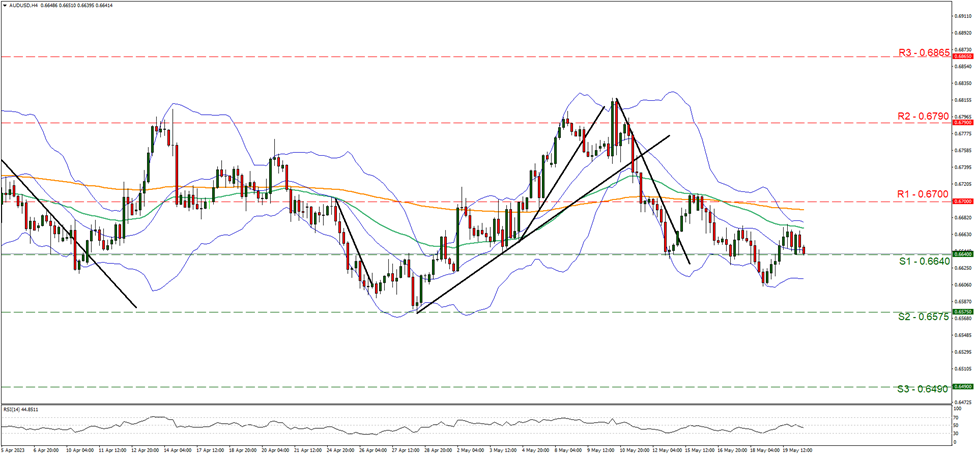

Fundamentally, we maintain our worries as tensions in the US-Sino relationships seem to be flaring up once again, over microchips this time and may weigh on AUD. AUD/USD took another swing on the 0.6640 (S1) support line during today’s Asian session. The picture of a sideways motion seems to be maintained for now and the fact that the RSI indicator is currently running along the reading of 50 tends to support such a notion as it implies a rather indecisive market. Should a selling interest be expressed by the market we may see the pair breaking the 0.6640 (S1) support line and aim for the 0.6575 (S2) support level. Should the bulls take over we may see the pair reversing course and aiming if not breaking the 0.6700 (R1) line.

その他の注目材料

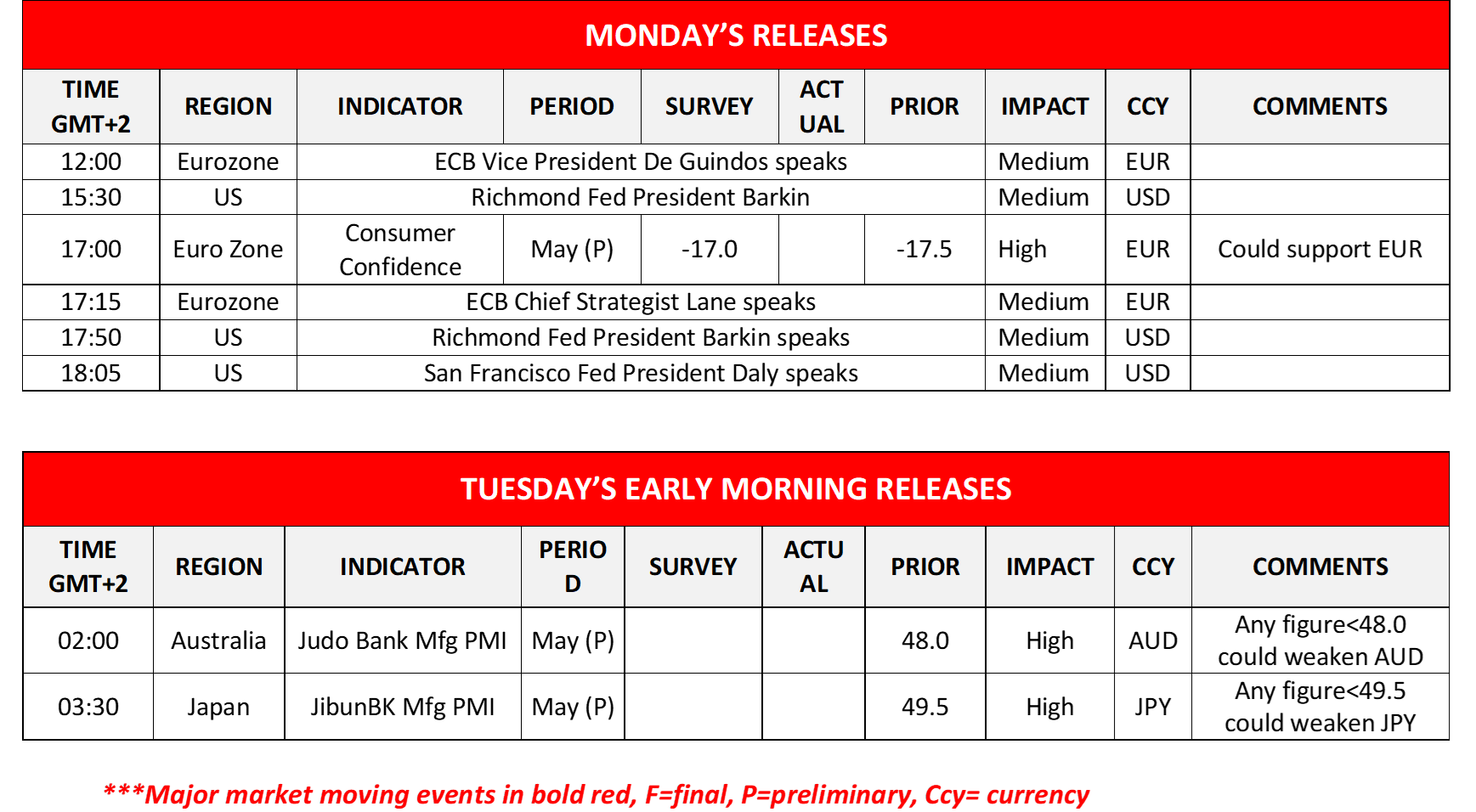

On an easy-going Monday, we note the release of Eurozone preliminary consumer confidence for May and on the monetary front we note that ECB Vice President De Guindos, Richmond Fed President Barkin, ECB Chief Strategist Lane and San Francisco Fed President Daly are scheduled to speak. During tomorrow’s Asian session, we note the preliminary PMI figures of Australia and Japan for May.

今週の指数発表:

On Tuesday, we get the preliminary PMI figures for Australia, Japan, Germany, France, the Eurozone, the UK and the US for May. On Wednesday, we note New Zealand’s retail sales for Q1, UK’s CPI rates for April and Germany’s IFO figures for May, yet on the monetary front we note the release of New Zealand’s RBNZ interest rate decision and the release of the Fed’s May meeting minutes. On a crucial Thursday, we get Germany’s Gfk Consumer sentiment for June, France’s Business manufacturing climate for May, Canada’s business barometer figure for May and we highlight the US GDP 2nd estimate rate for Q1, while on the monetary front, we note from Turkey CBRT’s interest rate decision. Lastly, on Friday, we note Japan’s Tokyo’s CPI rates for May, followed by Australia’s final retail sales rate for April and later on UK’s retail sales for the same month and we highlight the US final University of Michigan consumer sentiment figure for May.

EUR/USD 4時間チャート

Support: 1.0695 (S1), 1.0525 (S2), 1.0370 (S3)

Resistance: 1.0855 (R1), 1.1000 (R2), 1.1140 (R3)

AUD/USD 4時間チャート

Support: 0.6640 (S1), 0.6575 (S2), 0.6490 (S3)

Resistance: 0.6700 (R1), 0.6790 (R2), 0.6865 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。