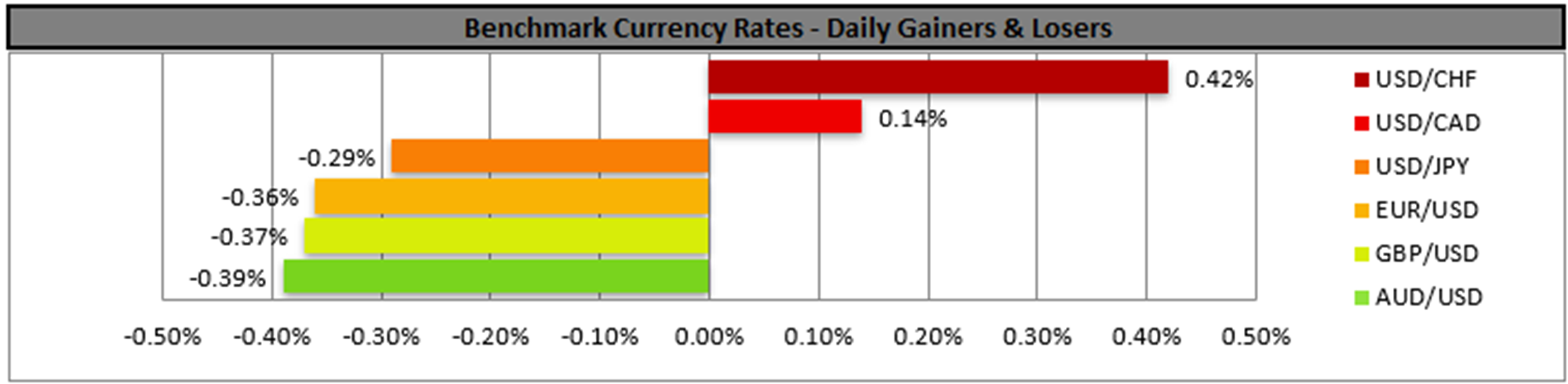

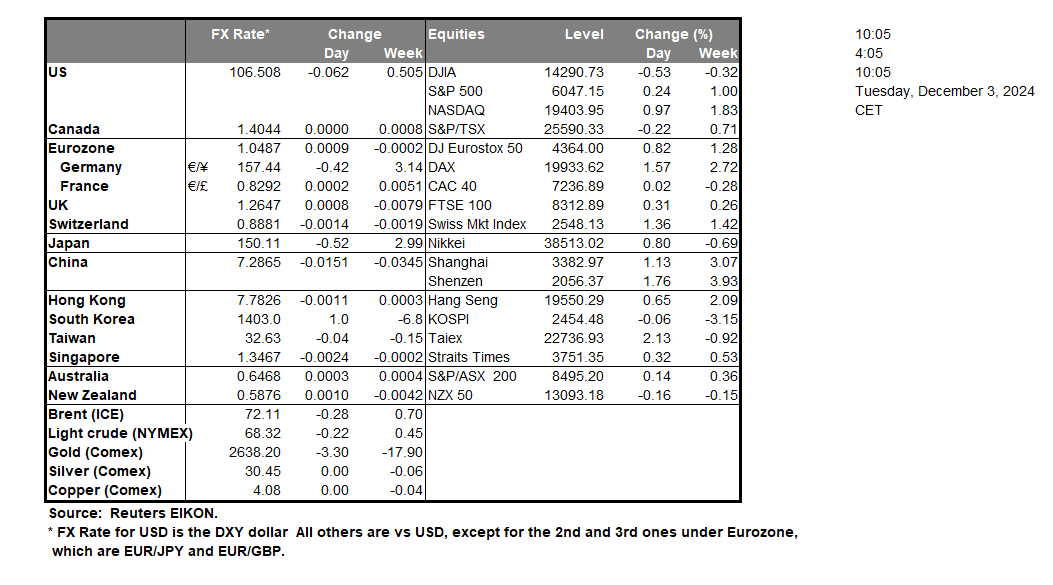

In the FX market the USD seems to remain supported against its counterparts, while attention is slowly turning to the release of November’s US employment report with its NFP figure. On a fundamental level, the uncertainty created by the factor “Trump” with threats for imposing tariffs left and right provides support to the greenback. On a monetary level, the doubts for the Fed’s rate-cutting path tend to also be supportive for the USD. For the time being the bank is expected to proceed with another rate cut yet it remains to be seen what the Fed’s move will be after that. Also, the USD got some support on a macroeconomic level, as the ISM manufacturing PMI figure for November showed that the contraction of economic activity for the past month in the sector was narrower than initially expected. Overall we see the case for the USD to remain supported on a fundamental level.

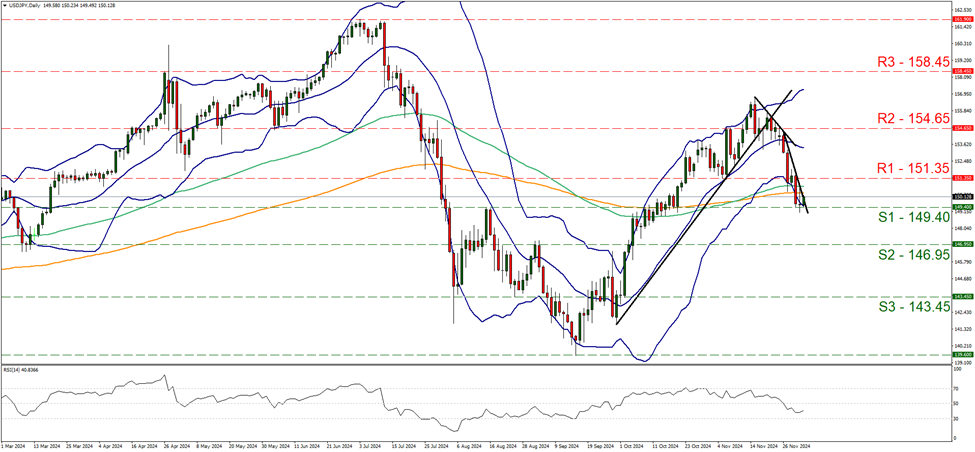

Ona technical level, we note that the USD remained relatively unchanged against the JPY testing the 149.40 (S1) support line, gaining some slight support in today’s Asian session. We maintain a bearish outlook for the pair given the downward trendline guiding USD/JPY, yet the downward trendline seems to be put to the test. For our bearish outlook to be maintained the pair has to break the 149.40 (S1) support line and start aiming for the 146.95 (S2) support level. Should the bulls take over, we may see USD/JPY breaking the prementioned downward trendline clearly in a first signal that the downward motion has been interrupted and continue higher to break the 151.35 (R1) resistance level.

Across the Atlantic, the political uncertainty in the Euro Zone tends to weigh on the common currency. In the latest fundamental development, the French far right and left parties submitted no-confidence motions on Monday against Prime Minister Michel Barnier. Practically the French Government faces a collapse, in addition to the fact that the German government has already collapsed and called for elections on the 25th of February. But also on a monetary level, market expectations for the ECB to cut rates further, tend to weigh on the single currency. On a fundamental level we se the case for the EUR to maintain bearish tendencies.

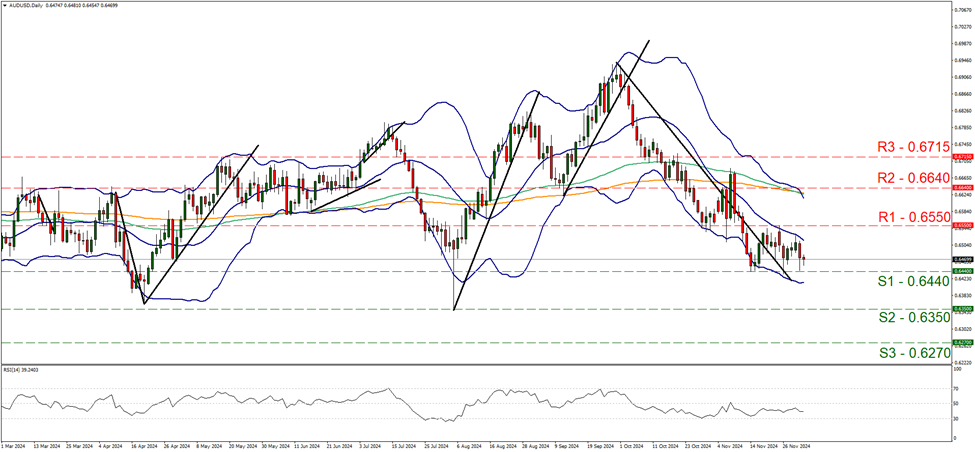

In the Pacific, the Aussie remained under pressure as the Chinese Yuan (CNH) weakened substantially against the USD and given the close Sino-Australian economic ties. On a fundamental level though AUD remains supported as RBA seems prepared to keep rates high for longer. We highlight for Aussie traders the release of the GDP rate for Q3 and a possible acceleration could provide some support for the Aussie as it would imply a wider growth than expected for Australia’s economy. Fundamentally the Aussie seems to be at crossroads. Technically, AUD/USD tested the 0.6440 (S1) support line yesterday yet overall, the sideways motion seems to be maintained. The pair’s price action over the past week seems to be forming slightly lower peaks yet hits a floor at the 0.6440 (S1) support line, forbidding the issuing of a bearish outlook. We maintain a sideways motion bias for the pair possible between the 0.6550 (R1) resistance line and the 0.6440

(S1) support line, with both levels having been tested in the past month. For a bearish outlook we would require the pair to break the 0.6440 (S1) line and aim for the 0.6350 (S2) support level. Should the bulls take over we may see AUD/USD breaking the 0.6550 (R1) line aiming for the 0.6640 (R2) resistance level.

その他の注目材料

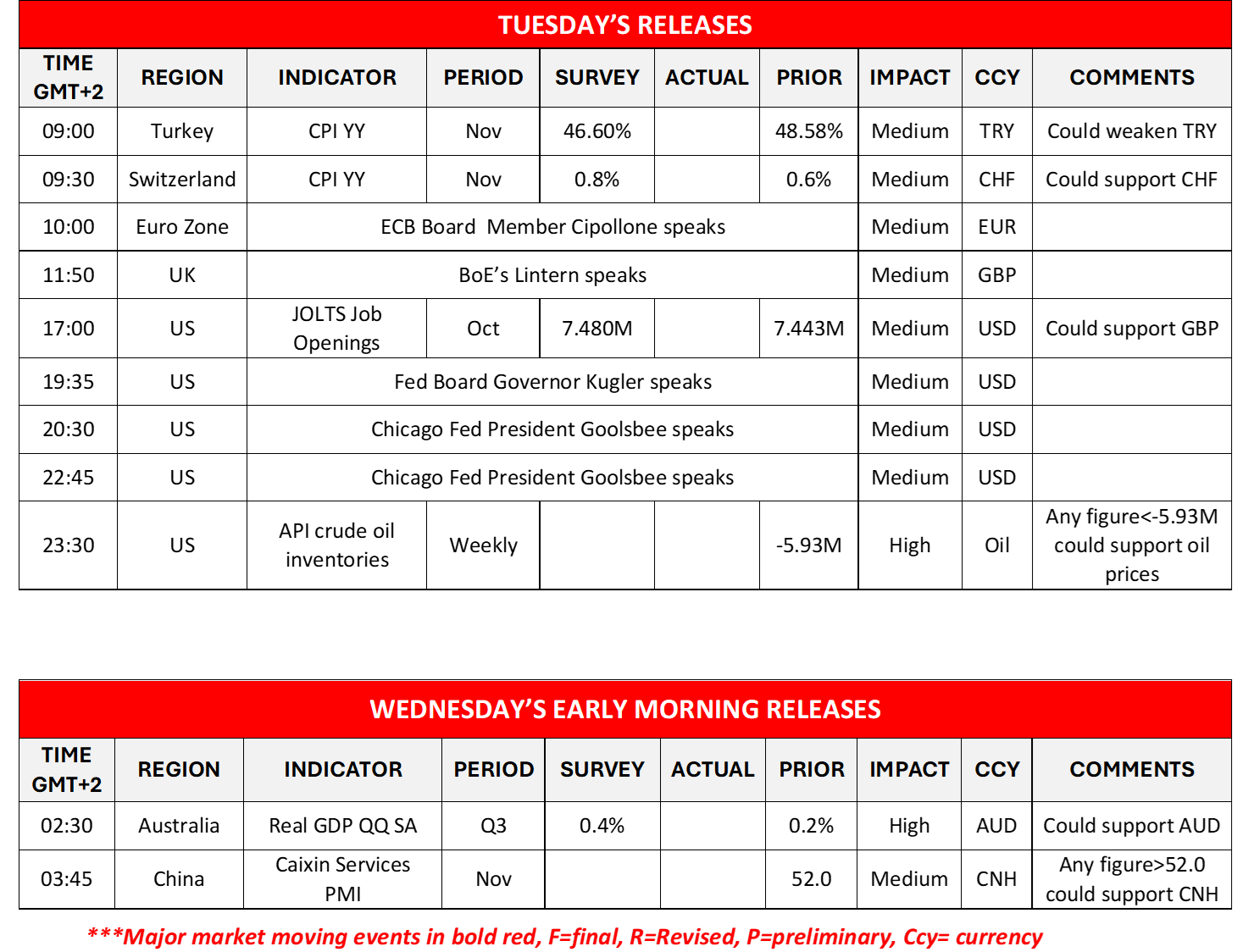

In today’s European session, we get Turkey’s and Switzerland’s CPI rates for November while ECB’s Cipollone and BoE’s Lintern are scheduled to speak. In the American session, we get the US JOLTS job openings for October while later on oil traders may be more interested in the release of the API US weekly crude oil inventories figure. In tomorrow’s Asian session, we note the release of China’s Caixin services PMI figure for November.

USD/JPY Daily Chart

- Support: 149.40 (S1), 146.95 (S2), 143.45 (S3)

- Resistance: 151.35 (R1), 154.65 (R2), 158.45 (R3)

AUD/USD デイリーチャート

- Support: 0.6440 (S1), 0.6350 (S2), 0.6270 (S3)

- Resistance: 0.6550 (R1), 0.6640 (R2), 0.6715 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。