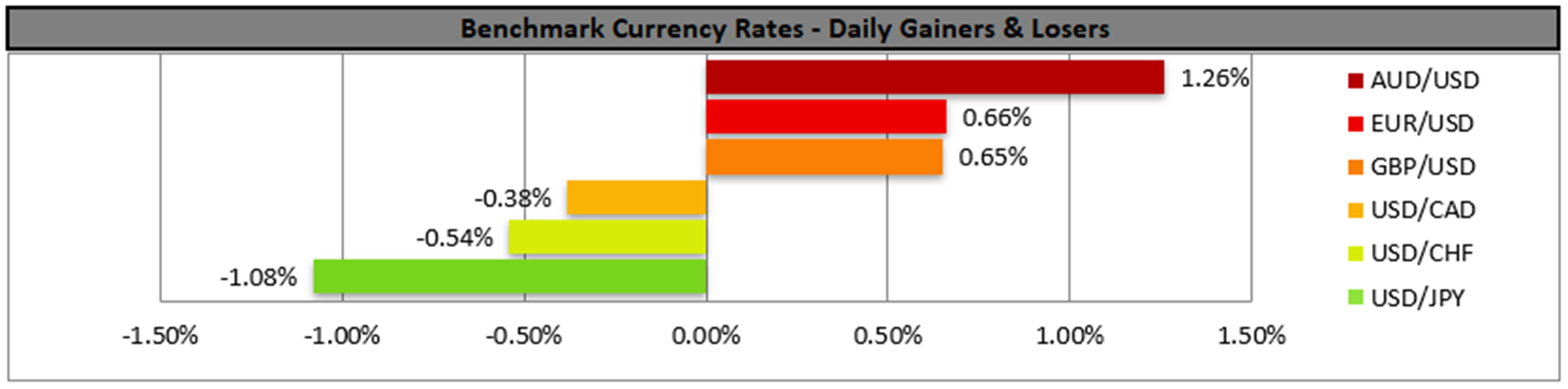

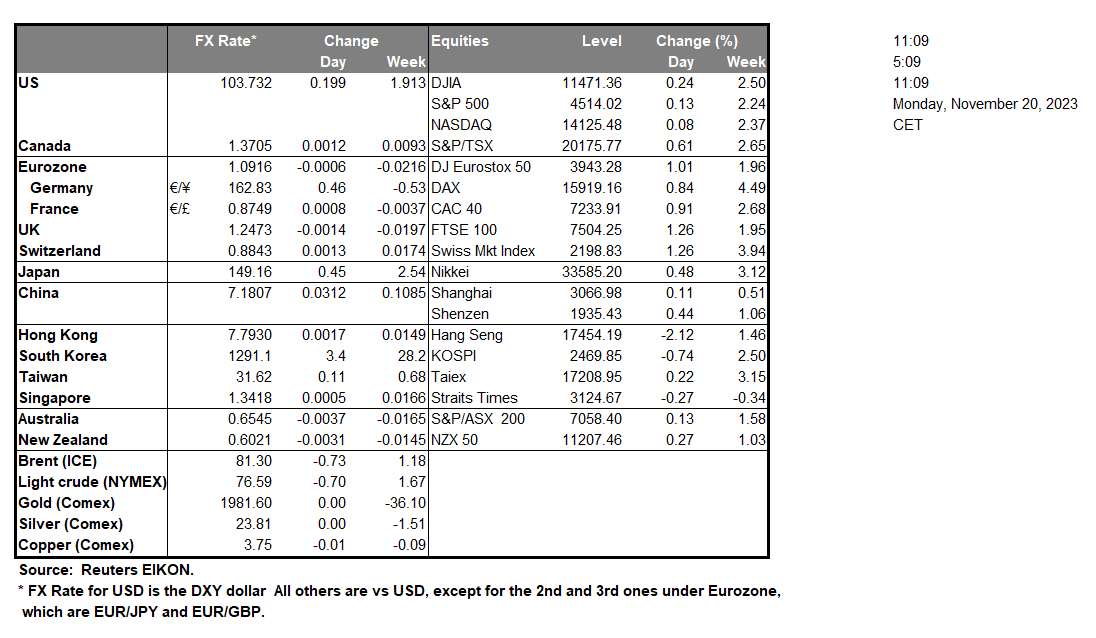

In an easy-going Monday, the USD continued to weaken against its counterparts, as the market’s expectations that the Fed has reached its terminal rate and its next move is to be a rate cut next year, tended to intensify. Fed policymakers tended to remain rather split, yet we see the balance of power increasingly tilting towards the cautious side, which is in accordance with the market’s expectations. Currently, Fed Fund Futures tend to imply that the market expects the bank to remain on hold until May 24 and proceed with a rate cut, a scenario though that may be over-optimistic on the market’s side. For today given the lack of high-impact financial releases from the US, we expect the USD to be led by fundamentals.

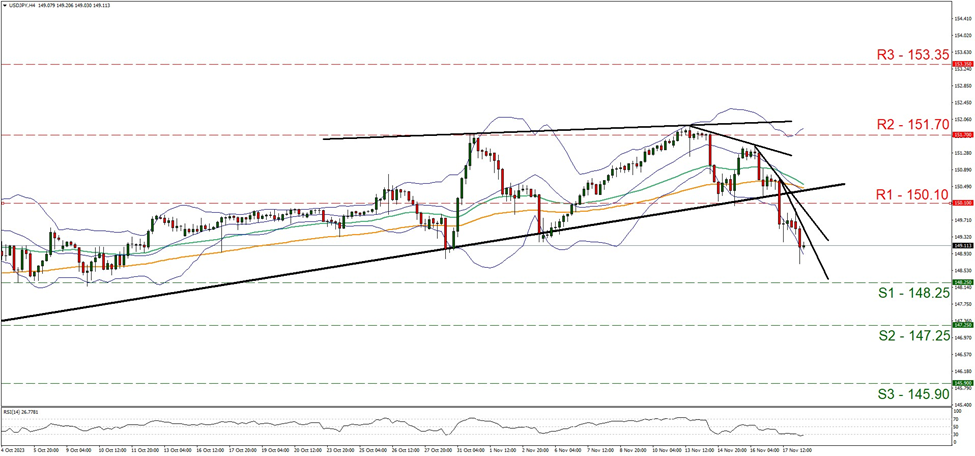

Τhe USD retreated against the JPY and the pair broke the 150.10 (R1) support line, now turned to resistance. We tend to maintain a bearish outlook for the pair, as long as it’s price action remains below the downward trendline which steepened its slope since the 17 of November. Furthermore the RSI indicator is just below the reading of 30, implying a strong bearish sentiment, yet may also be warning that the pair may have reached oversold levels and may be ripe for a correction higher. Similar signals come from the fact that the price action is flirting with the lower Bollinger band. Should the bears maintain control over the pair, we may see it breaking the 148.25 (S1) support line and aim for the 147.25 (S2) support level. For a bullish outlook, we would require the pair to break the prementioned downward trendline in a first signal that the downward motion has been interrupted, break the 150.10 (R1) resistance line and aim for the 151.70 (R2) level.

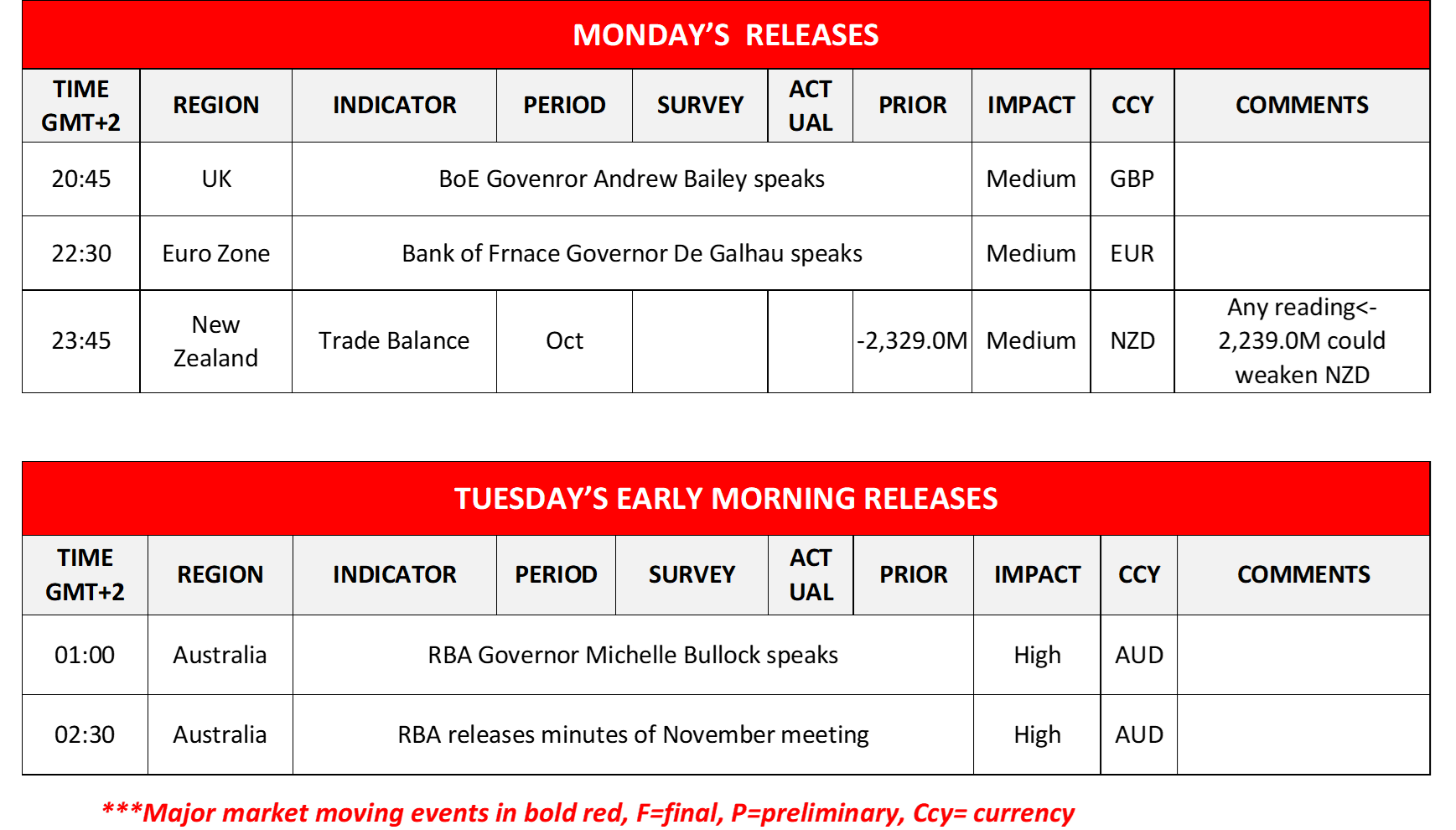

Aussie traders on the other hand are expected to keep a close eye on the release of RBA’s November meeting minutes during tomorrow’s Asian session while also RBA Governor Bullock is scheduled to speak. Should the document include a more hawkish tone we may see the Aussie getting some support, while a positive market sentiment may also provide some support to the riskier AUD.

AUD/USD rose and during today’s Asian session broke the 0.6515 (S1) resistance line, now turned to support. We tend to maintain a bullish outlook for AUD/USD as long as the upward trendline incepted since the 14 of November remains intact. The RSI indicator is at the reading of 70, implying a strong bullish sentiment yet may also be a warning that the pair is near overbought levels and may be ripe for a correction lower. Similar signals are being sent by the price action flirting with the upper Bollinger band. Should the bulls maintain control over the pair, we may see AUD/USD breaking the 0.6620 (R1) resistance line and aim for the 0.6725 (R2) resistance level. Should the bears take over, we may see AUD/USD breaking the prementioned upward trendline, the 0.6515 (S1) support line and aim for the 0.6400 (S1) level.

その他の注目材料

No major financial releases are expected today, yet we note the release of New Zealand’s trade data for October just before the Asian session starts. On a monetary level, we note that BoE Governor Andrew Bailey and Bank of France Governor De Galhau are scheduled to speak.

今週の指数発表:

We make a late start on Tuesday with Canada’s CPI rates for October, and on Wednesday we get UK’s CBI trends for November, from the Eurozone the preliminary Consumer confidence for the same month and from the US, October’s durable goods orders and the weekly initial jobless claims figure. On Thursday we get November’s preliminary PMI figures of Australia, France, Germany, the Eurozone and the UK, as well as Norway’s GDP rate for Q3 and on Friday we get the November preliminary PMI figures of Japan and the US as well as Japan’s CPI rates for October, Germany’s Ifo indicators for November and Canada’s September retail sales growth rate.

USD/JPY 4 Hour Chart

Support: 148.25 (S1), 147.25 (S2), 145.90 (S3)

Resistance: 150.10 (R1), 151.70 (R2), 153.35 (R3)

AUD/USD 4時間チャート

Support: 0.6515 (S1), 0.6400 (S2), 0.6285 (S3)

Resistance: 0.6620 (R1), 0.6725 (R2), 0.6820 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。