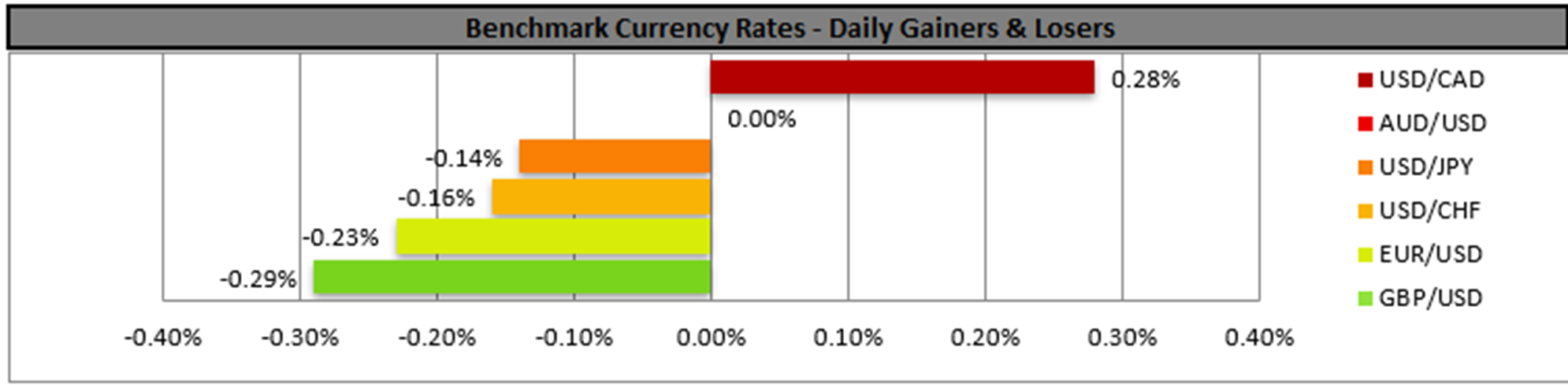

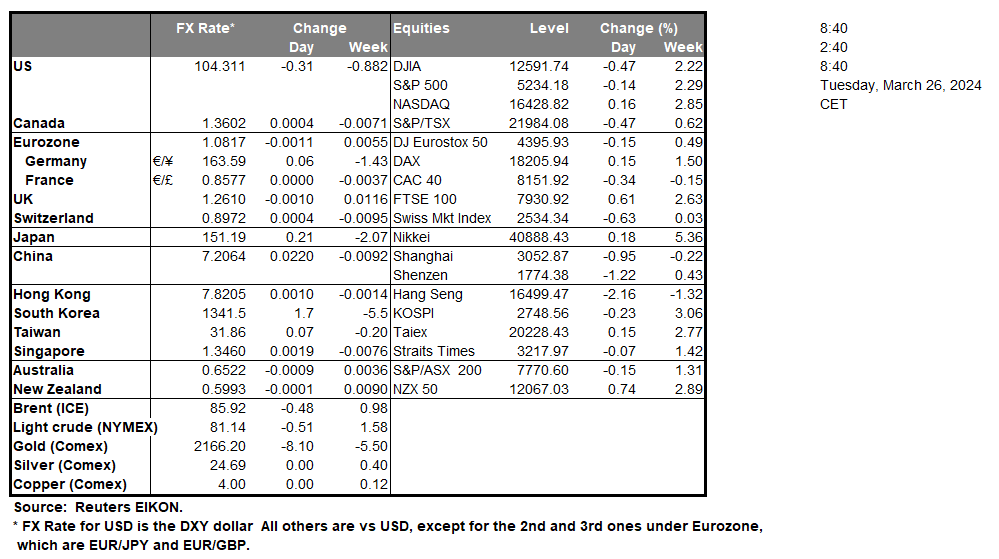

On an easy Monday Asian session, we note that the USD calmed down after Thursday’s and Friday’s rally. In the FX market, we note that Japanese Government officials stated that JPY’s weakness does not reflect current fundamentals, which some regarded as a threat for a possible market intervention to the Yen’s rescue. US stock markets on the other ended the week in the greens yet on Friday sent out some mixed signals. We note that Reddit on its first trading day on Friday, had a good start yet seemed to show some bearish tendencies later on. Gold’s price, on the other hand, seems to have stabilized after Friday’s drop. Finally, oil prices seem to have stabilized somewhat as the week is about to begin.

その他の注目材料

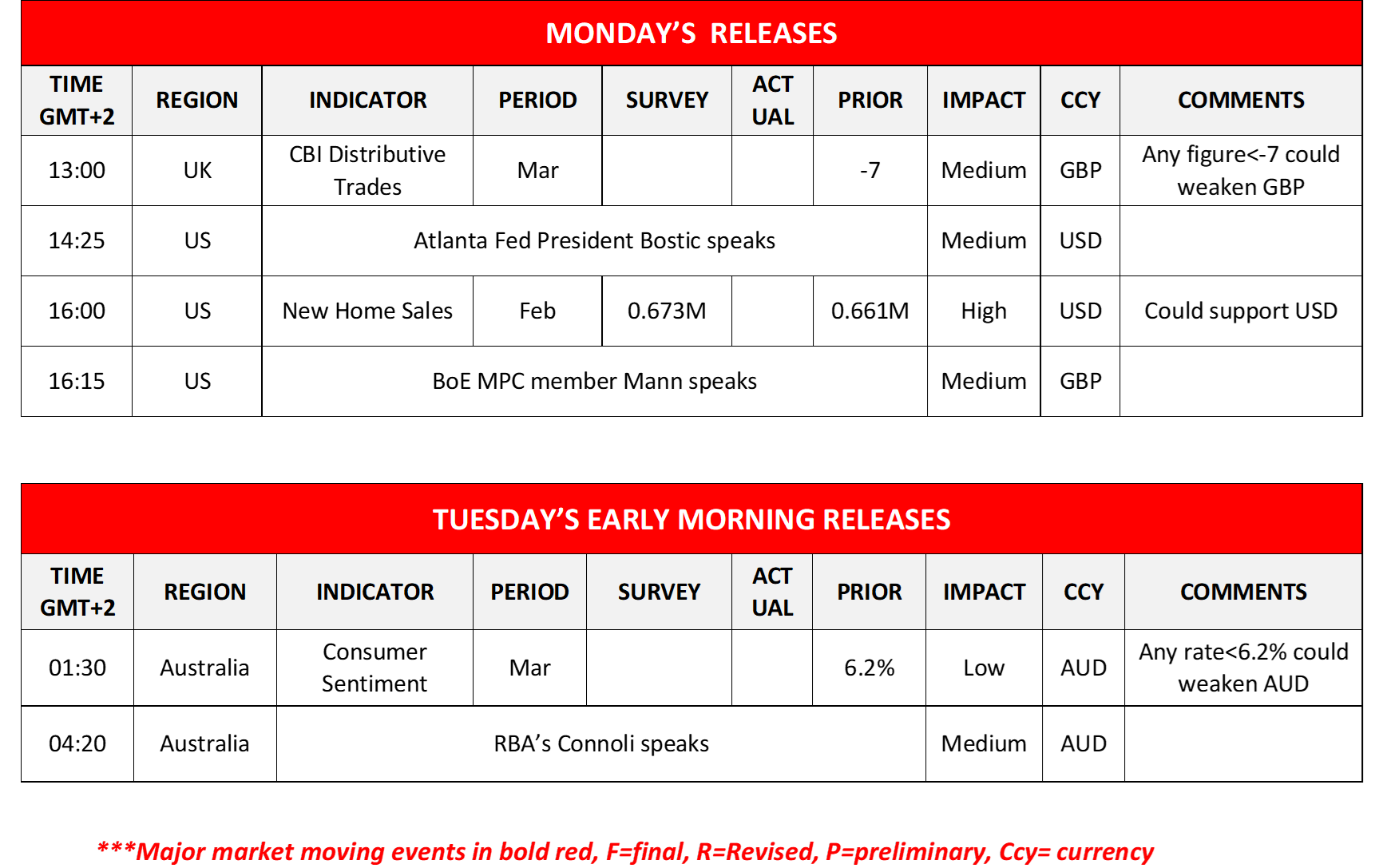

Today in the European session we note the release of the UK’s CBI distributive trades for March. In the American session, we note the release of the US New Home Sales for February while on the monetary front, we note that Atlanta Fed President Bostic and BoE MPC member Mann are scheduled to speak. During tomorrow’s Asian session, we note the release of Australia’s consumer sentiment for March while RBA’s Ellis Connoli speaks. For the time being, we note that the USD seems to remain the main market mover in the FX market and we expect the greenback to maintain the initiative.

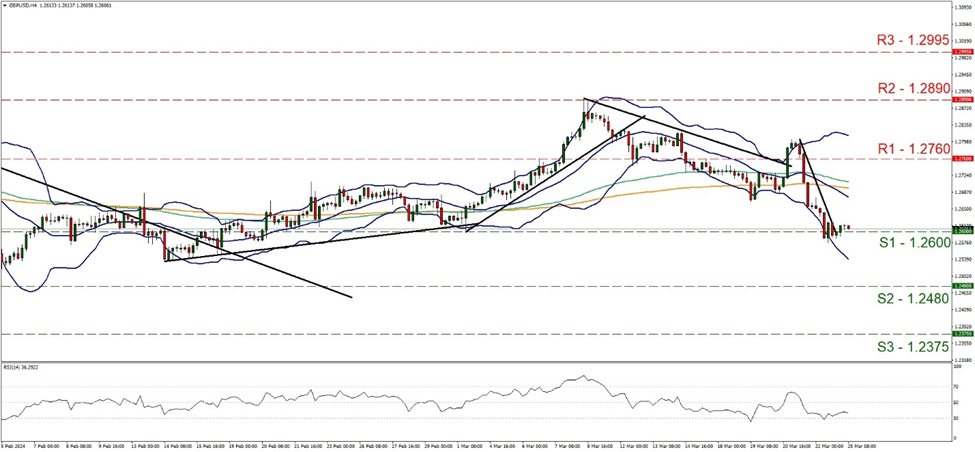

On a technical level the USD strengthened against the GBP, causing cable to drop, yet the drop was halted at the 1.2600 (S1) support line. Despite the drop and for the time being, we tend to maintain a bias for the sideways motion to continue, yet we note that the RSI indicator remains near the reading of 30, implying a bearish predisposition. Yet for a bearish outlook, we would require the pair to break the 1.2600 (S1) support line and aim for the 1.2480 (S2) support level. Should the bulls take over, we may see the pair, reversing course, breaking the 1.2760 (R1) resistance line thus paving the way for the 1.2890 (resistance level.

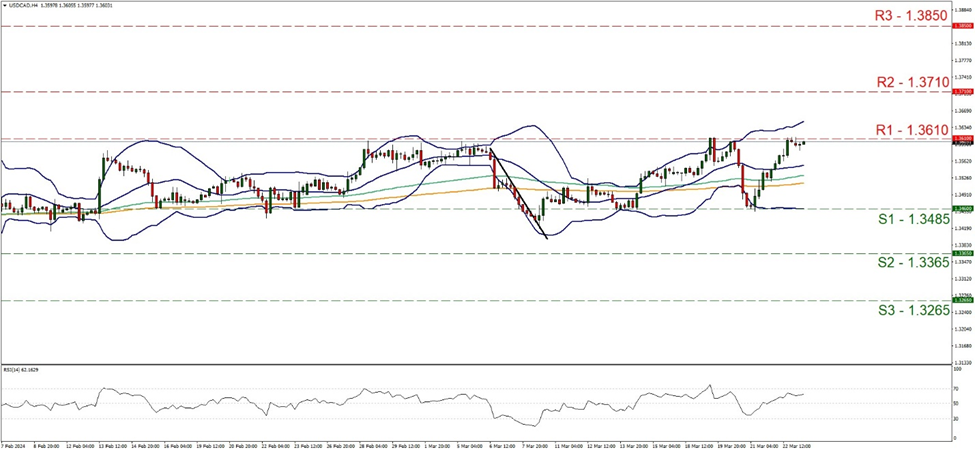

Against the CAD the USD strengthened, sending USD/CAD to the 1.3610 (R1) resistance line where the rise of the pair was halted. We view the R1 as still the upper boundary of the pair’s sideways motion. We tend to maintain our bias for the sideways motion to continue, yet note that the RSI indicator remains above the reading of 50, implying a residue of a bullish sentiment in the market for the pair. Yet for a bullish outlook, we would require the pair to break the 1.3610 (R1) resistance line and take aim if not breach the 1.3710 (R2) resistance level. On the other hand, for a bearish outlook to be adopted, the pair has to drop and break the 1.3485 (S1) support line which is the lower boundary of the current sideways motion, which would open the gates for the 1.3365 (S2) support level.

今週の指数発表

On Tuesday, we get Germany’s GfK consumer sentiment for April, the US durable goods orders growth rate for February and consumer confidence for March, while on the monetary front, we note the release of Riksbank’s interest rate decision. On Wednesday we get Australia’s CPI rate for February and the Eurozone’s business climate for March. On Thursday, we get Australia’s retail sales for February, Switzerland’s KOF indicator for March, Canada’s Business Barometer for the same month and from the US we highlight the final GDP rate for Q4, the weekly initial jobless claims figure and the final University of Michigan consumer sentiment for March, while from Canada we get the GDP rate for January and on the monetary front, we get BoJ’s summary of opinions for the March meeting. On Friday we get Japan’s Tokyo CPI rates for March and the preliminary industrial output for February, while from France we get the preliminary HIPC rate for March and from the US we get the consumption rate for February and the Core PCE price index for the same month.

USD/CAD 4時間チャート

Support: 1.3485 (S1), 1.3365 (S2), 1.3265 (S3)

Resistance: 1.3610 (R1), 1.3710 (R2), 1.3850 (R3)

GBP/USD 4時間チャート

Support: 1.2600 (S1), 1.2480 (S2), 1.2375 (S3)

Resistance: 1.2760 (R1), 1.2890 (R2), 1.2995 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。