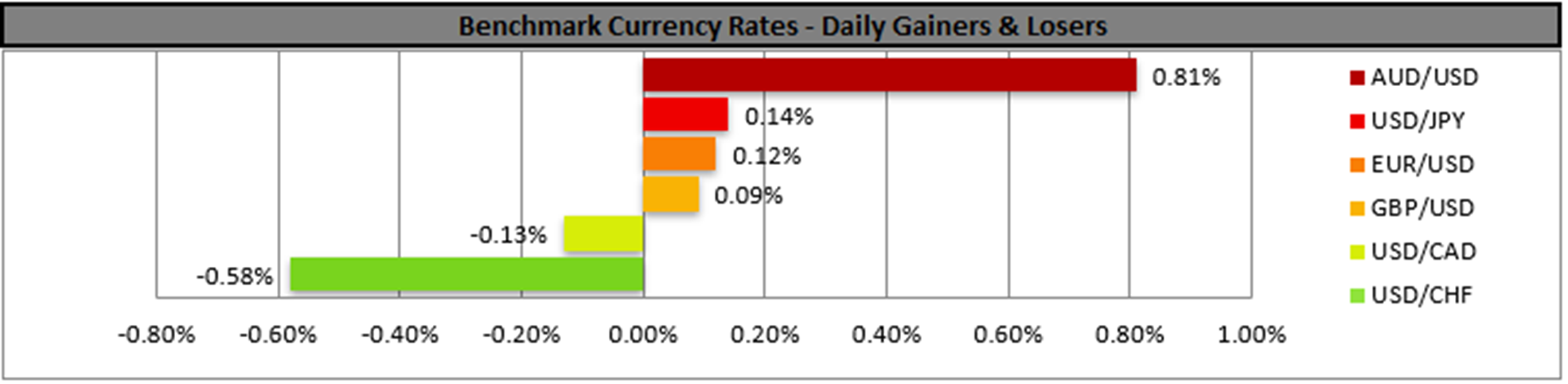

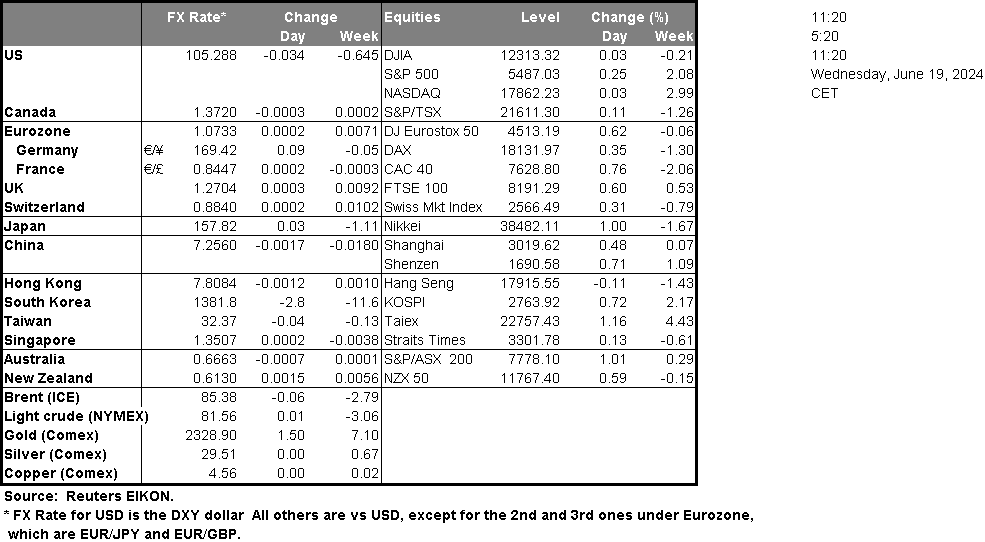

The US retail sales rate for May came in lower than expected, implying that the US consumer may be feeling the impact of the Fed’s restrictive monetary policy stance. As such, the releases may increase pressure on the Fed to ease its restrictive monetary policy stance, which in turn could weigh on the greenback. Fed Governor Kugler during her speech yesterday, stated that if the economy evolves as she is expecting, “it may be appropriate to begin easing policy sometime later this year”. However, she did also state that it could take “quarters” for the data to support a rate cut. In the US Equities markets, a Boeing whistleblower stated yesterday per CNN that he was told by his supervisors at Boeing (#BA) to conceal evidence that Boeing was cutting corners by losing track of parts that have been labeled as non-conforming or not up to design standards. The recent announcement casts another dark spot on the company’s already diminished safety credibility. Thus, could weigh on the company’s stock price. In Canada, the BoC is set to release its June monetary policy meeting minutes during today’s late American session. Should the minutes imply that BoC policymakers are set to continue cutting interest rates, it could weigh on the Loonie. Over in the UK, the CPI rates for May came in as expected, with the exception of the nation’s headline CPI rate on a mom level which came in lower than expected at 0.3% versus the expected rate of 0.4%. Nonetheless, when looking at the bigger picture, it could be implied that inflationary pressures in the UK economy appear to be easing, which in turn could increase pressure on the BoE to ease its monetary policy stance. Such a scenario could potentially weigh on the pound.

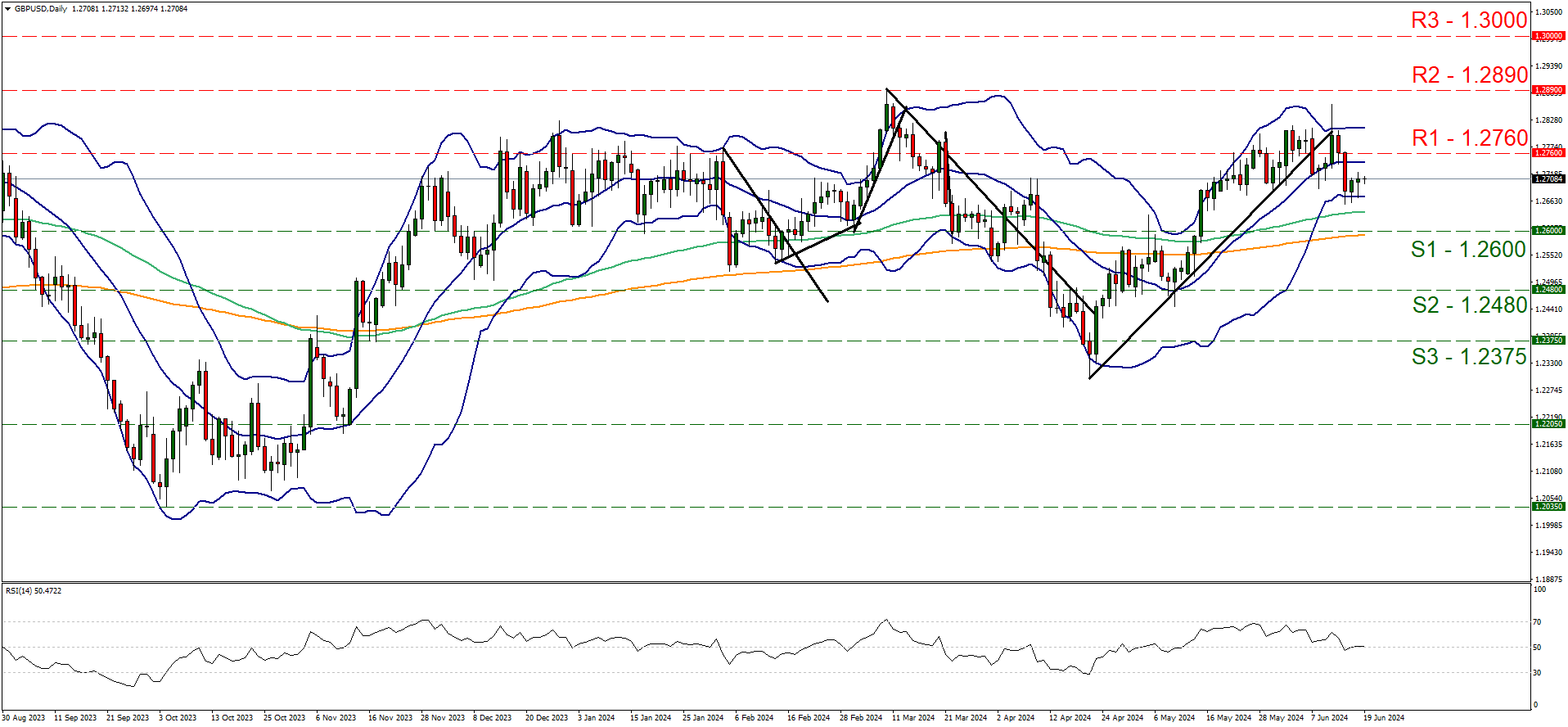

GBP/USD appears to be moving in a sideways fashion. We opt for a neutral outlook for the commodity and supporting our case is the RSI indicator below our chart which currently registers a figure of 50, implying a neutral market sentiment. For our sideways bias to continue, we would require the commodity to remain confined within the sideways moving channel defined by the 1.2600 (S1) support level and the 1.2760 (R1) resistance line. On the other hand, for a bearish outlook we would require a clear break below the 1.2600 (S1) support level, with the next possible target for the bears being the 1.2480 (S2) support line. Lastly, for a bullish outlook, we would require a clear break above the 1.2760 (R1) resistance line with the next possible target for the bulls being the 1.2890 (R2) resistance level.

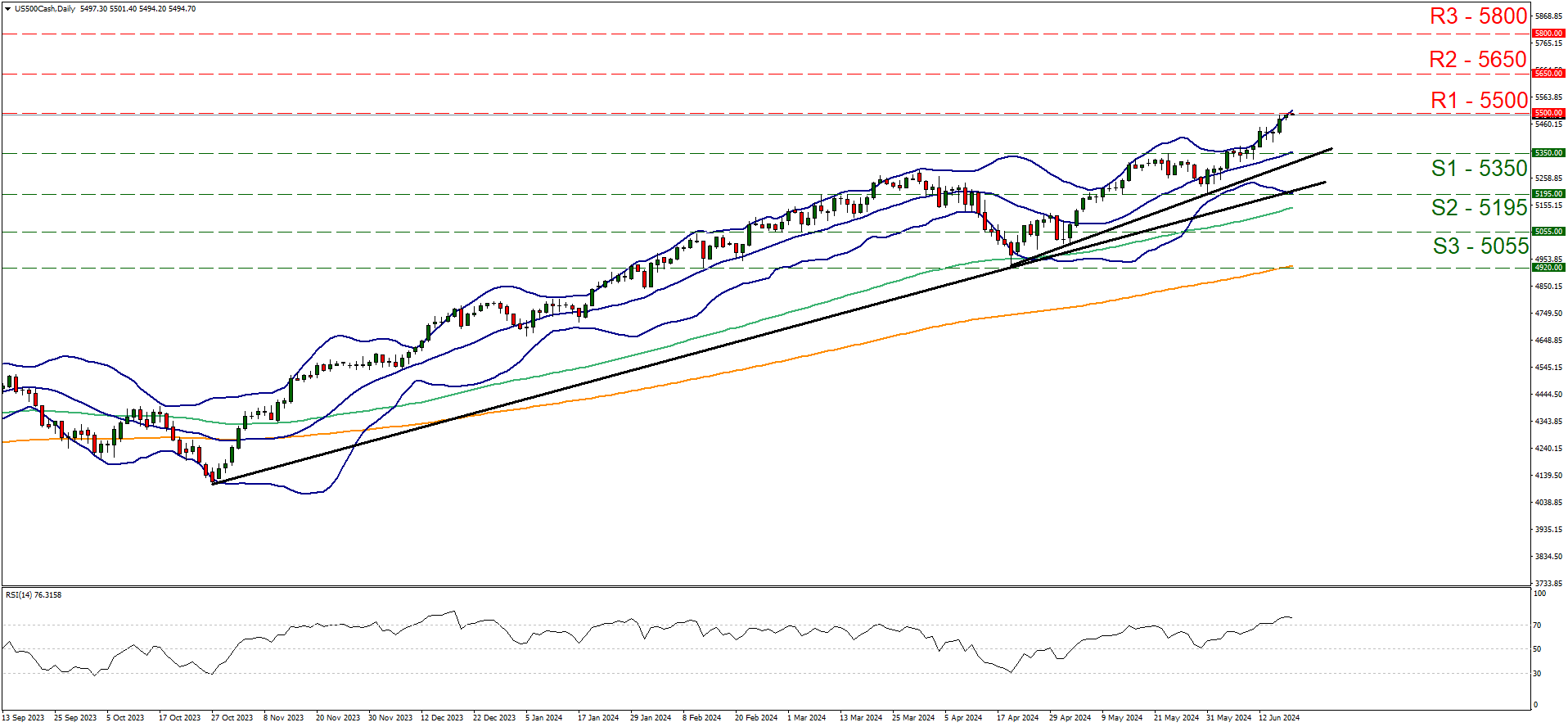

US500 appears to be moving in a upwards fashion, with the index currently testing the 5500 (R1) resistance line. We maintain a bullish outlook for the index and supporting our case is the RSI indicator below our chart which is currently above the figure of 70, implying a strong bullish market sentiment. However, the RSI indicator being above the figure of 70, may also imply that the index is overbought and may be due a market correction to lower ground. Nonetheless, for our bullish outlook to continue, we would require a clear break above the 5500 (R1) resistance line, with the next possible target for the bulls being the 5650 (R2) resistance level. On the flip side for a sideways bias we would require the index to remain confined between the 5350 (S1) support level and the 5500 (R1) resistance line. Lastly, for a bearish outlook, we would require a clear break below the 5350 (S1) support line with the next possible target for the bears being the 5195 (S2) support level.

本日のその他の注目点

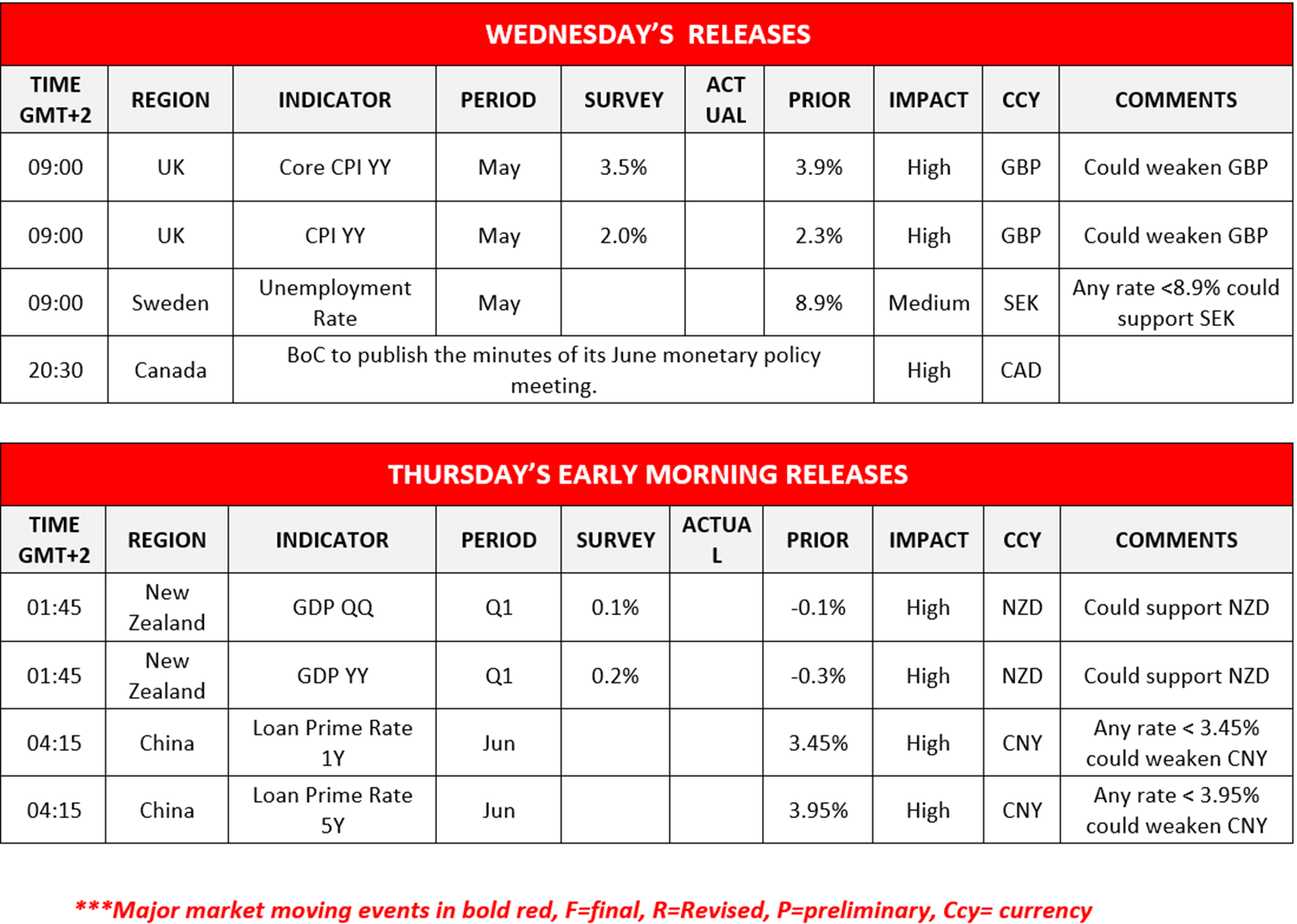

Today we note the release of the UK’s CPI rates for May, followed by Sweden’s unemployment rate for May as well. In tomorrow’s Asian session, we note the release of New Zealand’s GDP rates for Q1. On a monetary level, we note that in today’s American session, the Bank of Canada is set to release its June monetary policy meeting minutes. In tomorrow’s Asian session, we are noting the PBOC’s interest rate decision.

GBP/USD Daily Chart

• Support: 1.2600 (S1), 1.2480 (S2), 1.2375 (S3)

• Resistance: 1.2760 (R1), 1.2890 (R2), 1.3000 (R3)

S&P 500 Daily Chart

• Support: 5350 (S1), 5195 (S2), 5055 (S3)

• Resistance: 5500 (R1), 5650 (R2), 5800 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。