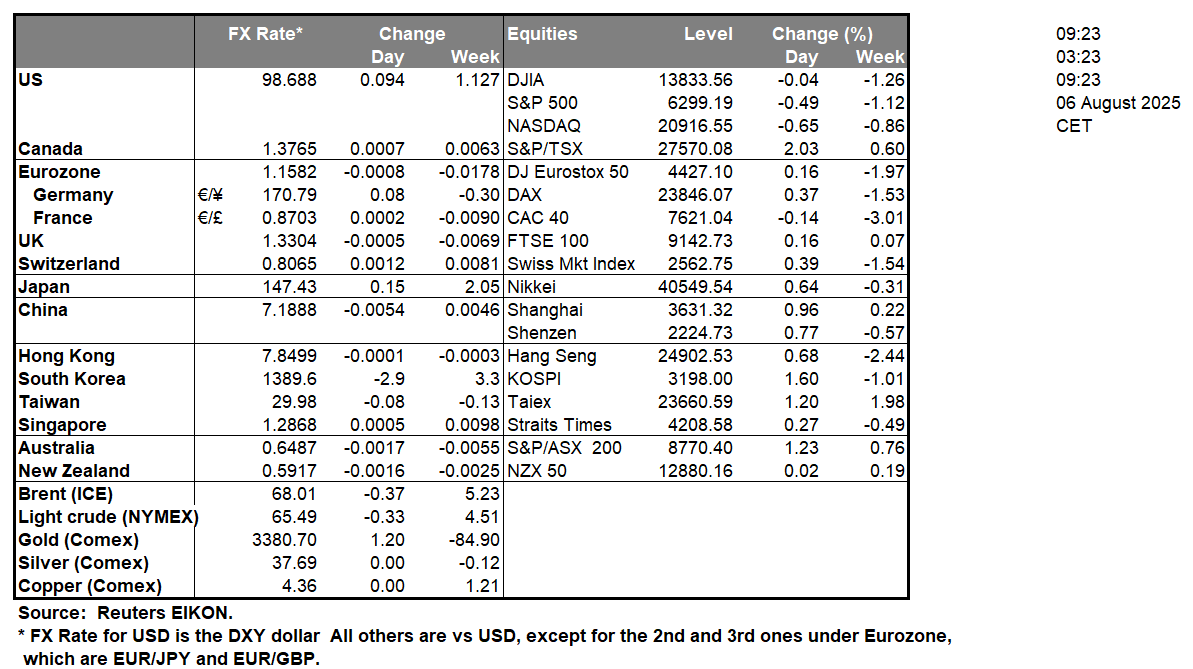

The greenback remained relatively stable against its counterparts yesterday, implying a wait-and-see position of the market. On a monetary level, we note the announcement by US President Trump that he has reached a short list of four for the replacement of Fed Chairman Powell. The nominee is to be announced by the end of the week and should he/she be leaning on the dovish side and seems to be willing to adhere to Trump’s wishes, could weigh on the USD. Interestingly enough, the US President has ruled out US Treasury Secretary Bessent as a possible replacement of Fed Chairman Powell. Also, the US President has to fill the vacancy of Fed Board Governor Kugler, who resigned and the two could coincide in the sense that the replacement of Kugler may also be named as the incoming Chairman. Overall, the Fed’s independence is at risk and market worries about the issue could weigh on the USD.

Furthermore, we note the release of the US non-manufacturing PMI figure for July yesterday. The indicator’s reading dropped despite being expected to rise, implying a flattening of economic activity in the sector. We should also bear in mind the drop of the ISM manufacturing PMI figure for July as released in July, which implied a contraction of economic activity in the sector. Both combined tend to generate worries for the outlook of the US economy and thus may weigh on USD fundamentally.

On the trade wars front, we note Trump’s intentions to substantially raise the current 25% US tariffs imposed on Indian products, given that Indian purchases of Russian oil fuel the war in Ukraine. The US President also highlighted his intentions to impose tariffs on pharmaceuticals imported in the US, which are to gradually rise to 250% over the next two and a half years, but also on semiconductors. Should we see trading tensions being elevated, we may see them weighing on the USD.

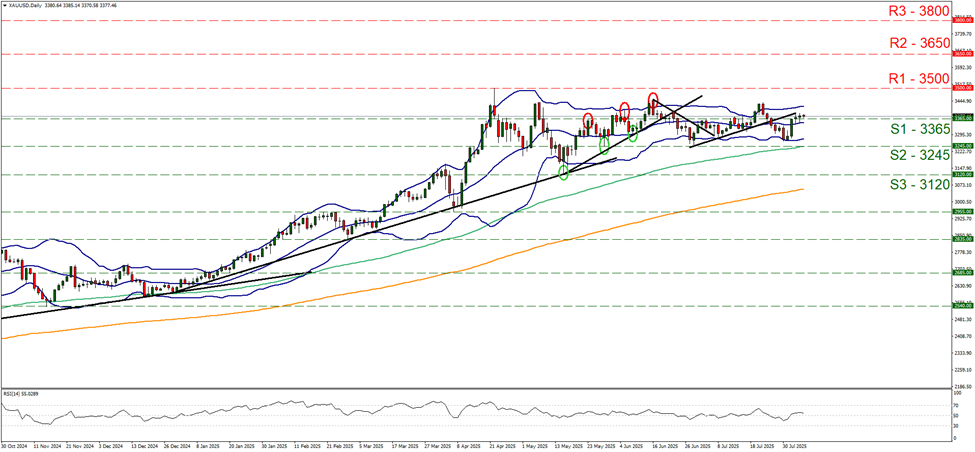

Gold’s price managed to remain above the 3365 (S1) support line. Yet the Bollinger bands remain tight and the RSI indicator continues to remain close to the reading of 50, both rendering any possible bullish tendencies at the current stage as unconvincing, hence we maintain for the time being our bias for the sideway motion to continue. Should the bulls take over, we may see gold’s price start aiming if not reaching for the 3500 (R2) resistance level, which is an All Time High for gold’s price. Should the bears take over, we may see the pair breaking the 3365 (S1) support line thus opening the gates for the 3245 (S2) support level.

その他の注目材料

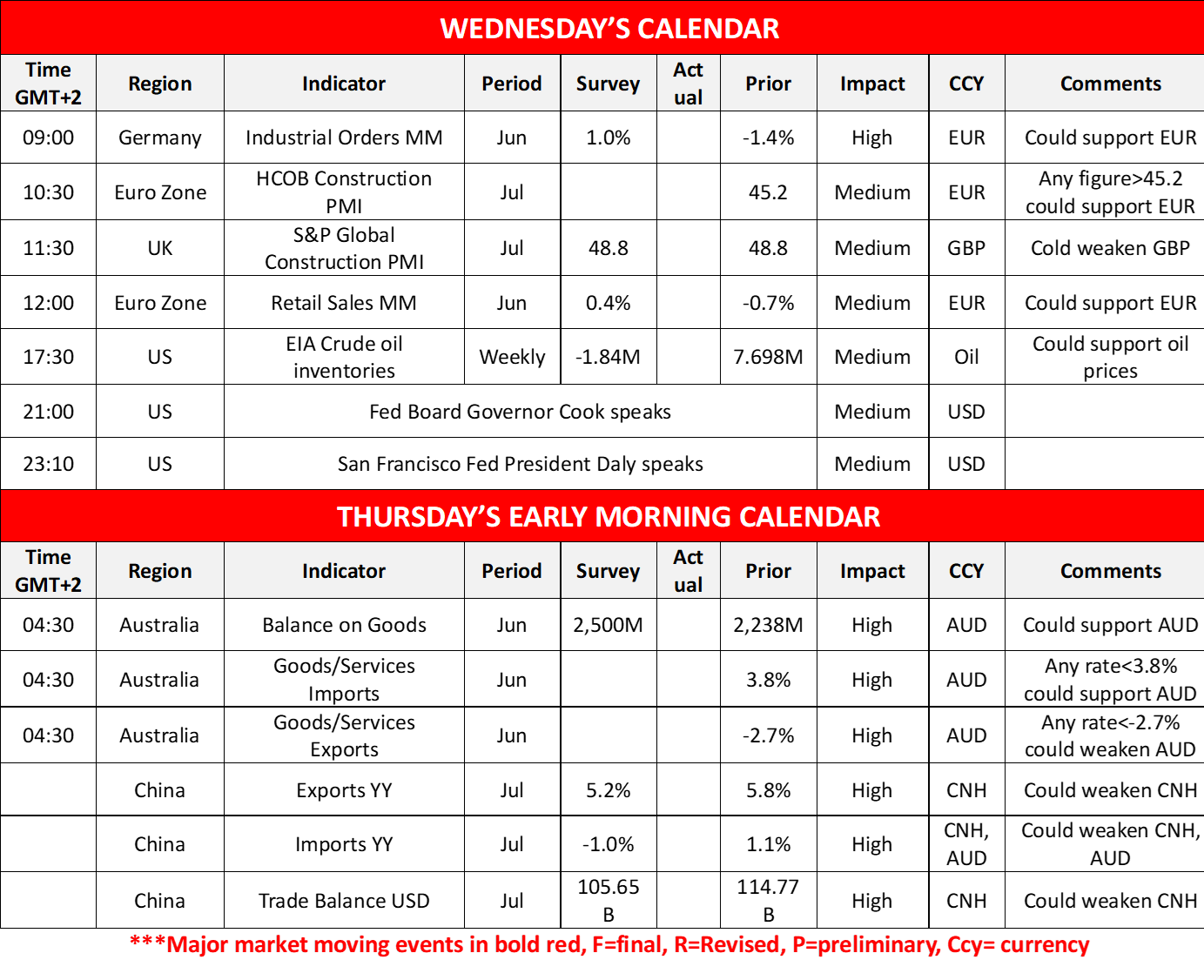

Today we get Germany’s industrial output for June, the Euro Zone’s and the UK’s July construction PMI figures, Euro Zone retail sales for June and oil traders may be more interested in the release of the weekly EIA crude oil inventories figure. On a monetary level, we note the speeches of Fed Board Governor Cook and San Francisco Fed President Daly in the late American session. In tomorrow’s Asian session, we get China’s trade data for July and we highlight Australia’s trade data for June.

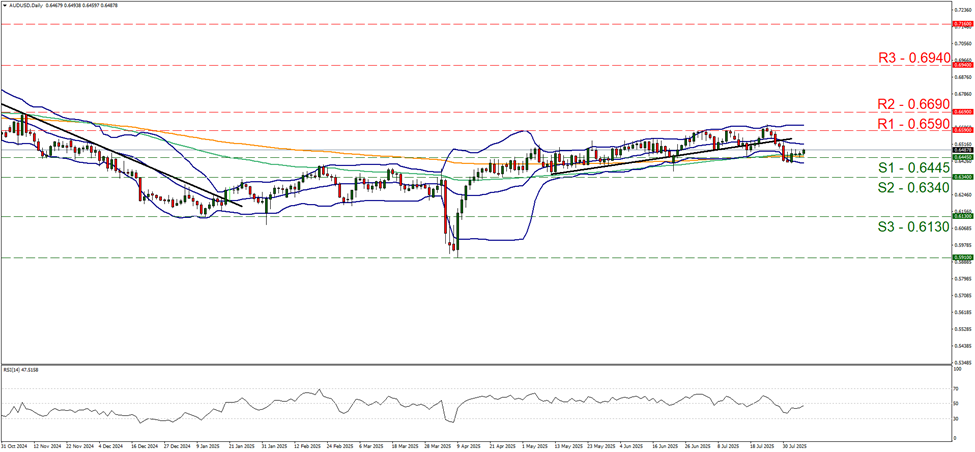

AUD/USD remained in a tight sideways motion just above the 0.6445 (S1) support line, enjoying some slight support in today’s Asian session. We tend to maintain our bias for the pair’s sideways motion to continue, despite a slight widening of the Bollinger bands and given that the RSI indicator has risen nearing the reading of 50, implying a further easing of the bearish market sentiment for the pair. For a bullish outlook, we would require the pair to clearly break the 0.6590 (R1) resistance line and start aiming for the 0.6690 (R2) resistance level. For a bearish outlook, we would require the pair to break the 0.6445 (S1) support line, which is currently the lower boundary of the pair’s current sideways motion and reach if not breach the 0.6340 (S2) support level.

XAU/USD Cash Daily Chart

- Support: 3365 (S1), 3245 (S2), 3120 (S3)

- Resistance: 3500 (R1), 3650 (R2), 3800 (R3)

AUD/USD デイリーチャート

- Support: 0.6445 (S1), 0.6340 (S2), 0.6130 (S3)

- Resistance: 0.6590 (R1), 0.6690 (R2), 0.6940 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。