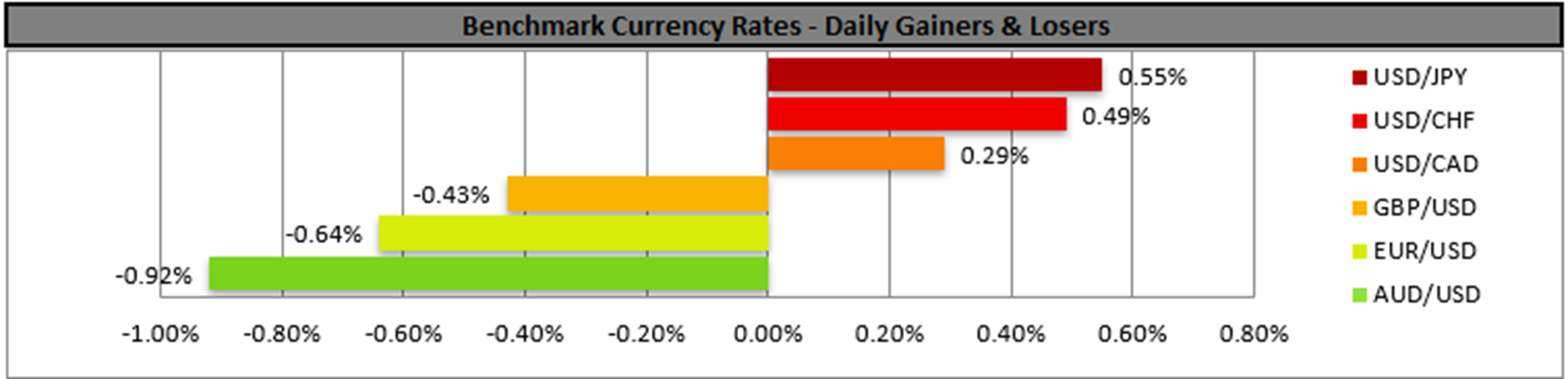

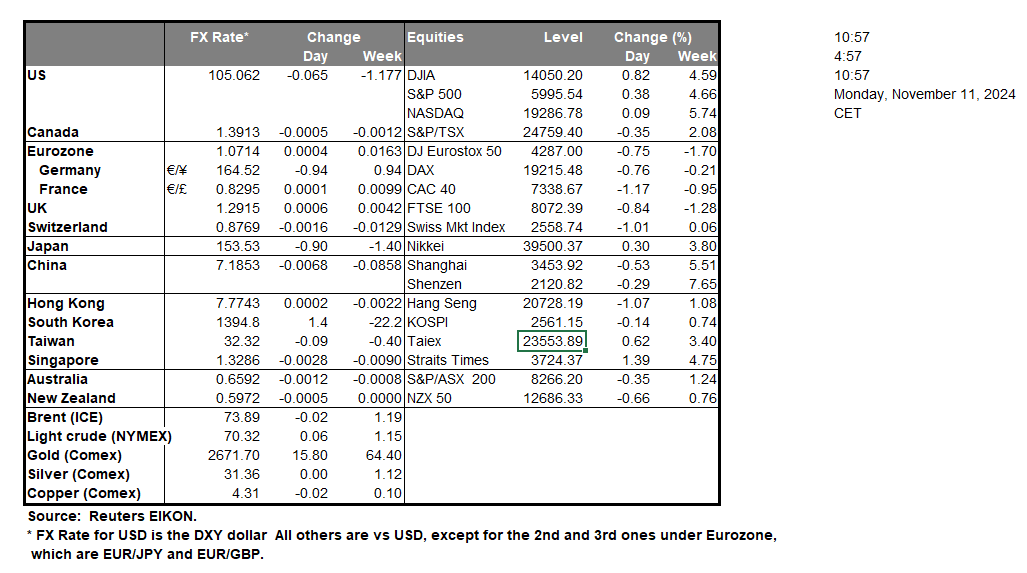

The USD tended to be supported against its counterparts in today’s Asian session as the markets turn their attention to the release of the October US CPI rates on Wednesday. We may see the market reevaluating the traction of Trump trades, given the lack of high-impact US financial releases, we may see fundamentals leading the way for the greenback.

In the land of the rising sun, BoJ’s summary of opinions for the October meeting was released. The document showed that opinions showed some divergence among some policymakers about the timing of a possible rate hike. There seems to be some hesitation for the bank to proceed with a rate hike in the December meeting, which in turn may weigh on the JPY.

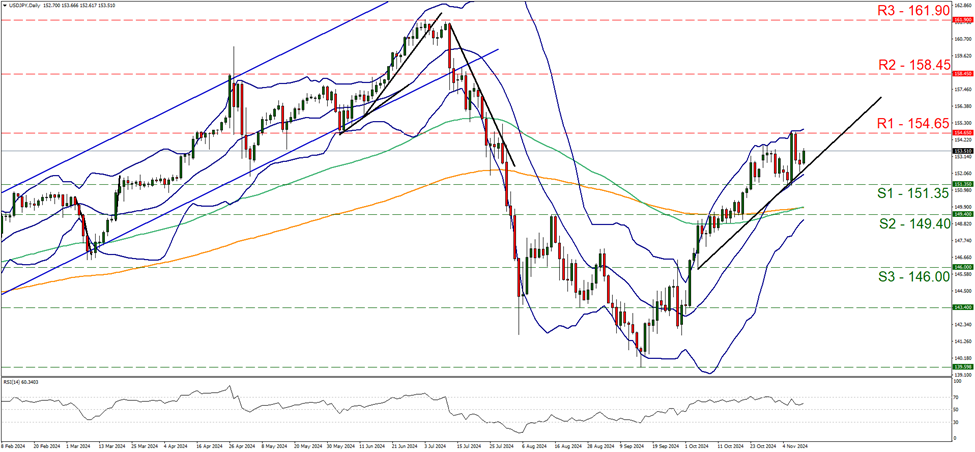

USD/JPY edged higher bouncing on the upward trendline guiding the pair since the 3rd of October, yet remained well between the 154.65 (R1) resistance line and the 151.35 (S1) support level. Given that the upward trendline remained intact, we tend to maintain our bullish outlook and we also note that the RSI indicator remains between the readings of 50 and 70, implying a bullish predisposition of the market for the pair. On the other hand we see some hesitancy on behalf of the bulls and for the bullish outlook to be maintained we would require the pair to form a higher peak than the one on the 6 of November, breaking the 154.65 (R1) resistance level thus opening the way for the 158.45 (R2) resistance base. Should the bears take over, we may see the pair breaking the prementioned upward trendline, in a first signal of an interruption of the upward movement and continue to break the 151.35 (S1) support line, thus paving the way for the 149.40 (S2) support level.

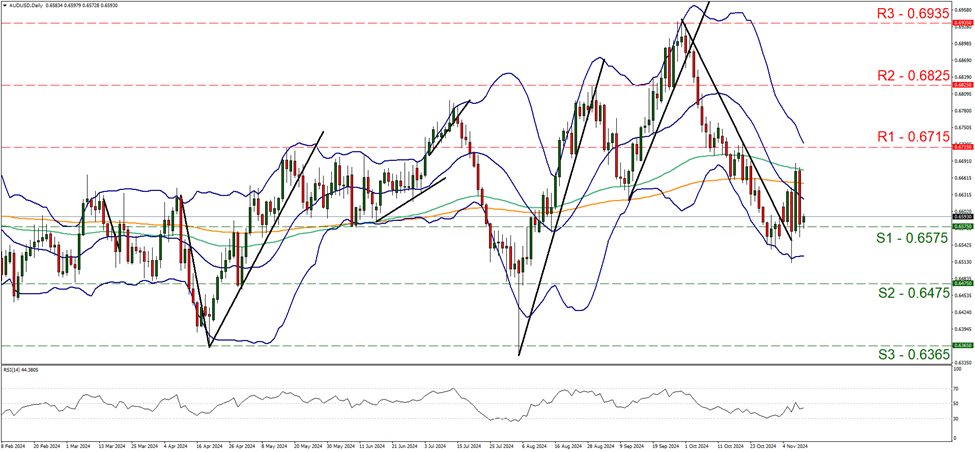

In China, October’s inflation metrics showed a slowdown of inflationary pressures at a consumer level and a deeper deflation of prices at a producer level, with both readings tending to disappoint market participants. The market’s disappointment may have been enhanced, given that the Chinese Government in the specific period, had intensified its efforts to boost the economy. Furthermore, the People’s Bank of China in its late September meeting had provided monetary support aggressively and was expected to start kicking in in October, yet that does not seem to be the case. Should we see market worries for the Chinese economy be further enhanced, we may see the market mood turning sour, weighing on riskier assets. AUD/USD had a roller-coaster rise over the past week and during today’s Asian session, tested the 0.6575 (S1) support line. Given that the downward trendline guiding the pair has been broken, we maintain a bias for a sideways, motion near the 0.6575 (S1) line. Yet some bearish tendencies seem to exist, but for a bearish outlook we would require the pair breaking the 0.6575 (S1) line and start aiming for the 0.6475 (S2) level.

Should the bulls take over we may see the pair rising and breaking the 0.6715 (R1) resistance line

その他の注目材料

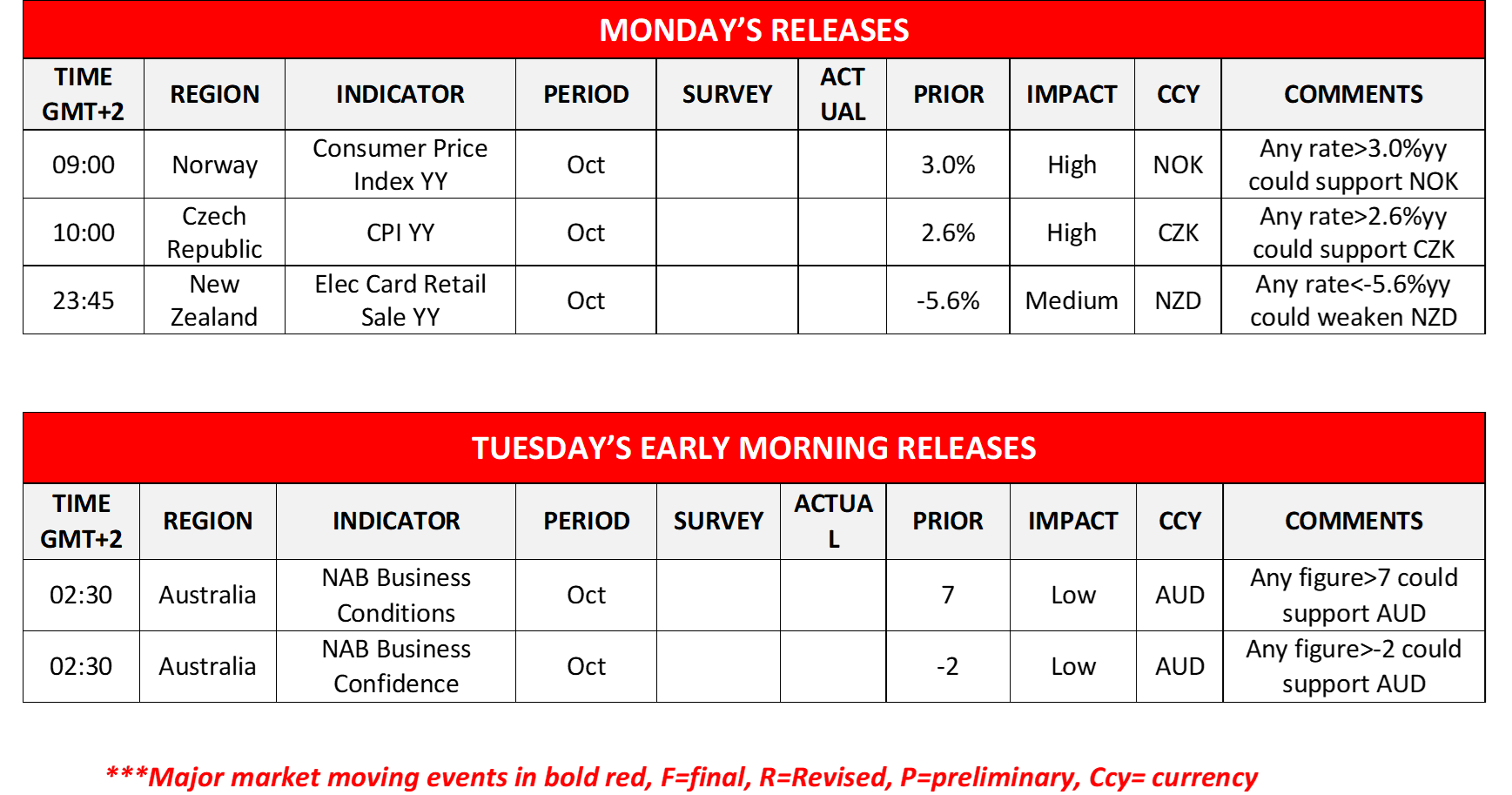

Today we get Norway’s and the Czech Republic’s CPI rates for October and New Zealand’s electronic card retail sales also for October.

今週の指数発表:

On Tuesday we get the UK’s September employment data, Germany’s November ZEW indicator and Canada’s September Building Permits. On Wednesday we note the release of Japan’s October corporate goods price and highlight the US CPI rates for the same month. On Thursday we get Australia’s employment data for October, Sweden’s CPI rates for the same month, Eurozone’s revised GDP rate for Q3 and from the US we get the initial jobless claims and October’s PPI rates. On Friday we get Japan’s GDP rate for Q3, China’s industrial output for October, the UK’s GDP rate for Q3 and the US retail sales for October.

USD/JPY Daily Chart

- Support: 151.35 (S1), 149.40 (S2), 146.00 (S3)

- Resistance: 154.65 (R1), 158.45 (R2), 161.90 (R3)

AUD/USD デイリーチャート

- Support: 0.6575 (S1), 0.6475 (S2), 0.6365 (S3)

- Resistance: 0.6715 (R1), 0.6825 (R2), 0.6935 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。