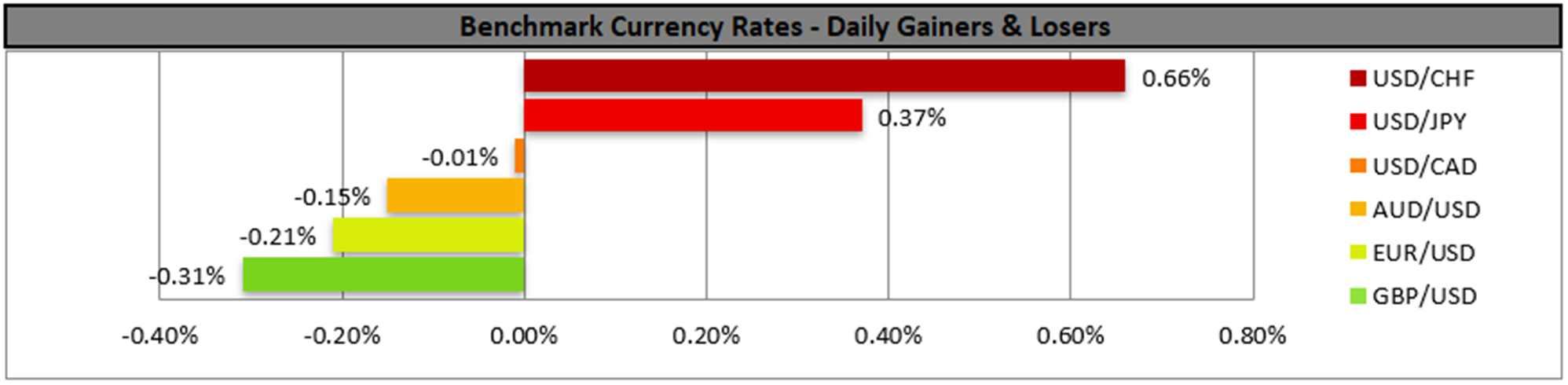

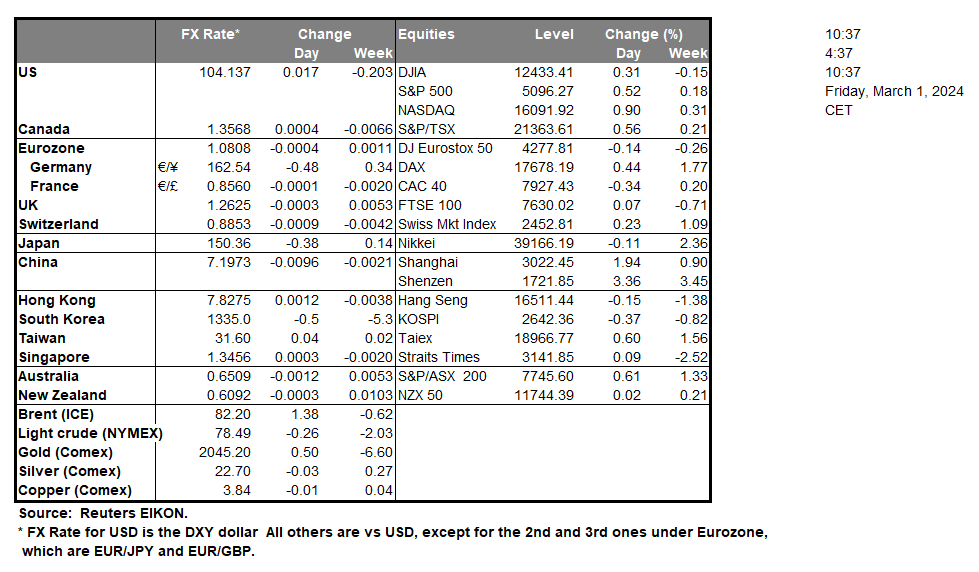

The USD rose yesterday against its counterparts despite the US Core PCE Price index ticking down as expected. Attention today turns towards the ISM manufacturing PMI figure for February and the indicators’ reading is expected to improve, which could provide some support for the USD, yet the reading is expected to remain below the cut-off point of 50, noting another contraction of economic activity albeit narrower, which may moderate any bullish reactions for the USD should the forecasts be realized. On a monetary level, we note the wide number of Fed policymakers that are scheduled to speak today and could provide some support for the USD should they imply that high rates are to remain for longer.

North of the US border Canada’s GDP rate for Q4 23, accelerated beyond market expectations reaching 1.0% qoq on an annualised basis, brightening the outlook for the Canadian economy and marking an avoidance of a recession for now.

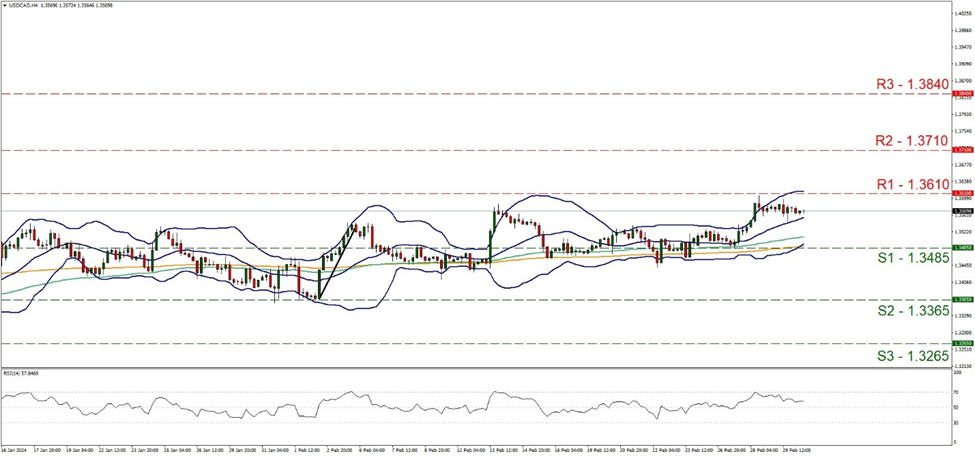

The CAD resisted the strengthening of the USD yesterday, allowing for USD/CAD to maintain its sideways motion between the 1.3610 (R1) resistance line and the 1.3485 (S1) support line. We tend to maintain our bias for the sideways motion to continue, yet note that the RSI indicator remains above the reading of 50, implying that a residue of a bullish sentiment for the pair is still present among market participants. Should buyers take over, we may see the pair breaking the 1.3610 (R1) resistance line and aim for the 1.3710 (R2) resistance level. On the other hand, should a selling interest be expressed by the market, we may see the pair breaking the 1.3485 (S1) support line and aim for the 1.3365 (S2) support level.

Across the Atlantic, Germany’s, France’s and Spain’s, preliminary HICP rates slowed down implying an easing of inflationary pressures in February, which is expected to be reflected also on the Eurozone level later today and could weaken the EUR.

On the Asian front, in China both the NBS and Caixin manufacturing PMI figures continued to send mixed signals for the level of economic activity in February, which in turn may weigh somewhat on the market sentiment and riskier assets. In the land of the rising sun, BoJ Governor Ueda stated that it was too early to conclude that inflation was close to the bank’s target reversing BoJ policymaker Takata’s comments yesterday, hence we may see JPY continue being in limbo.

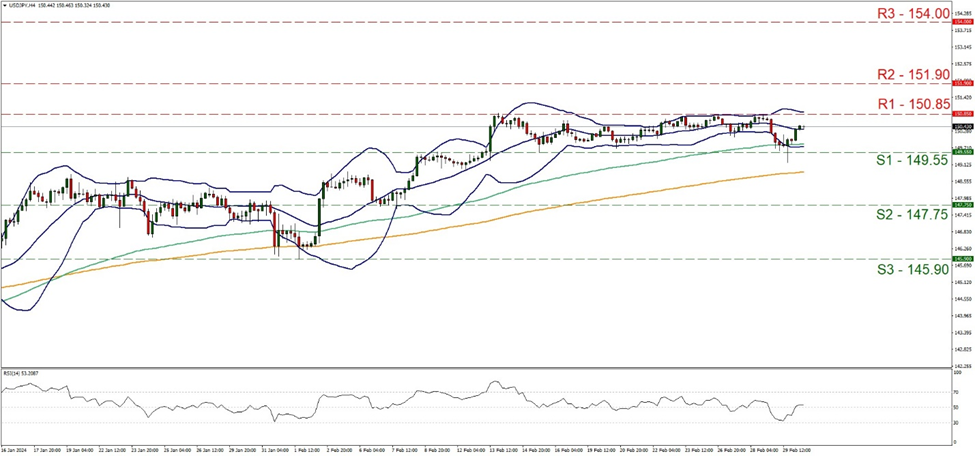

USD/JPY’s movement forced us to recalibrate the pair’s resistance and support lines, as it practically maintained a sideways motion despite an intense drop during yesterday’s Asian session. For the time being, we reinstate our past sideways movement bias given that h also the RSI indicator rose back to the reading of 50 and surpassed it yet set the new corridor containing the main body of the price action between the 150.85 (R1) resistance line and the 149.55 (S1) support line providing more leeway for USD/JPY. For a bearish outlook, we would now require the pair to break the 149.55 (S1) support line and take aim for the 147.75 (S2). On the flip side for a bullish outlook to be instigated, the pair would have to break the 150.85 (R1) resistance line and actively aim if not breach the 151.90 (R2) resistance hurdle.

その他の注目材料

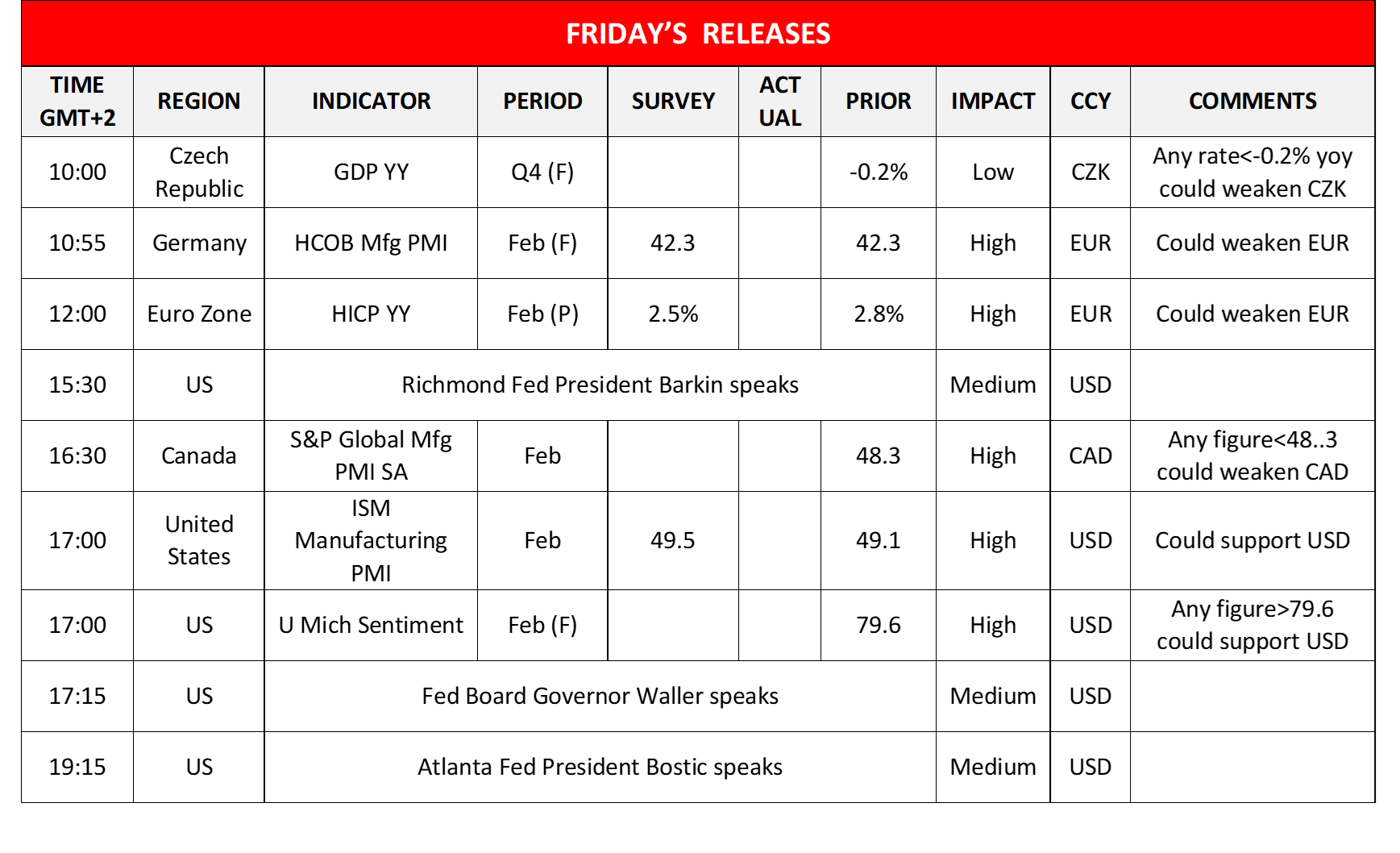

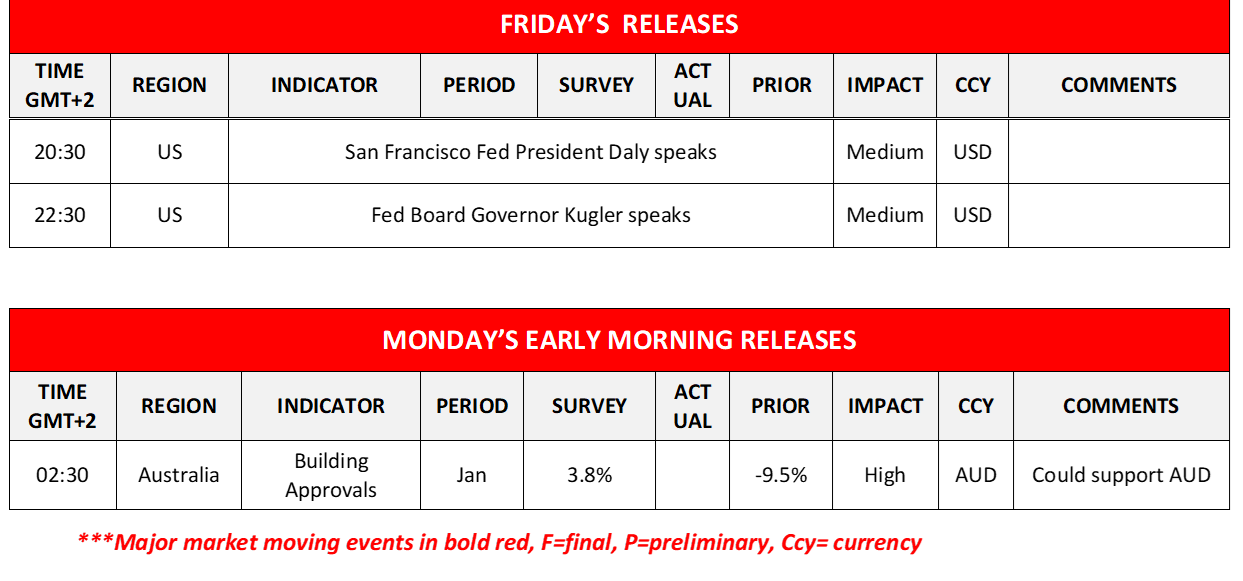

Today in the European session, we note the release of the Czech Republic’s final GDP rate for Q4 and Germany’s final manufacturing PMI figure for February. In the American session, we get Canada’s manufacturing PMI figure and from the US the final UoM consumer sentiment, both for February. On the monetary front, we note that Richmond Fed President Barkin, Fed Board Governor Waller, Atlanta Fed President Bostic, San Francisco Fed President Daly and Fed Board Governor Kugler speak. During Monday’s Asian session, we get Australia’s building approvals growth rate for January.

USD/JPY 4時間チャート

Support: 149.55 (S1), 147.75 (S2), 145.90 (S3)

Resistance: 150.85 (R1), 151.90 (R2), 154.00 (R3)

USD/CAD 4時間チャート

Support: 1.3485 (S1), 1.3365 (S2), 1.3265 (S3)

Resistance: 1.3610 (R1), 1.3710 (R2), 1.3840 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。