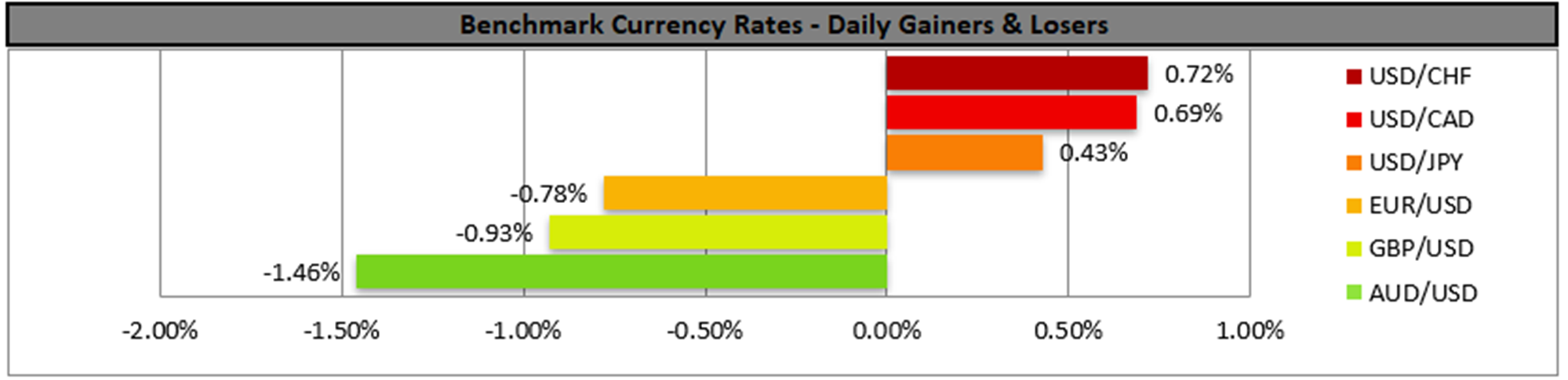

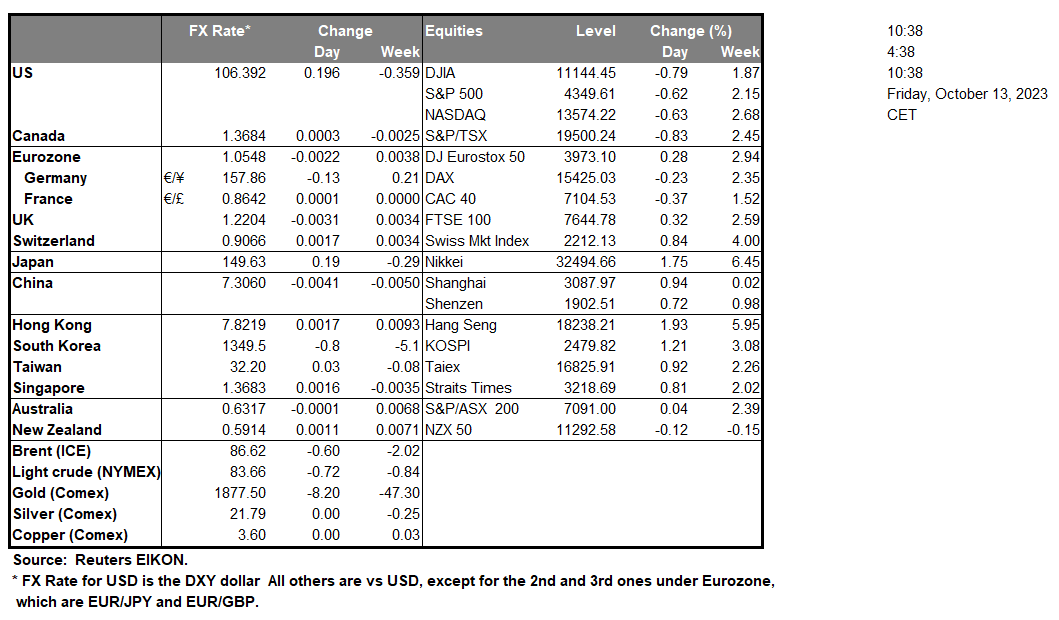

The USD tended to strengthen across the board yesterday as the US CPI rates for September refused to slow down and came in higher than expected. The release highlighted the persistence of inflationary pressures in the US economy and at this point we would like to remind our readers that the CPI rates were in line with the PPI rates for the same month and thus, showed a deeper qualitative aspect of inflation in the US. Market worries tended to intensify for the possibility of another rate hike by the Fed, given the tight US employment market as reported in the US employment report for September which was released last Friday. Attention today turns to the demand side of the US economy and the release of the preliminary University of Michigan consumer sentiment for October.

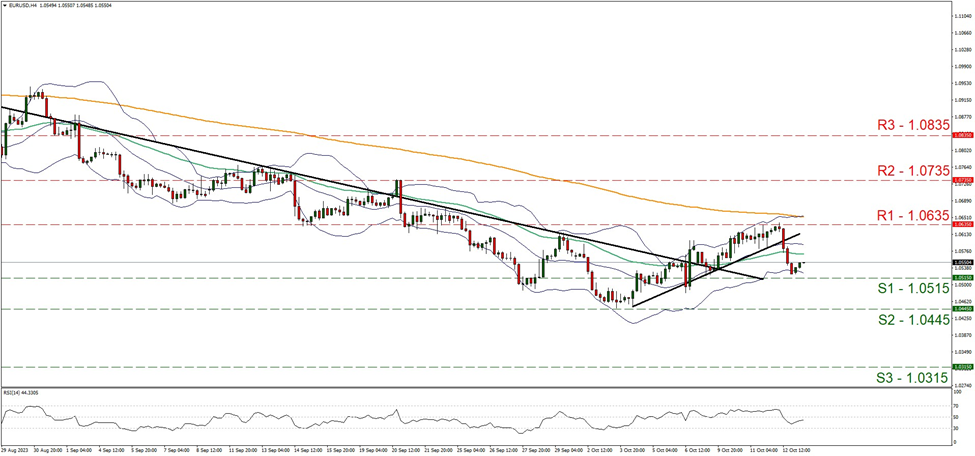

On a technical level, EUR/USD dropped from the 1.0635 (R1) resistance line to almost the 1.0515 (S1) support line yesterday. Given that EUR/USD’s price action broke the upward trendline guiding it since the 4 of October, the pair’s inability to actually break the S1 and that the RSI indicator despite being below the reading of 50, is rising implying a fading of the bearish sentiment of the market we tend to maintain a bias for a sideways motion between the R1 and the S1. Yet we note that bearish tendencies may arise and should the bears take control over EUR/USD’s direction we may see the pair breaking the 1.0515 (S1) support line and aim for the 1.0445 (S2) support level. On the other hand, for a bullish outlook, we would require the pair to break the 1.0635 (R1) resistance line and aim for the 1.0735 (R2) resistance nest.

It should be noted that all three major US stock market indexes, namely the Dow Jones, S&P 500 and Nasdaq dropped reflecting a more cautious sentiment on behalf of the market. We expect the release of the earnings reports of major US banks such as JP Morgan (#JPM), Wells Fargo (#WFC) and Citigroup (#C), later today to gain attention among stock market participants and better than expected readings may provide support for their share prices, but also imply a resilience of the US banking sector, a scenario that could also provide a slight boost to the greenback.

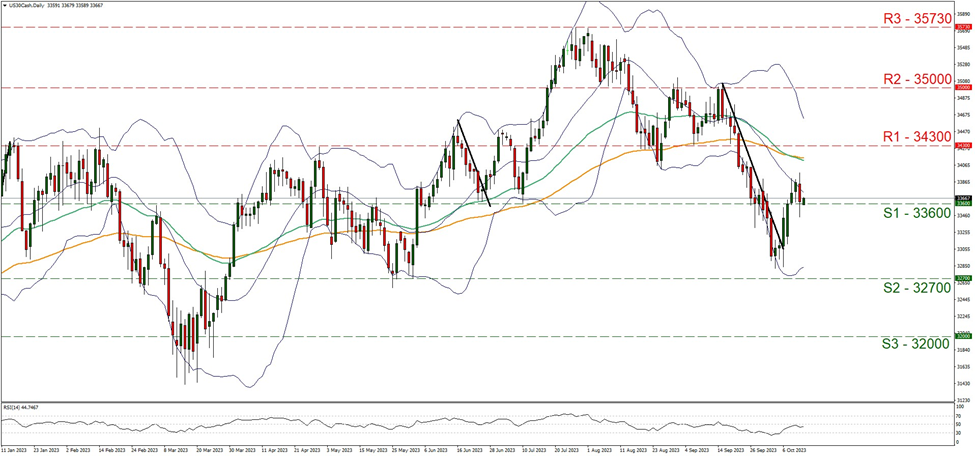

Dow Jones in particular dropped and tested the 33600 (S1) support line yesterday, yet managed to float above it during today’s Asian session. Given that the upward movement of the past week was interrupted yesterday we switch our bullish outlook in favour of a bias for a sideways motion initially. The fact that the RSI indicator remains just below the reading of 50 implying a rather indecisive market, tends to support such a notion. Should the buyers get control over the index’s price action we may see Dow Jones moving towards the 34300 (R1) resistance line if not breach it. On the flip side should the selling interest be renewed we may see the index breaking decisively the 33600 (S1) support line and aim for the 32700 (S2) support barrier.

On the other hand, the stronger Dollar tended to weigh on gold’s price yet the precious metal was able to overcome the bearish pressures and during today’s Asian session edged higher, also reacting to the fluctuations of US yields.

その他の注目材料

Today in the European session, we note the release of Sweden’s CPI rates for September, France’s final HICP rate for the same month and the Eurozone’s industrial output for August. On the monetary front, we note that ECB policymaker Nagel is scheduled to speak in the early stages of the session. In the American session, we note the release of the preliminary US University of Michigan consumer sentiment for October, while we also note the planned speeches of IMF’s managing director Georgieva, ECB President Lagarde, BoC Governor Tiff Macklem and BoE Deputy Governor Cunliffe are scheduled to speak. During Monday’s Asian session, we note that RBA Assistant Governor Jones speaks.

EUR/USD 4 Hour Chart

Support: 1.0515 (S1), 1.0445 (S2), 1.0315 (S3)

Resistance: 1.0635 (R1), 1.0735 (R2), 1.0835 (R3)

Dow Jones Daily Chart

Support: 33600 (S1), 32700 (S2), 32000 (S3)

Resistance: 34300 (R1), 35000 (R2), 35730 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。