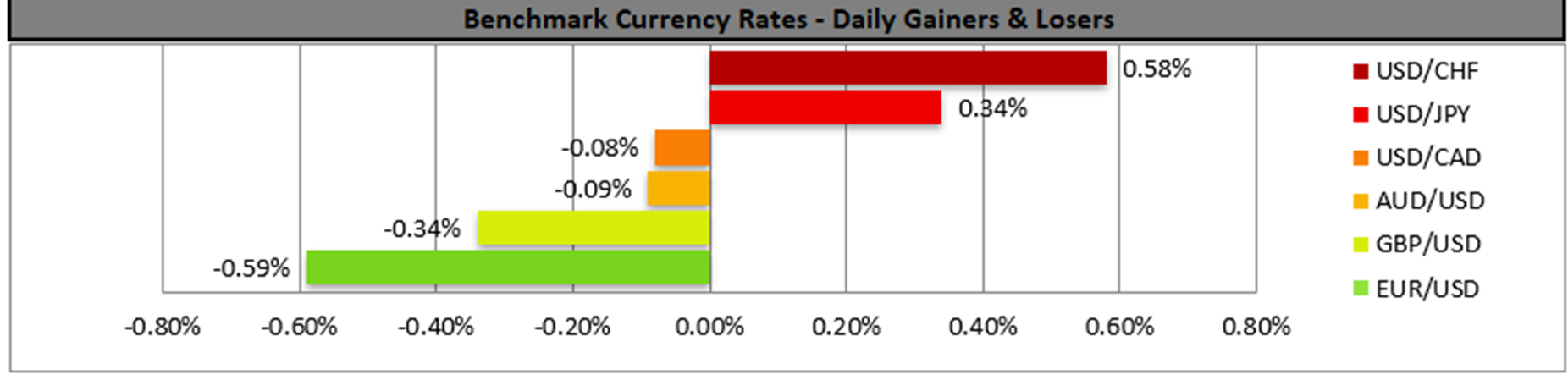

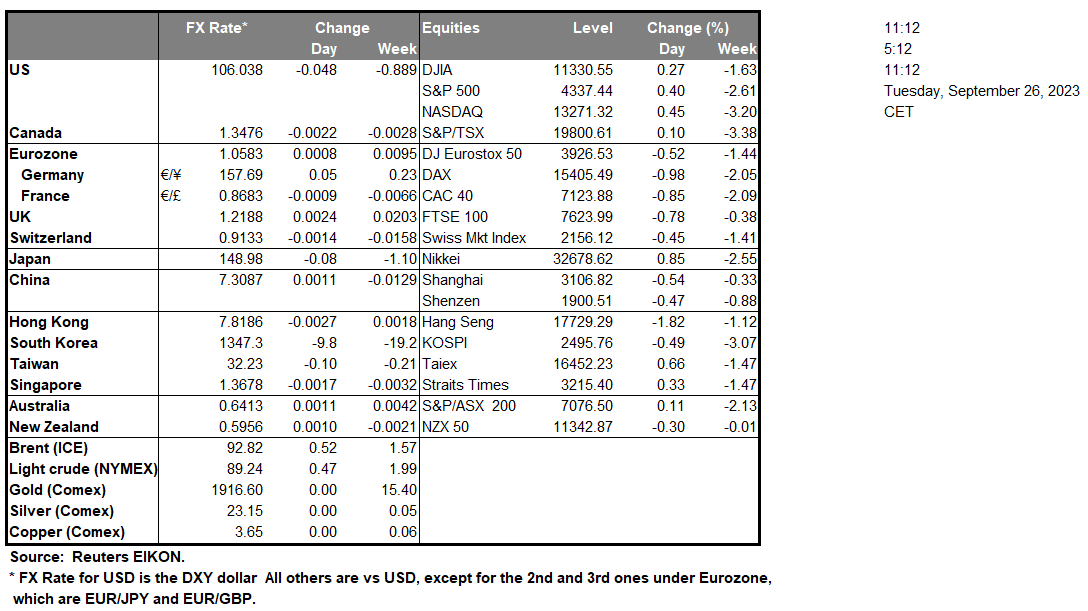

The US Government is facing a potential shutdown, as early as October 1 and with the deadline quickly approaching, we note that no major developments have been made by the House of Representatives in order to avoid a potential shutdown. In the event of a shutdown, we may see the greenback weakening, as the implications of a government shutdown, could greatly impact the US economy. Minneapolis Fed President Kashkari re-iterated his views yesterday, that the Fed may need to hike once more should the economy show signs that the economy is stronger than what is anticipated. Furthermore, he stated that market participants are anticipating one more hike by the Fed this year and as such may be inferring that another hike is still a possibility, potentially providing support for the dollar. Over in Europe, ECB President Lagarde stated yesterday that “ rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our target.”, implying that the ECB may have reached its peak terminal rate, yet they may have to stay at their current levels for a prolonged period of time, which may support the EUR should the ECB’s counterparts ease on their monetary policy earlier than the bank. Over in Asia, USD/JPY reached $149, reaching levels last seen in September 2022, which may be reaching levels upon which the Japanese Government had previously intervened and as such, should the government step in to safeguard the Yen, we may see the USD/JPY pair moving to lower ground. Over in the commodities market, sugar futures have eased from 12-year highs, over the past week or so, however, fundamentally speaking the divergence between supply and demand forces are expected to push the commodities price to higher ground, more specifically India who is one of the largest sugarcane producers is experiencing droughts and the Indian Government ponders limiting exports.

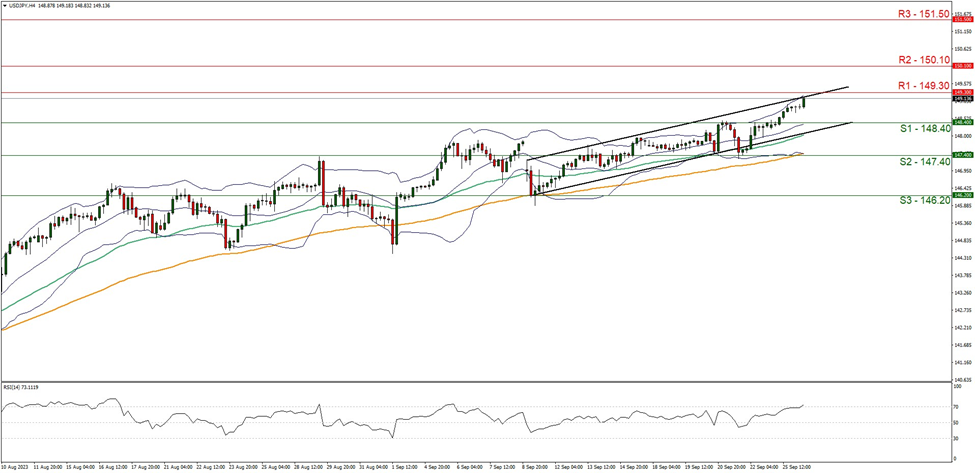

USD/JPY appears to be moving in an upwards fashion, with the pair currently aiming for the 149.30 (R1) resistance level. We maintain a bullish outlook for the pair and supporting our case is the upwards moving channel which was incepted on the 11 of September in addition to the RSI figure below our 4-Hour chart which is currently running along the figure of 70, implying a strong bullish market sentiment. For our bullish outlook, we would like to see a clear break above the 149.30 (R1) and the 150.10 (R2) resistance levels, with the next possible target for the bulls being the 151.50 (R3) resistance ceiling. On the other hand, for a bearish outlook we would like to see a clear break below the 148.40 (S1) support level, with the next possible target for the bears being the 147.40 (S2) support base.

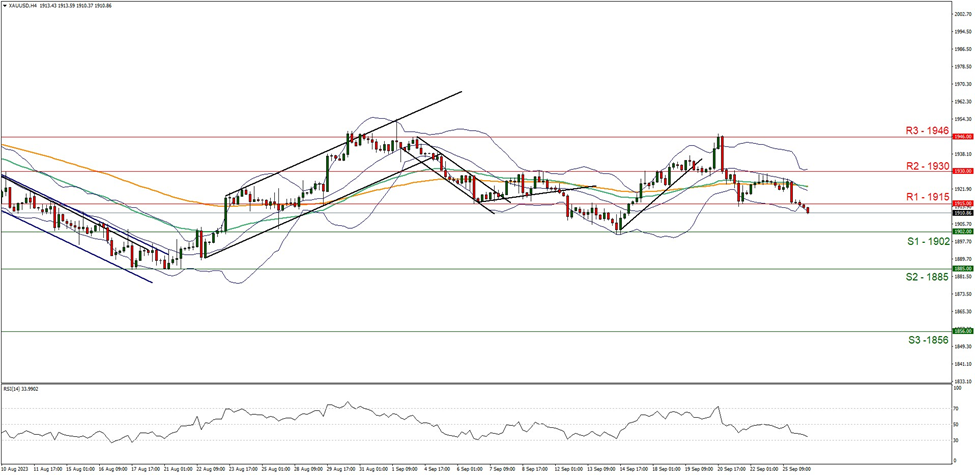

XAU/USD appears to be moving in a downwards fashion, having broken below support turned resistance at the 1915 (R1) resistance level. We maintain a bearish outlook for the commodity and supporting our case is the RSI indicator below our 4-Hour chart which is currently moving towards the figure of 30, implying a strong bearish market sentiment. For our bearish outlook to continue, we would like to see a clear break below the 1902 (S1) support level, with the next possible target for the bears being the 1885 (S2) support base. On the other hand, for a bullish outlook, we would like to see a clear break above the 1915 (R1) resistance level, with the next possible target for the bulls being the 1930 (R2) resistance ceiling.

その他の注目材料

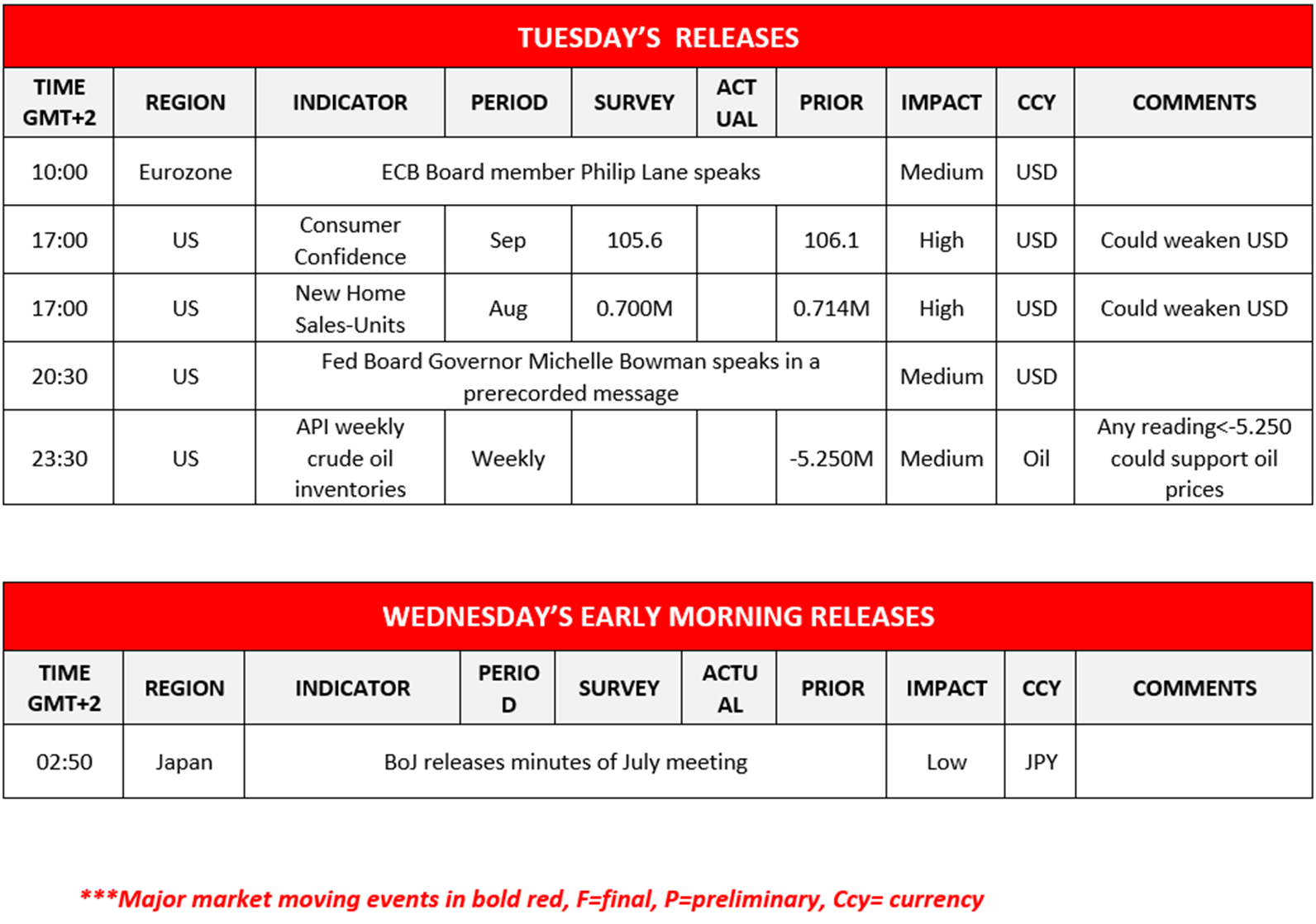

In today’s European session, we note that ECB Board member Philip Lane is scheduled to speak. In the American session, we note that we get from the US September’s consumer confidence and August’s number of new home sales while just before the Asian session starts oil traders may be more interested in the release of the API weekly crude oil inventories figure. Please note that during tomorrow’s Asian session, BoJ is to release the minutes of the July meeting.

USD/JPY 4時間チャート

Support: 148.40 (S1), 147.40 (S2), 146.20 (S3)

Resistance: 149.30 (R1), 150.10 (R2), 151.50 (R3)

XAU/USD 4時間チャート

Support: 1902 (S1), 1885 (S2), 1856 (S3)

Resistance: 1915 (R1), 1930 (R2), 1946 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。