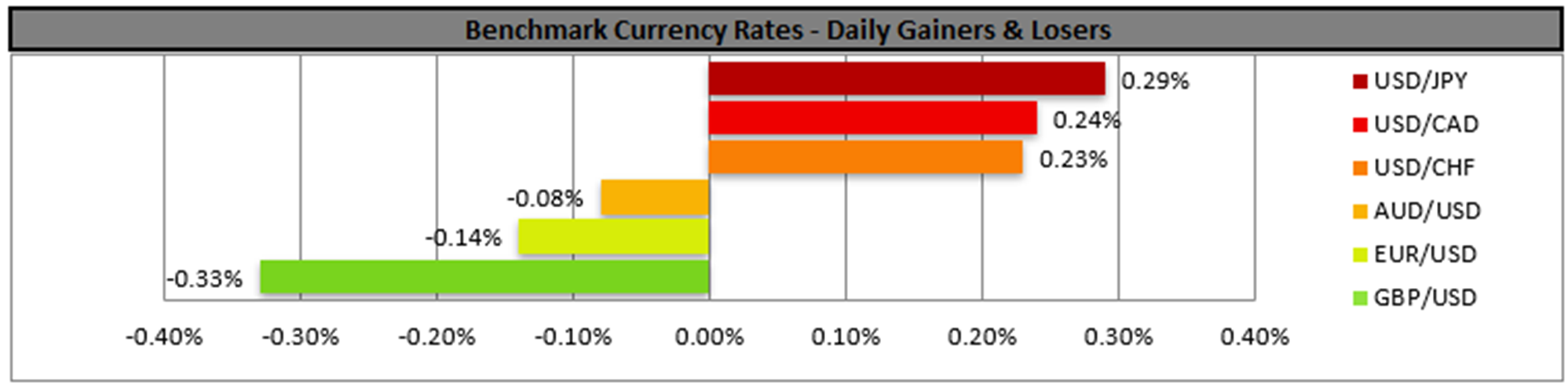

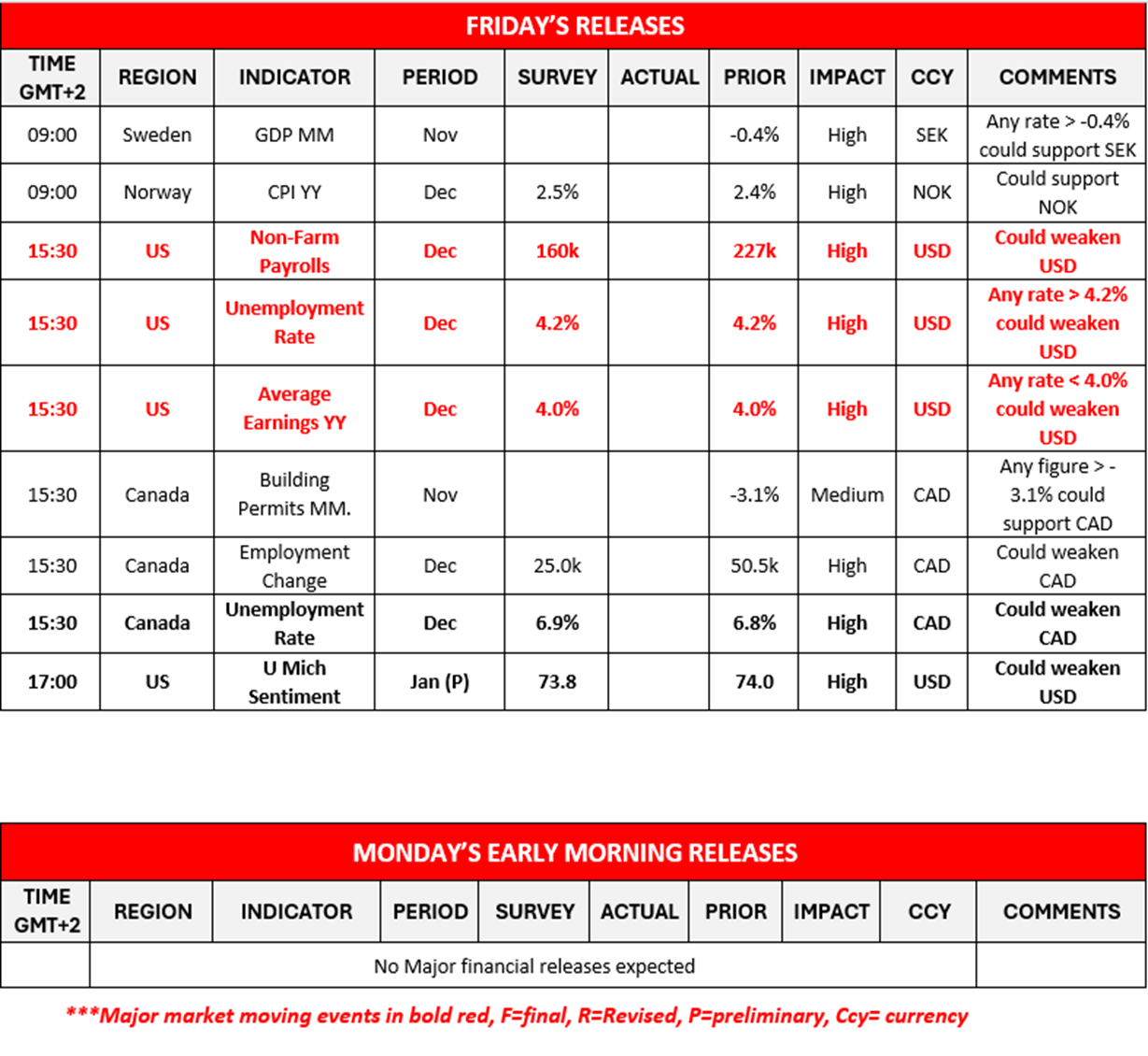

The USD continued to gain against its counterparts yesterday, in a rather quiet Thursday and markets are increasingly focusing on the release of December’s US employment report. The Non-Farm Payrolls (NFP) figure is expected to drop to 160k if compared to November’s 227k, while the unemployment rate is expected to remain unchanged at 4.2% and the average earnings growth rate also to remain unchanged at 4.0% yy. Should the actual rates and figures meet their respective forecasts, we may see the USD slipping as the drop of the NFP figure, may disappoint traders. Overall though we do not see the forecasted picture showing a loosening US employment market, thus may allow the Fed to maintain its hesitations in cutting rates further extensively. Yet the actual rates and figures tend to differ from the forecasts, hence should the report imply a tighter than expected US employment market we may see the USD getting some support. On the other hand, a possibly looser employment market than expected could weigh on the USD. The release may have ripple effects beyond the FX market and signals of a possibly tighter US employment market could weigh on US equities and gold’s price.

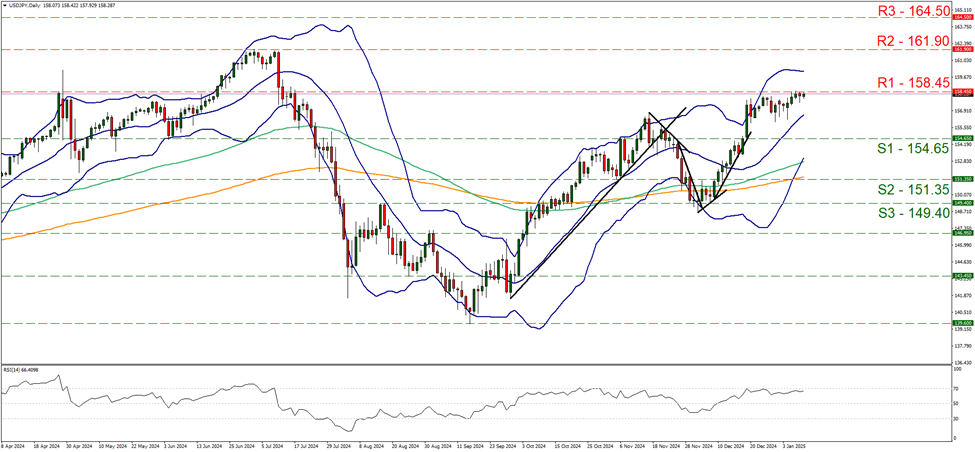

USD/JPY remained in a tight rangebound motion just below the 158.45 (R1) resistance line. We tend to maintain for the time being our bias for the sideways motion to continue between the 158.45 (R1) resistance line and the 154.65 (S1) support level. Yet the continues testing of the R1 and the fact that the RSI indicator has neared the reading of 70, tend to highlight the bullish predisposition of the market participants for the pair. Yet for a bullish outlook we would require USD/JPY to break the 158.45 (R1) resistance line clearly and start aiming for the 161.90 (R2) resistance level. On the flip side should the bears take over, we may see the pair reversing course, breaking the 154.65 (S1) support line, paving the way for the 151.35 (S2) support level.

At the same time as the US employment report for December we also get Canada’s employment data for the same month. The unemployment rate is expected to tick up to 6.9% if compared to November’s 6.8% and the employment change figure is expected to drop to 25.0k if compared to November’s 50.5k. Overall, the data tend to imply a loosening Canadian employment market which in turn could weigh on the Loonie as such data may enhance the dovishness of BoC. On a deeper fundamental level, we note the rise of oil prices and should it be extended, we may see the CAD getting some support.

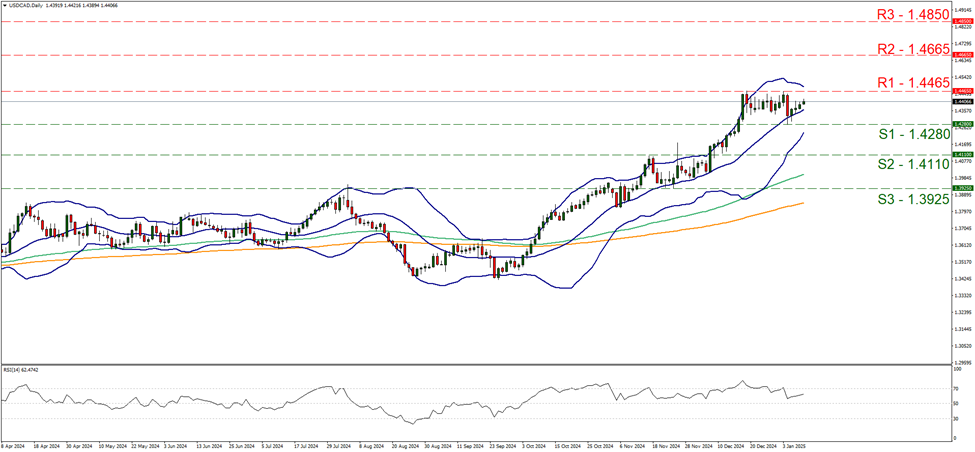

USD/CAD remained in a sideways motion between the 1.4465 (R1) resistance line and the 1.4280 (S1) support line, since the 18 of December. We tend to maintain our bias for the sideways motion to continue as long as the pair’s price action respects the prementioned levels. Yet the 20 moving average which is also the median of the Bollinger bands and supports the upward movement, continues to point upwards implying that the upward motion of the pair which begun on the 25 of September is still not over. Furthermore, the RSI indicator is rising implying the build up of a bullish sentiment among market participants for the pair. For the adoption of a bullish outlook once again, we would require the pair to break the 1.4465 (R1) resistance line and start aiming for the 1.4665 (R2) resistance barrier. Should the bears take over, a scenario we currently view as remote, we may see USD/CAD breaking the 1.4280 (R1) resistance line and start aiming for the 1.4110 (S2) support base.

その他の注目材料

In today’s European trading session, we note Sweden’s GDP rate for November and Norway’s CPI rate for December. In the American session we highlight the event of the week, which is the US Employment data for December, followed by Canada’s building permits rate for November and Employment data for December and ending of the day is the University of Michigan preliminary consumer sentiment figure for January. We would like to note that no major financial releases are expected in Monday’s Asian session.

USD/JPY Daily Chart

- Support: 154.65 (S1), 151.35 (S2), 149.40 (S3)

- Resistance: 158.45 (R1), 161.90 (R2), 164.50 (R3)

USD/CAD Daily Chart

- Support: 1.4280 (S1), 1.4110 (S2), 1.3925 (S3)

- Resistance: 1.4465 (R1), 1.4665 (R2), 1.4850 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。