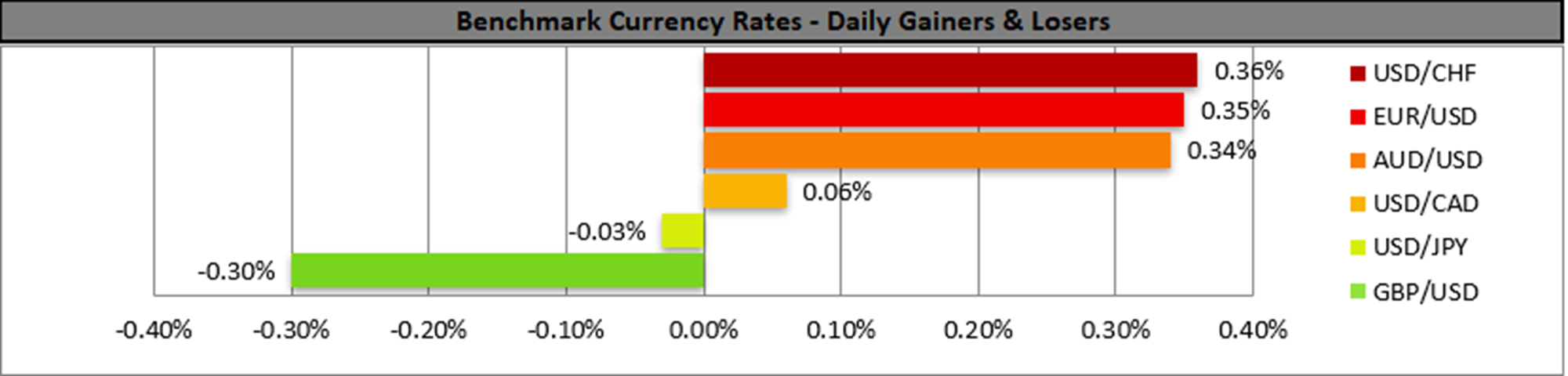

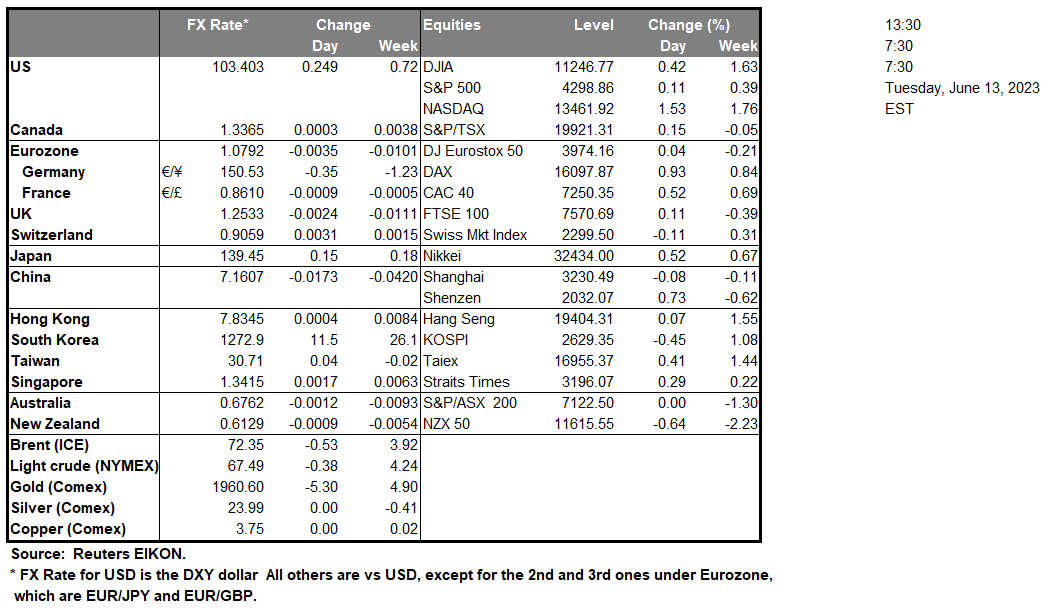

We anticipate that the main focus for traders today may be the US CPI rates that are due during the American session. Should the CPI rates come in lower than expected, hinting at easing inflationary pressures, we may see the case made by Philadelphia Fed President Harker of skipping the meeting, being re-iterated by market analysts in addition to the market sentiment switching predominantly in anticipation of a hawkish pause by the FOMC in their meeting tomorrow. However, should the CPI rates indicate persistent inflationary pressures in the US economy, the aforementioned case may be diminished, with the markets potentially poising themselves for more rate hikes by the Fed. Across the pond we note that BoE’s Mann stated yesterday that “Inflation expectations are now on the down swing” , implying that the bank may need some time to re-evaluate the current impact of their monetary policy on the economy. Hence should, BoE Governor Bailey re-iterate yesterday’s comments, we may see the pound weakening upon expectations that the BoE may be willing to keep its interest rate levels at par. In the Asian markets, we highlight Japan’s Topix index, which is currently trading at levels last seen in 1990, highlighting the growing demand by Global funds in the Japanese economy. In the US equities we highlight that British chip designer Arm which shunned a London stock exchange listing in favour of a New York IPO, has been linked to Intel (#INTC), in which it is claimed that Intel is looking to be an anchor investor in the company’s IPO.

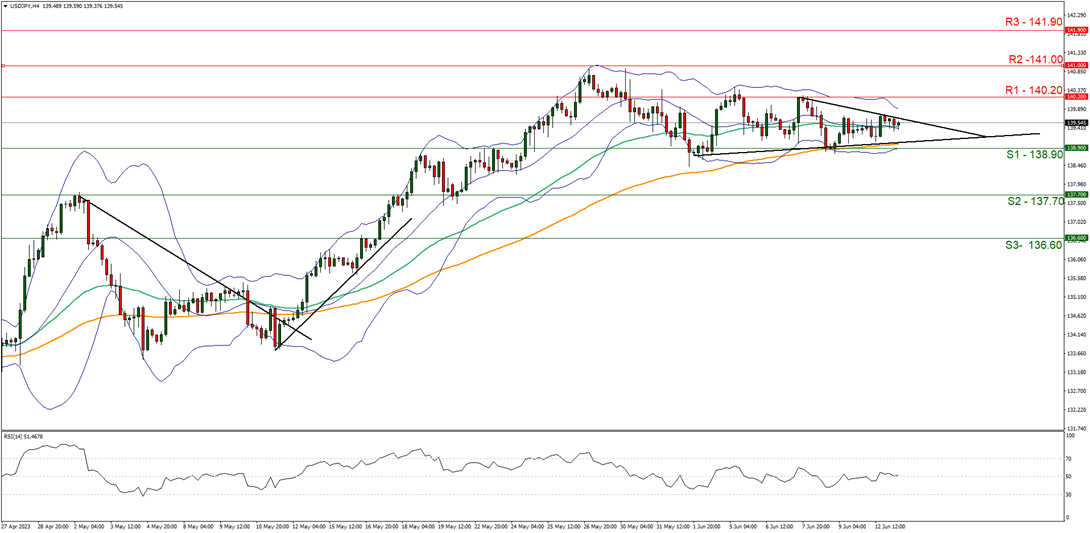

USD/JPY despite moving higher for the past two days, it would now appear that the pair is moving in a sideways fashion. As such we maintain a neutral outlook for the pair and supporting our case in the RSI indicator below our 4-Hour chart, which currently has a figure of 50, implying a neutral market, in addition to the narrowing of the Bollinger bands, implying low market volatility. For our neutral outlook to continue, we would like to see the pair failing to break below or above support and resistance at 138.90 (S1) and 140.20 (R1), in addition to the RSI figure remaining near the reading of 50. For a bearish outlook, we would like to see a clear break below support at 138.90 (S1) which would also coincide with breaking below the upwards moving trendline, incepted on the 2 of June, with the next possible target for the bears being the 137.70 (S2) support base. For a bullish outlook, we would like to see a clear break above resistance at the 140.20 (R1) level, breaking above the downwards moving trendline incepted on the 7 of May, which the next possible target for the bulls being the 141.00 (R2) resistance ceiling.

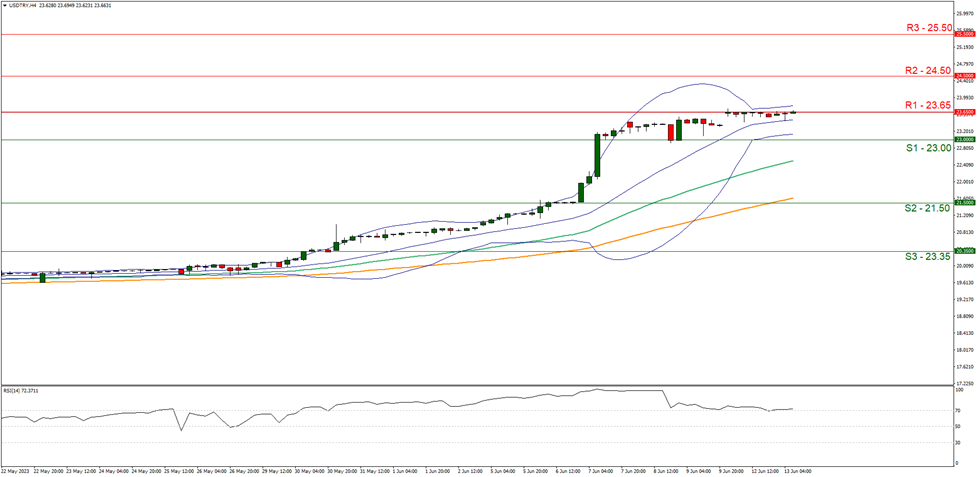

USD/TRY appears to have hit a ceiling at resistance at 23.65 (R1), yet we maintain a bullish outlook for the pair and supporting our case is the RSI indicator below our 4-Hour chart, which is currently running along the figure of 70, implying a strong bullish market sentiment. For our bullish outlook to continue, we would like to see a clear break above the 23.65 (R1) resistance level if not also breaking the 24.50 (R2) resistance ceiling with the next target for the bulls being the 25.50 (R3) resistance line. For a bearish outlook, we would like to see a clear break below support at 23.00 (S1) with the next potential target for the bears being the 21.50 (S2) support base.

その他の注目材料

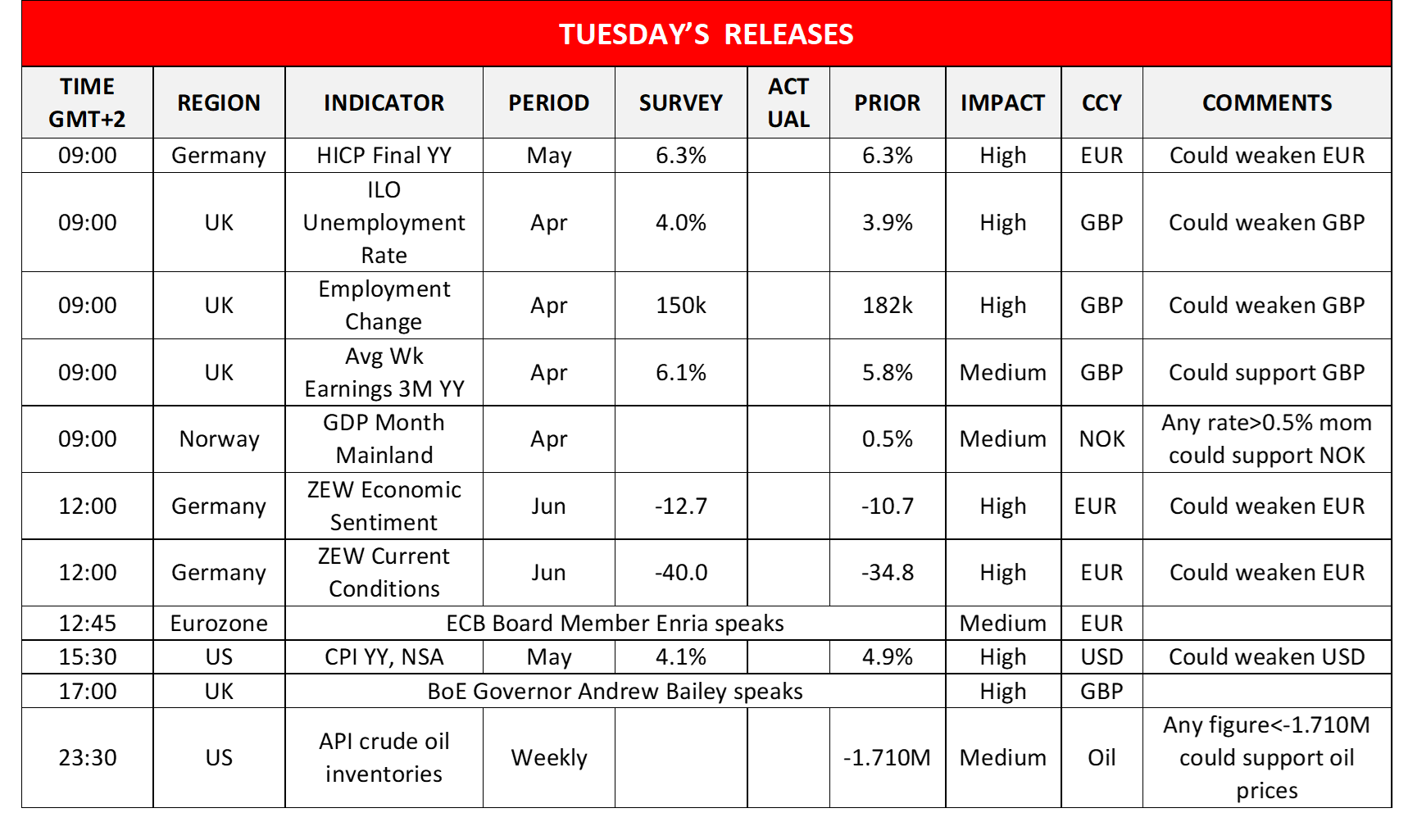

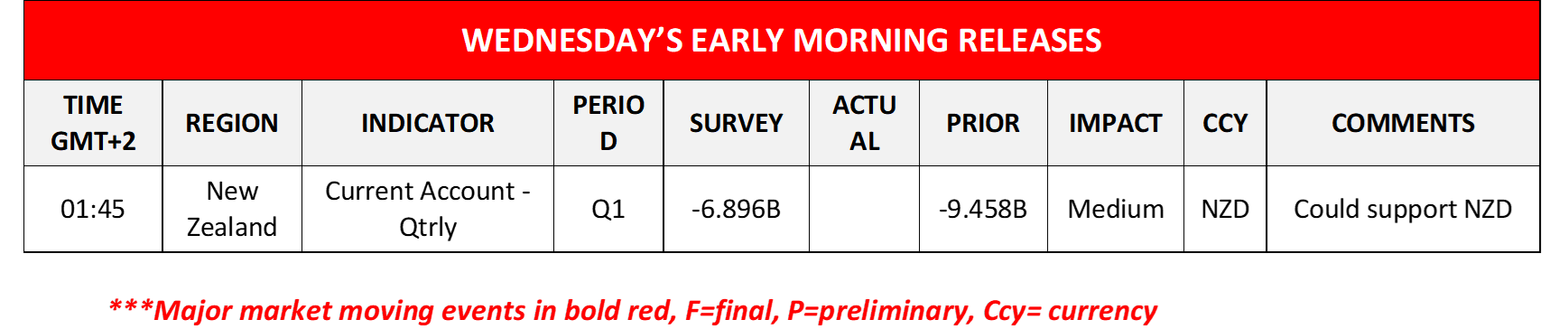

In today’s European session, we note the release of Germany’s final HICP rate for May, UK’s employment data for April, Norway’s GDP rate for the same month, and Germany’s ZEW indicators for June, while on the monetary front ECB board member Enria speaks. In the American session, besides the US CPI rates for May we also note the release of the API weekly crude oil inventories figure and on the monetary front we note the scheduled speech of BoE Governor Andrew Bailey. During tomorrow’s Asian session, we note the release of New Zealand’s Current Account balance for Q1.

USD/JPY 4時間チャート

Support: 138.90 (S1), 137.70 (S2), 136.60 (S3)

Resistance: 140.20 (R1), 141.00 (R2), 141.90 (R3)

USD/TRY 4時間チャート

Support: 23.00 (S1), 21.50 (S2), 23.35 (S3)

Resistance: 23.65 (R1), 24.50 (R2), 25.50 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。