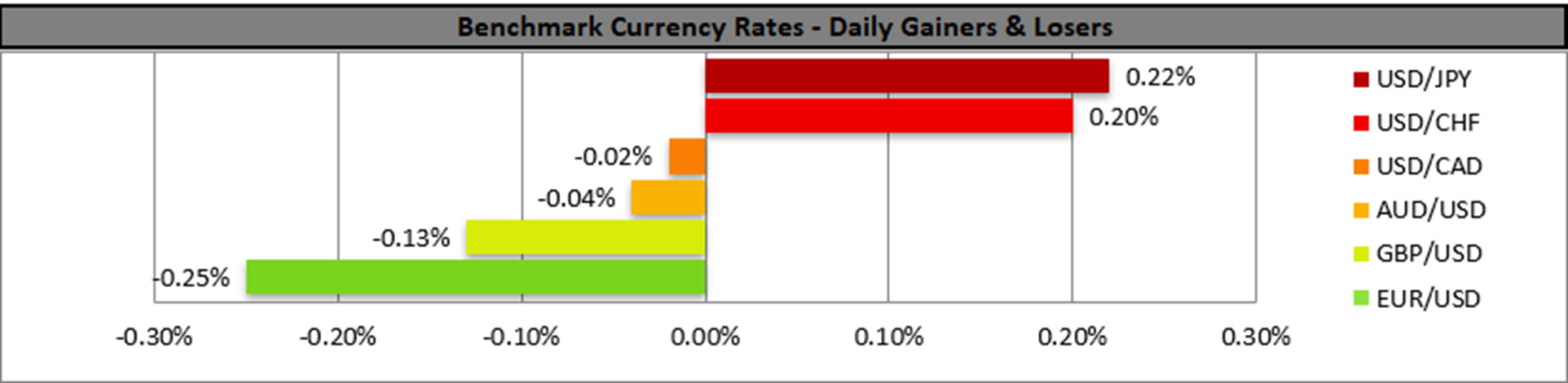

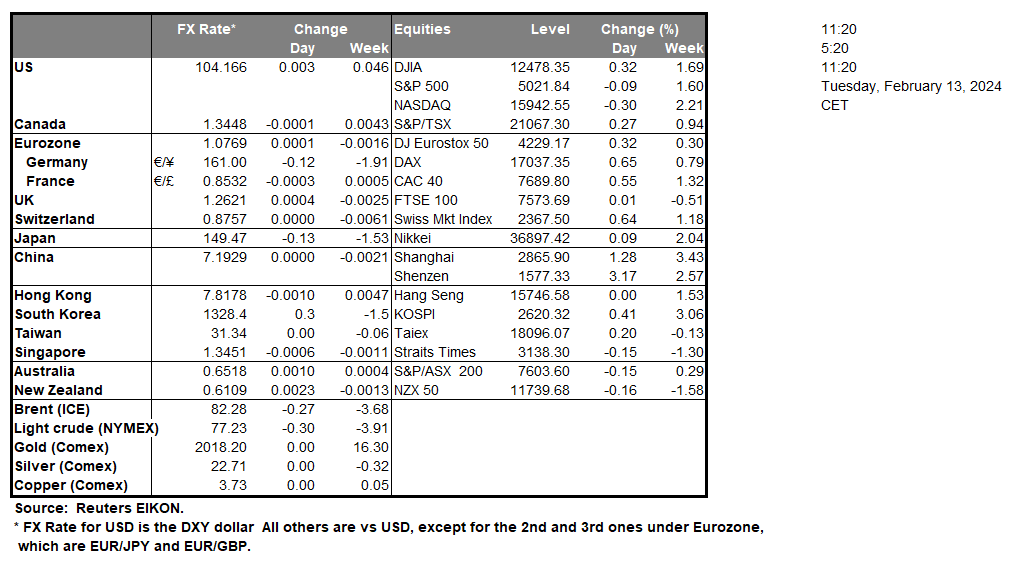

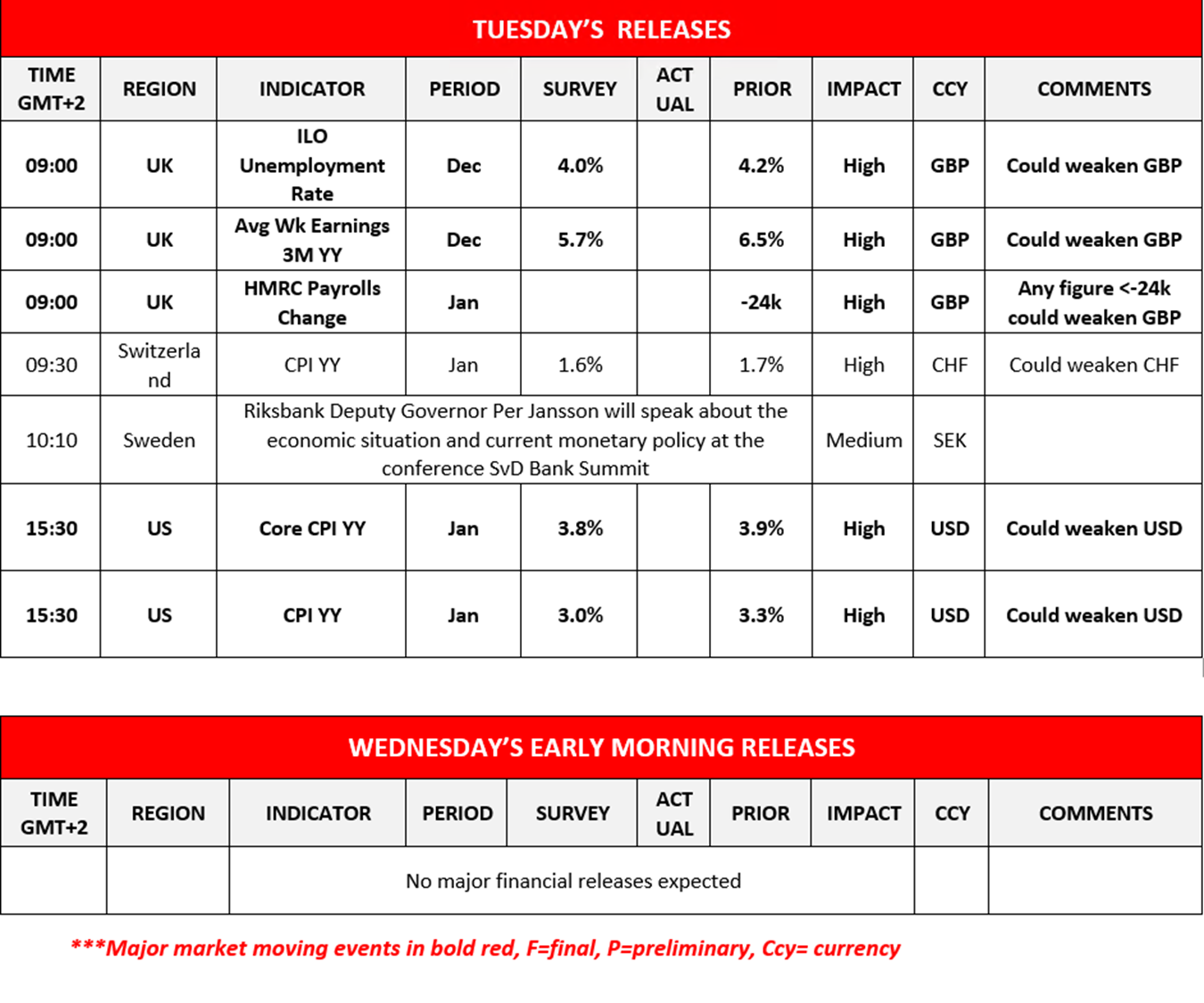

The US CPI rates for January are due to be released during today’s American session. According to economists, the inflation indicator is expected to increase at a decreasing rate, implying easing inflationary pressures in the US economy. Should the CPI rates validate expectations of easing inflationary pressures by coming in as expected or perhaps lower, it could weigh on the dollar, as the Fed’s hawkish rhetoric for maintaining interest rates at their current levels may be weakened. Whereas should the come in higher than expected, it could provide support for the greenback as the Fed’s rhetoric of maintaining interest rates at their current levels for a prolonged period of time, may intensify, a view we tend to agree with.

In the US Equities markets, we highlight the earnings releases by Coca Cola (#KO) and Airbnb(#ABNB), later on today. Both companies are expected to report lower earnings per share and revenue compared to the previous quarter, which could weigh on the stock price of each company respectively. Whereas should they exceed expectations it could provide support for their respective stock prices. In the UK, the ILO Unemployment rate in conjunction with the average hourly weekly earnings rate both for December, exceeded expectations by market participants, implying a resilient labour market. The better-than-expected financial releases, could provide support for the pound. Switzerland’s headline CPI rates for January came in lower than expected at 1.3% on year-on-year level and 0.2% on a month-on-month level, implying easing inflationary pressures in Switzerland, which could weigh on the CHF.

EUR/USD appears to be moving in an upwards fashion. We maintain a bullish outlook for the pair and supporting our case is the upwards moving trendline which has been guiding the pair since the 6 of February. Yet, the RSI indicator below our chart which currently registers a figure near 50, implies a neutral market sentiment. Nonetheless, for our bullish outlook to continue, we would like to see a clear break above the 1.0795 (R1) resistance level, with the next possible target for the bulls being the 1.0890 (R2) resistance line. On the other hand, for a sideways bias we would like to see the pair remain confined between the 1.0730 (S1) support level and the 1.0795 (R1) resistance line. Lastly, for a bearish outlook, we would like to see a clear break below the 1.0730 (S1) support level, with the next possible target for the bears being the 1.0645 (S2) support base.

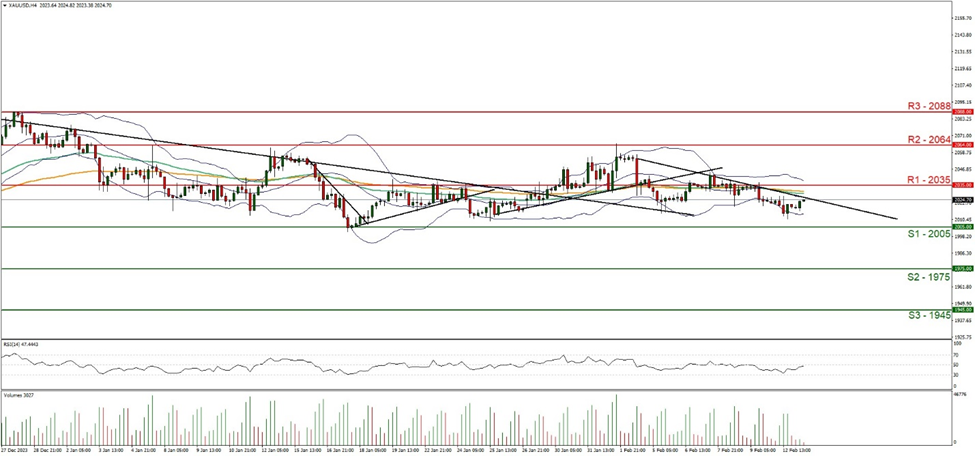

XAU/USD appears to be moving in a downwards fashion, with the precious metal having formed a downwards moving trendline which was incepted on the 2 of February. We maintain a bearish outlook for gold’s price and supporting our case is the aforementioned trendline. Although we should note that the RSI indicator below our chart currently registers a figure near 50, implying a neutral market sentiment. Nevertheless, for our bearish outlook to continue, we would like to see a clear break below the 2005 (S1) support level, with the next possible target for the bears being the 1975 (S2) support base. On the other hand, for a sideways bias, we would like to see the precious metal remain confined between the 2005 (S1) support level and the 2035 (R1) resistance line. Lastly, for a bullish outlook, we would like to see a clear break above the 2035 (R1) resistance line, with the next possible target for the bulls being the 2064 (R2) resistance ceiling.

その他の注目材料

We note in today’s European session, the release of Germany’s ZEW Economist sentiment figure for February. Later on during the American session, we highlight the release of the US CPI rates for January, whilst noting an easing going Asian session tomorrow, with no major financial releases expected. On a monetary level, we note the speech by Riksbank deputy Governor Jansson in today’s European session.

EUR/USD 4時間チャート

Support: 1.0730 (S1), 1.0645 (S2), 1.0530 (S3)

Resistance: 1.0795 (R1), 1.0890 (R2), 1.0985 (R3)

XAU/USD 4時間チャート

Support: 2005 (S1), 1975 (S2), 1945 (S3)

Resistance: 2035 (R1), 2064 (R2), 2088 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。