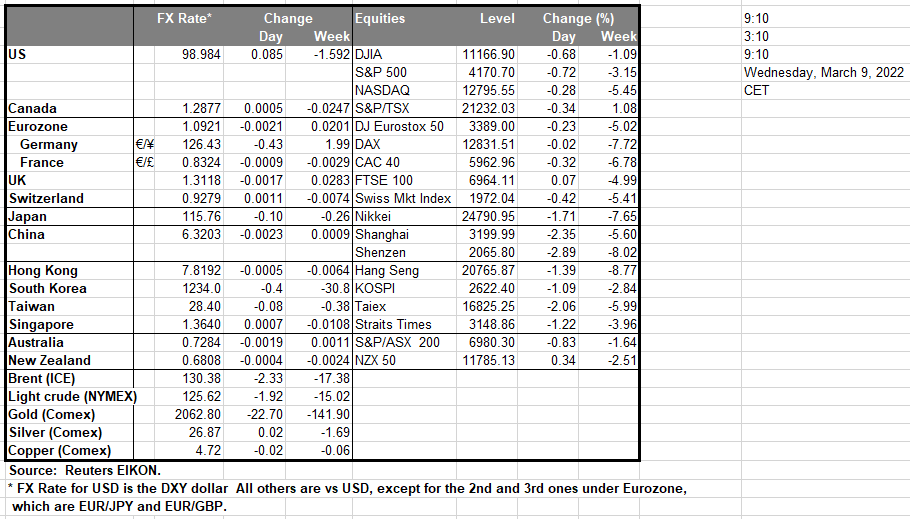

The war in Ukraine is ongoing yet the two sides seem to have reached an agreement for a mini ceasefire, so that civilians could flee major cities as humanitarian corridors are to be opened. We must also note that the Ukrainian side seems more willing to proceed with negotiations and also seems to be partially accepting some of the Russian terms, as no help is to come from the West. On the other hand the US banned the import of oil products from Russia, which could constitute another step in the sanctions imposed by Western powers on Russia, yet the efficiency of the ban remains questionable as the US imports only a small part of Russian output. US President Biden stated that in this way the American people will deal another powerful blow to the Russian economy yet at the same time recognized that the move would result also to higher prices.

The move also bans new U.S. investment in Russia’s energy sector, and prohibits Americans from participating in any foreign investments that flow into the Russian energy sector, as per Reuters. On other news we note that OPEC secretary general Barkindo stated that there’s ‘no capacity in the world’ that could replace Russia’s 7 million barrels a day in oil supply, a statement foreshadowing an even tighter oil market in the months to come. We must note that the bullish tendencies for oil prices continued today with WTI breaking above $125 per barrel, before correcting lower. The USD seems to have stabilised even has some slight bearish tendencies since yesterday, in a sign that the market seems to have calmed down somewhat while US stockmarkets were in the red territory yesterday yet tried to stage a rebound during the Asian session today. Market worries for the possibility of stagflation seem to have eased somewhat yet are still present and thus tend to weigh on the market sentiment.

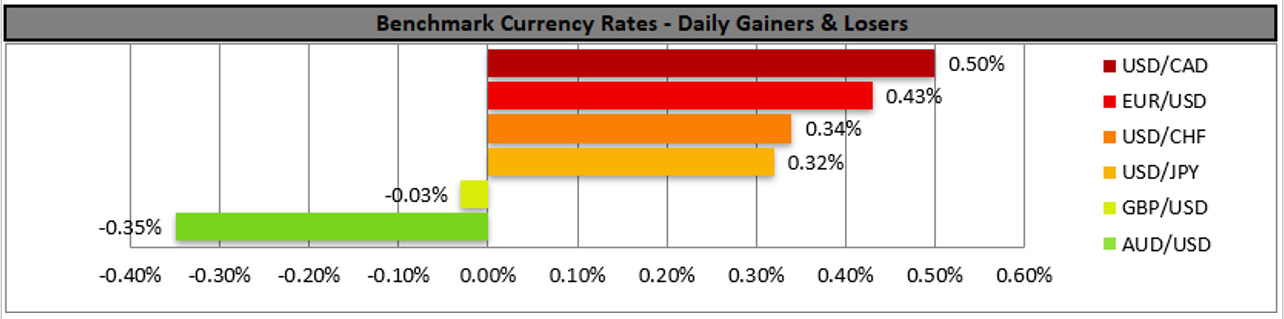

At the same time the markets keep an eye out on developments in Ukraine and sign of the two sides nearing with their position could improve the market sentiment. In the FX Front we note that volatility seems to have eased somewhat as the market seems to maintain a wait and see position while both commodity currencies CAD and AUD tended to be on the retreat against the USD despite a rise in prices of raw materials. The common currency on the other hand was cable to make some small gains against the USD taking advantage the recess of the greenback’s bulls while also had some gains against the pound and JPY. Gold’s price tended to remain rather flat during today’s Asian session given also that the USD had little if any progress and market worries about the war in Ukraine tended to ease somewhat. Today, given the lack of high impact financial releases we expect fundamentals to take over and lead the market sentiment with the war in Ukraine remaining the main topic.

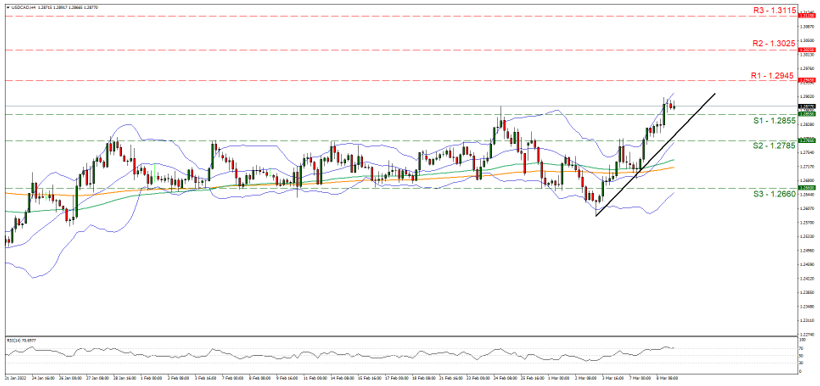

USD/CAD had a strong upward movement yesterday breaking the 1.2855 (S1) resistance line now turned to support. We maintain a bullish outlook for the pair as long as it remains above the upward trendline incepted since the 3rd of March. Please note that the RSI indicator below our 4-hour chart is at the reading of 70 which on the one hand confirms the bull’s dominance, yet on the other may imply that the pair has reached overbought levels and is ripe for a correction lower. Should the bulls maintain control over the pair we may see USD/CAD breaking the 1.2945 (R1) resistance line and aim for the 1.3025 (R2) level. Should the bears take over, we may see the pair breaking the 1.2855 (S1) support line and aim for the 1.2785 (S2) level.

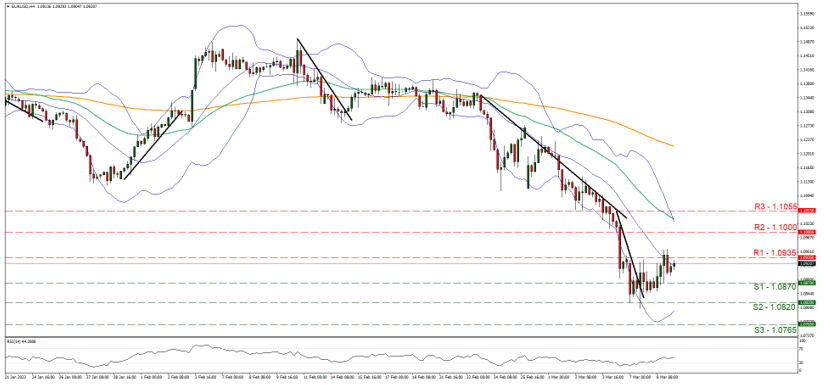

EUR/USD on the other hand, despite some bullish tendencies seems to maintain a sideways movement just below the 1.0935 (R1) resistance line. For our sideways bias to change in favour of a bullish outlook we would require the pair to clearly break the 1.0935 (R1) resistance line and aim for the 1.1000 (R2) resistance level. Should a selling interest be displayed by the market we may see the pair breaking the 1.0870 (S1) support line and aim for the 1.0820 (S2) support level.

本日のその他の注目点

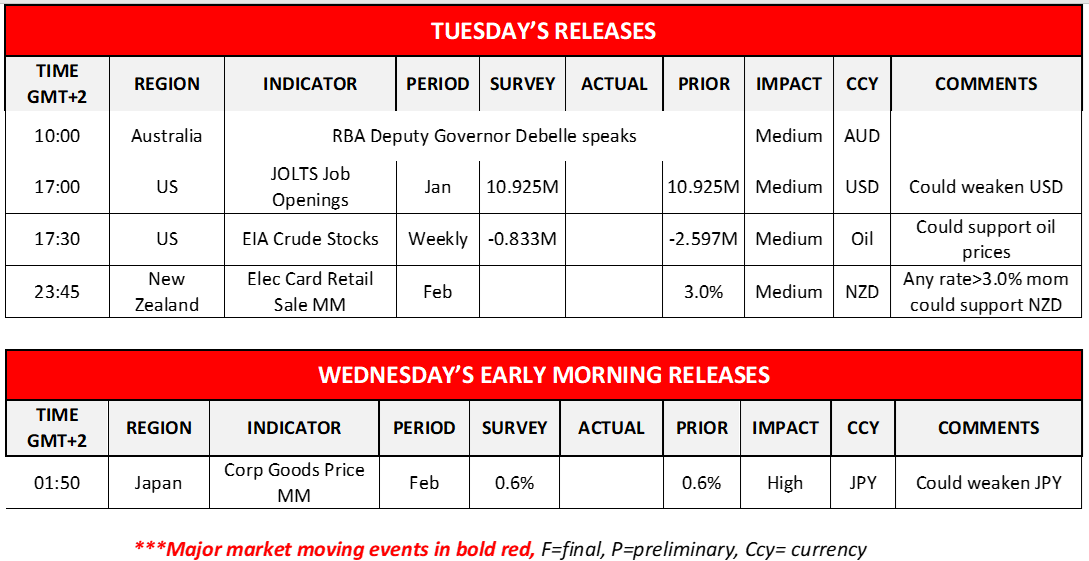

Today in the European session RBA Deputy Governor Debelle is scheduled to speak while in the American session, we note the release of the Jolts Job Openings for January and the weekly EIA crude oil inventories figure. Later on we note the release of New Zealand’s electronic card retail sales and during tomorrow’s Asian session we get from Japan the corporate goods prices growth rate for February.

Support: 1.0870 (S1), 1.0820 (S2), 1.0765 (S3)

Resistance: 1.0935 (R1), 1.1000 (R2), 1.1055 (R3)

USD/CAD 4時間チャート

Support: 1.2855 (S1), 1.2785 (S2), 1.2660 (S3)

Resistance: 1.2945 (R1), 1.3025 (R2), 1.3115 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。