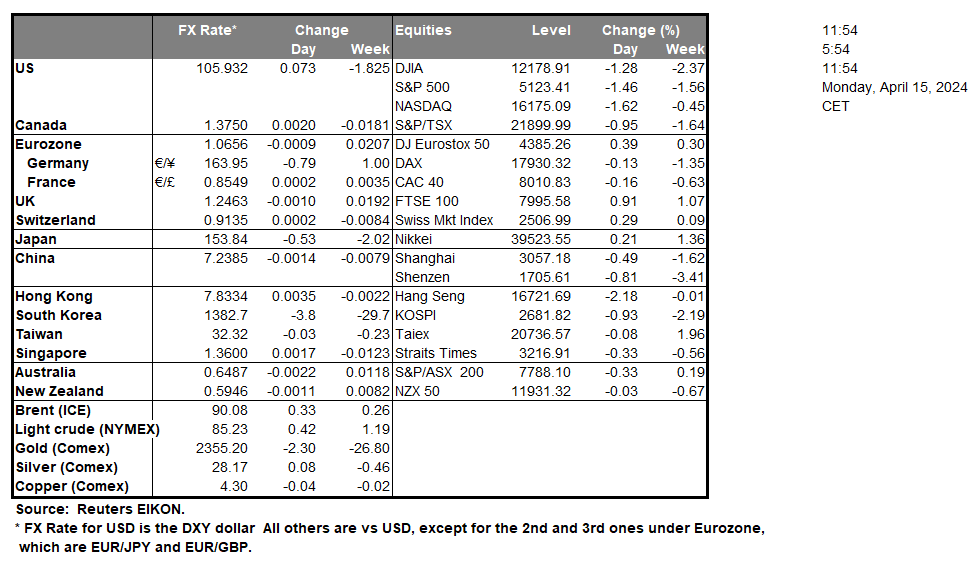

Uncertainty is on the rise at a geopolitical level, as the Israel conflict in Gaza threatens to get out of proportion after Iran’s counter-attack on Israel. Currently, we expect tensions to escalate further, albeit with have to note international calls for restrain and mediation for a possible de-escalation of the tensions. Overall, should tension remain present or escalate further, we expect fundamentally an adverse effect on riskier assets such as equities and commodity currencies, while safe-haven trading instruments are expected to benefit. Oil prices which tended to be among the main worries of the market seem to have eased during today’s Asian session, as the market was prepared for more, yet could rally if tensions rise further.

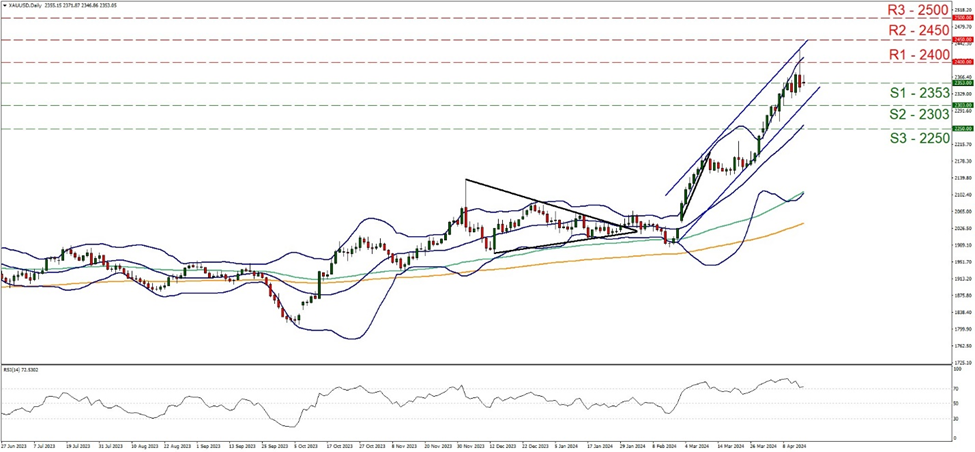

XAU/USD rallied on Friday breaking the 2400 (R1) resistance line yet corrected lower and tended to stabilise near around the 2353 (S1) support line. We tend to maintain the bullish outlook for the precious metal’s price given that the upward channel guiding it since the 15 of February remains intact. Furthermore, we note that the RSI indicator remains above the reading of 70 implying a strong bullish sentiment among market participants, yet at the same time may imply that the precious metal is at overbought levels and possibly rip for a correction lower. Should the bulls regain the initiative, we may see the precious metal’s price breaking the 2400 (R1) resistance line aiming for higher grounds. Should the bears take over, we may see the precious metal’s price breaking the 2353 (S1) support line and actively aim if not breach the 2303 (S2) support base.

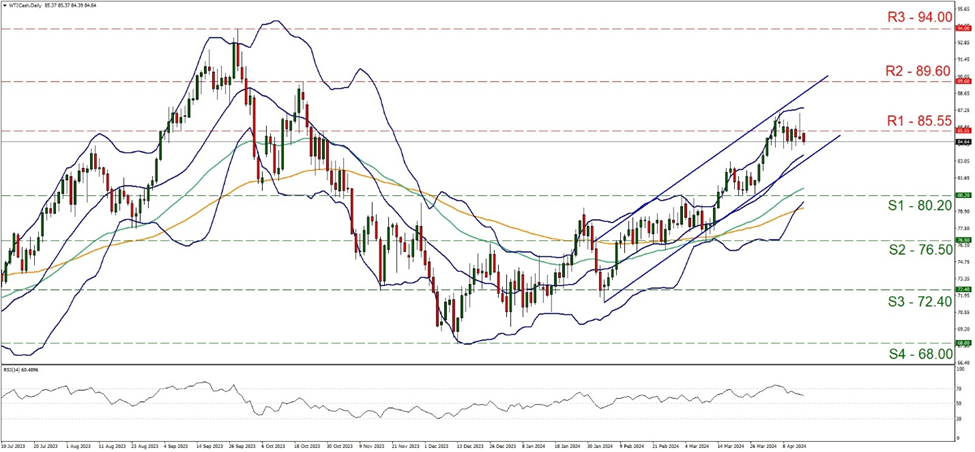

WTI’s price edged lower during today’s Asian session, placing some distance between the 85.55 (R1) resistance line and the price action. At the same time, we note that the RSI indicator is dropping currently aiming for the reading of 50, implying that the bullish sentiment is fading away in the markets. Yet for the time being, we tend to treat the drop of gold’s price as a correction lower for the precious metal’s price. For our bullish outlook to be switched to either a sideways motion bias or even a bearish outlook, we would require WTI’s price to clearly breach the lower boundary of the current upward channel guiding the commodity’s price. Should buyers regain control over WTI’s price action, we expect its price to break the 85.55 (R1) resistance line clearly and aiming for the 89.60 (R2) resistance barrier. Should the bears take over, we may see WTI’s price breaking the lower boundary of the prementioned upward channel in a first signal that the upward movement has been interrupted and aim for the 80.20 (S1) support line, with the 76.50 (S2) support level, being the next possible target for the bears.

その他の注目材料

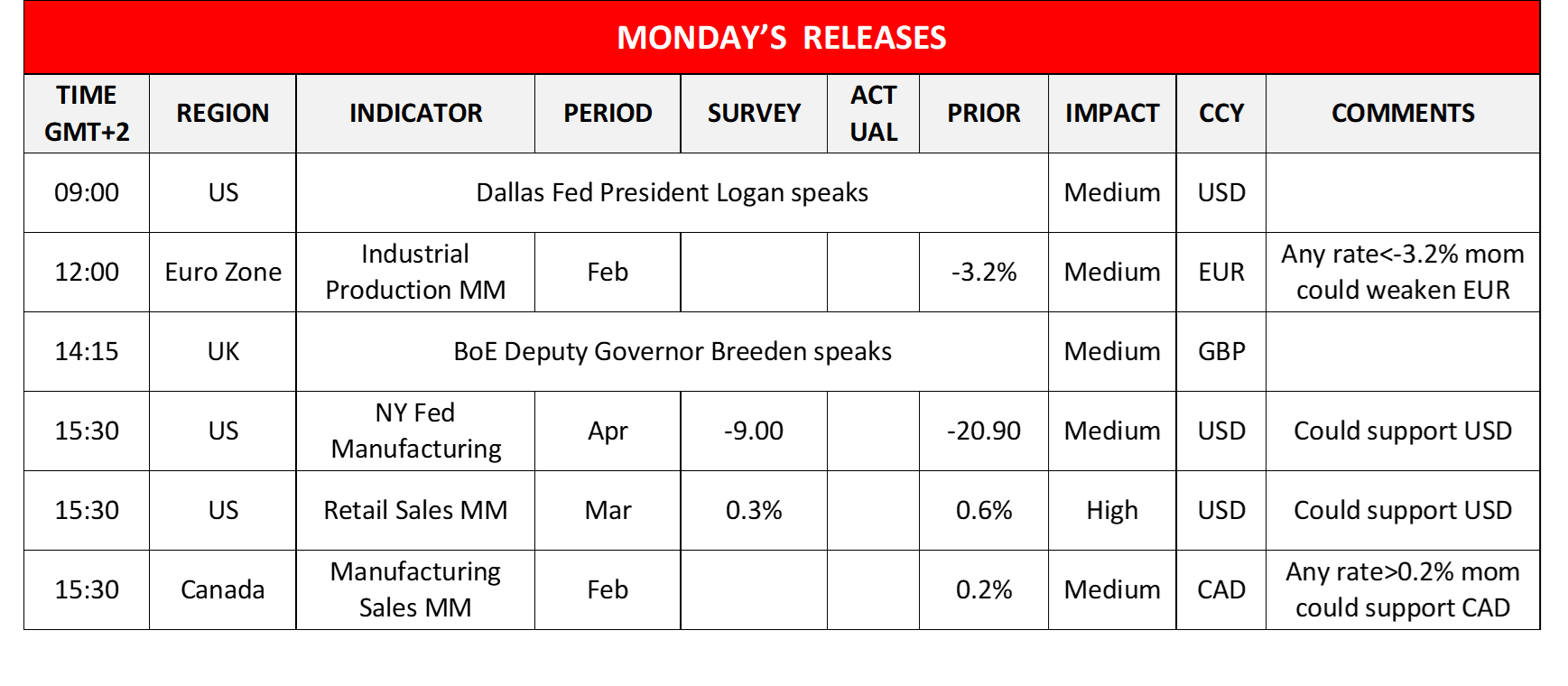

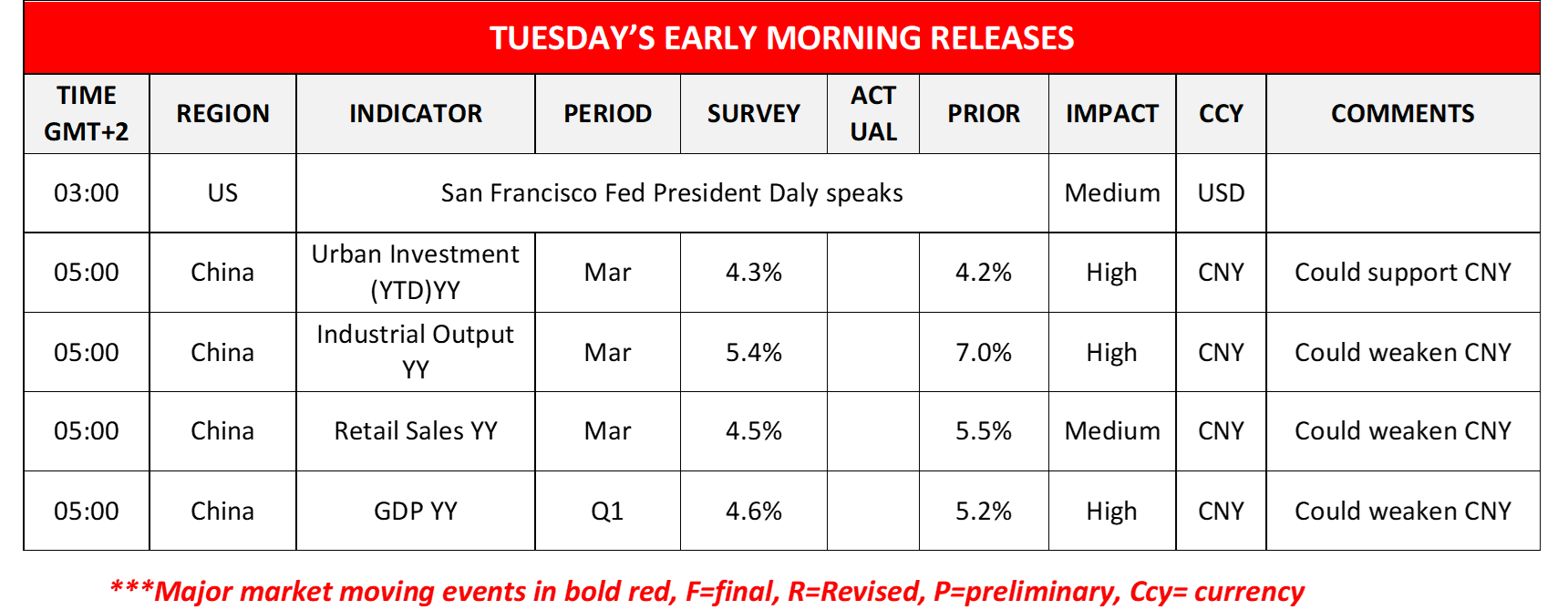

In today’s European session, we note the release of Eurozone’s industrial output for February, while on the monetary front, Dallas Fed President Logan and BoE deputy Governor Breeden are scheduled to speak. In the American session, we note the release of the US NY Fed manufacturing for April and Retail sales for March, while from Canada we get the Manufacturing sales for February. During tomorrow’s Asian session, we get China’s urban investment, industrial output, retail sales for March and GDP rates for Q1, while earlier San Francisco Fed President Daly is scheduled to speak.

今週の指数発表

On Tuesday, we make a start with China’s industrial output rate for March and GDP rate for Q1, the UK’s Unemployment data for February, Germany’s ZEW figures for April, Canada’s Housing starts figure and CPI rates followed by the US Industrial production rate, all for the month of March. On Wednesday we begin with New Zealand’s CPI rate for Q1, followed by Japan’s Tankan Non-Manufacturing and Manufacturing figures for April, followed by Japan’s trade balance for March. Later on in the day, we get the UK’s CPI rates and the Eurozone’s final HICP rate all for the month of March. On Thursday we start with Australia’s Employment data for March, the US weekly initial jobless claims figure, the US Philly Fed Business index figure for April and the US existing home sales figure for March. On Friday, we note Japan’s CPI rates for March, Germany’s producer prices rate and UK retail sales rate both for the month of March.

XAU/USD Daily Chart

Support: 2353 (S1), 2303 (S2), 2250 (S3)

Resistance: 2400 (R1), 2450 (R2), 2500 (R3)

GBP/USD Daily Chart

Support: 80.20 (S1), 76.50 (S2), 72.40 (S3)

Resistance: 85.55 (R1), 89.60 (R2), 94.00 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。