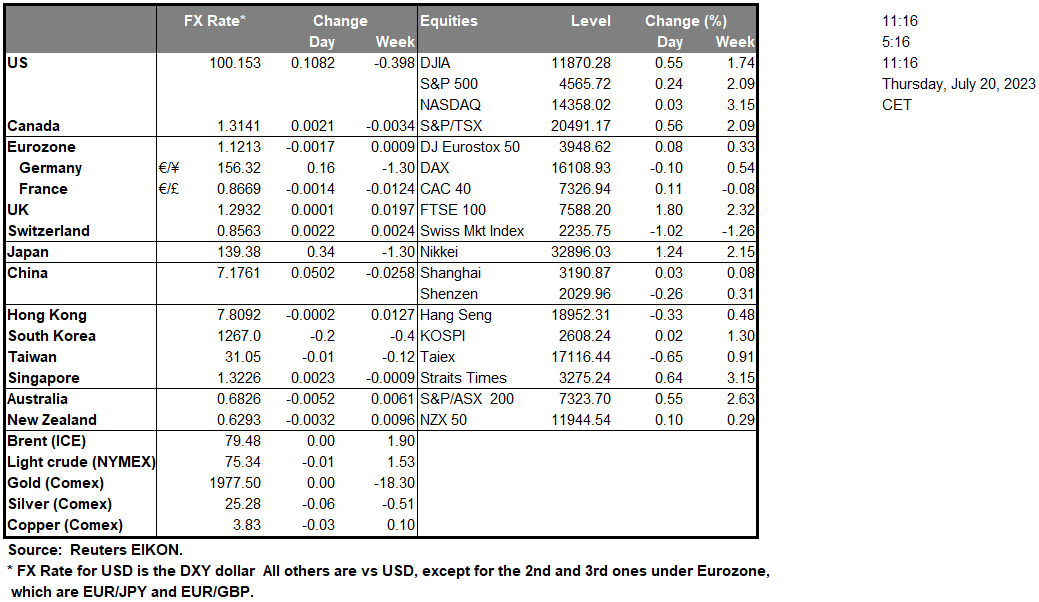

In Today’s European session we note the interest decision by the central bank of Turkey, with many analysts expecting that the CBT will continue increase interest rates, in an attempt to combat rampant inflationary pressures in the economy. However, we should note that the anticipated return to economic orthodox policy has not yet materialized, and we anticipate that a mediocre rate hike may not be enough to provide support for the currency and in order for it to have a significant impact of the market, it may need to be significantly higher than current market expectations. In the US Equities markets, we highlight NETFLIX’s (#NFLX) earning report, which saw the streaming platform add nearly 6 million subscribers, despite its password sharing crackdown. In addition the CEO stated in his letter to the company’s shareholders that “Revenue in each region is now higher than pre-launch, with sign-ups already exceeding cancellations”, indicative of a positive outlook for the company heading in Q3 and Q4. On the other hand, TESLA’s (#TSLA) earnings report yesterday seemed to disappoint investors, who saw a reduction in profitability , as their gross margins decline to 18.2% , despite the company actually beating EPS and revenue anticipations with the earnings per share coming in at $0.91 whilst revenue came in at 24.29B. For Today’s earnings release, we would like to highlight Johnson&Johnson’s (#JNJ) and Travelers Companies (#TRV) earnings releases. During Today’s early Asian session, we highlight Australia’s continued tight labour market, with Employment for June increasing, in addition to the Unemployment rate decreasing, could allow the bank to hike at least one more time, as pressure on the RBA to curb inflation, continues to increase. In the commodities market, following Russia’s termination of the grain deal agreement with Ukraine, comments by Russian officials that they would be targeting ships heading for Ukrainian ports as potential military targets, appears to have revived fears about the stability in the supply of wheat into the global markets.

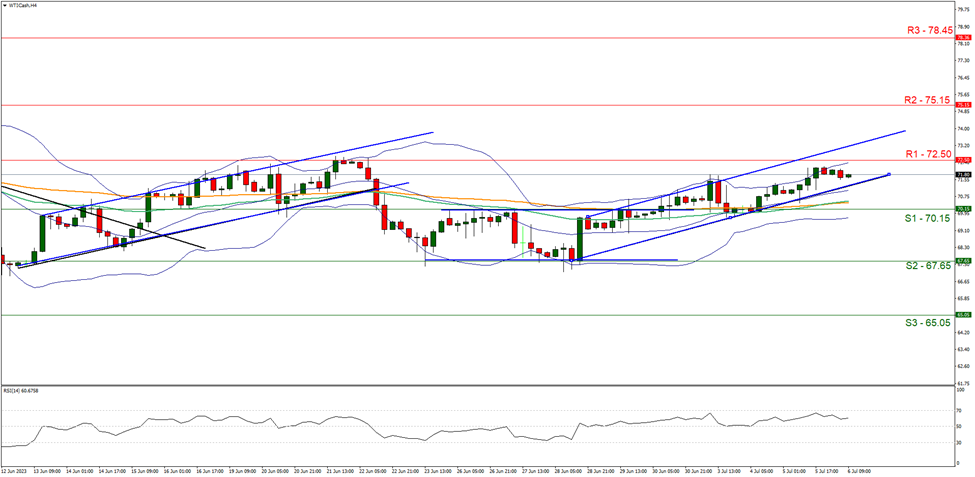

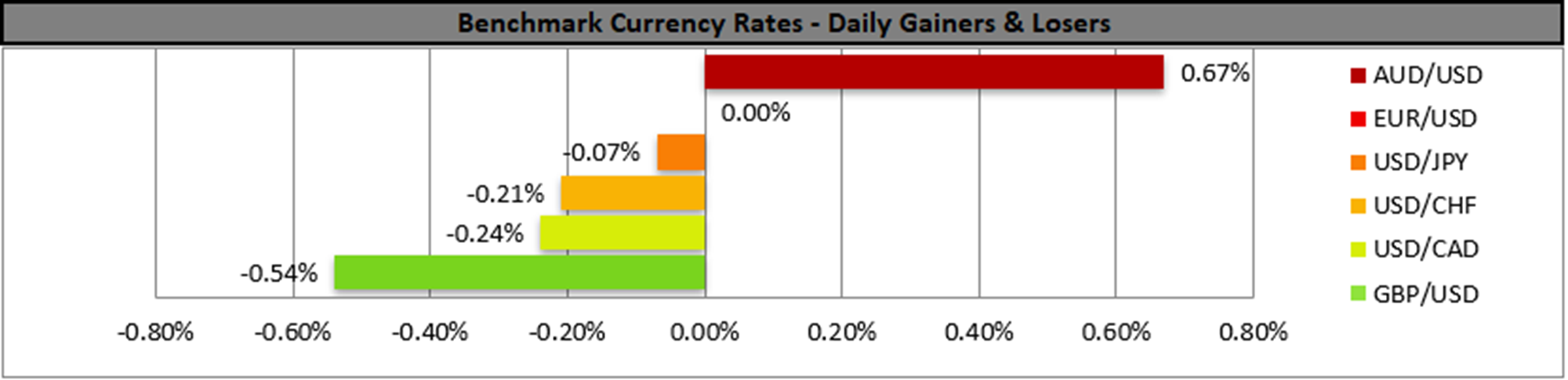

AUD/USD appears to be moving higher following the release of the country’s Employment data. We tend to maintain a bullish outlook for the pair and supporting our case is the RSI indicator below our 4-Hour chart, where it broke above the 50 figure, implying a potential shift in market sentiment from a bearish to a bullish outlook. For our bullish outlook to continue, we would like to see a clear break above the 0.6845 (R1) resistance level, with the next possible target for the bulls being the 0.6915 (R2) resistance line. On the other hand, for a bearish outlook, we would like to see a clear break below the 0.6765 (S1) support level with the next possible target for the bears being the 0.6685 (S2) support base.

本日のアジア市場序盤では、オーストラリアの労働市場が引き続き逼迫しており、6月の雇用者数が増加し、失業率も低下したことから、インフレ抑制を求めるRBAへの圧力が高まる中、少なくともあと1回の利上げが実施されるだろう。 商品市場では、ロシアがウクライナとの穀物取引協定を打ち切ったことを受け、ロシア当局者がウクライナの港に向かう船舶を潜在的な軍事標的として標的にするとコメントしたことで、世界市場への小麦供給の安定性に対する懸念が再燃しているようだ。

その他の注目材料

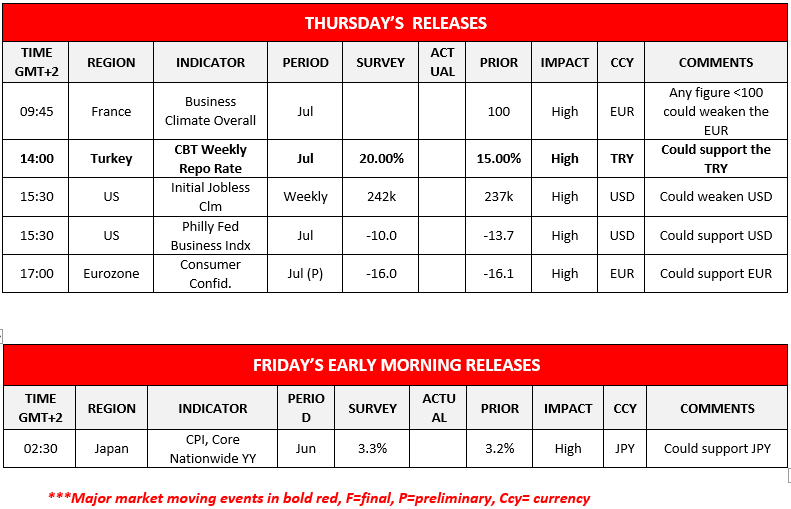

欧州時間には、フランスの7月景況指数、トルコの金利決定、そして米国時間には、米国の7月週間新規失業保険申請件数、ユーロ圏の7月消費者信頼感指数(速報値)に注目したい。明日のアジア市場では、日本の6月コア消費者物価指数に注目する。

AUD/USD 4時間チャート

Support: 0.6765 (S1), 0.6685 (S2), 0.6610 (S3)

Resistance: 0.6845 (R1), 0.6915 (R2), 0.6995 (R3)

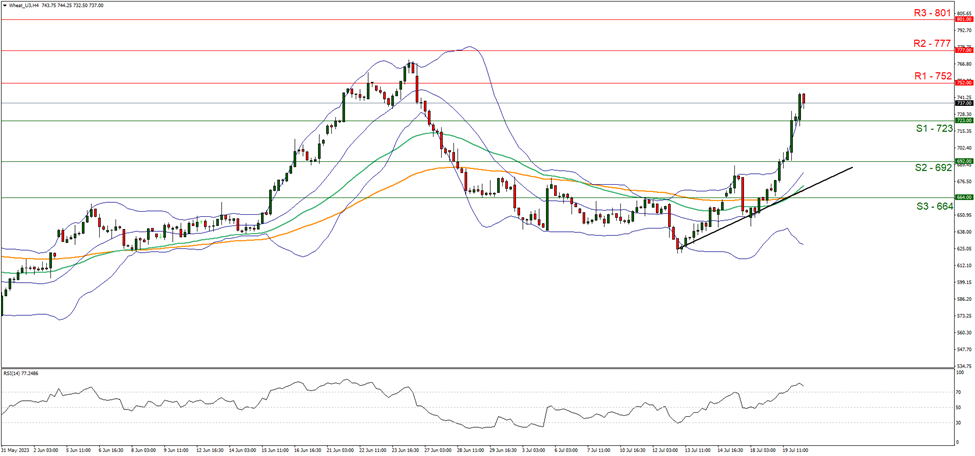

Wheat H4 Chart

Support: 723 (S1), 692 (S2), 664 (S3)

Resistance: 752 (R1), 777 (R2) 801 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。