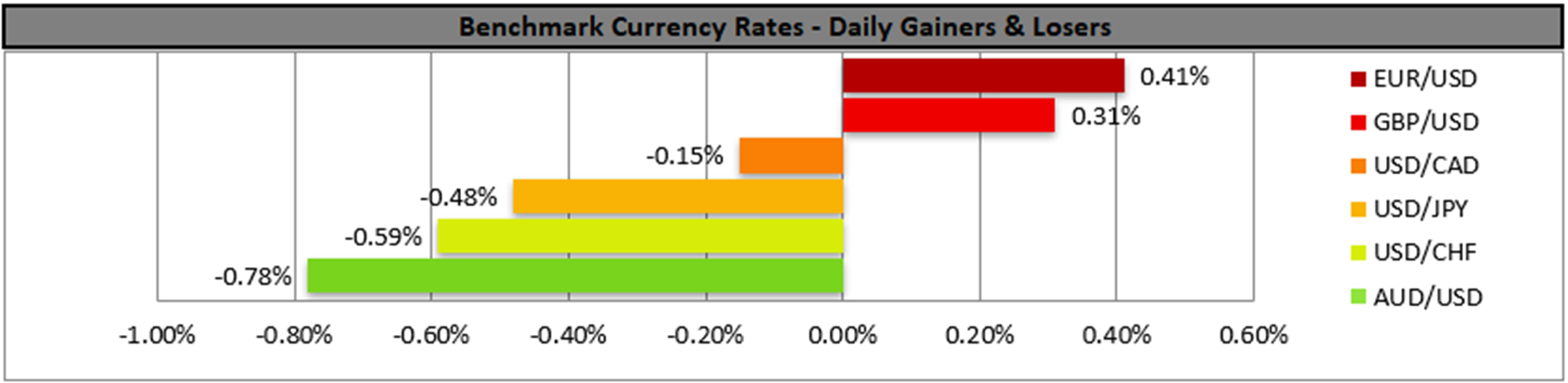

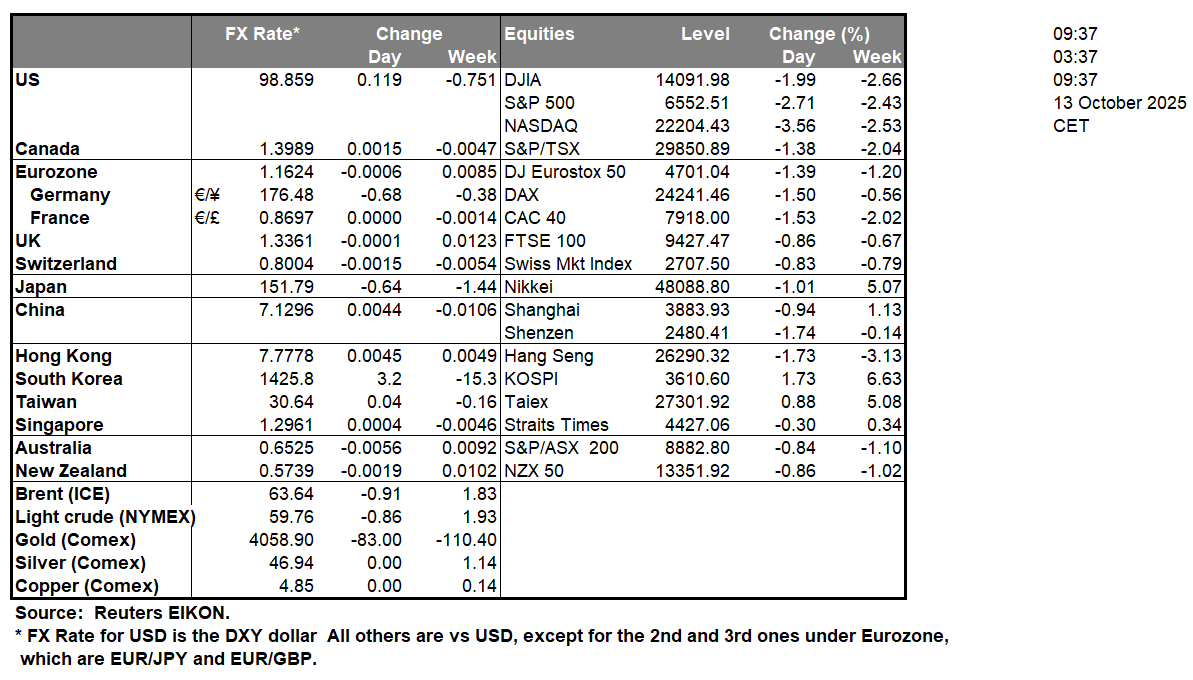

The USD tumbled on Friday with the main issue over the past weekend being US President Trump’s threats to impose 100% tariffs on US imports from China. The threat was made on Friday as the US President stated that the United States would impose a new tariff of 100% on imports from China “over and above any Tariff that they are currently paying,” starting on Nov. 1. China responded angrily, blaming Trump and the US for escalating the trade war. Later on, US officials seemed to play down the risk of such a scenario materialising, and its characteristic that Trump stated “Don’t worry about China, everything will be fine!” while also praising Chinese President Xi Jinping. For the time being it seems that the threat was more like a negotiating tactic rather than an actual intention, or if it was an actual intention after the market’s reaction it was retracted. The issue shook the markets serving as a painful reminder of the fragility of the state of the US-Chinese trading relationships and caused substantial uncertainty in the markets. Should we see the tensions in the US-Chinese trading relationships intensifying further, we may see riskier assets such as US stock markets losing ground and safe havens such as gold gaining.

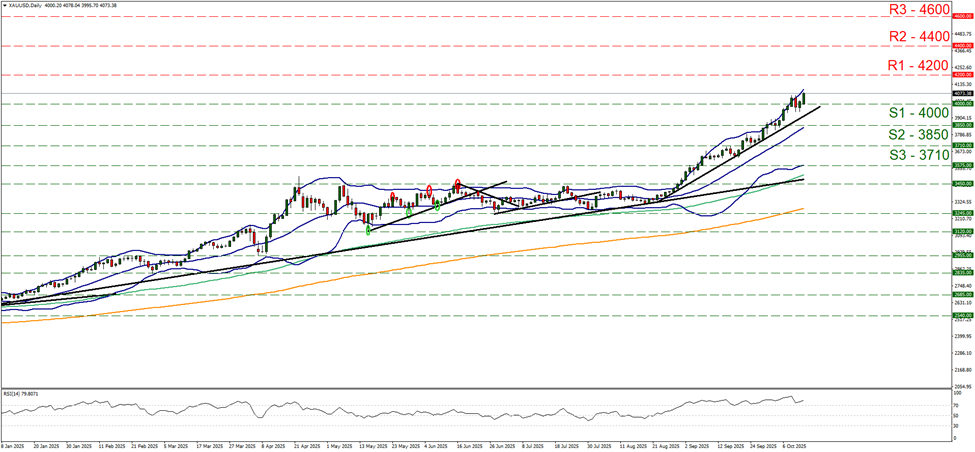

On a technical level we note that gold’s price continued to rise reaching new record high levels, placing some distance between its price action and the 4000 (S1) support line. We maintain a bullish outlook for the precious metal’s price as the upward trendline guiding it remains intact and accompany it with a warning for a possible correction lower, given that gold’s price remains in overbought levels. Should the bulls maintain control as expected, we set as the next possible target the 4200 (R1) resistance line. A bearish outlook currently seems remote and for its adoption we would require gold’s price to break the 4000 (S1) support line, continue lower to break the prementioned upward trendline in a first signal that the upward motion was interrupted and then continue lower to also break the 3850 (S1) support level, with the next possible level for the bears being the 3710 (S3) support barrier.

その他の注目材料

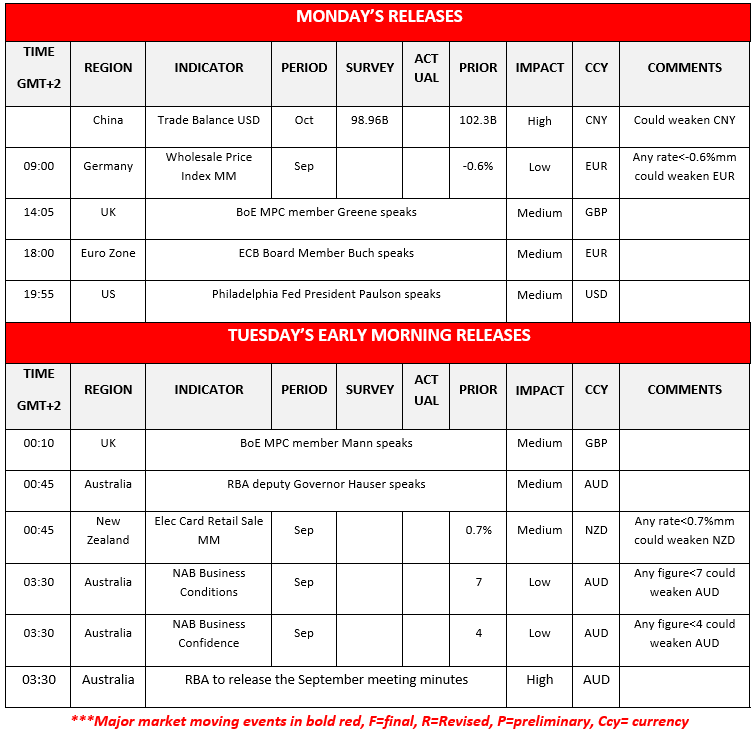

Today we get Germany’s wholesale price index for September, in the UK BoE MPC member Greene, ECB board member Buch, Philadelphia Fed President Paulson speak. In tomorrow’s Asian session, BoE MPC member Mann and RBA Deputy Governor Hauser are scheduled to speak, while we also get New Zealand’s electronic card sale, Australia’s NAB indicators for September and RBA is to release the minutes of the September meeting. There is some commotion among Aussie traders given also that the tensions in the US-Sino trade relationships have an adverse effect on AUD, given the close Sino-Australian economic ties.

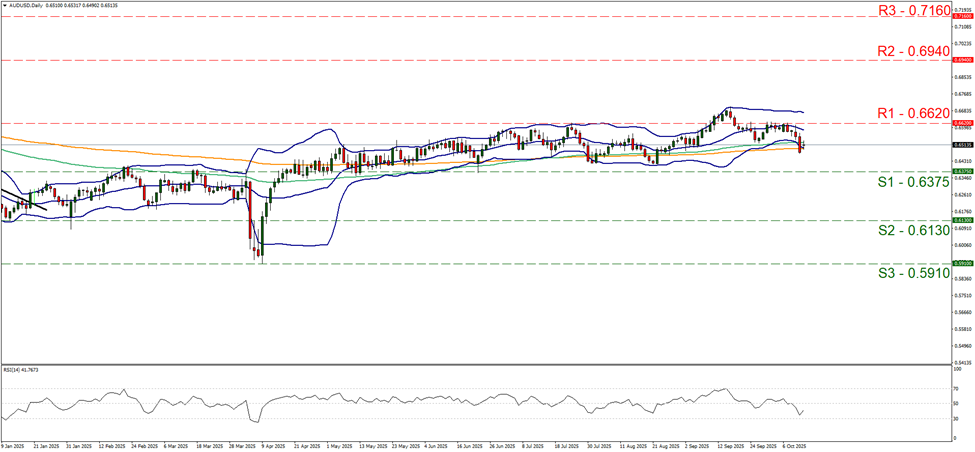

AUD/USD dropped on Friday yet during today’s Asian session, seems to stabilise between the 0.6620 (R1) resistance line and the 0.6375 (S1) support level. We maintain for the time being a bias for the sideways motion of the pair between the prementioned levels to be continued, yet also issue a warning for any bearish tendencies of the pair. Should the bears take over we may see the pair breaking the 0.6375 (S1) support line taking aim of the 0.6130 (S2) support level. Should a bullish outlook emerge we may see the pair breaking the 0.6620 (R1) resistance line and start aiming for the 0.6940 (R2) resistance level.

今週の指数発表:

On Wednesday, we get Sweden’s CPI rates and the release of the US CPI rates is planned yet highly doubtfull, all for September. On Thursday, we get Japan’s machinery orders rate for August, Australia’s employment data for September, the UK’s GDP rates for August and manufacturing output rate for the same month, followed by Canada’s business barometer for October, the US Philly Fed Business index figure for October, the US final PPI demand rate and US retail sales rate both for September, the US weekly initial jobless claims figure. On Friday, we get the US industrial production rate for September.

XAU/USD Daily Chart

- Support: 4000 (S1), 3850 (S2), 3710 (S3)

- Resistance: 4200 (R1), 4400 (R2), 4600 (R3)

AUD/USD デイリーチャート

- Support: 0.6375 (S1), 0.6130 (S2), 0.5910 (S3)

- Resistance: 0.6620 (R1), 0.6940 (R2), 0.7160 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。