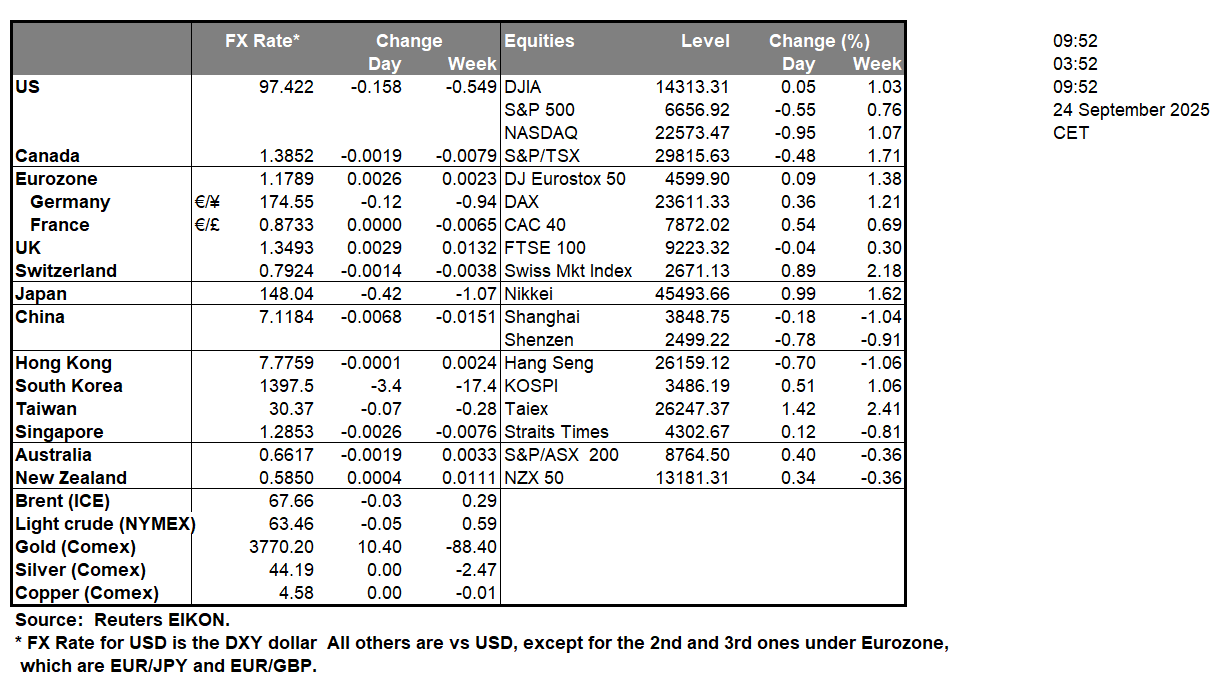

President Trump stated yesterday in a TruthSocial post that “I think Ukraine, with the support of the European Union, is in a position to fight and WIN all of Ukraine back in its original form”, marking a shift in the President’s approach towards the Ukraine-Russia conflict who up until recently appeared to support the idea that Ukraine may have had to cede some of its territory to Russia in order to reach a peace agreement. In turn the shift by the President may be perceived as a willingness to fully support the Ukrainian armed forces against Russia and that a possible peace agreement may not be viable at this stage. Moreover, considering the recent incursions from Russia into NATO’s airspace, the comments may showcase that NATO may be gearing up for an even more active role in the war. In turn, any escalation of tensions in the region could aid gold’s price given its status as a safe haven asset. Staying with the narrative emerging from the US we would like to note the comments made by Fed Chair Powell yesterday who stated that policymakers face a “challenging situation” and that should they ease too aggressively, it may result in leaving “the inflation job unfinished and need to reverse course”. In turn the Fed Chair’s comments may have been perceived as hawkish in nature as it may have dimmed expectations of aggressive rate cuts by the Fed. Thus the comments may have provided support for the dollar.In tomorrow’s Asian session, Yen traders may be interested in the release of the BOJ’s July meeting minutes. Granted the minutes are for the July meeting but could provide insight into the inner deliberations by policymakers.

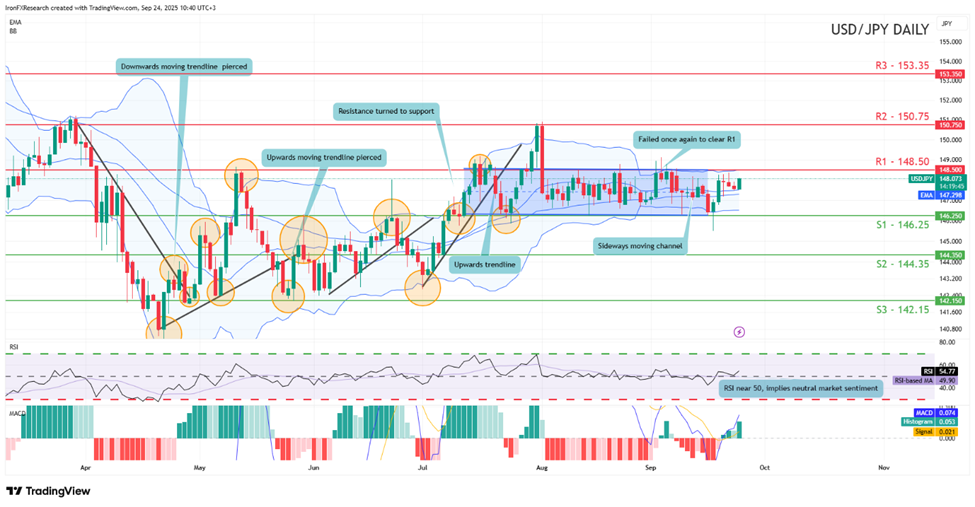

USD/JPY appears to be moving in a sideways fashion with the pair currently taking aim for our 148.50 (R1) resistance level. We cautiously opt for a sideways bias for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained, we would require the pair to remain within our sideways moving channel which was incepted on the 11th of July. On the other hand, we would immediately opt for a bullish outlook in the event that our 148.50 (R1) resistance line is cleared, with the next possible target for the bulls being our 150.75 (R2) resistance line. Lastly, for a bearish outlook we would require a clear break below our 146.25 (S1) support line with the next possible target for the bears being the 144.35 (S2) support level.

GBP/USD appears to be moving in a sideways fashion. We opt for a neutral outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained, we would require the pair to remain within our sideways moving channel which was incepted on the 11th of August. On the other hand for a bullish outlook we would require a clear break above our 1.3580 (R1) resistance line with the next possible target for the bulls being the 1.3750 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below our 1.3390 (S1) support level with the next possible target for the bears being the 1.3200 (S2) support line.

その他の注目材料

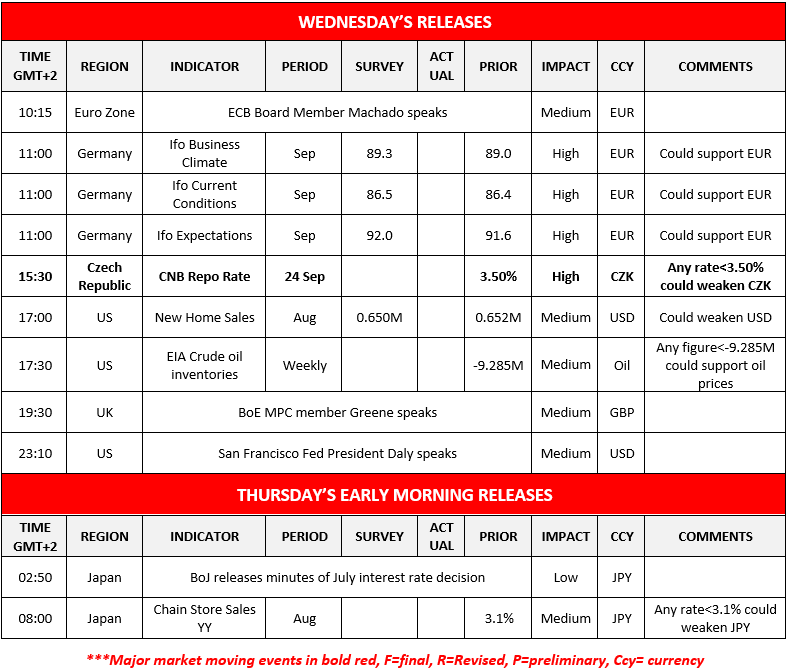

Today we note the release of Germany’s Ifo indicators for September, the US new Home sales figure for August and the EIA crude oil inventories figure. On a monetary level, we highlight the release from the Czech Republic of CNB’s interest rate decision and note that ECB Board Member Machado, BoE MPC member Greene and San Francisco Fed President Daly are scheduled to speak. In tomorrow’s Asian session, we get Japan’s Chain Store sales for August, while BoJ is to release the minutes of the July meeting.

USD/JPY Daily Chart

- Support: 146.25 (S1), 144.35 (S2), 142.15 (S3)

- Resistance: 148.50 (R1), 150.75 (R2), 153.35 (R3)

GBP/USD Daily Chart

- Support: 1.3390 (S1), 1.3200 (S2), 1.3005 (S3)

- Resistance: 1.3580 (R1), 1.3750 (R2), 1.3930 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。