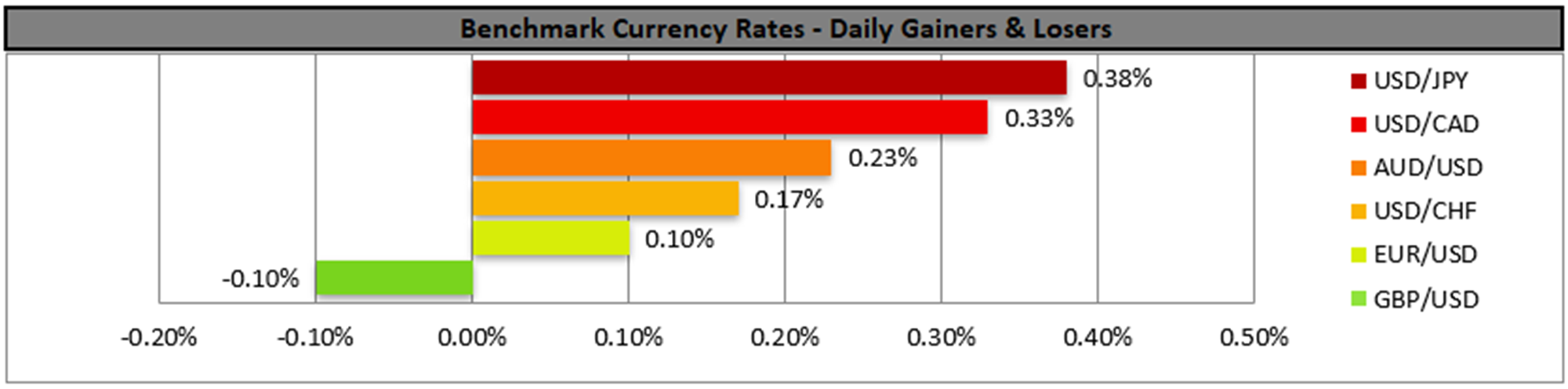

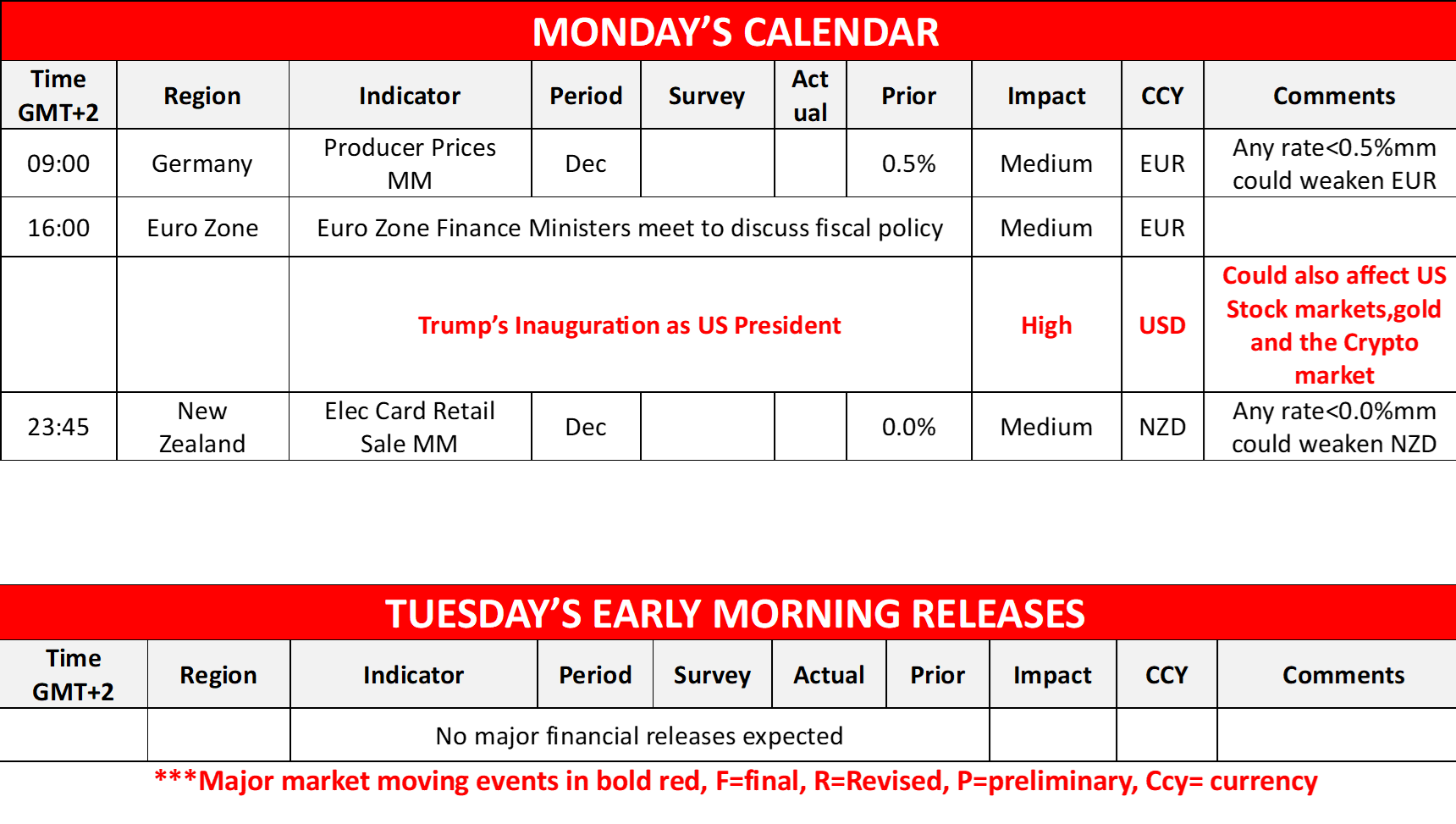

In an easy Monday, Trump is to be inaugurated, marking his return to power after four years on the opposition. We expect Trump’s second term to fuel uncertainty on a political level, both in the internal scene and international politics. Given that it’s his second term we expect a greater degree of confidence, if compared to the first term, which may lead to even more extreme choices on behalf of the US President. Market expectations are for Trump’s Presidency to promote further deregulation in the markets which may boost riskier assets such as US Stock markets and the Crypto market, but also gold’s Price. The possibility of the US imposing tariffs on US imports from Europe, Canada, China and Mexico, could underscore the dominance of the USD and provide it with some support. The interest of the inauguration lies primarily in Trump’s speech at which he is expected to highlight his intentions with some headline comments that could increase volatility in the markets.

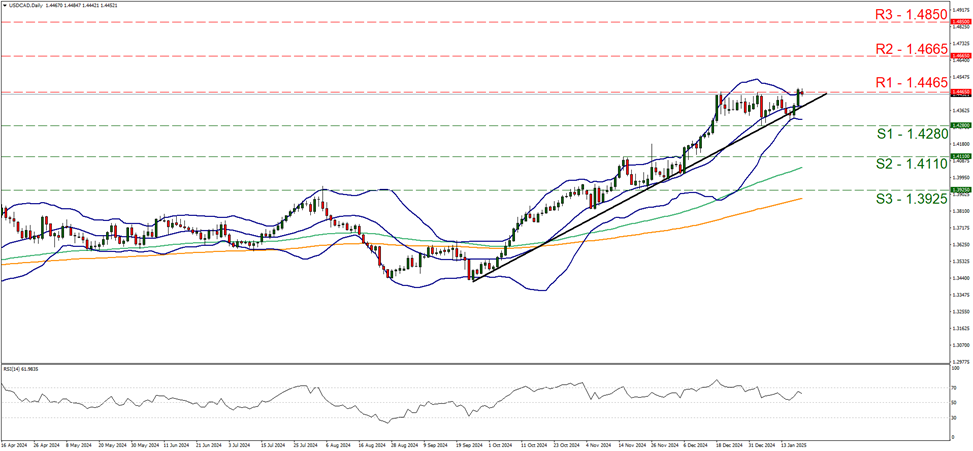

In the FX market we note that the USD edged higher against the CAD, forcing the pair to test the 1.4465 (R1) resistance line. We maintain a bullish outlook for the pair despite its stabilisation over the past month given the upward trendline guiding it since the 25 of September. We also note that the RSI indicator is between the reading of 50 and 70, implying a bullish predisposition of the market for the pair. For the continuance of the bullish outlook, we would require the pair to break the 1.4465 (R1) resistance line, which is a 4-year high and start aiming for the 1.4665 (R2) resistance barrier. Should the bears take over, a scenario we currently view as remote, we may see USD/CAD breaking initially the prementioned upward trendline signaling an interruption of the upward movement and continue to break the 1.4280 (S1) support line and start aiming for the 1.4110 (S2) support base.

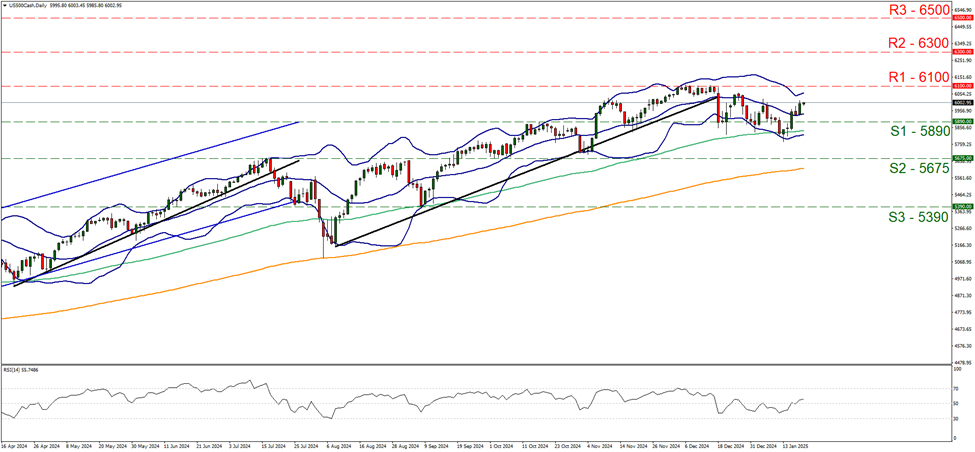

S&P 500 was in an upward motion in the past week moving between the 5890 (S1) support line and the 6100 (R1) resistance level. Given that the main body of the price action remained well within the boundaries of the prementioned levels, with few exceptions and the price action of the index has marked a peak yesterday equal and not lower than the one on the 6 of January, we maintain a bias for a sideways motion. The RSI indicator is rising and has just broken above the reading of 50, implying some bullish tendencies, yet remain unconvincing for now. Should the bulls take over, we may see the index breaking the 6100 (R1) resistance line, which is a record high level for S&P 500 with the next target for the bulls being possibly at the 6300 (R2) resistance level. Should the bears take over, we may see the index’s price action relenting the gains of the past week by dropping below the 5890 (S1) support line and start aiming for the 5675 (S2) support level.

その他の注目材料

Today we get Germany’s December PPI rates and later on New Zealand’s Electronic card sales for December.

今週の指数発表:

On Tuesday we get the UK’s employment data for November, followed by the Zone’s and Germany’s ZEW figures for January, Canada’s CPI rates for December and New Zealand’s CPI rates for Q4.On Wednesday we note the start of the World Economic Forum. On Thursday, we get Japan’s trade balance for December, the UK’s Nationwide house prices rate for January, Norway’s interest rate decision, Turkey’s CBT interest rate decision, the US weekly initial jobless claims figure, Canada’s retail sales rate for November and the Zone’s preliminary consumer confidence figure for January. On Friday, we note Australia’s preliminary PMI figures for January, Japan’s CPI rates for December and preliminary PMI figures for January, followed by the BOJ’s interest rate decision, Sweden’s preliminary GDP rate for Q4 and unemployment rate for December, France’s, Germany’s, the Euro Zone’s, the UK’s and the US preliminary PMI figures and lastly from the US the UoM final consumer sentiment figure all for the month of January.

USD/CAD Daily Chart

· Support: 1.4280 (S1), 1.4110 (S2), 1.3925 (S3)

· Resistance: 1.4465 (R1), 1.4665 (R2), 1.4850 (R3)

US 500 Cash Daily Chart

- Support: 5890 (S1), 5675 (S2), 5390 (S3)

- Resistance: 6100 (R1), 6300 (R2), 6500 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。